Prudential Insurance Review

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health insu...

Rachael Brennan

Updated September 2025

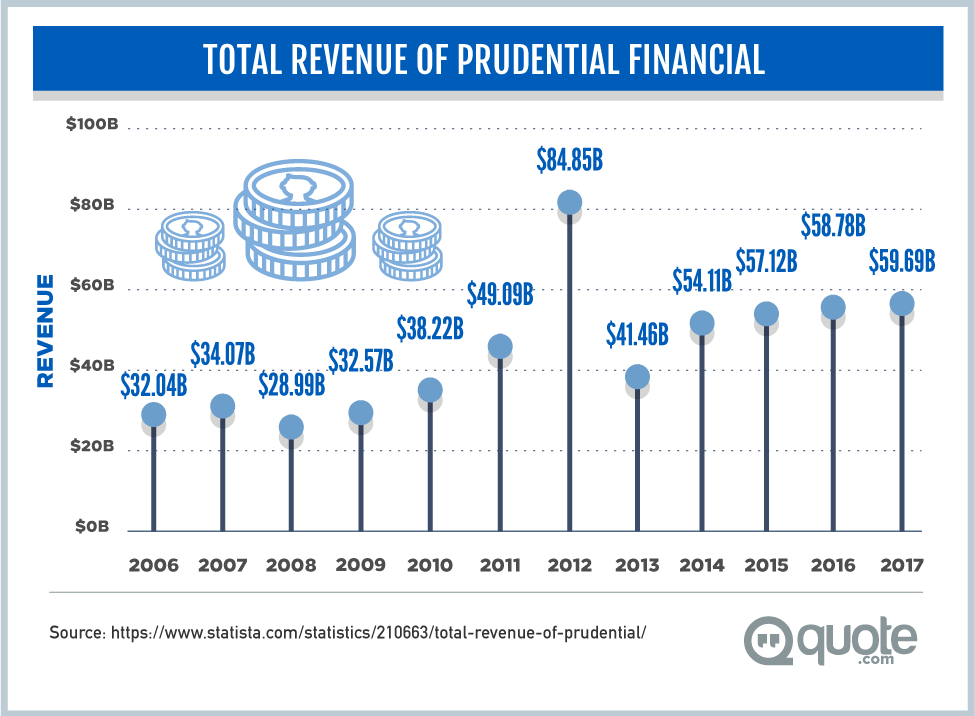

Prudential Financial was created by an insurance agent named John Fairfield Dryden in downtown Newark, New Jersey in 1875. At the time, the company was known as the Prudential Friendly Society. It was the first company in the country to make life insurance available at an affordable rate to the working class, a traditionally low-income group. The Prudential Friendly Society sold weekly premiums for as little as three cents.

The company has grown since then and took on its current name as the Prudential Insurance Company of America in 1885 upon selling its one-millionth policy. Today the company sells annuities, mutual funds, investment management, and retirement-related services in addition to its original life insurance policies in the United States, Asia, Europe, and Latin America.

What are the products/services offered by Prudential Financial Insurance?

For a company that started out offering just life insurance, Prudential has expanded significantly to offer a number of other services that include workplace benefits, life insurance, annuities, investments, and more.

Workplace Benefits

The workplace benefits offered by Prudential include 401(k), 403(b), 457, and pensions information. The company also provides a comprehensive list of tools and resources to help you understand the necessity of insurance, a proper retirement plan, and more. Some of the tools help you understand how much life insurance you might need to handle end-of-life costs, or what kind of disability insurance is required to ensure your financial needs are met.

Life Insurance

Prudential’s life insurance page breaks down the most important aspects of life insurance, as well as many questions people might have about it including “Why Life Insurance?” and information about the basics of life insurance.

Annuities

If your first thought on reading this was, “What is an annuity?” then this page is for you. Prudential makes it easy to understand how retirement can be a new start, rather than a terrifying end. It also helps customers understand why they need income and how to set up a retirement plan that could pay them a livable income for thirty years or more, breaks down what variable annuities are, how to make the most of them, and how to start saving now.

Investments

To many people, the idea of investing their hard-earned money into something as random and unpredictable as the stock market is terrifying. Prudential takes away the mysticism and makes it easy to understand mutual funds, how to evaluate risk and reward, what an investment portfolio is, and many other questions you might have about investments. By understanding how mutual funds and other types of investments can serve you, you can better grasp how to utilize these markets to earn money.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is the most sought out Prudential Financial product/service?

The most sought after Prudential Financial service is undoubtedly life insurance; after all, it is the rock on which the company was built. Life insurance is also one of those necessary services that everyone needs in their lives if only to account for the cost of funerals and another end of life costs.

Prudential Financial Life Insurance

Before purchasing life insurance, it’s important to understand the different types of life insurance and how each type applies to you.

Term life

Term life insurance is a life insurance policy that is limited by time. It is usually less expensive and pays out a larger amount, but is purchased with the expectation that the insured might pass away during the specified time period. This insurance can be purchased for when someone is starting a particularly high-risk endeavor, or when expenses are higher than they might be at other times; for example, during university education. If the insured passes away, then their family would receive the necessary funds to pay off any outstanding debt without gaining additional financial burden.

Universal life

Universal life is a type of life insurance policy with the affordability of term life insurance but the permanence of whole life insurance. Universal life insurance has an additional element that allows the interest from the principle to be used to pay premiums or to increase the cash value of the policy over time; in addition, the amount of coverage can be adjusted as needed through the life of the policy.

Compare Free Life Insurance Quotes

- Free quotes from the top carriers

- Fill out one simple form and receive multiple quotes

- Choose the rate that works for you!

Get Free Quotes

Indexed life

An indexed life insurance policy is a variant of a universal life insurance policy. You choose a financial index to base the growth of your policy on; for example, the Standard & Poor 500. If that index grows by 4%, then your policy will grow by 4%. The risk comes into play when you consider the index might not grow, in which case your policy will not increase in value. While it may not decrease in value, either, the natural inflation will result in an overall loss of value.

Variable universal life

A variable universal life insurance policy is another type of universal life policy in which the cash value is spread across a variety of different accounts. These accounts do not have to have the same value, and which account most influences the policy’s value is up to the policyholder. There is also no endowment age to consider, which means the policy can be paid in full at any point after purchase as long as the accounts it is invested in provide enough value to meet the payment amount.

What are some of the policies with Prudential life?

Prudential Life Insurance offers term life insurance, as well as universal life, indexed universal life, and variable universal life insurance policies.

Prudential Life Insurance add-ons

Life insurance policies often have optional conditions and clauses called ‘riders.’ This helps enhance the value of the policy and provide coverage for specific conditions that might not be applicable to everyone, such as serious illness considerations or disabilities. These are the potential riders you may need.

Benefit Access Rider

While most life insurance policies take time before they reach their full payout level, the BenefitAccess Rider will accelerate the maturation of your policy so that it reaches the total death benefit while you’re still alive. This allows you to use the money before death in whatever way you need, such as to pay medical costs.

Living Needs Benefit

This rider is similar to the BenefitAccess Rider in usage, except that rather than paying additional underwriting costs, there is no charge to add this rider to your policy; there is only a charge if you use it.

My Needs Benefit

Most of the time, withdrawing from your policy is accompanied by a withdrawal charge. The MyNeeds Benefit waives this charge for people in nursing homes who would like to make a withdrawal from their policy and use the money toward the cost of their health and upkeep.

Terminal Illness Rider

The Terminal Illness Rider accelerates your policy and makes your death benefit available to you while you are still alive.

Waiver of Premium

This is a disability rider that makes it so that your life insurance policy remains intact even if you are unable to work and cannot keep paying your premiums.

Enhanced Disability Benefit Rider

This rider has an effect much like the waiver of a premium rider; if you become disabled and find it difficult to work or are unable to do so, this rider ensures your life insurance remains intact. It is only available to permanent life insurance policies.

Children’s Protection Rider

This is a rider available to people with term life insurance policies that makes it possible to provide life insurance for young children. When you add this rider, you can choose to convert it to a permanent life insurance policy once the child reaches a specific age.

Children Level Term Rider

This rider is available on permanent life insurance policies and functions as an additional term policy that can be made permanent once a child reaches a certain age.

Additional Death Benefit

This rider will pay additional benefits if you are in an accident that directly causes your death.

Overloan Protection Rider

If you borrow money from your loan and fail to pay it, your policy could lapse and you could be left without life insurance. The Overloan Protection Rider helps prevent that, but there is a one-time fee if it is used.

Enhanced Cash Value Rider

If for some reason you need to give up your policy in the early years of owning it, the Enhanced Cash Value Rider can increase the cash value of your policy.

Guaranteed Policy Split Rider

If you purchase your life insurance policy as part of your estate planning with your spouse, this rider allows you to split a single policy into two separate policies if your estate laws change or the two of you get divorced.

Estate Protection Rider

This rider can increase the death benefit by as much as 100% if both of the people insured on the policy die before the 4th policy anniversary.

Canceling your Prudential Financial Insurance

Most life insurance policies can be canceled within 30 days of purchase with no charge. However, beyond this period, you should be able to cancel if necessary, although the steps required may vary. Usually, you simply need to contact your provider and inform them that you wish to cancel. A charge may or may not be applied, but the policy should be closed. You simply stop making premium payments and your coverage ceases. However, you are not entitled to refunds of any premiums you have already paid.

In many cases, you can close a policy early and take the cash value of the policy to redeem some of your lost investment.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Prudential Financial Insurance strengths

Prudential Financial Life Insurance excels in select areas, including:

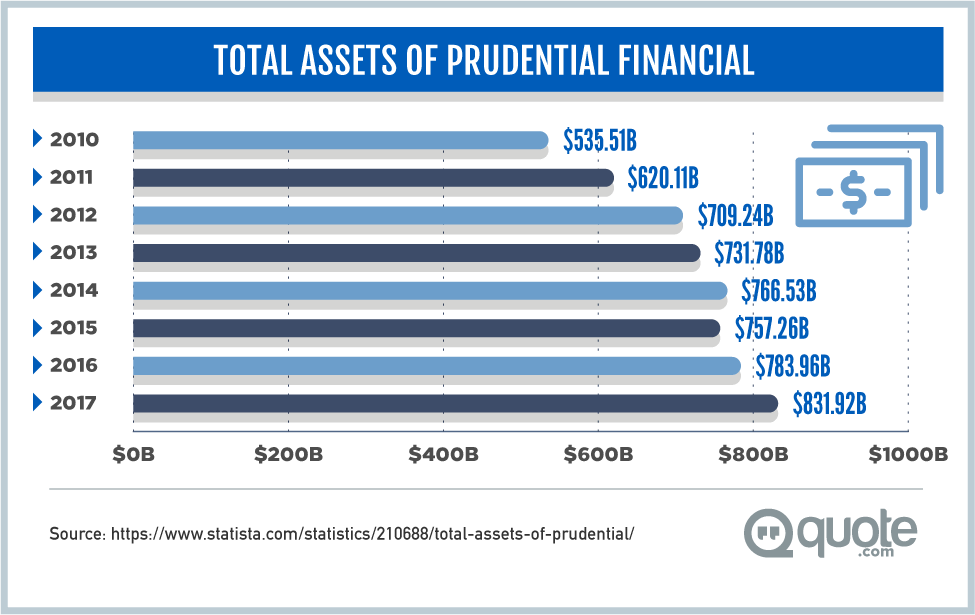

- Prudential is the second largest life insurance company in the country.

- Prudential offers some of the best rates available for healthy people.

- The company provides extra safeguards for beneficiaries with special needs.

- Prudential has a great Standard and Poor rating, and Moody’s and Fitch rate it at A+.

Prudential Financial Insurance weaknesses

- Prudential Financial only has limited customer service.

- Prudential does not offer a whole life insurance policy.

How to file a prudential life insurance claim

Prudential makes it easy to file a claim either online or over the phone. To file online, simply go to this page. If you would prefer to speak to someone on the phone, call 855-277-8061 between 8 AM and 8 PM EST Monday through Friday. You should note, however, that not all states support the online claim process. If you live in California, Indiana, Kentucky, Maryland, Minnesota, new Hampshire, New Jersey, Oklahoma, or Rohde Island, you’ll need to call the number listed above.

You’ll need the policy and social security numbers relevant to the policy, the name of the insured, the death of birth and date of death, as well as the name of the funeral home and their phone number. The online claims form will take anywhere from five to seven minutes to complete. As you fill out each section, make sure to include as much information as possible; the more information you include, the more quickly the claim can be processed. Once you have submitted the form, a representative from Prudential will review what you’ve submitted and reach out to you if more information is needed.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the most common complaints about Prudential Financial Insurance?

The main complaints filed against Prudential revolve around customer service and a failure to understand the terms of the policy. However, because customer service isn’t what it could be, many people do not have the details of their policies laid out to them, and this results in numerous misunderstandings. Here are a few customer complaints:

“Just had the worst experience with Prudential! They sold my elderly mother a VUL life policy in 2001. She had no way of understanding it because she is native Japanese and has a terrible understanding of the English language. She paid into it around 60,000 dollars, they gave no help in managing her portfolio so it basically was worthless. Because of the way the policy works as you reach the end of your life, they will increase the policy premiums so high that if you’re living on SS or limited income it will be very difficult to pay. I had to cancel it and they screwed me out of my last 500.00 dollars that was left in her portfolio after 16 years. I would not recommend this company they will try to use every effort not to pay out.” Lola of Encinitas, CA on April 13, 2017 (Consumer Affairs)

“Mom passed in 1999. We were contacted in 2017 and told she had a policy. After sending in paperwork was told we needed a death certificate. “All we need is that” to process the claim. Was told after sending that the check would be coming in 8 weeks. Another form to fill out then arrived which also stated reply must be sent by 4/9. The form was dated and sent 4/7! This company has gone out of their way to forward this policy to the state. They keep adding hoops to jump through every time I talk to them. This money belongs to the beneficiaries and they know it. Shame on Prudential.” Robert of Bloomsbury, NJ ON April 9, 2015 (Consumer Affairs)

Do products/services offered by Prudential Life Insurance differ from state to state?

While the products and services offered will not vary to any significant degree, each state has different requirements for what is and is not allowed. Criteria such as underwriting requirements, medical exam requirements, and timeframes will vary from state to state and may affect the availability of specific life insurance policies in that state.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

FAQ

Here are some of the most frequently asked questions about Prudential:

The Verdict

Thinking of going with Prudential?

When it comes to life insurance, Prudential Financial certainly knows what it’s doing. The company has been in business for around 140 years and offers a broad range of both term and universal life insurance policies. The additional riders provide enough customization options that you can adjust your policy as needed to fit your specific situation.

With an eight percent discount available for paying annually, Prudential Financial can be quite affordable if you can work it just right. Their term life policies are also beneficial to individuals who need large amounts of coverage for a limited time. Considering their financial strength, high praise, and history of success, we would recommend Prudential Financial Insurance as an option to anyone looking for life insurance.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.