Does homeowners insurance cover wildfires in 2025?

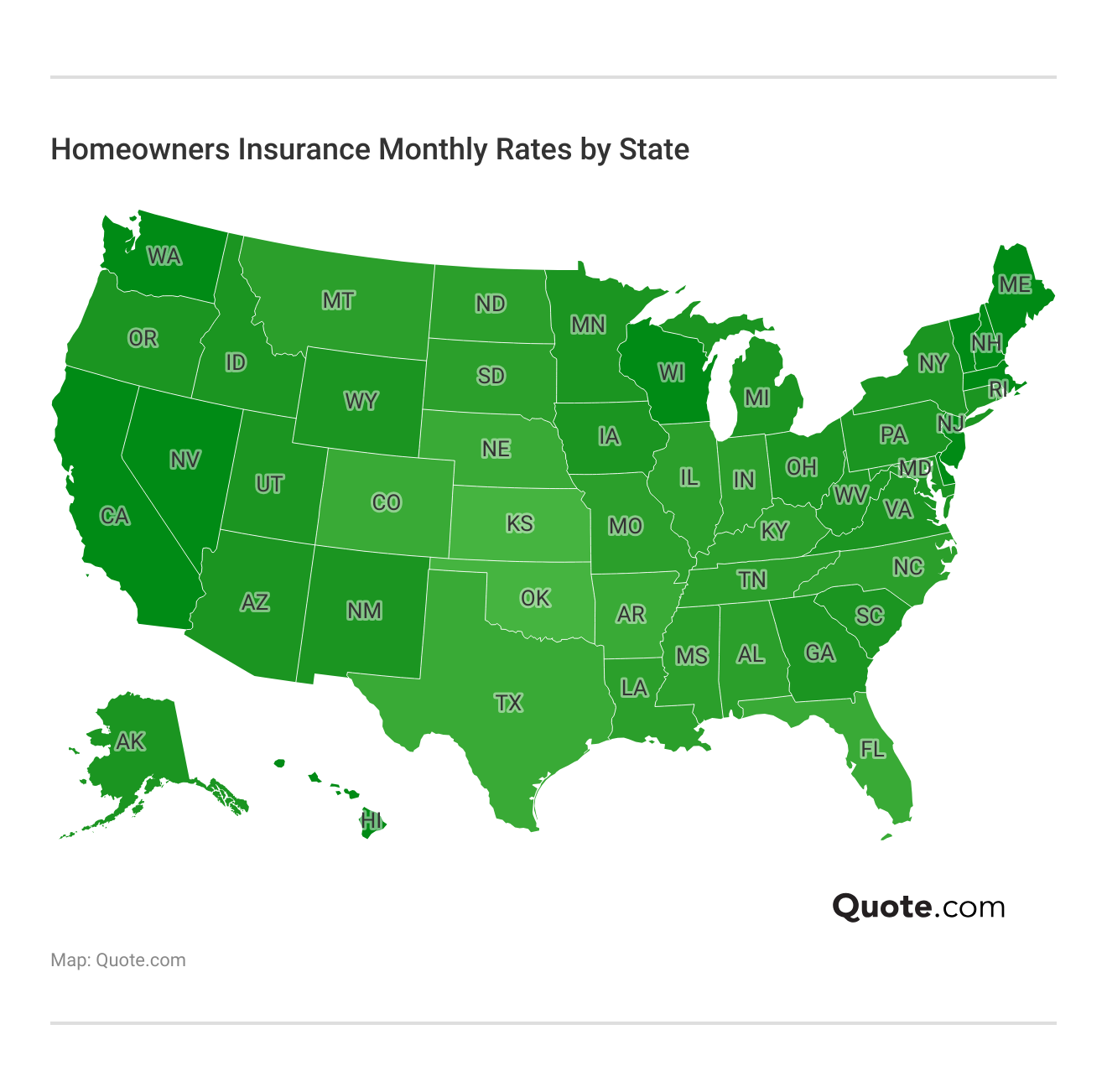

Wondering if homeowners insurance covers wildfires? In most cases, yes. Unless wildfires are excluded, your home insurance policy or FAIR plan covers wildfire damages up to the limit. A $200,000 wildfire insurance policy starts at $70 a month, though rates may be higher in high-risk states like California.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated November 2025

Does homeowners insurance cover wildfires? Yes, the majority of home insurance policies will include wildfires as a covered peril, but some companies may choose to exclude coverage if you live in a high-risk state for wildfires.

- Home insurance will usually cover wildfires unless it’s an excluded peril

- You may have to buy wildfire insurance as an add-on rider at some companies

- Wildfire insurance can be costly in high-risk wildfire states

Fires are one of the seven most dangerous threats facing American homeowners, so it is important to check your home insurance policy to ensure you have wildfire insurance. You may also want to adjust coverage amounts for better protection.

Read on to learn more about wildfire insurance coverage and your home insurance policy. If you don’t have coverage for wildfires, our free quote tool can help you find coverage from companies in your area.

How Home Insurance Covers Wildfires

Does home insurance cover wildfire? Most standard home insurance policies cover damages and losses from a wildfire, but it depends on whether wildfires are listed as an excluded peril on your policy.

For example, dwelling coverage would pay to rebuild your home if damaged in a wildfire, while personal property coverage would pay to replace your belongings.

Home Insurance Coverage for Wildfire Damage| Coverage | What it Covers |

|---|---|

| Additional Living Expenses | Structures other than your home, like sheds or fences |

| Dwelling | Repair or replacement value of your home |

| Liability | Legal and medical bills for injuries on the property |

| Detached Structures | Detached structures from the home, like sheds and fences |

| Personal Property | Belongings such as furniture, electronics, and clothing |

Your home insurance policy will cover wildfires as long as they are not an excluded peril on your home insurance policy. Make sure to ask if wildfires are covered by home insurance at your company.

If wildfires are listed as an excluded peril, home insurance won’t cover any of the damages and losses from a wildfire.

You can find out if wildfire is an excluded peril by reviewing your declaration page or contacting your home insurance company directly.

Kristine Lee Licensed Insurance Agent

Home insurance isn’t required in high-risk areas, but you should check your policy to see which coverages you have. If your home insurance doesn’t offer wildfire ride-on coverage, then you may want to shop at other home insurance companies to find wildfire insurance.

If you live in a state where it is difficult to find home insurance for wildfires, check to see if your state has a FAIR plan. These are state insurance pools for high-risk homeowners who can’t find home insurance due to local factors, such as a higher homeowners insurance wildfire risk.

Making sure you have the right home insurance that will cover wildfire damage will give you peace of mind if you live in an area where a wildfire is more likely to happen.

To get an idea of how much home insurance costs, take a look at the average cost of home insurance at popular companies below.

Home Insurance Monthly Rates by Coverage Amount| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $85 | $120 | $180 | $320 | |

| $81 | $115 | $175 | $310 | |

| $90 | $130 | $190 | $330 | |

| $75 | $110 | $170 | $300 | |

| $95 | $135 | $195 | $340 |

| $82 | $118 | $178 | $315 |

| $88 | $125 | $185 | $325 | |

| $80 | $115 | $175 | $310 | |

| $86 | $122 | $182 | $322 | |

| $70 | $105 | $165 | $290 |

You may want to add or adjust your home insurance coverages if you live in an area where a wildfire is more likely to happen (Read More: Homeowners Insurance Coverage Explained).

How much is wildfire insurance? Home insurance will cost more in states where wildfires are more likely to happen.

Making minor home insurance fire coverage adjustments if you live in a high-risk state will ensure you have better financial assistance from your home insurance company after a wildfire.

We advise following the 80% rule when choosing a dwelling coverage amount for wildfire insurance in high-fire-risk areas. What is the 80% rule regarding fire insurance? It means that you should get coverage that will cover 80% of your home’s replacement cost.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

When Home Insurance Won’t Cover Wildfires

There may be several instances when your home insurance won’t cover wildfire damage to your home from forest fires. They include:

- Policy Exemptions: Wildfires are listed as an exemption on your home insurance policy.

- Low Coverage: If you don’t have enough coverage, not all of your damages will be covered. Make sure to accurately value your home, including modifications and outdoor features (Read More: The 5 Outdoor Features That Add Value To Your Home).

- Negligence: If the wildfire started in your own backyard due to negligence, the claim may be denied.

Make sure to verify when you buy a home insurance policy that it covers wildfires.

What to Do if Wildfires Are an Excluded Peril

If your home insurance lists wildfires as an excluded peril, you can see if they offer high-wildfire-risk homeowners insurance as an add-on coverage or endorsement. A home insurance endorsement will modify your coverage to make sure wildfires are included.

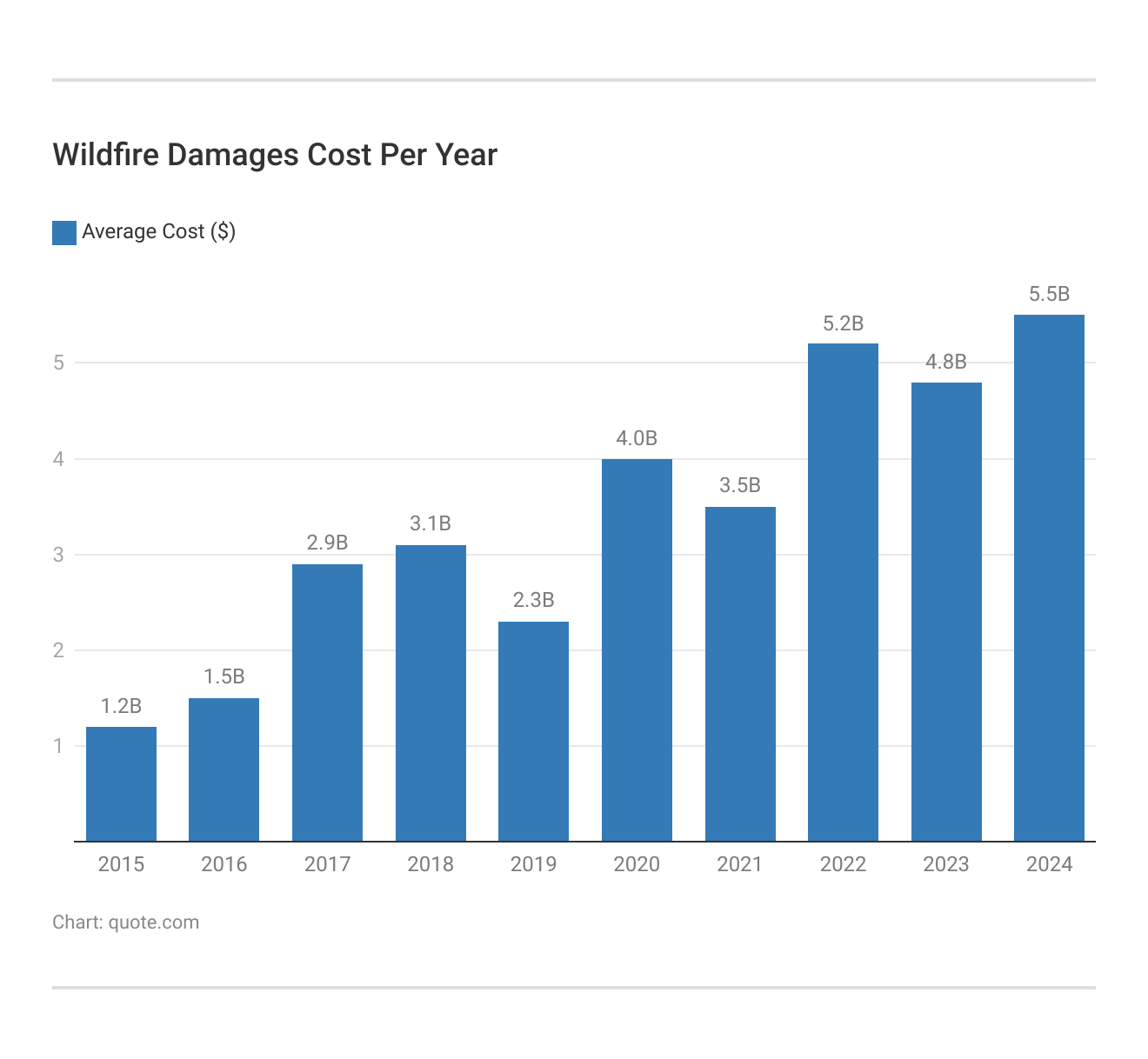

Wildfire insurance as an add-on is common in states like California, where wildfires are frequent, as wildfires cause billions of dollars of loss in these states.

Wildfire losses in the U.S. have increased significantly since 2015, with the cost of damages rising every year. Compare home insurance rates by state to see if these risks affect your premiums.

Dwelling coverage costs will depend on the size of your home and location, as well as the risk of wildfire in your state (Read More: Cheapest Homeowners Insurance Companies).

For example, fire insurance in Washington State or California may be harder to find as you are shopping for home insurance in high fire-risk areas.

If you have trouble getting a wildfire insurance policy and want to know how to get home insurance after a fire, you can contact your state insurance department for assistance.

They will help you locate the best wildfire insurance companies and find a home insurance policy that covers wildfires.

How to File a Claim After Wildfire Damage

If wildfire damaged your home and you have the right coverage, there are three steps to follow when filing a fire claim.

Step 1: Contact Your Insurer

The first step in how to file a home insurance claim after a wildfire is to contact your home insurance company. A representative will help guide you through all the steps of the claim, from submitting evidence of damages to calculating damage costs.

Your insurance company will likely send out a home insurance adjuster to inspect the property and damages.

Michelle Robbins Licensed Insurance Agent

Once you finalize and submit your claim, you will receive a settlement offer from the home insurance adjuster. Provide evidence of damages from the wildfire and keep a record of all receipts and communications.

Step 2: Review the Settlement Offer

Once you’ve received an offer from your home insurance company, review it carefully before accepting. If you think the settlement is too low, you can file an appeal with your evidence.

However, bear in mind that if your coverage is low, you’ll only receive the maximum payout for the coverage you purchased. So if you didn’t purchase enough coverage to cover the cost of your new walk-in tub, you won’t receive extra compensation for it.

Step 3: Resolve the Claim

If you’re happy with the forest fire insurance payout, you can accept the settlement and close the claim. Your insurance company will likely require you to sign a document to finalize the process, after which your claim will be processed and filed away.

Keep in mind that you may have higher home insurance rates after a claim, as your area may be deemed higher risk after a wildfire (Read More: How to Estimate Home Insurance Costs Based on Where You Live).

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Prevent Wildfire Damage to Your Home

While wildfire damage is sometimes inevitable, there are some things you can do to minimize the risk of fire damage to your home.

- Clear Vegetation Around Home: Keep the vegetation within a 30-foot radius around your home to a minimum, and regularly trim and cut back any overgrown vegetation.

- Keep Combustibles Away: Ensure any combustible items, such as grills, are at least 15 feet from your home.

- Get Fireproof Siding: You can get fire-resistant siding on your home and treat windows to minimize combustibility.

The more steps you take to protect your home from wildfires, the lower the chances of severe fire damage, especially in the case of small, containable wildfires.

Home insurance adjusters who price your home coverage may also offer a lower rate if they see prudent steps taken against wildfires (Read More: What We Learned Analyzing 815 Insurance Companies).

Shopping for the Best Wildfire Home Insurance

The best homeowners insurance companies will include wildfire risk insurance in their policies, and common coverages like dwelling and personal property insurance will cover the cost of rebuilding your home and replacing your belongings.

However, there is a chance it may be listed as an excluded peril on your policy. If so, see if you can add wildfire insurance coverage to your policy.

If your insurance company doesn’t offer this option, which is common in high-risk areas for wildfires, such as looking for wildfire insurance in California, you may have to shop around at different companies to find insurance for forest fires.

If you can’t get wildfire insurance from your current insurer, shop at specialty insurers or work with an independent agent to find alternative wildfire coverage options. Live in an area prone to wildfires and want to find coverage fast? Search for home insurance today by entering your ZIP in our free quote tool.

Frequently Asked Questions

Is wildfire included in homeowners insurance?

Worried about does home insurance cover forest fires? Wildfire damages and losses will be included in home insurance unless wildfires are listed as an excluded peril on your policy. Basic coverages like dwelling, personal property, and additional living expenses will cover the cost of losses and damages.

Does my home insurance cover natural disasters?

Home insurance will cover most natural disasters unless they are listed as excluded perils. This is common in high-risk areas. For example, flooding may be excluded in areas that frequently flood unless you purchase extra flood insurance.

Can you be denied fire insurance?

Yes, you may be denied fire insurance if you are shopping for wildfire insurance in Arizona, California, or other high-risk areas. You may have to compare homeowners insurance quotes from several companies before you find one willing to insure you with home insurance for wildfires.

Does insurance payout for fire?

Insurance will payout for fire unless the incident is listed as an exclusion.

What is a wildfire deductible?

A wildfire deductible is simply the home insurance deductible you have to pay on a covered home insurance claim.

Does homeowners insurance cover wildfires in California?

You may have trouble finding wildfire insurance in California. In most cases, you will have to pay extra to add fire insurance to your California policy, whether buying home or auto insurance (Learn More: Best Auto Insurance Companies in California).

How much does insurance pay if a house burns down?

Insurance will pay up to your policy limit if the event is covered.

Do you have to pay a mortgage if your house burns down?

Yes, you must still pay your mortgage even if your home burns down.

What happens if your house burns down in a wildfire?

If your home burns down in a wildfire, you will need to contact your home insurance company to file a claim. Insurance will cover wildfire as long as you have the right homeowners insurance for wildfires (Read More: Understanding the 8 Types of Homeowners Insurance Policies).

What is not covered by homeowners insurance?

Home insurance will not cover fires caused by war or arson. Wildfires may also be an excluded peril.

What is the difference between fire insurance and homeowners insurance?

How much does wildfire insurance cost?

Does renters insurance cover wildfires?

What should you never do during a wildfire?

Is fire included in home insurance?

Does home insurance cover earthquakes?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.