10 Best Life Insurance Companies in 2026

State Farm, Guardian, and MassMutual are the best life insurance companies, recognized for their customer satisfaction. A term life policy starts at just $23 per month. You'll also find unique benefits with these providers, such as a return of premium policy, which refunds your policy if you outlive the coverage.

Read more Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Life insurance policies starting at less than $1/day

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated January 2026

State Farm, Guardian, and MassMutual are the best life insurance companies. Rates start at just $23 monthly for a 20-year term policy.

- State Farm ranks #1 in our rating for highest customer satisfaction

- Many insurers, like Guardian, offer no-exam policies up to $250,000

- MassMutual stands out for its policy options and annual dividends

State Farm stands out as the top pick overall for its claims satisfaction and reliable service. Check out our life insurance guide for more information.

Our Top 10 Picks: Best Life Insurance Companies| Company | Rank | Claim Satisfaction | No-Exam Plans? | Best for |

|---|---|---|---|---|

| #1 | 699 / 1,000 | ✅ | Customer Service | |

| #2 | 685 / 1,000 | ✅ | No-Exam Coverage | |

| #3 | 673 / 1,000 | ❌ | Financial Strength | |

| #4 | 670 / 1,000 | ❌ | Paying Dividends | |

| #5 | 666 / 1,000 | ✅ | Bundling | |

| #6 | 659 / 1,000 | ✅ | Seniors | |

| #7 | 657 / 1,000 | ❌ | Annuities |

| #8 | 653 / 1,000 | ❌ | Lowest Premiums | |

| #9 | 644 / 1,000 | ✅ | Wellness Rewards | |

| #10 | 644 / 1,000 | ❌ | Employer Coverage |

These insurers lead the industry by balancing affordability and exceptional benefits, ensuring that policyholders receive both cost-effective coverage and high-quality service.

Safeguard your family’s future while saving on coverage. Enter your ZIP code to instantly compare life insurance quotes with our free tool today.

Comparing Life Insurance Costs

Life insurance rates vary for several reasons, including age, health, and coverage amount, making it critical to compare life insurance quotes from multiple insurers before buying a policy (Learn More: How to Get Life Insurance Quotes).

This guide offers a detailed comparison of monthly life insurance rates from leading providers, covering both term and whole life insurance options.

Life Insurance Monthly Rates by Policy Type| Insurance Company | 20-Year Term | Whole Policy |

|---|---|---|

| $27 | $210 | |

| $26 | $200 | |

| $25 | $195 | |

| $28 | $215 | |

| $24 | $190 | |

| $26 | $205 | |

| $30 | $230 | |

| $25 | $200 |

| $23 | $185 | |

| $27 | $210 |

For term coverage, rates range from $23 a month with Protective to $30 monthly with Northwestern Mutual.

For a whole policy, monthly rates range from $185 with Protective to $230 with Northwestern Mutual.

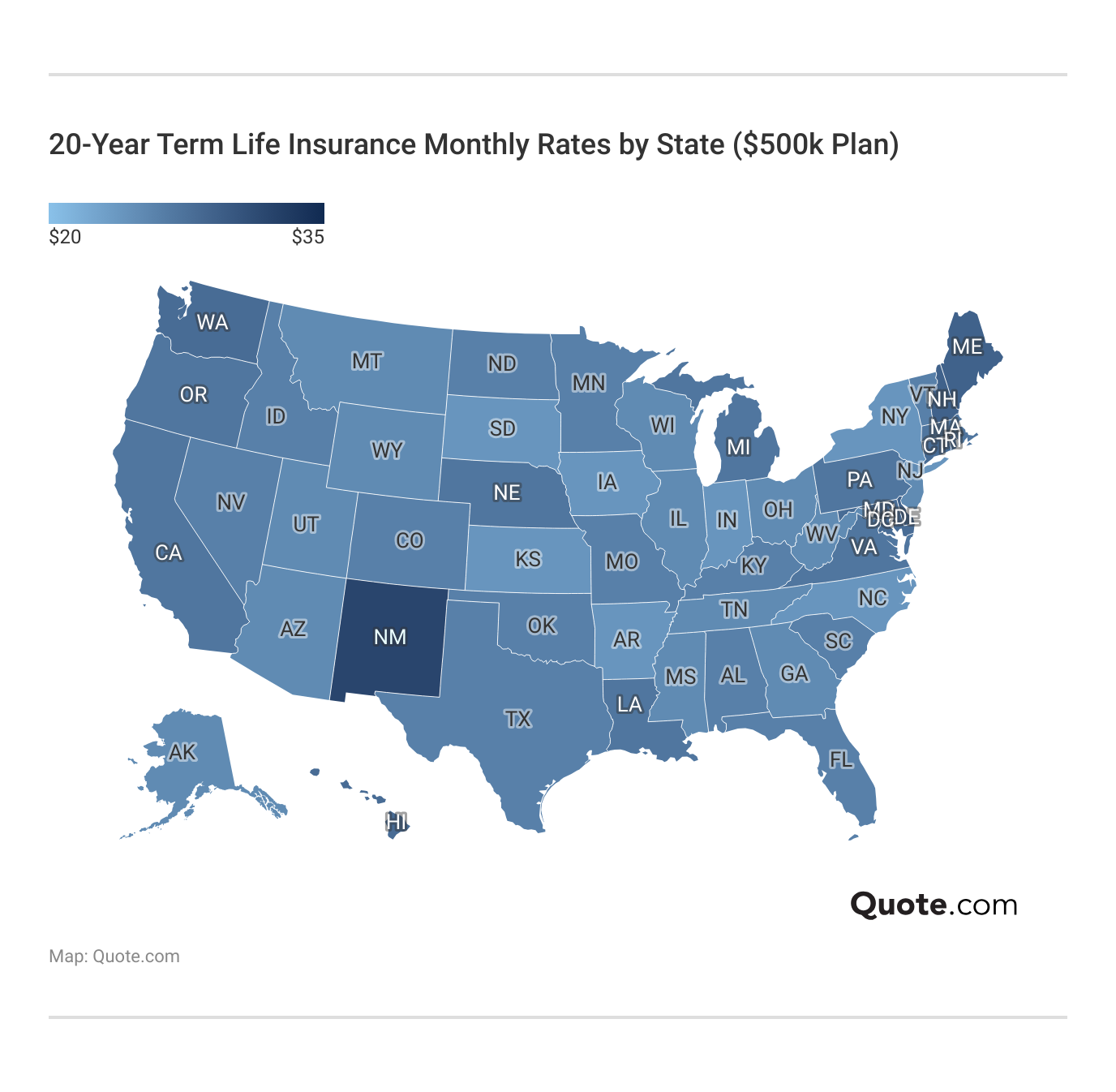

You will also find that life insurance rates vary based on where you live. Local premiums fluctuate based on state insurance laws, state-wide death rates, and unique risks related to local weather or crime rates.

New Mexico, New Hampshire, and Maine are some of the most expensive states for life insurance.

While most people pay around $25 a month for life insurance, people with New Mexico ZIP codes pay over $30 monthly.

Ready to find out what coverage could cost near you? Compare life insurance quotes today and see personalized options in minutes.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance Coverage Options

Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years, and is more affordable than permanent life insurance because it only pays out if the insured dies within the term.

It is ideal for individuals who need coverage until their children graduate or a mortgage is paid off.

Term policies expire with no benefit if the insured is still alive, and renewals can be costly. They also don’t build cash value or offer investment options.

Jeff Root Licensed Insurance Agent

Advantages of term life insurance include lower premiums, simplicity, and coverage flexibility (Learn More: Whole vs. Term Life Insurance).

Some term policies may also qualify for conversion to whole life insurance, depending on your insurer.

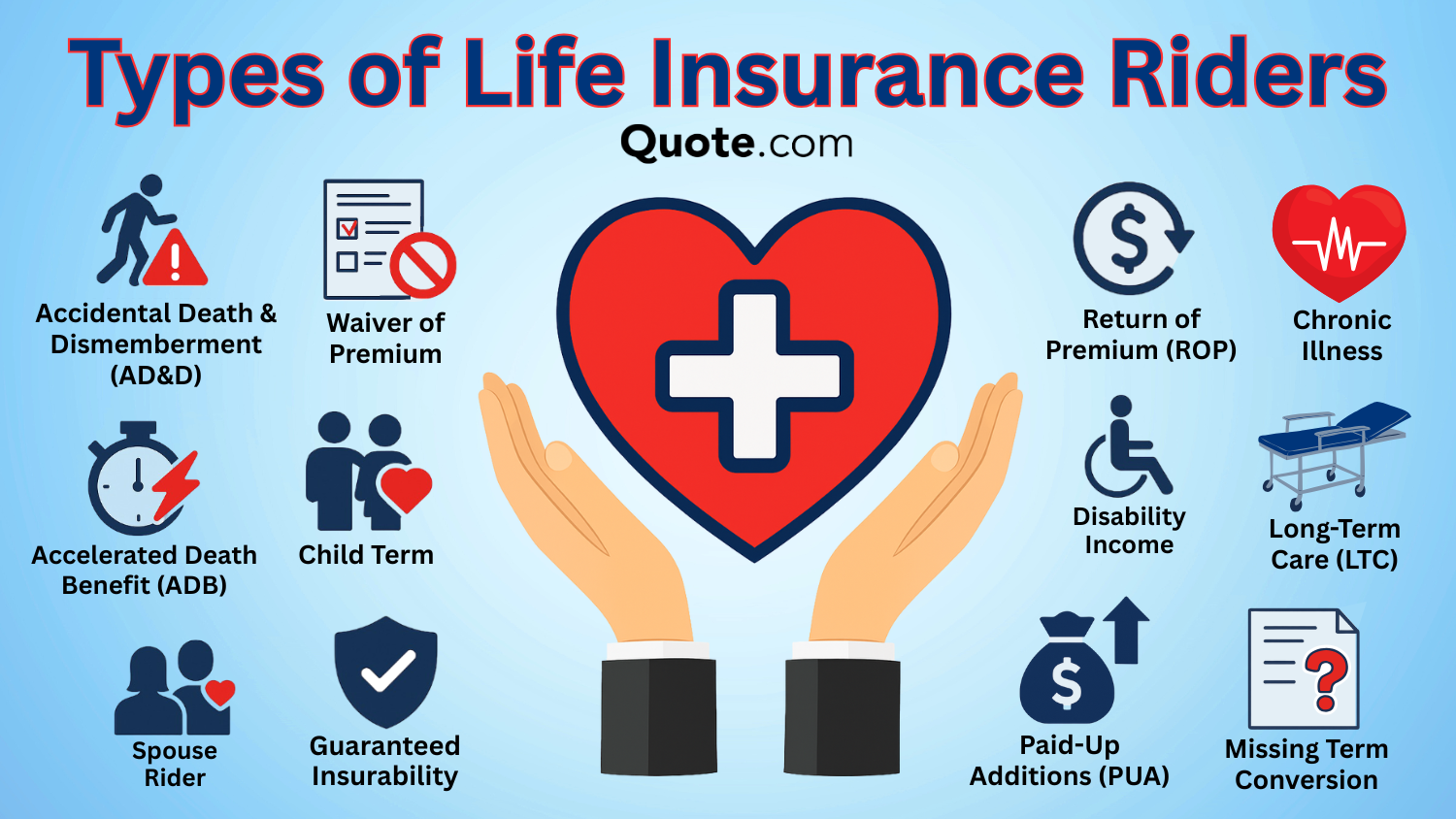

Many term policies offer optional riders, which increase your policy’s value. For example, an accelerated death benefit rider lets you access part of the death benefit if you’re diagnosed with a terminal illness. This can help cover medical bills or other financial needs.

Another common option is a child term rider, which provides a small amount of life insurance for your children until they reach adulthood.

Permanent life insurance costs more because it offers lifelong coverage as long as you continue to make premium payments.

There are several types of permanent policies that offer different types of coverage and investment opportunities:

- Whole Life Insurance: Provides fixed premiums, guaranteed cash value growth, and a guaranteed death benefit, though it’s the most expensive option.

- Universal Life Insurance: Universal life insurance offers flexible premiums and death benefits, with cash value based on interest rates or market performance.

- Variable Life Insurance: Includes investment options for your cash value, which can yield higher returns but also carries investment risk.

Standard term and whole life policies work for most families looking to cover unpaid debts or pay for children’s educations.

Universal and variable universal life are recommended for individuals looking to supplement an existing portfolio

For seniors and individuals looking for more basic life coverage, final expense life insurance is a type of permanent policy that only pays out to cover funeral expenses.

Policy limits are relatively low for final expense coverage, usually only providing around $10,000, but premiums are much more affordable than standard whole or term life insurance.

Factors Affecting Life Insurance Rates

Understanding the factors that influence life insurance rates is crucial for securing the best coverage at an affordable price.

Life insurance premiums can vary significantly based on individual circumstances, and recognizing the elements that drive higher costs can help you make informed decisions.

- Age: Health risks become more prevalent as people age, leading to higher life insurance premiums. Insurers see age as a significant risk factor, resulting in higher costs for older applicants.

- Health Conditions: Pre-existing conditions like diabetes, heart disease, or cancer drive premiums higher. Insurers carefully evaluate medical histories, and chronic illnesses increase the likelihood of claims, driving up costs.

- Lifestyle Choices: Activities like extreme sports or substance abuse can raise premiums. Risky lifestyles increase the likelihood of injury or illness, so insurers raise rates to offset potential claims.

- Occupation: Construction, mining, and firefighting often result in higher rates of injury. These high-risk professions increase the likelihood of accidents or health problems, which insurers factor into their pricing.

- Smoking: Smokers pay much higher life insurance rates. Since smoking is tied to respiratory and heart diseases that shorten life expectancy, insurers charge significantly more to offset the added risk.

By being aware of these factors, you can better navigate the life insurance market and make choices that may help reduce your premiums (Read More: The Complete Guide to Health Insurance).

Whether you’re seeking to lower your current rates or planning for future coverage, understanding these influences allows you to take proactive steps in managing your life insurance costs effectively.

Proven Strategies to Save Money on Life Insurance

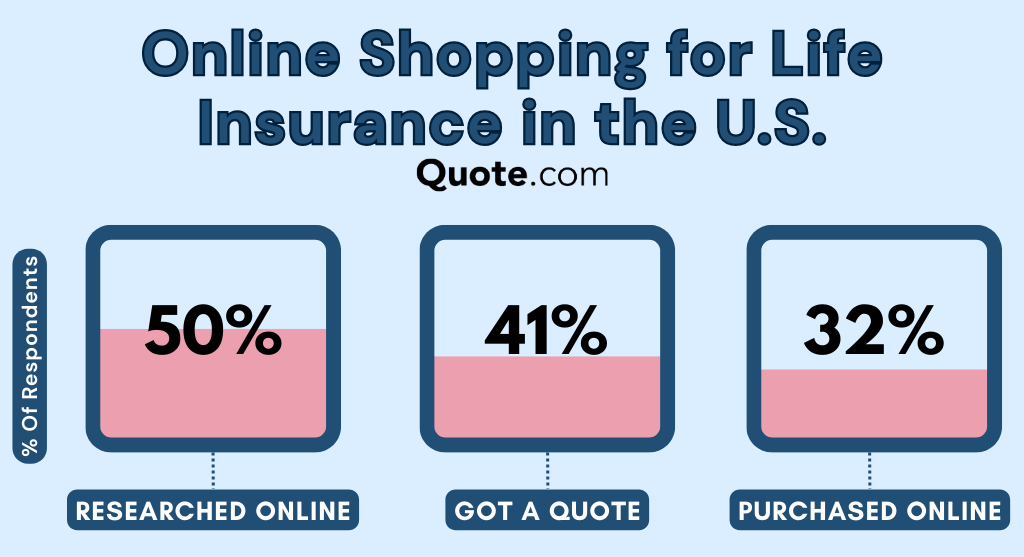

To save money on life insurance, start by comparing quotes from multiple providers to find the most competitive rates. More than half of shoppers look online before they buy life insurance.

Check out our step-by-step guide on how to get life insurance quotes and save big.

Many insurers offer life insurance discounts to help policyholders save on their premiums.

Maintain a healthy lifestyle, avoid smoking, and manage chronic conditions to lower premiums. Bundle life insurance with auto or home insurance for discounts, and select a policy term that fits your needs to avoid over-insuring.

Top Life Insurance Discounts| Company | Family History | Good Health | Non- Smoker | Professional Discount |

|---|---|---|---|---|

| 12% | 15% | 15% | 10% | |

| 5% | 20% | 10% | 15% | |

| 6% | 8% | 15% | 15% | |

| 5% | 12% | 15% | 10% | |

| 7% | 10% | 10% | 12% | |

| 5% | 14% | 12% | 10% | |

| 20% | 25% | 10% | 15% | |

| 10% | 13% | 10% | 10% |

| 18% | 14% | 15% | 10% | |

| 15% | 12% | 8% | 10% |

You can also opt for term life insurance rather than permanent coverage if you need temporary protection.

It’s generally more affordable, but coverage is temporary, and you may see higher rates if you renew. Use our guide to help you determine how much life insurance you need.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Life Insurance Companies in the U.S.

State Farm, Guardian, and MassMutual are the best life insurance companies. Check out our list of pros and cons below to see why we chose these top providers:

#1 – State Farm: Top Pick Overall

Pros

- Customer-Centered Life Insurance: Prioritizes customer needs, offering life insurance policies that cater to individual preferences (Read More: State Farm Review).

- Strong Customer Support: State Farm’s life insurance customer support is dedicated to helping policyholders with their questions and concerns.

- User-Friendly Policies: It designs its life insurance policies to be easy to understand and accessible for all customers.

Cons

- Premium Costs: The customer-focused approach of State Farm may lead to higher premiums for life insurance policies.

- Limited Online Resources: The emphasis on customer service might result in fewer online resources for managing life insurance policies.

#2 – Guardian: Best for No-Exam Coverage

Pros

- No-Exam Policies: Offers simplified issue policies up to $250,000 without a medical exam, while term life coverage is available up to $3 million.

- Financial Strength: Guardian has an A++ rating from A.M. Best, reflecting long-term stability for policyholders’ families.

- Few Complaints: Guardian receives fewer complaints than other top insurers, which usually means smoother claims. Compare it to the best no-exam life insurance companies.

Cons

- Few Digital Tools: Many policies require you to speak with an agent, and you can’t get online quotes.

- Limited Service Hours: Customer service isn’t available 24/7 to handle questions or claims.

#3 – MassMutual: Best for Financial Strength

Pros

- Great Financial Ratings: MassMutual boasts an A++ rating from A.M. Best and a strong track record of claim payments. (Learn More: MassMutual Insurance Review).

- Policy Options: Offers many term, whole, variable, and universal life insurance options.

- Dividend Potential: Policyholders may earn annual dividends to boost their cash growth.

Cons

- Exam Often Required: Most MassMutual policies require you to undergo a medical exam.

- Limited Online Tools: You can’t get a digital quote for every policy type, so you’ll have to call an agent for one.

#4 – Northwestern Mutual: Best for Paying Dividends

Pros

- Dividend Payments: Northwestern Mutual has a history of paying dividends to policyholders, which helps build long-term cash value for its policies.

- Convertible Policies: Policyholders can convert term policies to permanent life insurance (Learn More: Single Premium Life Insurance).

- Financial Stability: Northwestern Mutual’s A++ rating from A.M. Best shows its trustworthiness and reliability.

Cons

- Lack of Policy Details: There isn’t much information online about Northwestern Mutual’s policy options.

- Can’t Apply Online: You’ll need to speak with a Northwestern Mutual agent to apply for life insurance.

#5 – Nationwide: Best for Bundling Policies

Pros

- Comprehensive Life Insurance Coverage: Nationwide offers extensive life insurance policies covering various needs and scenarios (Learn More: Nationwide Review).

- Customizable Policies: Nationwide allows for comprehensive customization of life insurance policies, ensuring that you get the coverage that best fits your unique requirements.

- Inclusive Coverage Options: Nationwide’s life insurance plans include various riders and add-ons, providing comprehensive protection for policyholders.

Cons

- Higher Premiums: The comprehensive life insurance coverage offered by Nationwide may come with higher premiums compared to basic plans.

- Complex Policy Choices: The extensive options for life insurance coverage can be overwhelming for some customers, making it harder to choose the right plan.

#6 – Mutual of Omaha: Best for Seniors

Pros

- Senior-Friendly Policies: Offers simplified issue and guaranteed issue life insurance coverage, making it easier for seniors to get coverage without a medical exam.

- Free Living Benefits: All term life and indexed universal life policies include an accelerated death benefit at no extra cost.

- Coverage Variety: Mutual of Omaha offers various life insurance products, such as term, whole, and universal life. See our Mutual of Omaha life insurance review for details.

Cons

- No Online Quotes: You can’t get a life insurance quote online through Mutual of Omaha’s website.

- Limited Whole Life: Mutual of Omaha’s whole life insurance coverage caps at $25,000.

#7 – Pacific Life: Best for Annuities

Pros

- Annuity Products: Pacific Life is well known for its life insurance annuity products and retirement options.

- Many Coverage Options: Provides term, whole, universal, and indexed universal life insurance.

- Conversion Rider: Pacific Life allows policyholders to convert term life insurance to permanent coverage.

Cons

- Limited Availability: Not all types of life insurance are available nationwide, and New York residents aren’t eligible for life insurance.

- Few Online Tools: Pacific Life provides limited policy information online, and you can’t get a quote on its website.

#8 – Protective: Best for Lowest Premiums

Pros

- Lowest Rates: Protective’s life insurance rates start at just $23 per month, making it the cheapest provider in our ranking.

- Flexible Policy Terms: Term life policies with Protective go up to 40 years, longer than most other competitors.

- Few Complaints: Protective has fewer complaints than average. Compare it to reviews of the best term life insurance companies.

Cons

- Not Many Riders: Protective offers fewer riders compared to other insurers.

- Typically Requires Exam: Usually, you’ll need to undergo a medical exam when applying for life insurance coverage.

#9 – John Hancock: Best for Wellness Rewards

Pros

- Wellness Program: John Hancock’s wellness programs let policyholders earn discounts and gift cards for healthy habits.

- Various Riders: Offers term, universal, indexed universal, and variable universal life insurance.

- High Policy Limits: John Hancock offers high death benefit limits if you need greater coverage (Learn More: How to Finance What Your Health Insurance Won’t Cover).

Cons

- No Whole Life Policies: You can’t get whole life insurance through John Hancock.

- Few Online Resources: John Hancock lacks email or live chat customer support, and doesn’t offer online quotes.

#10 – MetLife: Best for Employer Coverage

Pros

- Group Coverage: MetLife leads in group life insurance, bringing lower rates to eligible employees (Learn More: MetLife Insurance Review).

- Extra Benefits: A MetLife policy includes additional benefits, such as travel assistance and grief counseling.

- No-Exam Coverage: Certain group policies don’t require a medical exam.

Cons

- No Direct Sales: Only those with employer-sponsored coverage qualify for MetLife.

- High Customer Complaints: MetLife has fewer policy types than other top competitors (Read More: Erie vs. Metlife Insurance).

Find the Best Life Insurance Provider Today

Discover the best life insurance companies, including State Farm, Guardian, and MassMutual, known for their comprehensive coverage and competitive rates.

Protective has the cheapest life insurance rates of all the providers in our ranking, with term coverage at $23 per month (Learn More: Comparing Plans and Getting an Insurance Plan That Works for You).

Compare monthly rates, explore the differences between term and permanent life insurance, and learn how factors like health and lifestyle impact your premiums before you buy to find the right company for you.

Protecting your family financially doesn’t have to be expensive. Enter your ZIP code in our free comparison tool to find affordable life insurance.

Frequently Asked Questions

What makes a life insurance company the best?

The best life insurance companies offer a balance of competitive rates, comprehensive coverage, excellent customer service, and strong financial stability.

Avoid overpaying for life insurance by comparing rates with our free tool. Simply enter your ZIP code below to get started.

Which are the best life insurance companies?

The best life insurance companies include State Farm, Guardian, and MassMutual. These companies are known for their strong financial stability, customer service, and comprehensive coverage options. They consistently rank high in industry evaluations.

How can I find the best life insurance quotes?

To find the best life insurance quotes, compare rates from multiple insurers. Using online comparison tools can help you quickly find the best quotes tailored to your needs.

What is the average price of life insurance?

The average price of life insurance varies based on factors such as age, health, coverage amount, and policy type. Generally, term policies can start as low as $23 per month, while whole life insurance starts at $185 per month.

What are the best life insurance companies for overweight individuals?

The best life insurance companies for overweight individuals often consider overall health and lifestyle factors rather than just weight. Leading companies like Nationwide, Progressive, and Farmers are known for their comprehensive coverage and competitive rates, making them good options for those concerned about weight-related premiums.

For a comprehensive overview, explore our detailed resource titled “How to Finance What Your Health Insurance Won’t Cover.”

Who is life insurance best suited for?

Life insurance is best suited for individuals who have dependents, financial obligations like mortgages, or anyone who wants to ensure their loved ones are financially protected in the event of their passing. It is particularly important for primary breadwinners and parents.

See how much you can save on whole life insurance by entering your ZIP code below into our free comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.