The Millennial’s Guide to Health Insurance

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

Shopping for health insurance can be difficult—especially for millennials.

Lots of millennials are facing challenges related to health insurance.

There are those who looking for a plan for the very first time after losing eligibility to remain on their parents’ health insurance upon turning 26.

While some millenials with young families are having a hard time figuring out the best option that could benefit their spouse and kids.

Then there’s the fact that the health insurance market changes all the time, which further complicates the process of picking a plan.

These frequent shifts may be one of the reasons why a significant portion of millennials tend to admit that they’re not very informed about their health insurance options.

This is exactly why I wrote this helpful guide for millennial health insurance shoppers.

Cutting through the confusion and picking the right health insurance can protect two of the most important things in life—money and health.

Choosing the right plan can spell the difference between having a serious ailment like cancer go undetected, and catching and treating it early on through annual checkups and preventative care.

It can also ensure that the birth of a child is a joyous occasion, rather than one that costs up to $250,000 without insurance.

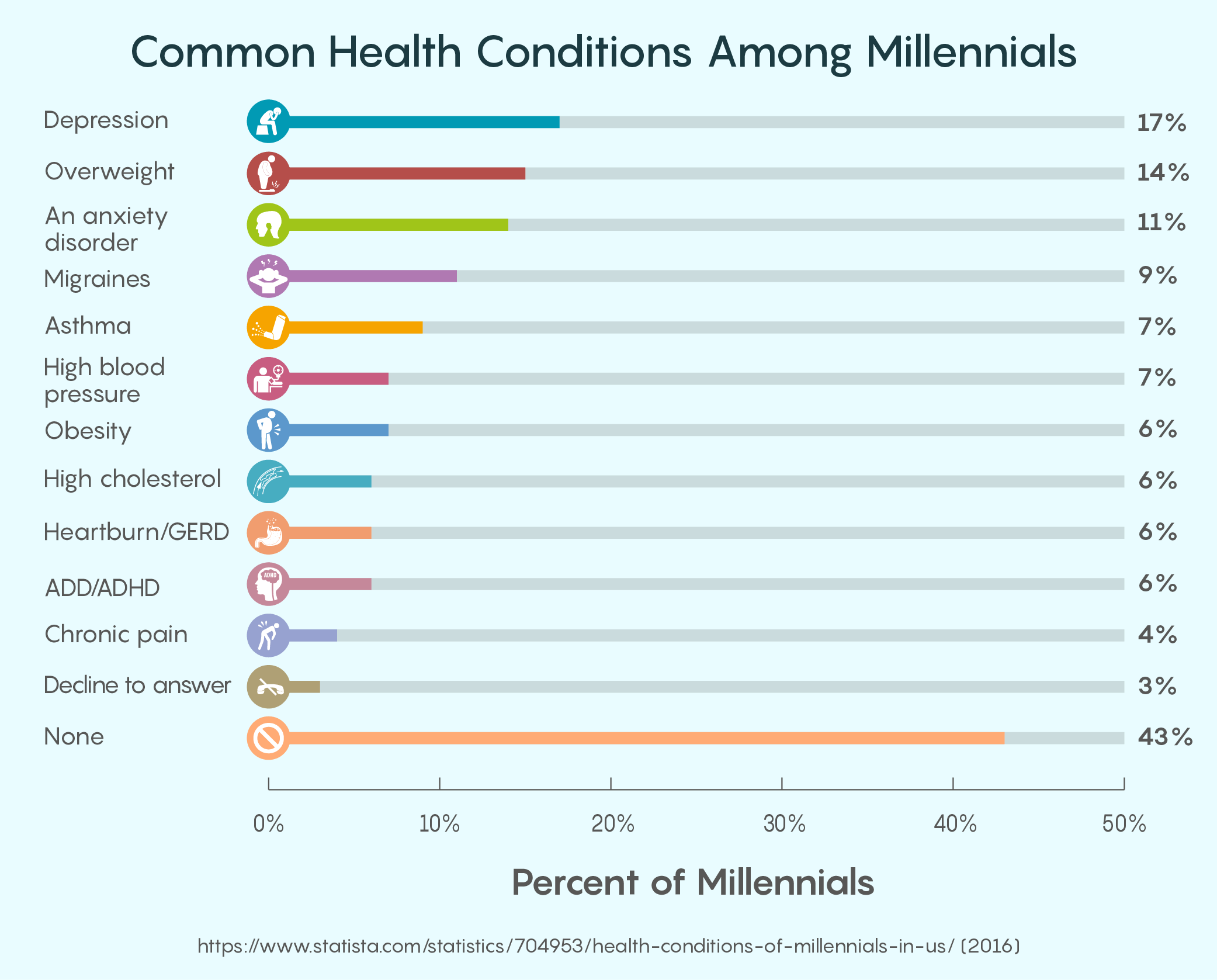

Insurance is now especially important for young people due to rising rates of mental health issues, skin cancer, and hearing loss among millennials.

With the right plan, you can have peace-of-mind knowing you’ll receive the best healthcare available without breaking the bank.

Health insurance may be complicated, but the first step to picking the right plan is simple and it all starts by getting informed.

The millennial’s guide to health insurance covers information that may be familiar to some readers, so you can check each different section for new information.

It’s as comprehensive as possible, so even baby boomers looking to brush up on their health insurance knowledge should find it helpful.

Know the Different Parts

Understand a health insurance plan to get the coverage you need

Know the parts, know the plan. Almost everyone knows that health insurance is there to help pay for your medical expenses, but understanding exactly how and what different plans cover can get confusing.

By breaking down the individual components and kinds of coverage these plans offer, you can confidently pick the plan that’s right for your healthcare needs.

For example, if you regularly take prescription meds you should understand how copays work under each plan.

Otherwise, you may end up spending (instead of saving) hundreds of dollars for your medication.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Get Educated on Premiums

Pay less for premiums by staying healthy

Premiums are what you pay. Starting with the basics, health insurance premiums are how much you pay every month or year for health insurance.

You either pay this yourself—if you purchased your health insurance plan from the individual market.

Or your premiums may get deducted from your paycheck—if you receive health insurance through an employer.

Get healthy, pay less. Many health insurance companies offer healthy living discounts that lower your premium.

Check if your health insurance company offers discounts for gym memberships, nutritionists, and other ways of staying in great shape.

Also, try to check whether your employer offers discounted or free memberships for these services as part of a work-life balance program.

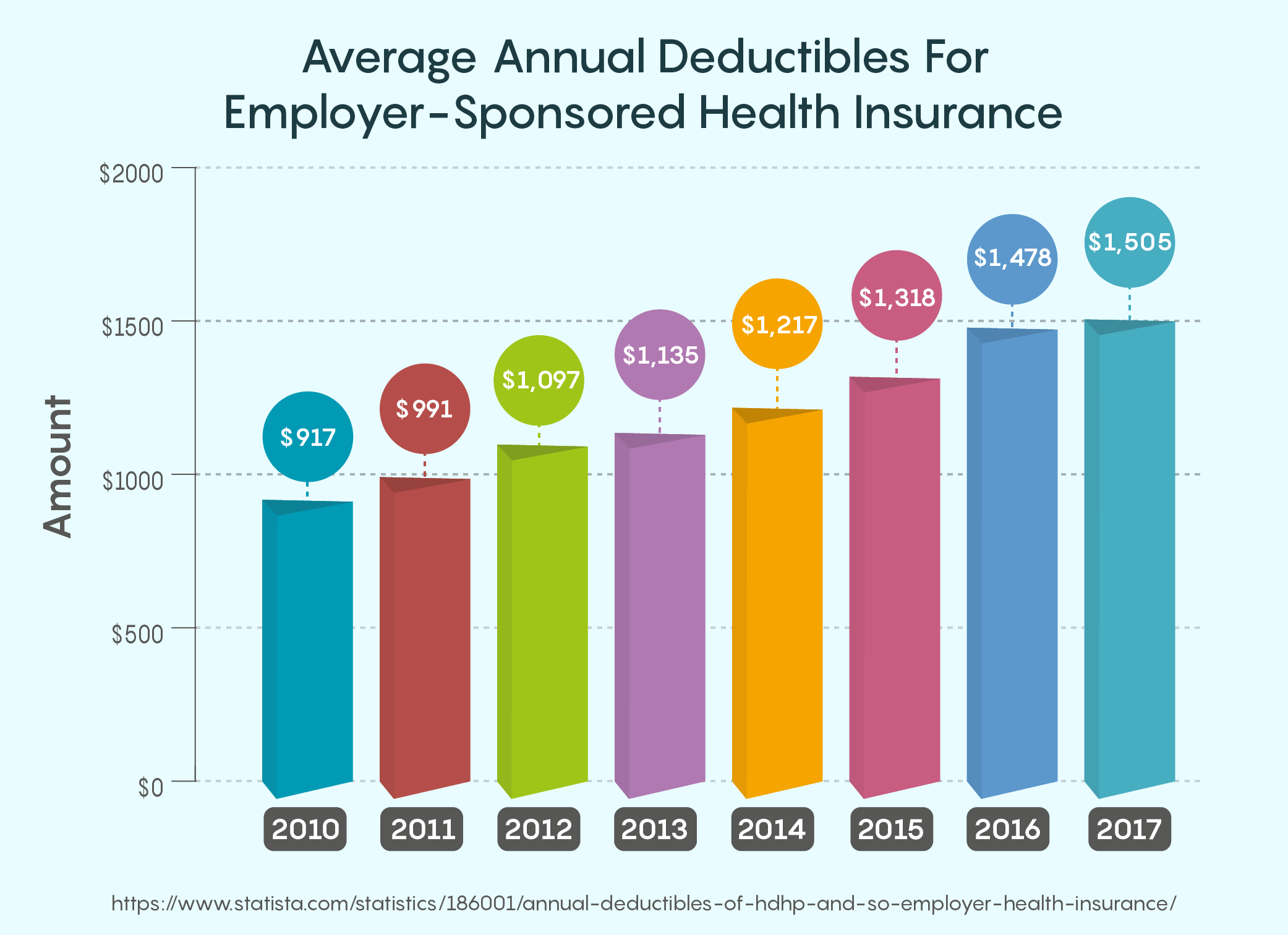

Lower your premiums by raising your deductible

How deductibles work. Your deductible is how much you pay before your health insurance provider begins covering certain types of care.

For instance, say you have a $4,000 deductible and receive $10,000 worth of medical care.

You would pay the first $4,000, and then your insurer would help you cover the remaining $6,000.

Higher deductibles, lower premiums. You can save money on your premiums by choosing a high-deductible health plan, something I cover in my article about getting the most out of your health insurance policy.

But note that this is only advisable if you’re in generally good health since you would pay more of your medical costs upfront in the event you actually require medical care.

As soon as their finances allow, young people should consider switching from a high-deductible health plan to one that provides for needs such as long-term care.

Understand Coinsurance

Save by knowing how much you pay with coinsurance and copays

How coinsurance works. Coinsurance is what percent your health insurance will pay for certain medical expenses after you reach your deductible.

Going back to our previous example with a $4,000 deductible and $10,000 in medical expenses, let’s say your co-insurance was 20% …

That means your insurer would cover 20% of the remaining $6,000 in expenses after reaching your deductible, which works out to $1,200.

This leaves you paying the remaining 80%, which comes out to $3,800.

How copays work. A copay is a flat fee you pay for certain services, like lab work or prescriptions.

Say you have a $35 copay for name brand prescription medications.

As long as this medication is prescribed and is covered by your plan, you would only pay $35 even if the prescription would cost hundreds of dollars without insurance.

Pick the plan with the right coverage. Think about whether you regularly receive medical care when looking at a plan’s copays and coinsurance.

If you infrequently need medical attention or don’t have a pre-existing condition, a plan with low copays and no co-insurance would save you on your premiums—but if you require medical care, you’ll pay a much higher rate.

If you know you’ll meet a plan’s deductible due to your health needs, look for one with high coinsurance rates.

Know Your Out-of-Pocket Expenditure

Don’t get hit with unexpected costs by understanding your out-of-pocket maximum

The max you pay. Your out-of-pocket maximum is the max you’ll pay for medical expenses over the course of a year.

This doesn’t include your monthly premiums, meaning it’s typically for your deductible, copayments, and co-insurance.

Check what’s included. Some plans don’t include your deductible as part of your out-of-pocket maximum.

Carefully read over your health insurance policy to see whether this is the case.

This matters because if your plan carried a $500 deductible and a $2,500 out-of-pocket maximum, you could end up paying $3,000 if your deductible isn’t included in your maximum.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Save on Costs and Stay In-Network

Find providers in-network and you’ll be doing yourself a favor

Who’s in the network. A network is the collection of hospitals, specialists, and healthcare providers that have partnered with your insurance company.

Your insurance company may pay a higher percent of expenses for in-network providers and possibly may not cover any costs incurred with providers out of this network.

Keep costs down by staying in your network. The importance of staying in-network to reduce healthcare costs gets emphasized again and again in Quote.com’s collection of health insurance resources.

If you’re shopping around for a new plan, check whether your health insurance covers doctors and hospitals that are conveniently close to you or any provider that you regularly use.

Play it Smart

Find the right health insurance by knowing your coverage options and plans

What’s on the market. Now that you know about the different components of a health insurance plan, let’s now go over the types of plans you can choose from.

Understanding your options will help you choose the right kind of coverage.

Go Through Your Employer

Employer-provided insurance can lower your premiums

Know if you qualify. If your employer has over 50 employees, the Affordable Care Act requires them to provide health insurance.

Also, you can stay on your parents’ employer-sponsored or other type of insurance if you’re under 26 years old.

Usually your best deal. Using an employer-sponsored plan can save you money, as most employers are legally mandated to shoulder a decent chunk of your insurance premiums.

For instance, the average rates for health insurance in 2016 were $4,632 on the individual market and $6,435 for an employer-sponsored plan, according to Medical Mutual.

On the surface, employer-sponsored plans look more expensive until you factor in that these businesses typically pay around 82% of an employee’s premiums, making a plan only cost $1,158 on average.

That’s $323 less than the average cost of an individual plan.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Check out the Individual Marketplace

See if you qualify for savings through the Health Insurance Marketplace

Savings based on income. If your income falls within a certain range, you can qualify for savings and tax credits by buying your health insurance through the Health Insurance Marketplace on Healthcare.gov.

The site includes a tool for checking whether you’re eligible for the savings based on your income, household size, and state.

Pay lower premiums with a catastrophic plan

Helps you avoid high premiums. Catastrophic health insurance costs less than other forms of health insurance but features high deductibles and doesn’t cover many costs like doctor visits or prescriptions.

This makes it a poor fit for those with higher-than-average healthcare needs or pre-existing medical conditions.

Know if you qualify. Catastrophic plans are only available for those under 30 or in cases of a hardship exemption, as I mention in my guide to health insurance for people under 30.

Older millennials and baby boomers can seek to qualify for a hardship exemption.

This is available for those who make too much money to qualify for Medicaid, but too little to qualify for savings on the health insurance marketplaces offered by federal and state governments.

Know how to shop smart on the individual market

Shop around and save. If you don’t get health insurance through an employer and don’t qualify for savings on the federal or state health insurance marketplace, you can find health insurance on the individual market.

You can do so by contacting brokers, insurance companies, and using comparison sites like Quote.com.

Look at the details. Make sure you read over these plans carefully to understand what you have to pay and what will be covered.

Poring over the details of your deductible, network, copays, and coinsurance is just as important as knowing your premiums.

Pros and Cons

Research different plans to pick the right health insurance

Different plans for different needs. All available health insurance plans come with their own unique set of strengths and weaknesses.

Understanding these different pros and cons will help you pick the right form of coverage for your needs.

Employer-sponsored health insurance is affordable, but not portable

Frequently the cheapest. As mentioned earlier, getting health insurance through your job is usually the cheapest and best option.

Most employers pay around 82% of their employee’s health insurance premiums, and they offer far better coverage than catastrophic plans.

Some additional options to save. Read over your employer’s health insurance plan carefully.

Many larger companies offer discounted gym memberships or other services as part of a work-life balance program.

Signing up for those services could qualify you for a discount on your premiums.

Limited control. Your employer gets to pick your plan if you rely on them for health insurance.

That means the types of coverage or doctors available through the network they selected may or may not meet your needs.

Gone with the job. Another drawback of relying on an employer-sponsored plan is that when your employment with the company ends, so does your insurance coverage.

Unlike health insurance purchased on the individual market, an employer-sponsored plan doesn’t follow you from job to job.

Catastrophic plans help you avoid penalties, but may not save you money on medical costs

Lower costs, less coverage. For those that don’t receive insurance through their employer or don’t qualify for a subsidy or Medicaid, catastrophic plans often stand as one of their very few remaining options.

Extremely high deductibles. Catastrophic plans typically carry deductibles reaching into the thousands of dollars.

Even if you pay less in premiums, you could find yourself paying much more than you save in case you actually needed medical care.

Limited availability. You only qualify for catastrophic plans if you’re less than 30 years old or meet a hardship exemption.

While younger millennials may still be able to get these plans, some of those in their 30s may not qualify. Gen Z, the next generation, will also run into difficulties.

Subsidized plans can lower your premiums, but you may have to pay back those savings

Help with premiums. Depending on your income level, household size, and state of residence, you may qualify for premium-reducing subsidies for insurance bought on the Healthcare.gov site.

Higher income may mean returning subsidies. If your income increases past a certain level, you may be required to pay back the subsidies you received.

These repayments are capped at certain levels based on your current income.

Those making less than 200% of the federal poverty level could pay back up to $300.

If you’re earning somewhere between 200–300% of the poverty line, you could pay back up to $750.

While if your income falls between 300–400% of the poverty line, you could be required to pay back $1,275.

Finally, those who end up making greater than 400% must pay back the full amount.

Individual plans let you shop around, but you pay for the privilege

You have options. You can switch plans if you find one at a lower rate or one that better meets your needs if you shop in the individual marketplace.

That gives you the flexibility to shop around.

Limited timeframe for changing plans. You can only change your insurance during the annual open enrollment period at the end of each year.

However, you can select a new plan after certain life events such as getting married or having a child.

More expensive. Health insurance on the individual market is typically more expensive than employer-provided or subsidized insurance.

You have more flexibility for changing plans, but it comes at a cost.

Get the best plans and coverage by knowing your situation

You need to find the health insurance plan that’s right for you.

By evaluating your situation, you can pick the best plan and coverage for your needs.

Find out what you need to know to pick the right plan

Know if you can stay on your parents’ health insurance. Millennials frequently find themselves in between jobs or hopping from one job to the next, while others are struggling to find their financial footing.

This reason makes staying on their parents’ plan a good option for a lot of people under 26 years old.

The Affordable Care Act doesn’t present a lot limitations for those under the age of 26 who wish to stay on their parents’ insurance plan.

As long as you’re not older than 26, you can still qualify for coverage under your parents’ plan even after you get married, move out of their home, aren’t declared as their tax dependent, or turn down an offer of job-based coverage.

Know whether to choose employer or individual health insurance. Deciding between employer and individual health insurance is often an easy choice since employer-sponsored health insurance is often much cheaper in terms of monthly premiums.

However, if your employer doesn’t cover a good amount of your premiums or their plan doesn’t include the medical professionals you regularly use, consider looking around on the individual market.

Make sure you check what other kinds of insurance your employer offers as well.

You may be able to save money by bundling your personal health insurance or other forms of coverage with your employer-sponsored health plan.

Know if your income qualifies for subsidies. You should consider shopping around on Healthcare.gov for health insurance if your income falls somewhere between 100–400% of the federal poverty line.

At this range, you may be eligible for certain premium tax credits or cost-sharing reductions.

Know your health to decide if you want a catastrophic plan. Catastrophic health plans are only available if you’re under 30 or meet a hardship exemption.

However, they come with high deductibles and only cover preventative care and three primary care visits per year.

That means most people shouldn’t consider them because actually having to see a doctor or a medical emergency could result in huge out-of-pocket costs.

But catastrophic health plans remain the best option for those facing financial issues since premiums for these plans are extremely low.

If you’re in good health, don’t qualify for insurance through your employer, can’t get a subsidy, and see saving on your health insurance costs as a top priority, feel free to consider a catastrophic plan.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Be prepared to pick a plan with this essential information

Almost ready to choose. By now, you should feel a little more familiar with the types of coverage available and how to choose a plan that works for you.

Before you start looking for a plan, let’s go over a few pieces of essential information millennials need to know about health insurance.

Get the information you need to pick your health insurance

Most insurance come with a list of “must-have” benefits. Whether you get your health insurance on the individual market, through Healthcare.gov, or through your job, these plans must all offer 10 essential benefits.

The one exception is catastrophic plans, which are not required to offer all these benefits.

These include:

- Ambulatory services, also known as outpatient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services, and chronic disease management

- Pediatric services, including oral and vision care

While this seems like a comprehensive set of benefits, other essential types of coverage, like long-term care, are not required for health plans.

You may want a plan that covers more than the minimum.

Marriage can affect insurance. Millennial couples who are planning on getting married will have to decide whether they should get on the same plan or remain on their individual insurance policies.

Check with your company about how much it would cost to add your spouse if you use employee-sponsored insurance.

For those with insurance from the individual market, you can shop around for coverage that better fits the needs of your growing family within thirty days after getting married.

Be aware that all of your insurance needs change when you get married.

Avoid problems down the road by checking whether you have adequate car, home, and life insurance after tying the knot.

You can get disqualified from subsidies. Your subsidies for insurance purchased on Healthcare.gov aren’t just based on your income.

If your particular employer offers affordable, comprehensive health insurance, you lose your eligibility for a subsidy.

You can shop around for insurance outside the annual enrollment window. You’re usually limited by the annual enrollment period for shopping around for health insurance on the individual market.

However, certain life events can make you eligible to choose a new plan.

These include:

- Turning 26

- Getting married

- Having a baby

- Moving out of state

- Losing or starting a new job

Health conditions can disqualify you from catastrophic plans. Even if you’re under 30 and meet the hardship exemptions required for catastrophic health insurance, certain conditions may prevent you from qualifying.

Those diagnosed with AIDS, diabetes, emphysema, heart disease, multiple sclerosis, schizophrenia, and other conditions cannot purchase a catastrophic health plan.

With the right information, Millennials can pick the health insurance they need

Millennials shopping for health insurance may struggle to understand the types of coverage available and which choice would work best for their situation.

By getting informed about the different kinds of health insurance plans and who these plans are designed for, you can pick a plan that provides protection for both your health and your finances.

Do you use any of these health insurance options?

How have they worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.