8 Questions to Ask When Considering Pet Insurance in 2026

Before signing up for pet insurance, make sure you ask these 8 important questions to find the right plan for your pet’s health and your budget.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insurance...

Leslie Kasperowicz

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated January 2026

You’ve welcomed your furry loved one to the family and have filled your home with toys, treats, and adorable pet accessories—or perhaps you’re considering it.

As the French novelist Collete explains, “Our perfect companions never have fewer than four feet,” but the one thing that isn’t always so perfect is the potential pet healthcare costs associated with your beloved friends.

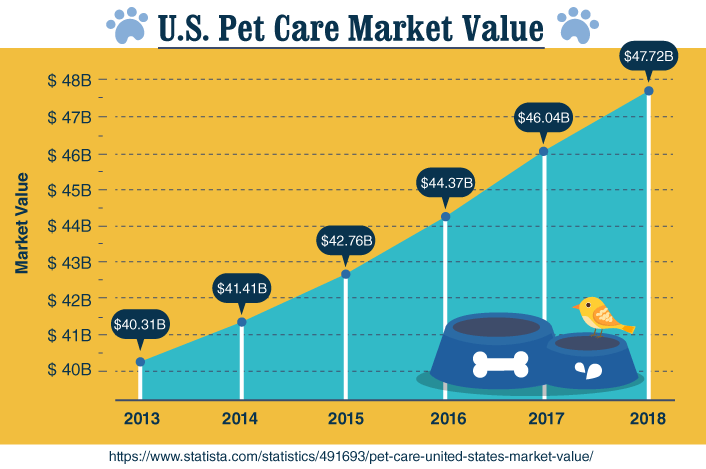

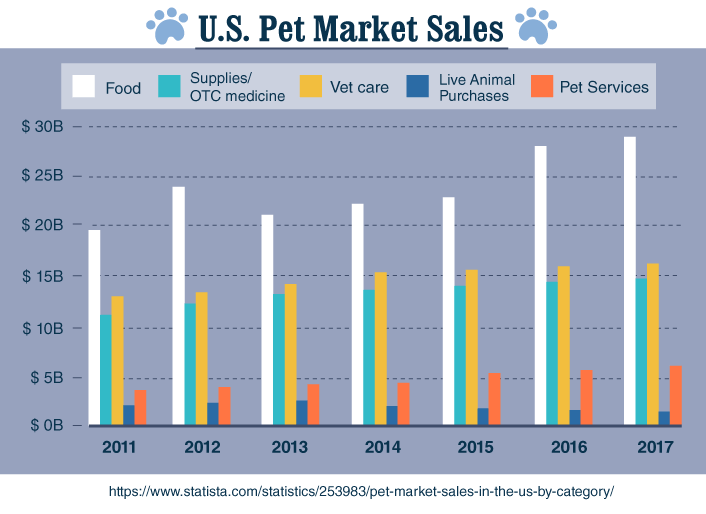

Just like a child, your pet will incur endless expenses throughout his or her lifetime, which is why more and more pet owners are turning to pet insurance policies to cover the veterinary costs of their dogs, cats, and other critters.

If you think going without a policy is a risk worth taking or an extra bill you can avoid, consider the cautionary tales of both veterinarians and pet owners who’ve incurred exorbitant costs.

You wouldn’t sleep easily at night without homeowners’ insurance—why should protection for your pets be any different?!

We turned to pet industry professionals from vets to insurance providers, as well as real-life pet owners, to explain how a customized insurance plan can help you avoid the heart-wrenching decision of foregoing treatment for your pet or going into debt.

Read on these pet insurance FAQs to learn more.

1. How much does pet insurance cost?

Many pet owners believe the myth that pet insurance will break the bank, or aren’t convinced that proactively purchasing pet insurance is a smart move.

Others simply wonder whether there are more cost-effective savings options that trump pet insurance, explains Dr. Doug Kenney, a general practice veterinarian, expert, and author on pet health insurance, in an article for PreventiveVet.com.

“I think that people often have the wrong attitude about pet insurance. For example, it’s not uncommon for someone to say they would rather just open up a savings account to pay their veterinary expenses rather than “waste” money on pet insurance premiums. This person doesn’t understand the purpose of pet insurance.”

And that purpose is to protect your finances from unexpected pet illnesses that can put you in debt, something that a monthly insurance premium will not do. According to Rebecca Wallick, a contributing editor at The Bark.com and executive director of MCPAWS Regional Animal Shelter in McCall, Idaho, the average cost of a typical corrective surgical procedure for canines will leave you working like a dog just to afford the cost of care. For example, take these prices of various medical procedures:

- Gastric torsion (bloat): $1,955

- Foreign-body ingestion (small intestine): $1,629

- Pin in broken limb: $1,000

- Cataract (senior dog): $1,244

And, if your furry friend is among the almost 12 million pets in the United States diagnosed with cancer each year, the cost of surgeries and treatments can surpass the thousands.

Even the annual costs of routine pet care can add up. The American Pet Products Association’s 2015-2016 National Pet Owners Survey found that U.S. dog owners spend $235 each year on routine vet visits, while cat owners spend $196.

The Right Plan Depends on What’s Best for You and Your Pet

Just as with humans, the cost of coverage can vary depending on your pet’s breed (i.e., purebreds cost more to insure because they’re more prone to some hereditary conditions); age (plans may cost more as your pet gets older); the rising cost of veterinary care; and the coverage options you choose, such as your deductible amount.

Ultimately, it comes down to a numbers game. You might choose the most popular pet insurance policy that covers just accident and illness (81% of pet insurance policies are accident and illness plans for dogs), or you could go with blanket coverage that also includes wellness visits and routine care.

Another consideration when evaluating providers is how the coverage pays out. Some insurers pay a flat percentage of covered costs after your deductible is met, while others calculate reimbursements based on the “usual and customary costs” of vet care in your area.

Your monthly premium will also be determined by the annual maximum coverage amount you choose ($5,000, $8,000, $10,000, $15,000, etc.).

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

2. Which pets are the priciest?

Now that you have a general sense of how pet insurance works, here’s some good news: You do have some control over figuring out what your ideal insurance policy should look like based on the kind of pet you choose.

Here are some critter characteristics that might necessitate higher pet insurance costs:

Cats versus dogs. Rob Jackson, cofounder and CEO of Healthy Paws Pet Insurance & Healthy Paws Foundation, attributes the higher cost of dog insurance vs. cat insurance to the fact that dogs tend to get into more mischief than their feline friends. “Healthy Paws Pet Insurance average cat monthly premiums are around $25, whereas the average dog monthly premium is around $40,” he says. (Note: While most companies only insure cats and dogs, Nationwide also covers birds, rabbits, snakes, turtles, and other animals.)

Breed plays a big role. Mixed breeds tend to be healthier than purebreds, which are susceptible to hereditary conditions, such as hip dysplasia, heart disease, and cancer, all of which are costly to treat.

Age matters. “Our pet insurance plans do not have an age limit for enrollment or continuing care, but the older the pet, the higher the premium cost due to older animals experiencing more illnesses and an increase in vet visits,” explains Liz Watson, chief marketing officer at Hartville Pet Insurance Group.

Where you live is a factor. Because pet insurance companies pay claims based on veterinary bills, they charge more for policies in high-cost-of-living areas, such as New York and California.

Vet surgery costs in New York are twice as much as they are in Topeka, Kansas.

Also worth noting is that many companies offer discounts for families with multiple pets. “For each additional pet, there is often a 10% savings,” says Watson. Be sure to inquire accordingly about such “pack” discounts.

Real-Life Examples of How Much a Pet and Its Insurance Costs

Of course, if you’re considering paying for pet insurance, you want to see real-life results in dollars and cents.

Enter Consumer Reports. The independent, nonprofit organization compared the vet bills of Guinness, an almost 12-year-old Labrador mix from New York, and Freddie, an almost 9-year-old mixed-breed cat from Connecticut in one of its guides to pet insurance. Guinness’ owners have paid for two surgeries and follow-up care for the dog’s skin cancer, and Freddie’s owners have paid for a dental cleaning under anesthesia as well as prescription cat food and medication to treat infections.

3. What happens if I buy my pet insurance after my pet gets sick?

Jeanette Cereske, a pet owner from Pennsylvania, learned the hard way just how expensive a cancer diagnosis can be. In January 2013, her beloved cat Sugar, a domestic short hair, was diagnosed with mammary cancer. Over the course of the next 16 months, Cereske’s 11-year-old cat underwent surgeries and five rounds of chemotherapy. The total cost: $16,000.

“That was a huge wake-up call,” says Cereske, an instructional designer for a small high-tech firm in San Francisco. At that point, she and her husband decided to insure all their cats. Because they didn’t have insurance for Sugar prior to her diagnosis, the costs of her specific treatments were not covered; her cancer was considered a pre-existing condition.

Indeed, pet insurance does not cover pre-existing medical conditions, so it’s important to sign up before your pet becomes ill or seriously injured, says Jackson.

Not sure if your pet’s issues fall under the category of a pre-existing condition? Take a look at how the term is typically defined:

“A pre-existing medical condition is any injury, illness, or irregularity noticed by you or your veterinarian before the end of your waiting period, even if your pet never went to see the veterinarian for it. No pet insurance company covers pre-existing conditions.”

While no pet insurance company covers pre-existing medical conditions, it’s still worth considering insurance that will protect you from future unrelated health expenses. “They can still be covered for other conditions that develop while the pet is under the protection of the pet insurance policy,” says Christie Long, a small-animal veterinarian and chief vet for PetCoach.com.

For Cereske, that proved to be the case with Sugar, who developed two additional illnesses that were covered by pet insurance, along with some dental work, before a final illness (lung cancer) ended her life in 2014.

“I wish more people had pet insurance, and I’m not sure why they don’t,” says Cereske. “Maybe they don’t realize how expensive it is when your pet has a serious illness.”

4. Are alternative treatments covered by pet insurance?

With advancements in medicine, more veterinarians are performing alternative treatments to help pets live healthier, more comfortable lives—but insurance companies may or may not cover the costs.

Healthy Paws Pet Insurance covers alternative therapies for the treatment of a covered condition. Therapies include those that are well-known, widely researched, and generally accepted by the veterinary community, including acupuncture, chiropractic care, massage therapy, physical therapy, water therapy, and cold laser therapy, says Jackson. Hartville Pet Insurance Group covers similar treatments, says Watson, including stem cell therapy.

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

5. Should I start a savings account for my pet instead of pet insurance?

According to Dr. Judy Morgan, an author, speaker, and holistic veterinarian in New Jersey, a pet savings account is only beneficial for the most disciplined and dedicated savers. And even then, bills can easily skyrocket beyond what you have saved thanks to the high cost of diagnostics and surgery.

“You never know how much you might have to spend,” she says. “I just spent $6,500 for a dog with cancer in a period of two months.” Had her dog survived, she says the costs would have continued to mount.

Plus, due to the high cost of diagnostics and surgery, it would take a long time to build up a savings account to cover unexpected costs, says Long. “If you want to make sure you can afford the best vet care, your best bet is pet insurance,” she says.

6. Which insurance plan is right for my pet?

With so many companies to choose from, pet insurance experts encourage you to do your research before making a decision. In the same way you’ve prepared your home for your pet, you should also take the same care in researching your options.

We really want people to understand what they’re purchasing.

Companies like the Hartville Pet Insurance Group offer two basic plans: the Accident Plan and the Complete Coverage Plan (which includes accidents and injuries), along with the option to select your annual deductible and reimbursement level.

Healthy Paws Pet Insurance offers one plan that covers all accidents and illnesses, including cancer as well as hereditary and congenital conditions.

We don’t want pet parents to have to choose which accidents and illnesses to cover—that’s like playing roulette with your four-legged family member,” says Jackson.

Like the Hartville Pet Insurance Group, this plan allows for adjustments to premiums and reimbursement levels to fit the consumer’s budget.

Whatever plan you choose, choosing one that covers more than just wellness visits and vaccinations is in your best interest. Additionally, check if the pet insurance policy has a waiting period between enrollment and the start of coverage. Also, be sure to inquire about the reimbursement timeframe after you pay the bill and submit the claim. For example, with the Hartville Pet Insurance Group, Watson says it takes approximately 14 days for a check to arrive.

No matter what plan you choose, it’s important you understand the policy thoroughly, including the proper procedure for filing claims and any specific requirements the company might have.

7. What questions about pet insurance should I ask the company before buying?

There’s a lot to consider when researching pet insurance providers. Here are Jackson’s top five pet insurance questions to ask when comparing policies:

- What does the pet insurance policy cover? Does it cover cancer and hereditary conditions?

- Are there any limits on benefits (per-incident limits, annual limits, or lifetime limits)?

- Is the claim payment based on the actual vet bill, or will the insurance pay pre-determined amounts for each accident or illness?

- How fast and easy is the pet insurance policy’s claims process? Can I submit my vet bill online or via smartphone?

- What do actual customers say about their pet insurance in online reviews?

- Does the pet insurance policy cover diseases or problems specifically associated with certain breeds?

“For example, if you have an English Bulldog, you can bet it’s going to have some problems with its respiratory system—it’s just common in the breed,” says Long. “I know, for example, that Petplan does not exclude certain conditions common in certain breeds.”

Free Pet Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

8. Who are the major pet insurance players?

Listed out in alphabetical order are the top 12 major companies for pet insurance, all of which are members of the North American Pet Health Insurance Association.

- Embrace Pet Insurance: (800) 511-9172

- Hartville Pet Insurance Group: (800) 799-5852

- Healthy Paws Pet Insurance & Foundation: (855) 898-8991

- Nationwide: (800) 872-7387

- PetFirst Pet Insurance: (855) 270-7387 (PETS)

- Pethealth Inc: (866) 275-7387

- PetPartners: (866) 774-1113

- Petplan: (866) 467-3875

- Pets Best: (877) 738-7237

- Pets Plus Us: (866) 376-3019

- Trupanion: (855) 210-8749

- Western Financial Insurance Company: (800) 268-1169

Securing the Best Quality of Life for Your Pet

The reality is that illness can come suddenly, like when Braun’s 7-year-old Labrador mix collapsed unexpectedly. Before he and his wife had a clear diagnosis, their bill was more than $3,000—and that was just from testing. Their final bill was double that amount. Fortunately, having pet insurance gave them peace of mind, knowing they could afford to do everything possible to help their furry child.

“As a veterinarian, I am always happy when a client says, ‘No problem, I have insurance,’ when a pet needs a big procedure or a life-saving surgery,” says Dr. Morgan. “It really can mean the difference between life and death.”

If you want to provide your dog or cat with high-quality healthcare throughout his/her life, pet health insurance deserves a serious look.

Do you have pet insurance for your furry best friend? How is it working out? Any horror or heartwarming stories to share with us? Please let us know in the comments below.

Frequently Asked Questions

What factors affect choosing a pet insurance company?

Key factors include:

- Coverage options (accidents, illness, hereditary issues),

- Policy fine print (exclusions, waiting periods, maximum payouts),

- Cost variables (premium rates, deductibles, reimbursement levels),

- Flexibility (ability to customize coverage),

- Customer support (accessibility, claims handling)

What questions should I ask when getting a pet insurance quote?

Here are some questions to ask about:

- Coverage of pre-existing conditions,

- Waiting or affiliation periods before coverage starts,

- Breed-specific or congenital exclusions,

- Deductibles, reimbursement rates, and any annual limits,

- Whether wellness care is included or available as an add-on

How to choose pet insurance?

- Identify the coverage you need (accident-only vs. illness vs. extras).

- Compare quotes using trusted tools

- Inspect policy terms: limits, exclusions, deductibles, and reimbursement.

- Read reviews to assess claim experiences and customer support

- Enroll early—young, healthy pets typically risk fewer exclusions and offer better rates

Is pet insurance a waste of money?

Veterinary costs, especially for emergencies and chronic care, continue to rise, and pet insurance can offer financial peace of mind.

How much does pet insurance cost per month?

Pet insurance costs around $62 a month for dogs and $32 a month for cats (accident & illness plans).

How to shop for pet insurance?

- Use comparison tools to quickly compare quotes and coverage tiers.

- Evaluate policies based on: coverage limits, exclusions, deductibles, and reimbursement rates.

- Read reviews and check claim history for insurers.

- Secure coverage early to lock in favorable terms and avoid pre-existing condition exclusions.

How much is dog insurance?

The average monthly cost for a dog, covering accidents and illness, is about $60-62 a month, depending on the provider and plan

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.