Expert Guide to Medicare in 2026

Medicare is a U.S. health insurance program for seniors 65+ and those with certain disabilities or illnesses. Parts A, B, C and D cover hospitals, doctors, and prescriptions, with some premiums as low as $0. Enrollment is automatic if you get Social Security or Railroad Retirement benefits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding c...

Meggan McCain

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated January 2026

Medicare is a government health care program in the United States that covers individuals aged 65 or older and younger individuals with certain disabilities or conditions.

- Social Security recipients 65+ are automatically enrolled in Medicare

- Initial enrollment runs 3 months before and after you turn 65

- Medicare Part A is free for most, while Part B costs vary by income

Medicare consists of different parts that cover hospital, medical, and prescription drug costs. Understanding how Medicare works and the different parts of the program is crucial for those who are eligible, as it greatly impacts health care options and costs.

Read More: Who is eligible for Medicare?

- Medicare Enrollment

- Medicare Basics

- Medicare Coverage

- Does Medicare cover prescription drugs in 2026?

- Medicare Parts A, B, C, & D

- Medicare Coverage & Eligibility in 2026

- Medicare Part B (2026 Guide)

- Medicare Part A (2026 Guide)

- What is Medicare Part D? (Coverage Details for 2026)

- Medicare Supplemental Insurance (Medigap) in 2026

- What is Medicare Advantage?

- Medicare Advantage vs. Original Medicare in 2026

- Best Gastroenterologists That Accept Medicare in 2026

- Best Endocrinologists That Accept Medicare in 2026

Keep reading our Medicare insurance guide to find the right plan for you. Call (855) 634-0435 now for Medicare guidance from a licensed insurance agent, or enter your ZIP code to compare free Medicare quotes online.

What is Medicare, and How Does it Work?

Medicare is a federal health insurance program that helps people 65 and older, as well as individuals with certain disabilities or end-stage renal disease, access affordable health care and prescription drugs.

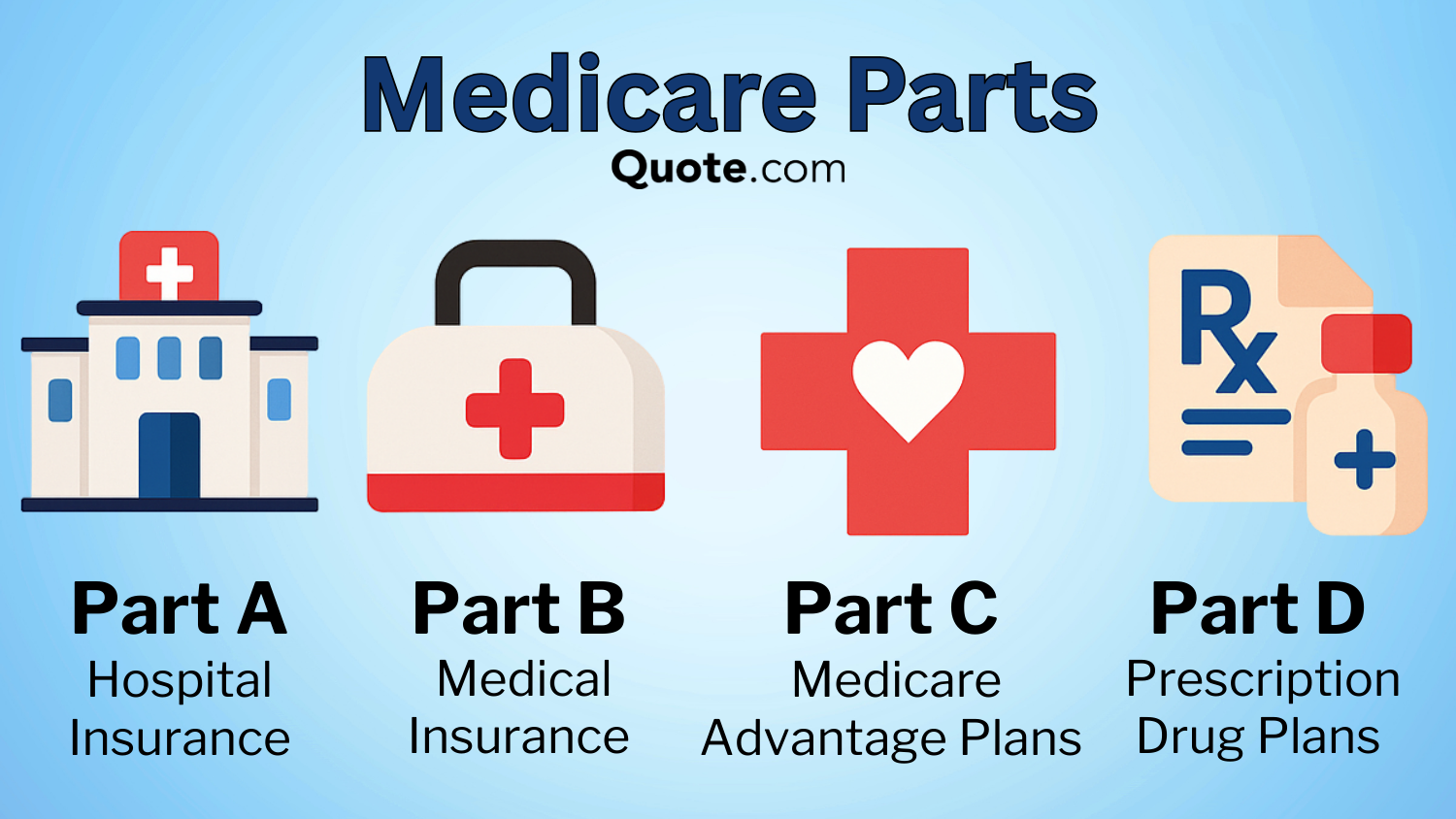

It is divided into four main parts, each covering different medical needs, such as hospital stays, outpatient services, and prescription drugs.

Understanding how Medicare’s parts work is crucial, since each one impacts the care you receive, your out-of-pocket costs, and your coverage options. The parts of Medicare are:

- Medicare Part A: Hospital insurance

- Medicare Part B: Medical insurance

- Medicare Part C: Medicare Advantage

- Medicare Part D: Prescription drug coverage

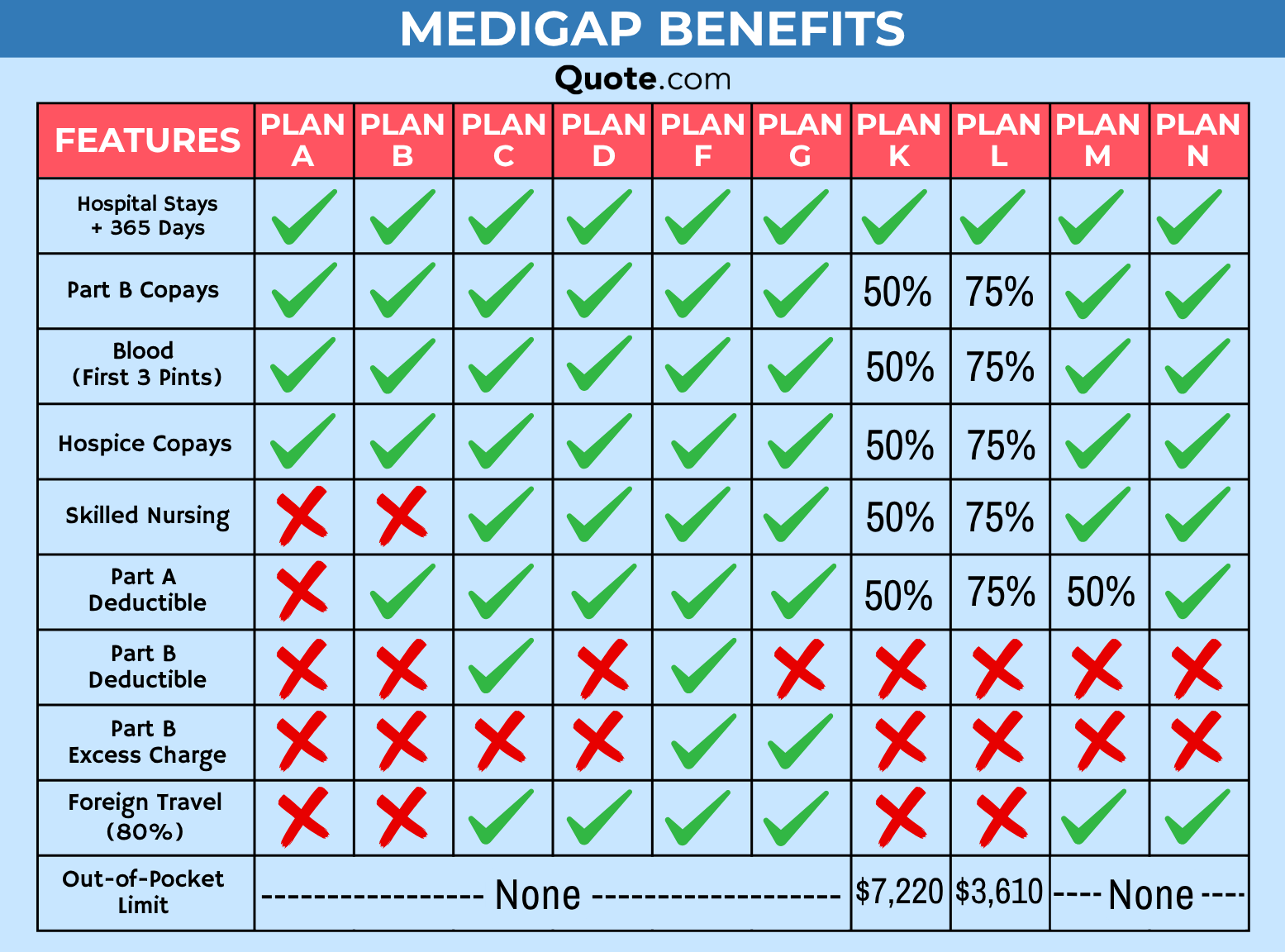

Many Medicare recipients also get a supplemental plan called Medigap, which helps cover expenses not included in Original Medicare (Parts A and B).

Unlike Medicare Advantage, which replaces Original Medicare entirely, Medigap works with Parts A and B to lower out-of-pocket costs, such as copayments, coinsurance, and deductibles.

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Who is Eligible for Medicare?

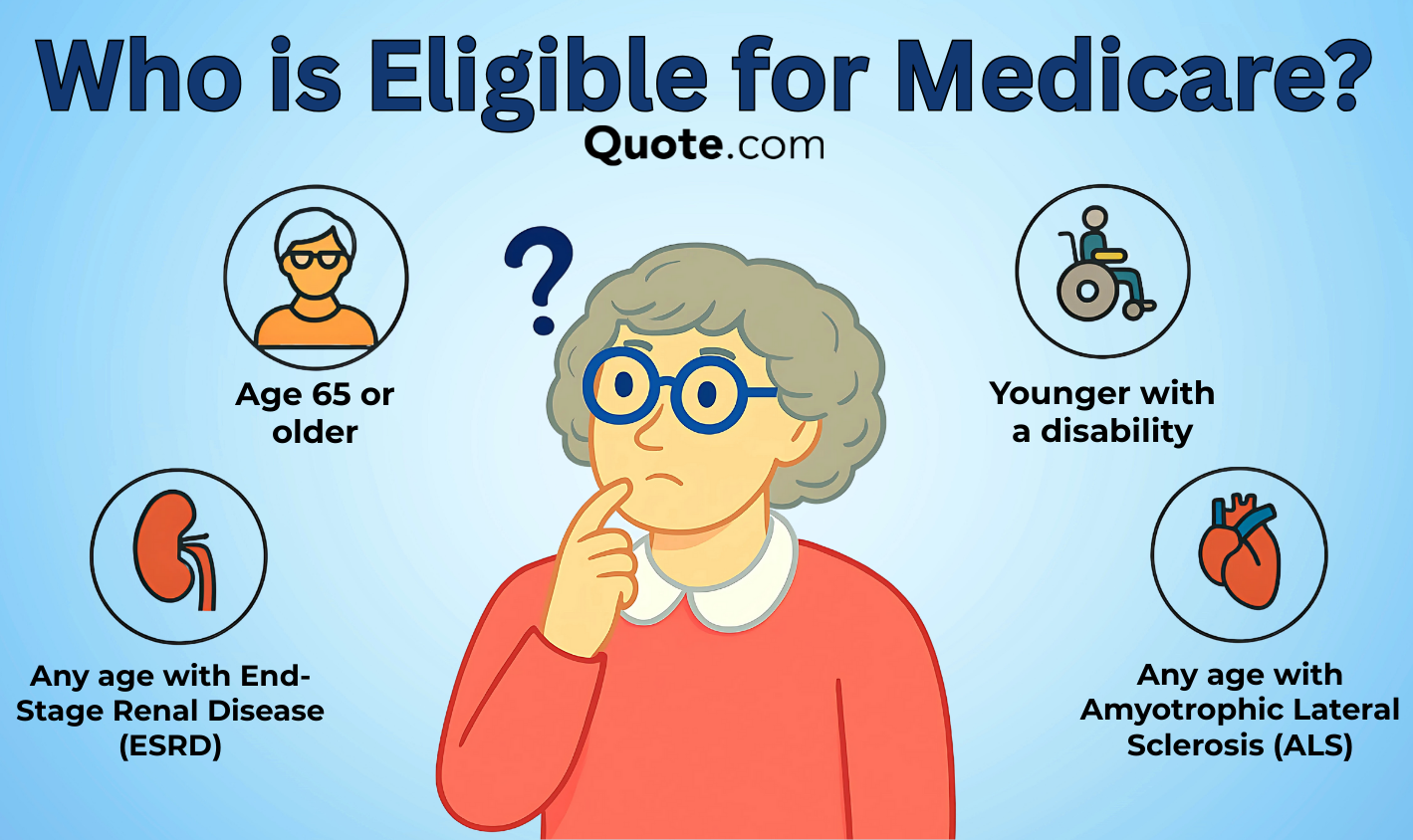

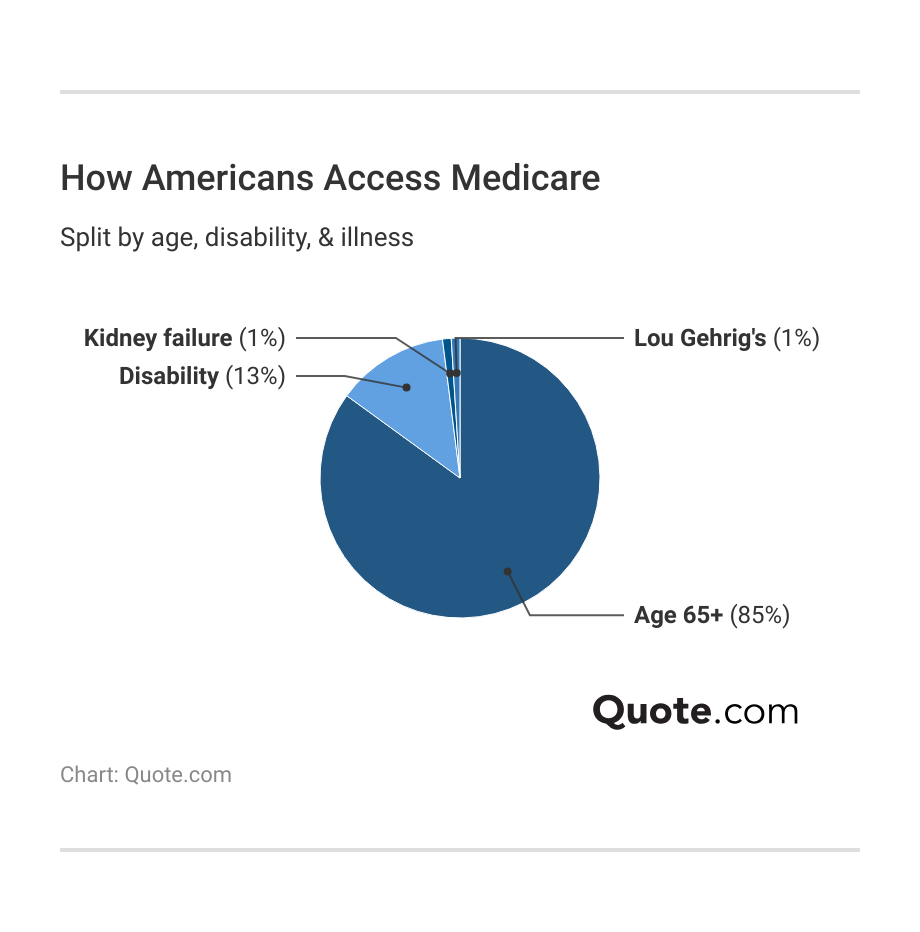

Most people become eligible for Medicare when they turn 65. However, some may qualify before they reach that age if they have certain disabilities or end-stage renal disease.

If you’re 65 or older, eligibility is generally tied to your work history or your spouse’s. Those who have paid Medicare taxes for at least 10 years usually qualify for premium-free Medicare Part A. Medicare Part B, however, requires a monthly premium.

If you’re under 65, Medicare eligibility depends on disability status as determined by the Social Security Administration. People with end-stage renal disease who need regular dialysis or a kidney transplant may also qualify at any age.

It’s important to note that being eligible for Medicare does not automatically enroll you in the program. You need to take steps to enroll and choose a plan that best suits your needs.

Medicare Eligibility Requirements| Factors | Details |

|---|---|

| Age | Eligible at age 65 and older |

| Disability | Disability benefits for 24 months |

| Conditions | Kidney failure or Lou Gehrig's disease |

| Residency | U.S. citizen or legal resident 5+ yrs |

| Work History | 40 quarters (10 yrs) covered work |

| Special Cases | May qualify earlier through spouse’s work |

The Initial Enrollment Period (IEP) is the first opportunity for most individuals to sign up for Medicare. It begins three months before the month of their 65th birthday and ends three months after the month of their 65th birthday.

Missing this initial Medicare enrollment period may result in late enrollment penalties and delays in coverage.

Jimmy McMillan Licensed Insurance Agent

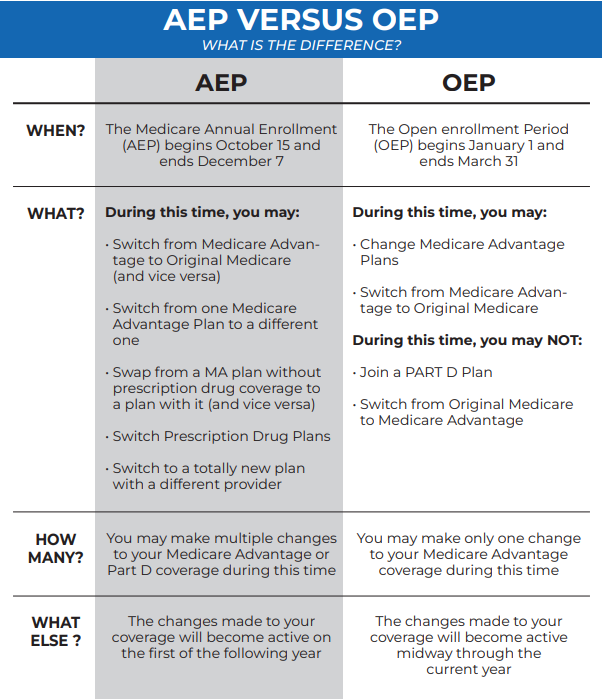

In addition, the Annual Enrollment Period (AEP) allows you to switch or join plans between October 15 and December 7.

You can also change your Medicare Advantage plan during the Open Enrollment Period (OEP) from January 1 to March 31.

Key Medicare Terms to Know| Term | Description |

|---|---|

| Initial Enrollment | Sign up during the 3mo before / after 65th bday |

| Late Penalties | Delaying Part B / D without coverage adds fees |

| Special Enrollment | Enroll after losing work coverage without penalty |

| Open Enrollment | Oct 15-Dec 7 to switch Advantage or drug plans |

| Medigap Window | 6mo after 65th bday & joining Part B (best rates) |

| Costs Not Covered | Deductibles, coinsurance, & excluded services |

The Special Enrollment Period (SEP) lets you enroll in Medicare outside of the Initial Enrollment Period.

They’re triggered by certain life events, such as retiring from a job with health coverage or relocating to a location outside your Medicare plan’s service area.

The Parts of Medicare and What They Cover

Medicare consists of four main parts: Parts A, B, C, and D, each covering specific health care services with its own rules and costs.

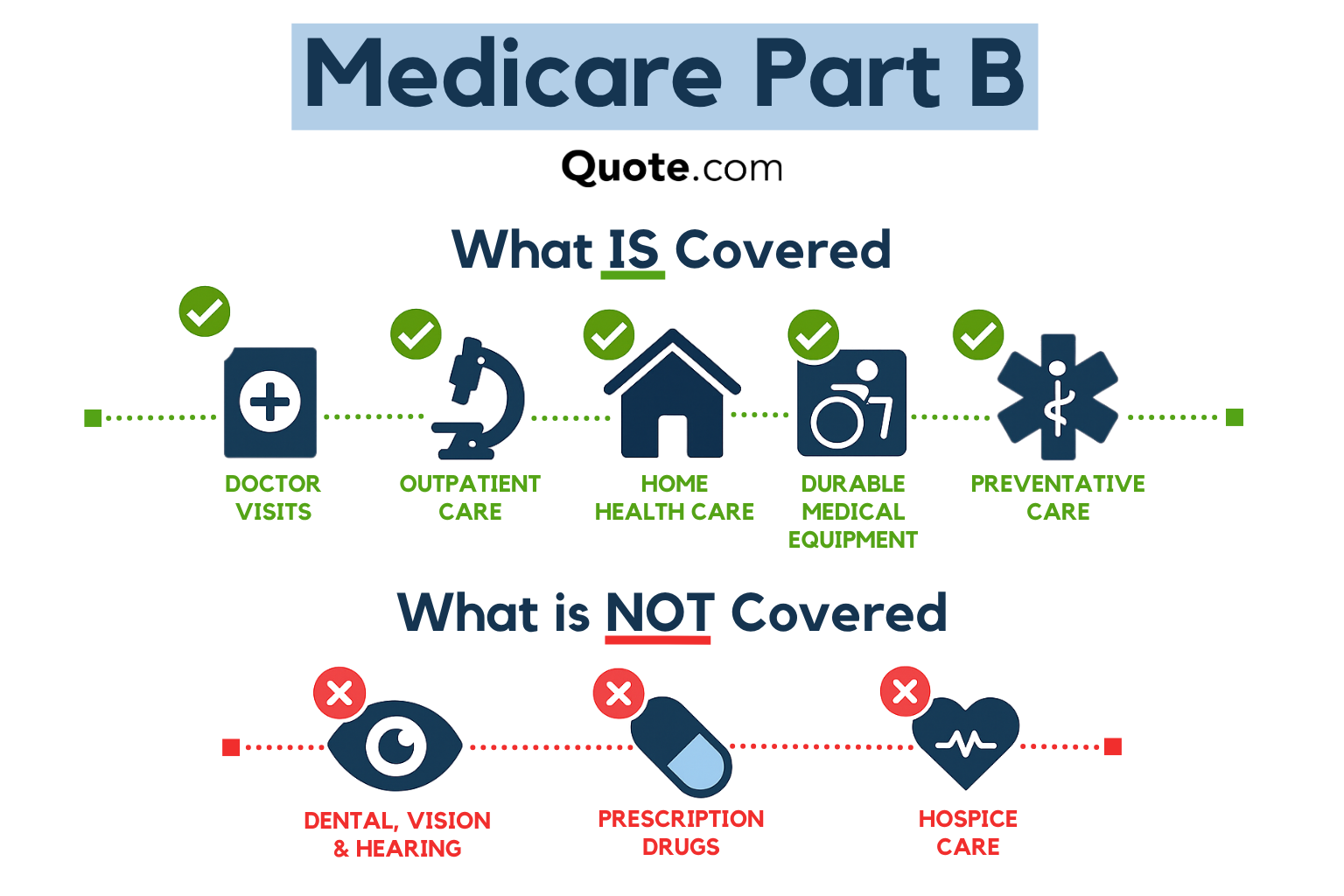

For example, Part A provides hospital insurance, covering inpatient stays and skilled nursing care, while Part B covers doctor visits, outpatient care, and preventive services.

Part C, or Medicare Advantage, is available through private insurers as a substitute for Original Medicare (Parts A and B) and often comes with extra benefits.

Medicare Part D is prescription drug coverage you can get on its own that helps lower the cost of your medications since Original Medicare doesn’t cover them.

Medicare Part A: Hospital Insurance

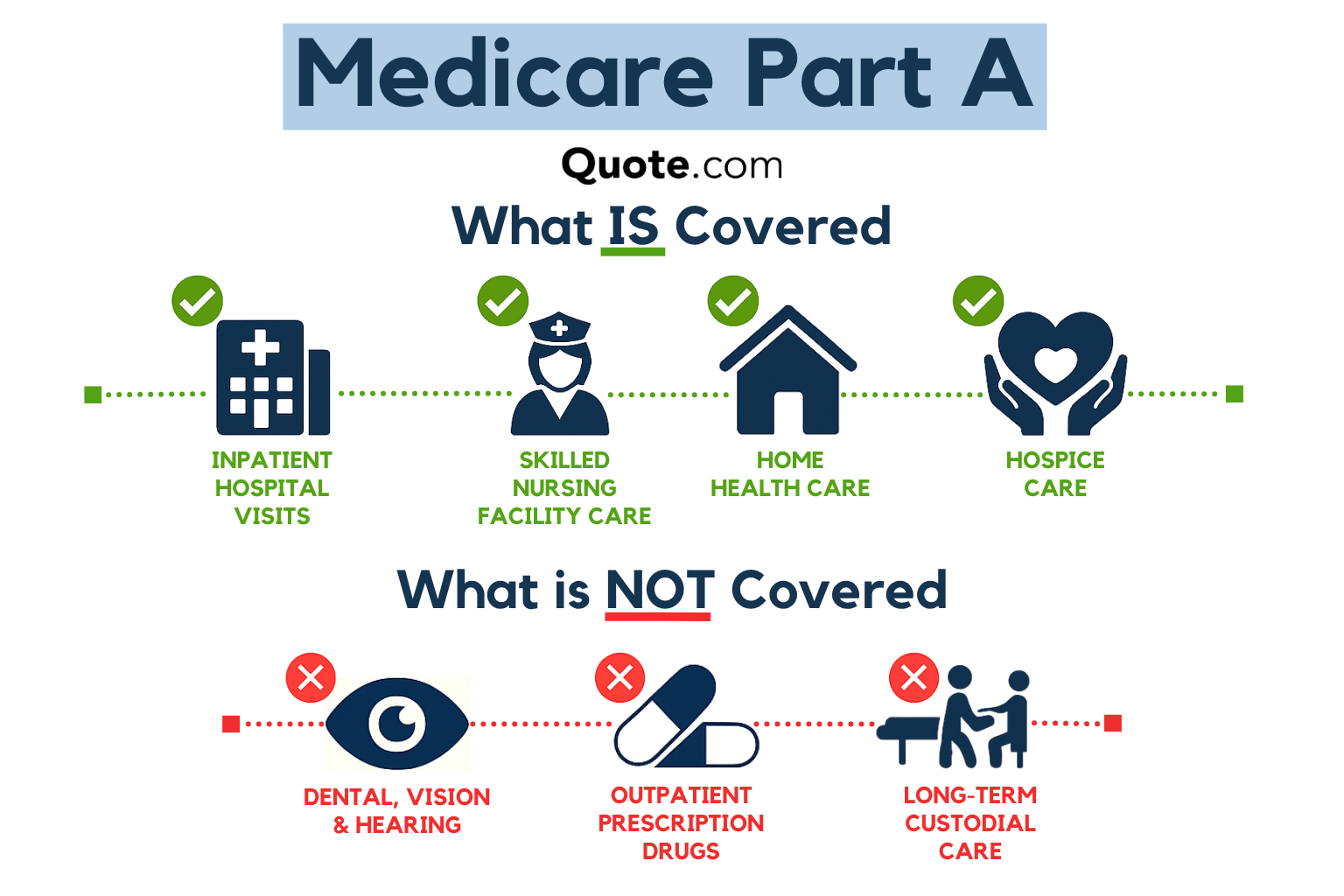

Medicare Part A covers inpatient hospital stays, skilled nursing care, hospice, and certain home health care services.

It has a deductible for each benefit period, and once you meet it, Medicare pays for hospital stays for 60 days with $0 coinsurance.

Most people don’t pay a Medicare Part A premium if they or their spouse paid Medicare taxes for at least 10 years, or 40 quarters, while working. However, if you don’t qualify for $0 premiums, you could pay up to $505 per month for Medicare Part A coverage.

For inpatient hospital stays, Part A includes a semi-private room, meals, general nursing, and medically necessary services and supplies.

Medicare Part A Overview| Coverage | Details | Eligibility |

|---|---|---|

| Inpatient Hospital Care | Room, meals, nursing, and drugs | Age 65+ or disability with work record |

| Skilled Nursing Facility | Care after 3-day hospital stay | After hospital stay and doctor order |

| Hospice Care | End-of-life comfort and support | Terminal illness, 6-mo expectancy |

| Home Health Services | Part-time nursing or therapy | Doctor-ordered & medically needed |

| Psychiatric Inpatient Care | Psychiatric hospital (190 days) | Must qualify for Medicare Part A |

| Blood Transfusions | First 3 pints unless donated | Must qualify for Medicare Part A |

It also extends to critical access hospitals, inpatient rehabilitation facilities, and long-term care hospitals across the country.

Part A also covers up to 100 days of skilled nursing care in a Medicare-certified facility after a qualifying hospital stay. Services include semi-private rooms, meals, and therapies like physical and occupational therapy.

Medicare Part A Pros & Cons| Feature | Pros | Cons |

|---|---|---|

| Inpatient Hospital Care | Covers hospital room, meals, services | Limited days; coinsurance may apply |

| Skilled Nursing Facility | Helps with rehab after hospital stay | Only after 3-day hospital admission |

| Hospice Care | Full support for terminal care needs | Must end curative treatments for care |

| Home Health Services | Covers part-time nursing or therapy | Only if medically necessary services |

| Automatic Enrollment | Auto-enroll with Social Security | May delay if still working employed |

| No Monthly Premium | Free with enough work credits | Premium if work credits are lacking |

| Nationwide Access | Accepted at most U.S. hospitals | No coverage outside the U.S. |

| Limited Out-of-Pocket Costs | Predictable costs with set limits | Doesn’t cover all medical expenses |

Hospice care is available under Part A for individuals with a terminal illness and a life expectancy of six months or less.

Coverage includes medical treatment, pain management, symptom relief, and emotional or spiritual support for both patients and their families.

Medicare Part A: Copay, Coinsurance, & Premium Breakdown| Feature | Copay | Coinsurance | Premium |

|---|---|---|---|

| Inpatient Hospital Stay | Days 1–60: $0 | Days 1–60: $0 Days 61–90: $419/day Days 91–150: $838/day | $0 with 40+ work quarters; up to $505/month otherwise |

| Skilled Nursing Facility | Days 1–20: $0 | Days 21–100: $219.50/day | Included in Part A |

| Hospice Care | $5 drug copay | $0 for care; 5% for respite care | Included in Part A |

| Home Health Services | $0 | $0 | Included in Part A |

| Psychiatric Inpatient | Days 1–60: $0 | Days 1–60: $0 Days 61–90: $419/day Days 91–150: $838/day | $0 with 40+ work quarters; up to $505/month otherwise |

| Blood Transfusion | You pay first 3 pints unless donated | $0 after 3 pints if hospital gets it free | Included in Part A |

Additionally, Medicare Part A provides limited coverage for inpatient care in a freestanding psychiatric hospital for up to 190 days.

However, the 190-day limit is a lifetime maximum and does not reset annually, so Part A will not cover inpatient psychiatric care once that limit is reached.

Medicare Part A Exclusions| Exclusions | Reasons |

|---|---|

| Custodial Long-Term Care | Not medically needed; non-skilled care |

| Dental Services | Not related to inpatient treatment |

| Vision Care | Routine exams & glasses not covered |

| Hearing Aids | Not essential inpatient treatment |

| Private Duty Nursing | Not standard for inpatient coverage |

| Overseas Care | International care not included |

| Cosmetic Surgery | Not medically needed for treatment |

| Care Outside the U.S. | Foreign care is rarely covered |

| Personal comfort items | Not medically required items |

| Blood Transfusions | First 3 pints are not covered |

Part A also covers limited home health care services, such as intermittent skilled nursing, physical therapy, and speech-language pathology. These services must come from a Medicare-approved home health agency and are generally available to individuals who are homebound and need skilled care.

If you qualify for premium-free Part A, coverage begins on the 1st of the month during your 65th birthday. Otherwise, coverage starts based on the month you enroll.

Medicare Part B: Medical Insurance

Medicare Part B covers doctor visits, outpatient care, preventive services, and medically-necessary supplies. Unlike Part A’s deductible, which applies to each hospital stay, the Part B deductible only needs to be paid once per year.

Your Medicare Part B premium, usually deducted from your Social Security benefits, is determined by your income under Medicare’s Income-Related Monthly Adjustment Amount (IRMAA).

Beneficiaries must meet a yearly deductible before Part B begins paying for most services, though many preventive care services are fully covered without cost.

While Part B coverage is optional, it’s highly recommended because it provides access to a wide range of essential health care services.

Medicare Part B Overview| Coverage | Details | Eligibility |

|---|---|---|

| Outpatient Care | Dr. visits, minor care, surgeries | Age 65+ or disabled |

| Preventive Care | Flu shots, screenings, checkups | Enrolled in Part B |

| Doctor Visits | Primary or specialist treatment | Medically necessary |

| Labs & Screenings | Blood tests, X-rays, screenings | Ordered by provider |

| Medical Equipment | Wheelchairs, oxygen equipment | Prescription needed |

| Ambulance | Emergency transport to hospital | Medicare-approved |

However, if you delay Part B enrollment without qualifying for a Special Enrollment Period, a permanent late enrollment penalty may apply to your monthly premium.

Under Part B, you have access to a variety of doctor services, including visits to primary care physicians, specialists, and other health care providers. These services can include examinations, consultations, diagnostic tests, and procedures.

Medicare Part B Coverage Cost by Income| Individual Income | Joint Income | Annual Deductible | Monthly Premium |

|---|---|---|---|

| $106,000 or less | $212,000 or less | $257 | $185 |

| $106,000 – $133,000 | $212,001 – $266,000 | $257 | $259 |

| $133,001 – $167,000 | $266,001 – $334,000 | $257 | $370 |

| $167,001 – $200,000 | $334,001 – $400,000 | $257 | $481 |

| $200,001 – $499,999 | $400,001 – $749,999 | $257 | $592 |

| Above $500,000 | Above $500,000 | $257 | $629 |

Unlike Medicare Advantage plans, Part B usually allows you to see any provider in the country who accepts Medicare.

Part B also covers outpatient care, such as same-day surgeries, diagnostic imaging, and outpatient rehabilitation services.

Medicare Part B: Cost, Coverage & Enrollment Details| Feature | Details | Notes |

|---|---|---|

| Adjusted Premium | $74 - $444 | Based on income brackets |

| Annual Deductible | $257 | Paid before coverage starts |

| Coinsurance | 20% of costs | Applies after deductible met |

| How it's Paid | Taken from benefits or billed | Billed quarterly if no benefits |

| Initial Enrollment | 3 mos before & after turning 65 | Delays may trigger penalty |

| Late Penalty | 10% increase per year delayed | Penalty lasts while on Part B |

| Monthly Premium | $185 | Under $103K / $206K joint |

| What it Covers | Dr. visits, tests, equipment | For needed / preventive care |

| What Isn't Covered | Dental, vision, hearing, cosmetic | Some covered by Advantage |

Preventive care is another key aspect of Part B coverage. Services like screenings, vaccinations, and counseling are included to help detect health issues early and support healthier lifestyle choices.

Most preventive services covered under Part B come at no additional cost if you visit a provider who accepts Medicare.

Medicare Part B Exclusions| Exclusions | Reason |

|---|---|

| Inpatient Hospital Care | Covered under Medicare Part A |

| Long-Term Care | Not medically necessary by Medicare |

| Prescription Drugs | Covered under Part D, not Part B |

| Dental, Vision, Hearing | Only with Medicare Advantage plans |

| Care Outside the U.S. | Medicare does not cover care abroad |

Part B also covers durable medical equipment (DME), such as wheelchairs, walkers, and oxygen equipment. To be covered, DME must come from a Medicare-approved supplier, and prior authorization may be required for certain items.

Not every item qualifies, so it’s best to confirm with Medicare before purchasing coverage.

Medicare Part C: Medicare Advantage

Medicare Part C, also known as Medicare Advantage, is offered by private insurance companies as an alternative to Original Medicare.

These Medicare-approved plans combine the coverage from Parts A and B and often include additional benefits.

Medicare Advantage premiums vary but typically include the Part B premium, plus any additional monthly premiums, copays, deductibles, and coinsurance set by the private insurer.

For help deciding between the two, our guide on Medicare Advantage vs. Original Medicare breaks down costs, coverage options, and how each plan impacts your choice of doctors and hospitals.

Medicare Advantage plans also have an annual out-of-pocket limit for protection against expensive medical bills.

However, all Part A and B benefits come from a Medicare-approved private insurer, meaning you’ll usually need to use doctors and hospitals within the plan network. Some plans may also require referrals for specialists, and copayments or coinsurance can apply for certain services.

Medicare Part D: Prescription Drug Coverage

Medicare Part D covers the cost of prescriptions as part of a standalone plan. Since each plan has its own formulary, a list of covered drugs, compare options side by side to ensure the medications you need are included.

If a prescription isn’t covered, you may have to pay the full cost out of pocket or consider alternatives.

Medicare Part D premiums are set by private insurers and may include an extra charge called the Income-Related Monthly Adjustment Amount (IRMAA).

You don’t have to enroll in a Part D plan, but if you skip it during your initial enrollment period and don’t have creditable prescription drug coverage, you’ll face a permanent 1% late enrollment penalty for every month without coverage.

If your medication needs change, switching Part D plans during Open Enrollment can help you avoid higher costs. Even small formulary or pricing changes can significantly impact your annual prescription drug expenses.

Part D plans used to include a coverage gap, commonly known as the “donut hole,” where you paid more for prescriptions until reaching catastrophic coverage. However, this gap was eliminated in 2025 under the Inflation Reduction Act.

Part D plans categorize drugs into cost tiers, with generics typically being less expensive and brand-name or specialty drugs costing more.

Ted Patestos Licensed Insurance Adjuster

To keep prescription costs down, ask your doctor about generic alternatives and review your Part D plan options during the Annual Enrollment Period.

You can also use preferred pharmacies and mail-order services to save on prescription drug costs. Reviewing your medications each year helps ensure your Medicare Part D coverage still fits your needs and budget.

Medigap: Supplemental Coverage to Fill Gaps

Medigap, or Medicare Supplement Insurance, is private coverage that helps pay costs not covered by Original Medicare, such as deductibles, copayments, and coinsurance.

Medigap policies do not include prescription drug coverage, so beneficiaries may need a standalone Part D plan to cover medications.

These standardized plans, labeled A through N, are sold by private insurers and designed to work alongside Original Medicare.

Plans G and N are popular because they offer strong coverage and predictable out-of-pocket costs. Plan G has the most comprehensive benefits for new Medicare enrollees, while Plan N provides a lower premium with small copays for certain services.

Unlike Medicare Advantage, Medigap lets you see any doctor or specialist nationwide who accepts Medicare to give you more flexibility if you travel often.

Each Medigap plan offers a different level of benefits. When choosing a policy, consider the coverage, premium costs, and the insurer’s reputation for service. It’s also important to check Medicare enrollment windows and whether pre-existing condition waiting periods apply.

Premiums can vary widely between insurance companies even for the same lettered plan, so it’s smart to compare pricing methods like community-rated, issue-age-rated, and attained-age-rated.

Many shoppers compare Medigap plans because predictable out-of-pocket costs make it easier to budget for health care each year.

Call (855) 634-0435 to speak with a licensed insurance agent who can help you choose the Medigap policy that fits your health and financial needs.

You can also enter your ZIP code to get a Medicare supplement coverage quote in just 2 minutes.

What Medicare Doesn’t Cover

Medicare doesn’t cover routine dental care, vision exams, eyeglasses, or hearing aids. It also excludes long-term custodial care, most prescription drugs not covered by Part D, and care received outside of the United States, except in certain situations.

Common services not covered by Medicare include:

- Routine dental exams, cleanings, and dentures

- Routine eye exams and glasses

- Hearing aids and exams

- Long-term custodial care in nursing homes

- Most prescription drugs, unless covered under Part D

- Care received outside of the United States

- Cosmetic surgery

- Routine foot care

- Acupuncture

Read More: Medicare Coverage & Eligibility

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Medicare Costs: Premiums, Deductibles, Copays

If you’re wondering, “How much does Medicare cost?” premiums vary based on the parts of Medicare you select and the services you use.

Medicare Part A typically does not require a premium if you or your spouse has paid Medicare taxes.

Medicare Costs by Plan Type| Plan | Rate/mo | Deductible | MOOP |

|---|---|---|---|

| Medigap | $35-$488 | $0-$2,800 | $7,500 |

| Part A | $0-$505 | $1,676 | NA |

| Part B | $185 | $257 | NA |

| Part C | $0-$200 | $0-$200 | $8,850 |

| Part D | $34 | $0-$545 | $2,000 |

However, Part B and Part D have monthly premiums, and Part C (Medicare Advantage) may have additional costs.

Each part also has its own deductibles and copayments, so it’s essential to understand these costs upfront to avoid unexpected bills later.

Medicare Parts A-D & Medigap: Copay & Coinsurance| Part | Copay | Coinsurance |

|---|---|---|

| Part A | Skilled Nursing: Days 1-20: $0 Days 21-100: $210/day | Days 1-60: $0 Days 61-90: $419/day After 90 Days: $838/day |

| Part B | N/A | 20% after deductible |

| Part C | Varies by plan | Varies by plan |

| Part D | Varies by plan | Varies; 1% penalty/month if late |

| Medigap | Covers Medicare copays | Covers deductibles & coinsurance (depends on plan) |

For example, Medicare Part B is the only plan that doesn’t have a copay, but you’ll need to meet your deductible before coverage applies.

It’s also important to note that coinsurance for Part B requires you to pay 20% of the cost after your deductible, which could add up quickly.

Medicare Costs: Copay, Coinsurance, & Premiums| Feature | Copay | Coinsurance | Premium |

|---|---|---|---|

| Definition | Set fee per service / Rx | Percent of cost after deductible | Monthly fee for Medicare |

| When Charged | Paid at service or refill | Charged after deductible | Paid monthly, care or not |

| Medicare Parts | Part C and Part D | Part A, Part B, & some D | Part A (if due), B, C, D |

| Typical Cost | Ex: $25 doctor visit | Ex: 20% of $1k = $200 | Ex: $185/mo for Part B |

| Cost Predictability | Same fee for each service | Cost depends on service | Fixed, predictable cost/mo |

| Varies by Plan | Varies by C or D plan | Varies by plan, often with C | Varies by plan & income |

On the other hand, Medicare Part A includes set daily copayments for longer hospital or skilled nursing facility stays.

Parts C and D often require a copayment that varies by plan for routine doctor visits, prescriptions, and other covered services.

Medicare Savings Programs: Monthly Income Limits| Qualifying Program | Individual | Married Couple |

|---|---|---|

| QI Income Limit | $1,781 | $2,400 |

| QI Resource Limit | $9,660 | $14,470 |

| QMB Income Limit | $1,325 | $1,783 |

| QMB Resource Limit | $9,660 | $14,470 |

| QWDI Income Limit | $5,302 | $7,135 |

| QWDI Resource Limit | $4,000 | $6,000 |

| SLMB Income Limit | $1,585 | $2,135 |

| SLMB Resource Limit | $9,660 | $14,470 |

If you’re worried Medicare costs won’t fit your budget, you may qualify for a Medicare Savings Program (MSP) that helps pay for premiums and other out-of-pocket costs.

You must meet certain income and resource limits to be eligible for financial assistance.

How to Enroll in Medicare

Sign up for Medicare online through the Social Security Administration’s website, by phone, or by visiting a Social Security office in person. You’ll need documents such as your Social Security card, birth certificate, and proof of U.S. citizenship or lawful residency.

Medicare enrollment also lets you choose between Original Medicare and Medicare Advantage, depending on your coverage needs and budget.

Medicare Enrollment Periods: Dates & Options| Enrollment Period | When it Occurs | What You Can Do |

|---|---|---|

| Annual Enrollment (AEP) | October 15 – December 7 | Switch or change plans |

| Automatic Enrollment | At 65 with retirement benefits | Auto-enrolled in Part A |

| General Enrollment (GEP) | January 1 – March 31 | Enroll, possibly with penalty |

| Initial Enrollment (IEP) | 3mo before/after 65th bday | Enroll in Part A or B |

| Open Enrollment (OEP) | January 1 – March 31 | Pick Advantage or Original |

| Special Enrollment (SEP) | Employed or 8mo later | Enroll without penalty |

If you’re turning 65 and don’t already get Social Security or Railroad Retirement Board benefits, you’ll need to sign up. The Initial Enrollment Period (IEP) begins three months before the month of your 65th birthday and ends three months after. Apply during this time to avoid late enrollment penalties.

If you’re still working at 65 and have employer health care coverage, you may qualify for a Special Enrollment Period that lets you delay Medicare without penalties.

Annual Enrollment takes place from October 15 to December 7, giving you time to compare plans and switch if your needs change. People who miss their IEP can use the Open Enrollment Period from January 1 to March 31, although coverage may start later and cost more.

Be cautious of Medicare scams during enrollment, especially unsolicited calls, emails, or ads that ask for personal information or promise extra benefits. Medicare and Social Security won’t contact you unexpectedly to sell plans or request sensitive details.

You can enroll in Medicare Part D if you want prescription drug coverage, and doing so during your IEP helps you avoid late penalties. For a step-by-step breakdown, check out our guide on how to sign up for Medicare.

Before enrolling, compare plan premiums, deductibles, and provider networks so you understand your total health care costs.

Medicare vs. Medicaid

Medicare and Medicaid are government health insurance programs. While Medicare covers adults 65 and older and people with certain disabilities, Medicaid provides coverage for individuals and families with low incomes.

Medicaid is a joint program between the federal and state governments, meaning benefits and coverage vary depending on where you live.

Laura Kuhl Managing Editor

Often, Medicaid offers additional services that Medicare doesn’t, such as routine dental, vision, and long-term custodial care.

Some individuals qualify for both programs, often known as “dual eligibility.” In these cases, Medicare typically pays first for covered services, and Medicaid may help with expenses such as premiums, deductibles, and services not covered by Medicare.

Learn More: What is Medicaid?

Get a Free Medicare Plan Review

Speak With a Licensed Insurance Agent Today

Secured with SHA-256 Encryption

Find the Right Medicare Plan Today

By understanding the different parts of Medicare, enrolling in a timely manner, budgeting for costs, and exploring supplemental coverage options, you can maximize your benefits and ensure you have the best Medicare plan.

When planning your budget, include Medicare costs by estimating expenses for medications, doctor visits, and hospital stays based on your current health care needs.

We recommend considering Medicare Supplement Insurance (Medigap) to help cover any gaps in coverage and reduce out-of-pocket costs.

Review your options annually during the Medicare OEP and reach out to resources like licensed insurance agents or online tools for personalized guidance.

Plan today and pave the way for comprehensive and affordable health care coverage in your golden years.

Call (855) 634-0435 today for Medicare expert guidance from a licensed insurance agent who can help you compare plans. You can also enter your ZIP code to instantly compare Medicare insurance quotes.

Frequently Asked Questions

What is Medicare?

Medicare is a federal health insurance program in the United States that provides coverage for people who are 65 years old or older, certain younger individuals with disabilities, and people with end-stage renal disease.

Who is eligible for Medicare?

Eligibility for Medicare is primarily based on age, with individuals who are 65 years old or older qualifying for coverage. However, certain younger individuals with disabilities and people with end-stage renal disease may also be eligible.

Learn More: Medicare Coverage & Eligibility

What does Medicare cover?

Medicare provides coverage for various health care services, including hospital stays, doctor visits, preventive services, prescription drugs, and more. It is divided into different parts, such as Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage).

Have questions about the different parts of Medicare? Call (855) 634-0435 today to get clear answers from a licensed insurance agent. You can also enter your ZIP code to get a free Medicare quote instantly.

How can I apply for Medicare?

To apply for Medicare, you can visit the official website of the Social Security Administration or contact them directly. The application process can also be completed in person at a local Social Security office. It is recommended to apply for Medicare three months before turning 65 to ensure timely coverage.

How much does Medicare cost?

Costs vary depending on the parts you choose. Part A typically has no monthly premium for those who’ve paid Medicare taxes while working. Meanwhile, Parts B and D require monthly premiums, deductibles, and coinsurance.

What is Medicare Part A?

Medicare Part A is coverage that helps pay for inpatient hospital stays, skilled nursing facilities, hospice, and some home health.

What is Medicare Part B?

Medicare Part B covers doctor visits, preventive services, and durable medical equipment.

What is Medicare Part C?

Commonly known as Medicare Advantage, Medicare Part C is offered by private insurers as an alternative to Original Medicare and combines Parts A and B.

What is Medicare Part D?

Medicare Part D is prescription drug coverage offered through Medicare-approved private plans. Costs vary by plan, income level, and whether you enrolled on time.

Can you use Medigap with Medicare Advantage?

No, Medigap policies only work with Original Medicare and cannot be combined with Medicare Advantage plans.

Can you use Medicaid with Medicare?

Should I get Original Medicare or Medicare Advantage?

When does Medicare coverage start?

Can I go to any doctor if I have Medicare?

Can I have both Medicare and private insurance?

What services does Medicare not cover?

How do I get the most out of my Medicare benefits?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.