How to File a Home Insurance Claim After a Wildfire in 2025

Claim denials are as high as 51% at some companies, so learning how to file a home insurance claim after a wildfire is crucial. Getting the best wildfire insurance payout requires you to document the damage and work with an adjuster. Our eight steps make it easy to resolve your claim and start repairing your home.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Luke Williams is a finance, insurance, real estate, and home improvement expert based in Philadelphia, Pennsylvania, specializing in writing and researching for consumers. He studied finance, economics, and communications at Pennsylvania State University and graduated with a degree in Corporate Communications. His insurance and finance writing has been featured on Spoxor, The Good Men Project...

Luke Williams

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated December 2025

Figuring out how to file a home insurance claim after a wildfire might be the furthest thing from your mind after a loss. However, all you need to do to get your home insurance payout as quickly as possible is follow the eight easy steps below.

To successfully submit a wildfire homeowners insurance claim, you’ll need to take steps like speaking with a claims adjuster and documenting the damage done to your home.

Steps to Filing an Insurance Claim After a Wildfire| Step | Action | Description |

|---|---|---|

| #1 | Immediate Notification | Contact your insurance company as soon as possible to report the damage |

| #2 | Document Damage | Take photographs and video of all damages, including structures, belongings, and surrounding property |

| #3 | Keep Records | Maintain a record of all communications with the insurance company, including dates and names |

| #4 | Temporary Repairs | Conduct temporary repairs to mitigate further damage (save receipts for reimbursement) |

| #5 | Claim Form Submission | Fill out the claim form thoroughly and submit it along with any required documentation |

| #6 | Meet with Adjuster | Allow the insurance adjuster to inspect the damage to assess the claim |

| #7 | Review Settlement Offer | Review the insurance company’s settlement offer and negotiate if it does not cover all losses |

| #8 | Close the Claim | Once satisfied, finalize the claim to receive your compensation |

Buying homeowners insurance is always important, but it’s critical if you live in a fire-prone state, especially since some policies specifically exclude wildfire coverage.

Get homeowners insurance coverage and learn everything you need to know about how wildfire insurance claims work below. If you don’t have coverage or you want to upgrade an existing policy, enter your ZIP code into our free comparison tool to find the cheapest rates in your area.

- Step #1: Contact Your Provider – Notify your insurer ASAP

- Step #2: Document Wildfire Damage – Take photos of your home

- Step #3: Keep Records – Keep communication records and repair receipts

- Step #4: Perform Temporary Repairs – Repair what’s necessary to live in your home

- Step #5: Submit a Wildfire Claim – Use your provider’s website or call them

- Step #6: Meet With an Adjustor – An adjustor investigates your claim

- Step #7: Review Your Claim Settlement – Look over your settlement offer

- Step #8: Close Your Claim – Accept your insurance payout

8 Steps to File a Home Insurance Claim After Wildfire Damage

When your home is damaged or destroyed in a wildfire, figuring out the claims process for your home insurance might be stressful. However, you can have your claim successfully filed in just eight simple steps.

After figuring out that home insurance does cover wildfire damage, most homeowners want to start the claims process immediately. While you should file quickly, your claim will have a better chance of approval if you follow the steps listed below.

Step #1: Contact Your Provider

Contacting your provider as soon as you can is the first crucial step in getting your home repaired or rebuilt. Whether you want to contact your provider over the phone, through a mobile app, or on your company’s website is up to you, but you should do it as soon as you’re safe.

Most insurance providers offer 24/7 claims support. After a natural disaster, these support systems are usually swamped with requests, so getting your claim in early is crucial.

Kristen Gryglik Licensed Insurance Agent

When you initially contact your provider, you’ll need some basic information on hand. You don’t need every detail yet, though – your provider only needs the basics at this point.

If you can’t get to your homeowners insurance claim right away, that doesn’t mean you won’t be able to file. All insurance companies give you a little wiggle room to make your claim.

While most homeowners have up to a year to file a claim, that may not be the case. For example, Arizona state law gives homeowners up to six years to file a claim. Other states only require insurance providers to accept claims for 30 days.

Regardless of how much time you have to file, you’ll get your fire insurance payout quickest by filing early. You can also receive a smaller payout if you postpone filing your claim for too long, as it will be harder to prove fire damage.

Read more: Best Homeowners Insurance Companies

Step #2: Document Wildfire Damage

Once you can safely enter your home, you’ll need to gather evidence for your wildfire damage insurance claim. The more information you gather in this step, the better your chances of a successful claim are.

You’ll need the following information to increase your chances that your insurance for wildfire claims will be successful.

Wildfire Insurance Claims Important Documentation| Type | How It Helps |

|---|---|

| Claim Forms | Required to start a wildfire claim. |

| Insurance Policy | Lays out your coverage limits. |

| Inventory of Damages | Provides a detailed list of damaged belongings. |

| Photographs & Videos | Acts as visual proof for your claim. |

| Receipts for Expenses | Shows what your reimbursement should be. |

Make sure to take photos and video of anything that was damaged by the fire, including burnt structures, destroyed belongings, and anything damaged by soot. You’ll need this evidence in the upcoming steps below, so make sure to be as detailed as possible. This is also an important step if you rent your home. The best renters insurance companies will require similar documentation for your damaged belongings.

Step #3: Keep Records and Receipts

While you should wait for your wildfire payout to arrive before you start repairing your home, some repairs can’t wait. If you need to spend money before your claim is resolved, make sure to keep receipts. This can include:

- Temporary lodging

- Food

- Clothes

- Urgent repairs to make your home livable

This is why so many insurance experts recommend having an updated home inventory that you can show your provider. Fire damage can be extensive, but having an inventory makes learning how to file a claim after a wildfire that much easier.

In most cases, your insurance provider will reimburse you for anything covered by your policy so long as you keep your receipts. Having these receipts will also help you appeal a claim denial. You can learn more about what home insurance covers and what you should keep records of in our ultimate insurance cheat sheet.

Step #4: Perform Temporary Repairs

When you compare homeowners insurance quotes, hopefully you’ll get the best coverage possible. However, not even the best home insurance policy will pay out immediately after you file a claim. If your home needs temporary repairs to prevent more damage from happening, you won’t have time to wait for your insurance payout.

Examples of temporary repairs you should make include boarding up windows, patching holes, and removing debris. Remember – your insurance company will reimburse you for covered expenses.

Try to hold off on any permanent repairs until your claim has been processed. Once you receive your settlement, you’ll have a clearer picture of your repair budget.

Step #5: Submit a Wildfire Insurance Claim

No matter what type of property insurance you have, submitting a claim is usually easy. Most companies offer a variety of ways to start a claim, including over the phone and with a mobile app. Not every company has a mobile app that accepts home insurance claims, but the major providers like State Farm do. You can learn more about filing an insurance claim through the State Farm app in our State Farm insurance review.

To start your claim, you’ll need to fill out a claim submission form. Make sure to fill the form out completely and include any documentation you’ve collected.

You should also make sure that filing a claim is the right choice. Filing a claim will increase your home insurance rates, as you can see below.

Home Insurance Monthly Rates by Claims & Coverage| Number of Claims | $350,000 Coverage | $500,000 Coverage |

|---|---|---|

| No Claim | $140 | $184 |

| 1 Claim | $154 | $198 |

| 2 Claims | $175 | $220 |

There are many factors that affect home insurance rates, but your claims history is one of the most impactful. If home repairs after a wildfire will cost less than your deductible, you should skip filing a claim.

Step #6: Meet With an Adjustor

Once your company has processed your claim request, they’ll send a claims adjuster to assess. Meeting with an adjuster might be intimidating, but if you know how to file an auto insurance claim and win, you can handle a home insurance claim. Remain available by either phone, email, or text in case an insurance adjuster has questions. Keeping in touch with your provider is a simple way to keep the claims process rolling toward a resolution.

The claims adjuster’s evaluation of the damage to your home is one of the most crucial steps in the claim process. They’ll likely have questions, so you can help keep things smooth by providing information and responding quickly to any requests.

Step #7: Review Your Claim Settlement

After the adjuster finishes their evaluation, you’ll get a settlement offer. Review it closely to confirm it covers all damages and costs.

While meeting with an adjuster might make you nervous, you’ll have ample opportunity to make your case. If you need to negotiate your claim settlement, you can counter your insurance company’s offer. Your adjuster will stay in touch, allowing you to provide supporting evidence, like photos and repair estimates.

Stay courteous but firm throughout the process – adjusters are fair, but insurance companies often want to minimize how much they have to pay.

Scott W. Johnson Licensed Insurance Agent

Similar to the worst states to file a car insurance claim in, some states may see slower claim resolutions for home insurance. If you feel like your claim payout isn’t fair and your insurance company won’t work with you, you may need legal help. A lawyer who specializes in insurance law will know all your options.

Step #8: Close Your Claim

Once you accept the settlement and receive payment, verify that your claim is officially closed. Hopefully, you won’t need it, but keeping all documentation is wise for future reference. Taking steps like safeguarding your home and updating your coverage can help streamline any wildfire claims you may file.

After your claim is closed, your provider will send a check for the agreed amount. While timelines vary, most insurers issue payments within a week. If you’re not satisfied, some companies make it easy to re-evaluate your claim. For example, Allstate offers a claim guarantee that may apply to your home insurance. To learn more, check out our Allstate insurance review.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Handle Wildfire Claims Denials

Now that you know how to file an insurance claim after a wildfire, what happens if your provider denies your claim?

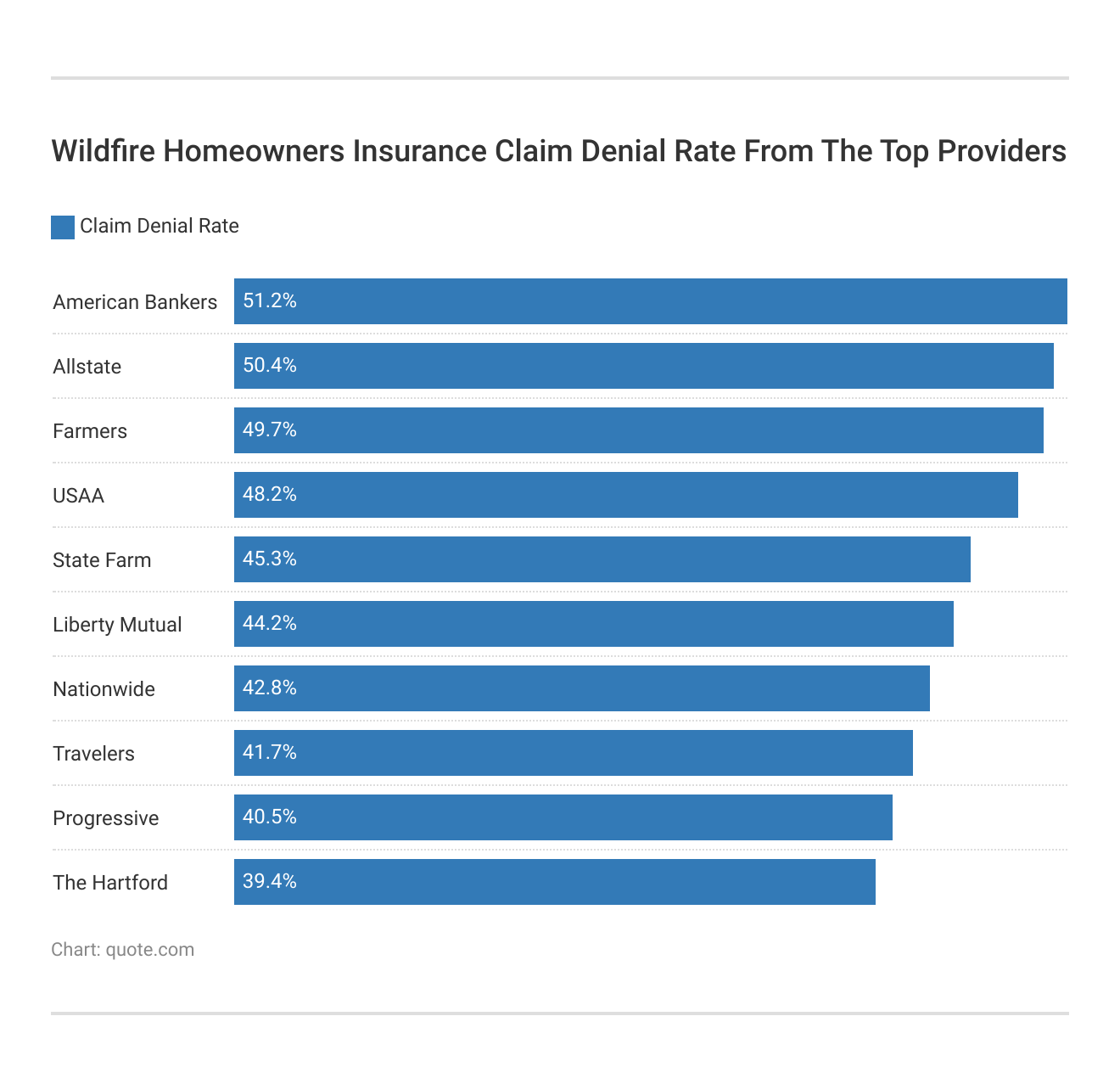

To begin with, there are steps you can take to reduce the chances of a future claim being denied by shopping at companies with a good reputation for paying claims. This is especially important if you need California wildfire insurance. Below, you’ll find a list of providers with the worst history of denying homeowners insurance claims after a wildfire.

If your coverage comes from one of the best homeowners insurance companies and you’ve still been denied, you’re not totally out of options. Try the following steps to reverse a denied wildfire insurance coverage claim:

- Review the Denial: Your insurance company will send you a letter listing why your claim was denied. If you need help, an insurance representative can walk you through it.

- Submit an Appeal: Request the paperwork you need to file an appeal from your company. Provide as much evidence as possible for your company to review.

- File a Complaint: If your insurance provider isn’t dealing with you fairly, you can submit a complaint to your state’s insurance department.

- Find Legal Help: In extreme cases, you can hire an attorney to help resolve your claim issue.

- Keep Documentation: No matter how your claim is resolved, make sure to keep records of all communication you have with your insurance provider.

Getting home insurance for wildfires can be stressful, especially in areas with increasing fire risks. That’s particularly true in states like California and Florida, where disaster insurance claims happen more frequently. However, finding an affordable policy isn’t impossible.

Finding the cheapest homeowners insurance for wildfires can be difficult, depending on where you live, but using a free online comparison tool makes it much easier. Using one is easy – simply enter your ZIP code to get started.

FAIR Plans for High-Risk Homes

FAIR programs help homeowners in fire-prone areas get insurance for their homes. For example, the California FAIR plan ensures California residents can get wildfire recovery assistance in even the highest-risk areas. With wildfires being one of the most dangerous risks homeowners face, having a FAIR plan can save you thousands.

Compared to traditional policies, FAIR home insurance plans offer less protection. However, FAIR plans can be affordable, depending on where you live. FAIR policies are managed by multiple companies. You’ll file claims on the FAIR website, but each company involved in your policy will pay a portion of your claim.

If you need wildfire insurance in California and FAIR is your only option, you can find tips to maximize your California wildfire coverage below.

FAIR shouldn’t be your first stop for home insurance, particularly because it won’t cover everything you lose in your home. In fact, one of the requirements for FAIR approval is providing proof that you’ve been denied coverage from other providers. However, if you can’t find coverage anywhere else, a FAIR plan will make sure you won’t completely lose your home after a fire.

File a Homeowners Insurance Claim After Wildfire Damage Today

When it comes to homeowners insurance and wildfires, making sure you have adequate coverage is one of the best steps you can take to avoid problems. Knowing how to file a home insurance claim after a wildfire and increasing your home fire safety can help minimize the risk of filing a claim altogether.

If you don’t have the right amount of coverage for a wildfire, you should start looking for a policy today. Checking your options periodically is an important step in maintaining a policy that works for you. Whether you want to shop for a new insurance company or need your first policy, you can find affordable home insurance rates by entering your ZIP code into our free comparison tool.

Frequently Asked Questions

Are wildfires covered by home insurance?

Yes, standard homeowners insurance typically covers wildfire damage, but coverage may vary by location and provider. Some high-risk areas may require separate wildfire insurance or a FAIR plan. Knowing how much home insurance you need to cover wildfire damage can help you get the best policy for your house.

How long do you have to file a wildfire home insurance claim?

The timeframe varies by insurer, but most policies require you to file a claim within 30 to 60 days after the wildfire. It’s best to check your policy and report damage as soon as possible.

How do you file a homeowners insurance claim after a wildfire?

To file a claim, contact your insurance provider, document the damage with photos, and provide an inventory of lost items. An adjuster will assess the loss, and your insurer will determine the payout based on your coverage.

What does home insurance cover for wildfire damage?

Home insurance typically covers the cost to repair or rebuild your home, replace personal belongings, and pay for temporary living expenses if your home is uninhabitable. It may also include coverage for landscaping, debris removal, and other structures like garages or sheds.

How much is wildfire insurance?

The cost of wildfire insurance depends on your location, home value, and risk level, with premiums ranging from a few hundred to several thousand dollars per year. Home insurance in high-fire-risk areas, like California, tends to have significantly higher rates. For example, the average American pays $101 per month for home insurance, but rates in fire-prone Texas average $321 per month. In the top 10 states for wildfire risk, the average homeowner pays $207 per month for coverage.

You can compare home insurance quotes to find the best wildfire insurance rates in your area.

Does your home insurance go up after a fire?

Filing a claim will increase your home insurance costs, but home insurance rates after a wildfire will increase even if you didn’t file a claim. The increased risk in your area and the cost of your neighbors’ claims will impact your premiums at the next renewal.

Does homeowners insurance cover wildfire damage in California?

Standard homeowners insurance policies in California cover wildfire damage, but some insurers have pulled out of high fire risk areas. If private coverage is unavailable, homeowners may need to rely on the state’s FAIR plan. To see what’s available, enter your ZIP code into our free insurance comparison tool.

What’s not covered by home insurance after a wildfire?

Standard policies may not cover certain losses, such as damage due to neglect, pre-existing conditions, or costs exceeding policy limits. Landscaping, fences, and expensive valuables like jewelry may require additional coverage. You’ll also need the right types of home insurance for your policy to cover wildfire damage.

Do you still own the land if your house burns down?

Yes, if your house burns down, you still own the land, as homeowners insurance only covers structures and belongings, not the land itself. You can rebuild or sell the property as you choose.

Why do insurance companies deny claims after a wildfire?

Claims can be denied if the damage isn’t covered under the policy, if the homeowner failed to maintain the property, or if there’s insufficient documentation. Policies with exclusions for wildfires or lapsed coverage can also lead to denial.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.