The Ultimate Insurance Cheat Sheet for 2026

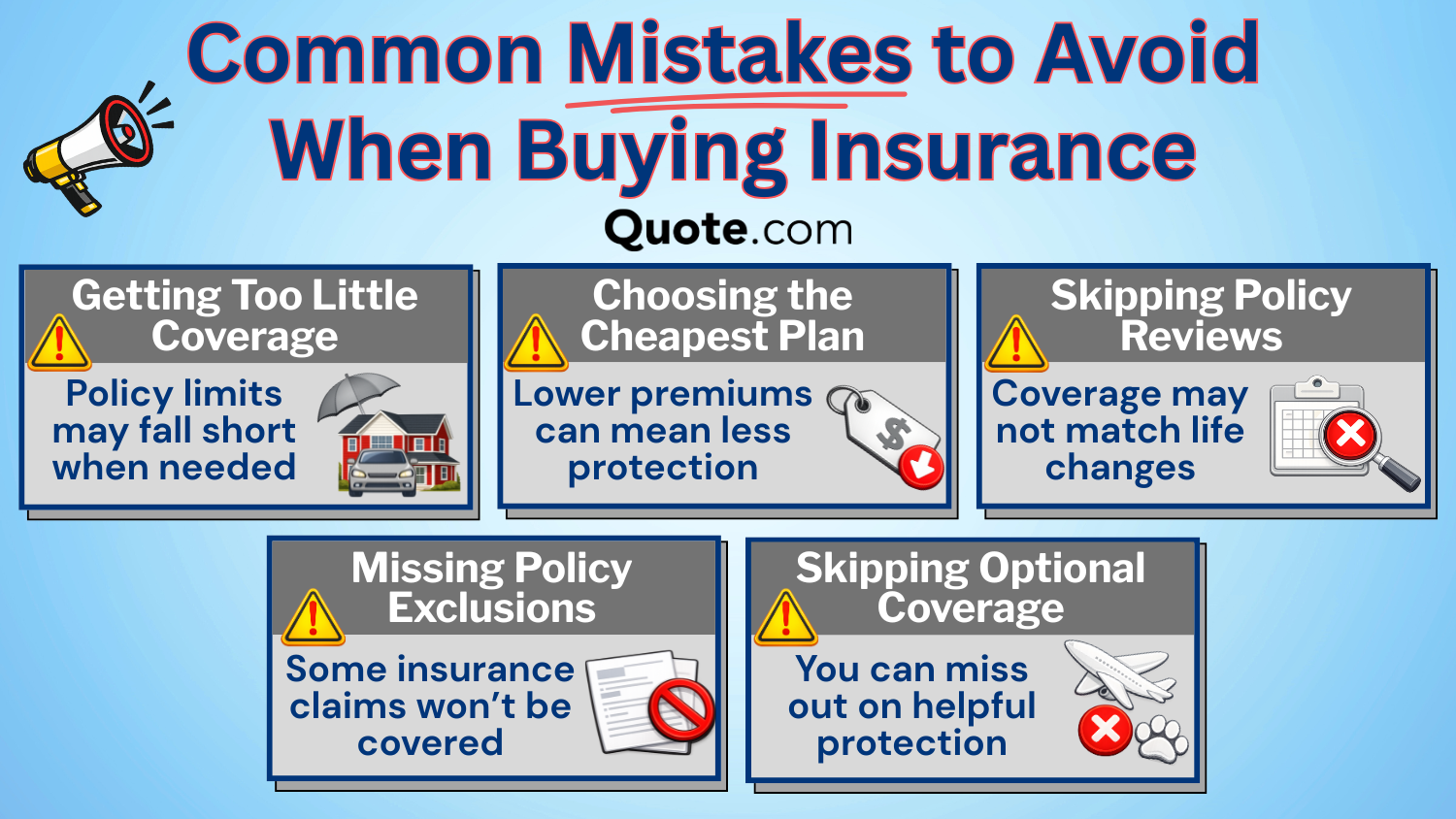

Saving up to $500 annually on auto insurance and about $400 on life insurance is possible when you understand your options. This insurance cheat sheet explains the key insurance types, including life, auto, health, home, travel, and pet insurance. Choose the right coverage amount, and avoid common insurance mistakes.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Expert

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life i...

Maria Hanson

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated February 2026

Let’s be honest. Insurance isn’t something most people enjoy thinking about. Between confusing terms and long policies, it’s understandable why you feel overwhelmed.

- Term life insurance provides coverage for 15, 20, or 30 years

- Bronze health plans have the lowest rates: $462-$603/mo

- Auto insurance is legally required to protect against vehicle damage

Costs can also vary widely. Term life insurance starts at $25 per month, car insurance at about $32 per month, home insurance at $70 per month, and health insurance at $462 per month.

That’s why we put together this insurance cheat sheet. Think of it as a practical, easy-to-use guide to insurance basics. It breaks down common types of insurance, explains what they typically cover, including tips for getting the best deal.

Jump to the coverage you’re looking for, skim the key points, and use this checklist to stay on track.

You can also enter your ZIP code into our free comparison tool to start comparing rates now.

Comparing Common Insurance Lines

Comparing insurance lines side by side can help you understand what you’re paying for. Even though auto, home, renters, life, travel, pet, and other policies cover different risks, most work the same way. You pay a monthly premium for protection against unpredictable expenses.

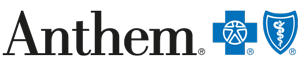

The chart below breaks down monthly costs across common insurance lines, so you can quickly see how prices compare.

Keep in mind that rates can vary based on where you live, what you’re insuring, how much coverage you choose, and your personal risk factors.

The biggest factors across most insurance lines are the same, though higher limits usually cost more, and higher deductibles usually cost less.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance: How it Works (+ Costs)

There’s one simple reason you should get auto insurance: It’s the law. You legally can’t drive without the state-mandated minimum amount of insurance.

Auto insurance can also keep you from getting sued if you’re at fault in an accident, as well as pay for damages to your vehicle.

Auto Insurance Coverage Options: Key Details & U.S. Requirements| Coverage | What it Covers | Required? |

|---|---|---|

| Classic/Collector Car Insurance | Agreed vintage value | Optional for classic cars |

| Collision Coverage | Accident repair costs | Optional, lender required |

| Comprehensive Coverage | Non-collision damage | Optional, covers risks |

| Gap Insurance | Loan value shortfall | Optional for financed cars |

| Liability Insurance | Injuries, property damage | Required in most states |

| Medical Payments (MedPay) | Basic medical bills | Optional medical add-on |

| Personal Injury Protection | Medical bills, lost wages | Required in some states |

| Rental Reimbursement | Rental during repairs | Optional rental coverage |

| Roadside Assistance | Towing, breakdown help | Optional emergency service |

| Uninsured/Underinsured Motorist | Uninsured-driver damage | Required in some states |

Everyone will need at least the state-mandated minimum in order to be on the road. If you’re strapped for cash, this may be all you should get for right now.

One suggestion from our financial advisers was to have an auto insurance policy that could cover almost any accident, given that we drive higher-end vehicles.

Kalyn Johnson Insurance Claims Support & Senior Adjuster

If you own a new car or a more expensive vehicle, you should consider additional coverage. Consider comprehensive, collision, or gap insurance. Motorcycle and classic car drivers should also consider specialty products that meet their needs.

The assumption is, if you drive, for example, a new Cadillac, you must have money, right? While that might be true, you don’t want the person you were in an accident with to automatically assume they hit the jackpot when you hit them.

Classic car insurance often works differently from a standard auto policy. Classic car policies typically assume the car isn’t your daily driver, so there may be certain eligibility requirements.

In addition, most classic car policies let you insure the vehicle for an agreed-upon amount based on appraisals, photos, and documentation.

Our car insurance cheat sheet breaks down key coverage types and tips you should know before comparing quotes.

Essential Auto Insurance Coverage Types

Different types of car insurance pay out in different situations.

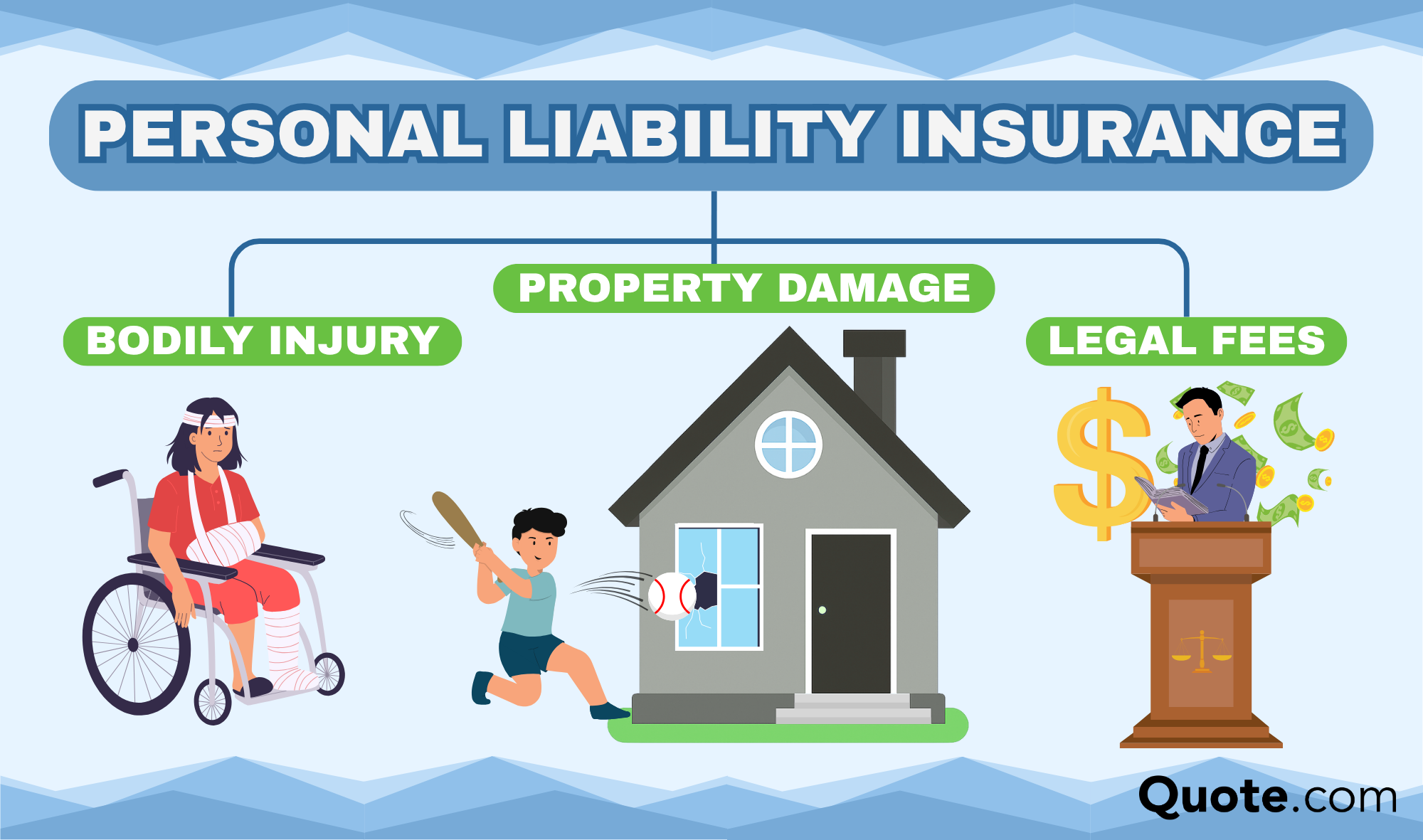

- Liability Insurance: It doesn’t cover you or your vehicle; instead, it pays up to a certain limit for property damage and medical bills for other people involved in a wreck.

- Collision Insurance: Helps pay for repairs or replacement of your car if you’re responsible for an accident, regardless of who or what you collide with.

- Comprehensive Insurance: Covers your car if it’s damaged by events such as theft, vandalism, fire, hail, flooding, or falling objects.

Auto Insurance Cost & How to Save

While car insurance is required by law, how much you pay each month depends mostly on the amount of coverage you choose. Most drivers start with the state-mandated minimum, but many opt for full coverage auto insurance for better protection.

Minimum coverage is significantly cheaper, making it a common choice for drivers on a tight budget or those with older, lower-value vehicles.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

However, having a higher auto insurance policy might just protect you from a personal lawsuit above and beyond what your policy would pay out, in the event you are in a serious accident.

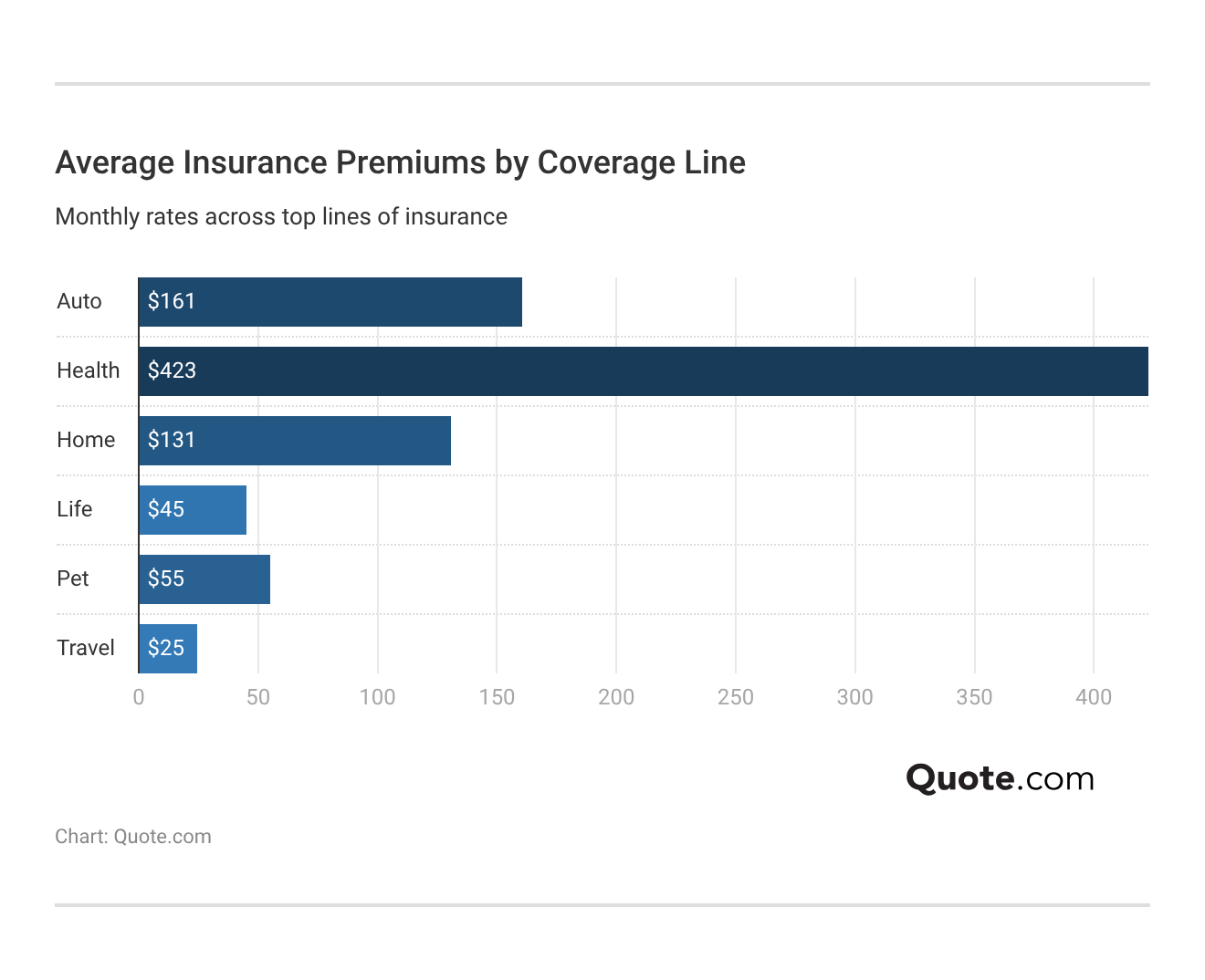

While some factors, like your age or where you live, may be out of your control, there are other ways to help you lower your rate without sacrificing protection.

Avoid accidents, speeding tickets, and other violations to keep premiums more affordable. Take advantage of every discount you qualify for, raise your deductible, watch your mileage and driving patterns, and review your coverage. Shopping around can also uncover better rates and discounts.

Looking for affordable car insurance? Compare car insurance online from leading auto insurance companies, choose only the coverage you need, and use discounts for bundling and safe driving to get the cheapest car insurance possible.

Top 10 Auto Insurance Tips

- Safer car, lower premiums. Many insurers will slash rates if your car has an alarm system, anti-lock brakes, or features that make it harder to steal or safer in a wreck.

- Do a cost/benefit analysis. If you pay $1,000 per year for collision insurance on a $3,000 car, after three years, you’ll pay more than your car is worth.

- Get gap insurance for new cars. Some policies pay only the car’s current value after a wreck, rather than what you paid for it.

- Consider usage-based insurance. Letting your insurer track when and how you drive can lower your rates as long as you’re a safe driver.

- For lower rates, raise your deductible. You pay a little more in case of an accident, but this can save you money over time.

- Get good grades for cheaper insurance. Some insurers offer discounts to good students who maintain a B average or higher.

- Life happens. Certain life events, such as switching careers, getting married, or buying a house, can lower your premiums. Inform your insurer if any of these happen.

- Take a defensive driving course. These courses can do more than prevent your rates from increasing after a speeding ticket.

- Switch cars. Insurers charge higher rates for certain vehicles. If you want a lower rate, replace the sports car with a minivan.

- Drive less. Most insurers offer a low-mileage discount to drivers who cover 5,000 miles or fewer per year.

Home Insurance: Coverage & Key Benefits

Next to health insurance, home insurance is one of the most important policies you can own. Home insurance coverage helps protect all that money from disappearing after a single bad accident.

Without it, you could lose tens or hundreds of thousands of dollars if something happens to your house.

Michelle Robbins Licensed Insurance Agent

A large palm tree can look healthy and stable, yet still pose a serious risk to a property. In one case, shifting roots caused cracks in a pool deck, surrounding concrete, and part of a home’s foundation.

The damage was unexpected, and the tree was later found to be one severe storm away from falling onto the house.

Types of Home Insurance Policies| Type | Policy | What it Covers |

|---|---|---|

| HO-1 | Basic | Perils like fire, theft, & falling objects |

| HO-2 | Broad | HO-1 perils + water damage, surges |

| HO-3 | Special | All perils except noted exclusions |

| HO-4 | Contents | Renters: Covers items and liability |

| HO-5 | Comprehensive | HO-3 perils at replacement value |

| HO-6 | Unit-Owners | Condos: Covers items and liability |

| HO-7 | Mobile Home | Mobile home coverage like HO-3 |

| HO-8 | Modified | Homes 40+ years old or historic |

While exploring repair options, the homeowners learned that their policy did not cover damage caused by tree roots unless the tree actually fell and caused significant structural harm.

As a result, they were left paying out of pocket for tree removal, structural repairs, and preventative removal of another nearby tree that could have caused similar issues in the future.

This underscores the importance of carefully reviewing homeowners insurance coverage and considering additional protection for property-specific risks, rather than assuming all damage scenarios are automatically covered.

Home insurance rates vary widely by insurer, which is why you need to compare multiple insurers within the same coverage tier before choosing a policy.

Check This Page: How to Compare Home Insurance Quotes

Essential Home Insurance Coverage Options

Most home insurance plans cover three basic areas:

- Dwelling Coverage: This plan protects the actual structure of the house.

- Contents Coverage: Covers your personal belongings inside the home.

- Personal Liability Coverage: This plan covers medical expenses for injuries sustained inside your home.

These types of coverage should be where your home insurance search starts, not where it ends.

For example, personal liability coverage protects you if you (or a household member) are found legally responsible for someone else’s injury or property damage. It can pay for legal defense costs and, if you’re liable, settlements or court judgments up to your policy limit.

Learn More: Is home insurance required?

Depending on your situation, you may need additional insurance to protect against floods, earthquakes, or other risks.

- Extended Replacement Coverage: Note that payouts are capped at 125% of your home’s insured value.

- Inflation Guard: This perk ensures your home’s insured value stays current with its current market value.

Some home insurance policies will only pay out the value of your home at the time it was appraised. That means a home insurance policy may not fully cover the cost of rebuilding or repairing your home if it lacks one of two essential coverages.

Home Insurance Cost & How to Save

Home insurance rates mostly depend on your dwelling coverage limit, which is the amount it would cost to rebuild your home from the ground up. Lower dwelling coverage means lower monthly premiums but less protection in the event of a total loss.

| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $85 | $175 | $258 | $400 | |

| $81 | $115 | $175 | $310 |

| $86 | $120 | $150 | $179 |

| $90 | $266 | $366 | $570 | |

| $75 | $110 | $170 | $300 | |

| $79 | $115 | $140 | $168 | |

| $88 | $151 | $189 | $300 | |

| $80 | $129 | $156 | $184 | |

| $86 | $175 | $280 | $425 | |

| $70 | $126 | $209 | $335 |

Premiums increase steadily with coverage, especially at higher limits such as $500,000 or $1 million. Homeowners insurance rates can also differ depending on where you live. Even within the same state, premiums can vary based on your ZIP code, local risk, replacement cost, claims, and litigation patterns.

The numbers above are statewide averages for $250K in dwelling coverage and may not include add-ons such as separate flood coverage. Some states also vary based on factors such as hurricane deductibles, which can significantly affect premiums.

Top 10 Home Insurance Tips

- Fix it yourself. Repair items yourself or hire a contractor to fix damage under $1,000. Filing multiple claims can increase your premiums.

- Determine whether you need flood insurance. You’re legally required to get this if you live in a floodplain.

- Insure your valuables. If you have expensive art, jewelry, or antiques in your home, get a separate policy for these items.

- Get an independent walk-through. Ask a homebuilder to provide a quote for your home’s value to accurately determine how much insurance you need.

- Get replacement cost instead of actual cash value. Actual cash value covers the full cost of replacement for your items.

- Safety first. Installing smoke alarms or security systems will lower your premiums.

- Get ordinance or law insurance. If you plan to live in your home, these will cover any required costs to bring your home into compliance with future building codes.

- Get external structures their own policies. Otherwise, your gazebos, detached garages, or sheds may not be covered under your home insurance policy.

- Bundle up. Many insurance plans will cut your premiums if you bundle your home and auto insurance together.

- Insurance for the sharing economy. Most plans won’t cover any damages resulting from renting your home out on Airbnb or a similar service.

How Life Insurance Works: Coverage Basics

Life insurance keeps your spouse, partner, or children from facing financial hardships in case the worst should happen. This can protect your family from expensive funeral costs and provide for them for years after you’re gone.

Life Insurance Coverage Options: Key Details & Monthly Rates| Policy | How It Works | Premium |

|---|---|---|

| Term Life | Coverage lasts for a set period (typically 10 to 30 years); no cash value and low cost. | $35 |

| Whole Life | Lifetime coverage with fixed premiums and a guaranteed cash value component. | $350 |

| Universal Life | Lifetime coverage with flexible premiums and a cash value that grows at a set rate. | $270 |

| Variable Life | Lifetime coverage; cash value is invested in market subaccounts values may rise or fall. | $425 |

| Variable Universal Life | Combines flexible premiums with investment based cash value growth potential. | $375 |

| Group Life | Employer provided term policy; limited coverage, typically not portable. | $25 |

| Final Expense | Small permanent policy designed to cover funeral and burial costs. | $50 |

It’s not just a salary that goes away with a loved one when they die. Its security. It’s knowing you can pay the bills every month while you contemplate a new normal.

Essential Life Insurance Options

Life insurance comes in two broad categories:

- Term Life Insurance: This plan covers a person for a fixed period, typically 15, 20, or 30 years. You pay a fixed annual or monthly premium, and the policy pays a benefit if you die during this period.

- Whole Life Insurance: This plan has no set term and remains in effect as long as you pay your policy premiums. It’s more expensive but accumulates cash value over time and can be accessed later.

Your life insurance coverage needs will change over time. If you’re young and just starting a family, you need more coverage.

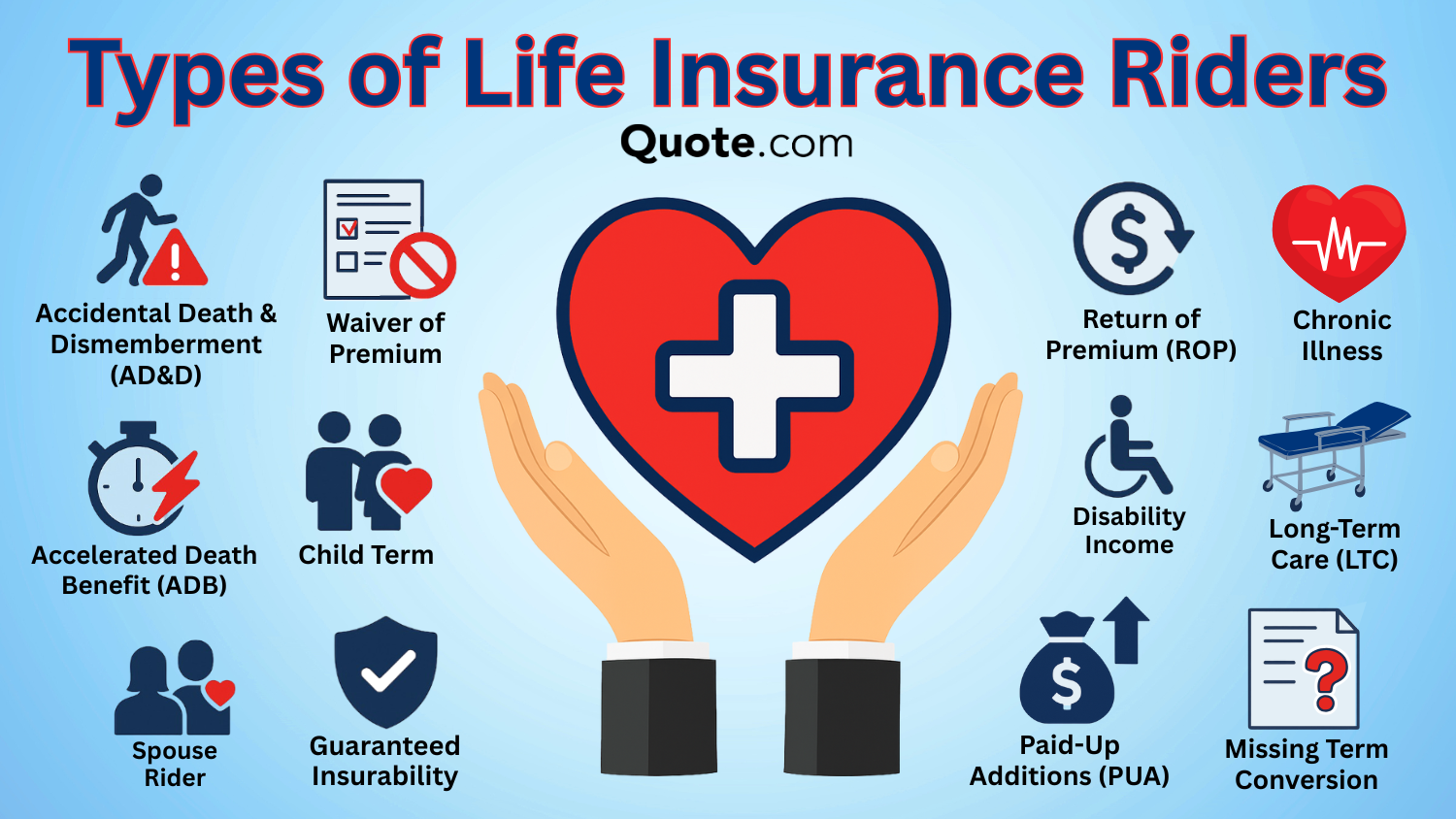

Life insurance riders are optional add-ons you can add to a life insurance policy to customize your coverage. They allow you to increase coverage later without a new medical exam, which can be valuable if your health changes and you’d otherwise pay much more or be unable to qualify.

Use riders to keep your policy active, protect your budget, and add coverage later. Your long-term insurance plan should help your loved ones cover expenses such as mortgages and other bills and save for retirement or college without your income.

Life Insurance Cost & How to Save

Term life insurance is far more affordable, even at higher coverage limits. Whole life insurance premiums are substantially higher, but they include lifelong coverage and cash value accumulation.

Whole vs. Term Life Insurance Monthly Rates by Provider & Policy| Insurance Company | 15-Year Term | 20-Year Term | 30-Year Term | Whole Life |

|---|---|---|---|---|

| $35 | $45 | $60 | $150 | |

| $34 | $43 | $58 | $145 | |

| $33 | $42 | $55 | $140 | |

| $32 | $40 | $53 | $135 | |

| $31 | $38 | $52 | $130 | |

| $30 | $37 | $50 | $128 | |

| $29 | $36 | $48 | $125 | |

| $28 | $34 | $47 | $120 | |

| $27 | $33 | $45 | $118 | |

| $26 | $32 | $43 | $115 |

When you’re on a better financial footing later in life, you can use your life insurance policy as an investment vehicle, much like a 401(K). That’s because certain types of policies let you contribute pre-tax income and save when tax season rolls around.

After you’ve retired, you may no longer need long-term life insurance coverage, depending on how much you saved during your working years.

Related Article: Whole vs. Term Life Insurance

Top 10 Life Insurance Tips

- Get enough coverage. Your policy should pay out enough to cover 15 years’ worth of your income. That means if you earn $50,000 per year, get a policy with a $750,000 limit.

- Term life insurance is most likely enough. Choose whole life only if you’re looking for an investment vehicle or a way to reduce your taxes.

- Don’t let your coverage lapse. Missing a premium payment may result in your policy being void. That means you will need to obtain a new policy.

- Stop smoking. The best (albeit not easiest) way of lowering your premiums is to quit smoking.

- Buy it early. The younger you are when you purchase a policy, the lower the premium will be.

- Drive safe. Your driving record affects your premiums, so keeping a clean record saves you money.

- Pay annual premiums. Most insurers will cut you a discount if you pay your premiums on a yearly basis instead of monthly.

- Ask about price breaks. Some insurers will reduce your rates if you choose a higher coverage amount, such as moving from a $240,000 policy to a $250,000 policy.

- Be upfront about pre-existing conditions. Not stating these could lead to your policy being suspended down the road or prevent benefits from being paid to your beneficiaries.

- You can still get life insurance with a pre-existing condition. Simplified issue or guaranteed issue policies are less stringent in their underwriting.

See This Article: Types of Life Insurance

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Health Insurance: What Plans Cover (+Costs)

Health insurance is probably the most important type of insurance you’ll ever get. Other types of insurance can cover your home, car, or trip, but your health is more valuable than all of those combined.

Medical bills can be incredibly expensive. With health insurance, getting a major surgery or treatment for a serious illness won’t put you in dire financial straits.

In one case, a woman woke up in the middle of the night experiencing severe abdominal pain and needed to be taken to the emergency room immediately. Given her typically high pain tolerance, the sudden intensity of the pain was a clear sign that something was seriously wrong.

Health Insurance Plan Types Comparison| Plan Type | Flexibility | Primary Feature | Best for |

|---|---|---|---|

| Catastrophic | Very Low | Emergency coverage for under 30 | Young Adults |

| EPO | Medium | No referrals, in-network only | Cost-Conscious |

| HDHP | High | High deductible, HSA eligible | Tax Planners |

| HMO | Low | Requires PCP & referrals | Budget Shoppers |

| POS | Moderate | Hybrid of HMO & PPO | Coordinated Care |

| PPO | High | Out-of-network access | Choice Seekers |

| Medicaid | Low | Income-based public insurance | Low-Income Families |

| Medicare | Moderate | Government for 65+ or disabled | Older Adults |

At the hospital, doctors initially suspected either a ruptured ovarian cyst or appendicitis. Further evaluation revealed that her appendix was close to rupturing, and she was rushed into emergency surgery.

Without a solid insurance plan, an unavoidable, middle-of-the-night health surprise would have cost her over $40,000. With insurance, she spent about $2,000 out of pocket.

Essential Health Insurance Plans

This will vary widely and continue to change as healthcare laws and regulations evolve. For now, consider these options.

- Employer-Provided Health Insurance: This plan is often a good option if it’s available through your employer. Most of these plans are affordable and offer decent benefits.

- Bronze, Silver, Gold, and Platinum Health Insurance: These plans typically cover 60%-90% of most medical costs. Higher coverage levels mean higher premiums.

- Catastrophic Plans: Available only to those under 30. If you’re young, don’t go to the doctor often, and are in good health, this may be a decent option.

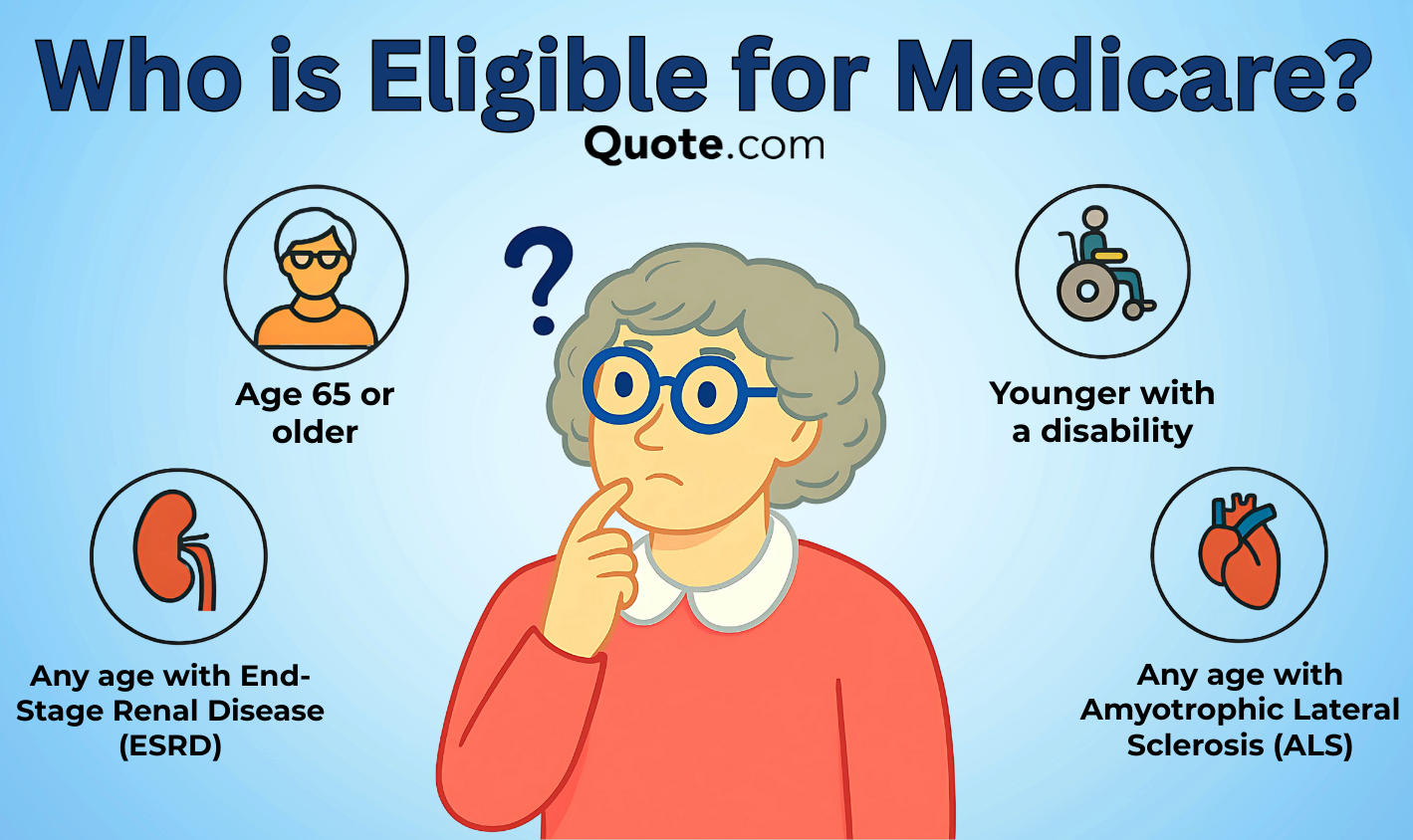

If you’re approaching 65, it’s worth checking how Medicare works alongside any employer coverage so you can avoid gaps and unnecessary late-enrollment costs. There are specific enrollment windows for most people, so if you assume you’re covered automatically, you could miss your opportunity to sign up for Medicare.

- Part A: Covers hospital-related services (like inpatient stays and some skilled nursing care).

- Part B: Covers outpatient care (like doctor visits, lab work, and preventive services).

- Part C: A private plan that bundles coverage and often includes extra benefits.

- Part D: Covers prescription medications through private plans approved by Medicare.

Reviewing Medicare coverage and eligibility ahead of time can help you choose the plan that fits your health needs and prescription costs.

Find Out More: The Best States for Employer-Provided Health Insurance

Need affordable health insurance? Comparing plans by total yearly cost and checking if you qualify for discounts can help you get the cheapest health insurance.

Health Insurance Cost & How to Save

Most health insurance plans are categorized into metal tiers: Bronze, Silver, Gold, and Platinum. The best plan depends on your health, budget, and risk tolerance. If you’re generally healthy, a Bronze plan may be enough.

If you expect regular doctor visits, prescriptions, or ongoing care, a Silver or Gold plan can reduce your out-of-pocket costs. For frequent medical needs, a Platinum plan might be the best option.

Health Insurance Monthly Rates by Metal Tier| Company | Bronze | Silver | Gold | Platinum |

|---|---|---|---|---|

| $519 | $565 | $639 | $1,051 | |

| $487 | $521 | $612 | $978 | |

| $603 | $637 | $704 | $1,168 | |

| $541 | $574 | $652 | $1,095 |

| $590 | $620 | $681 | $1,145 | |

| $478 | $502 | $588 | $945 | |

| $507 | $534 | $598 | $913 |

| $462 | $496 | $579 | $935 |

| $470 | $512 | $585 | $1,015 | |

| $576 | $601 | $663 | $1,092 |

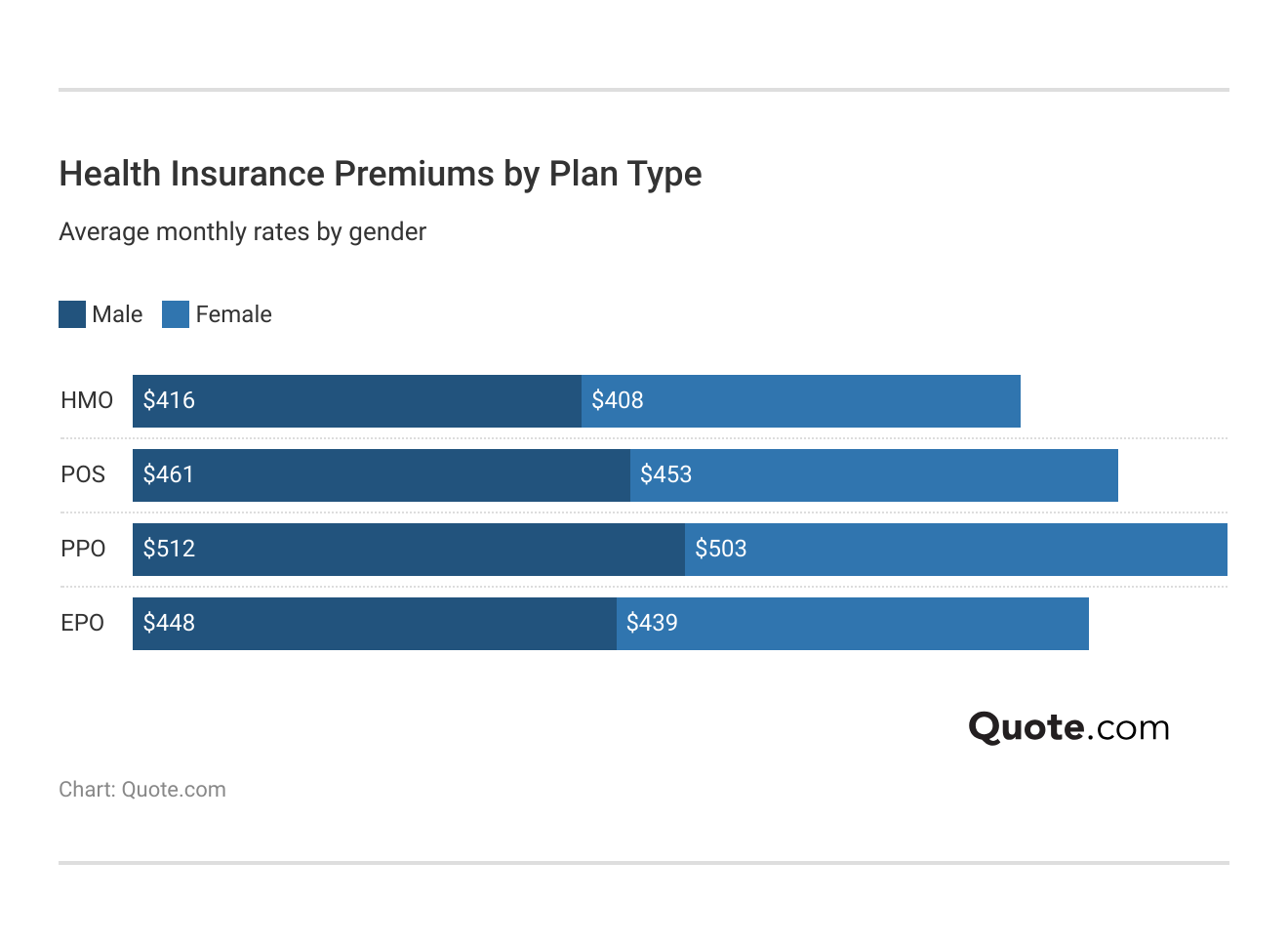

In the table below, you can find the most common plan types so you can choose the option that fits your budget and desired level of care. An HMO or EPO is often the most affordable. You just need to make sure your preferred doctors and hospitals are in-network.

A PPO typically offers the most flexibility to see specialists and use out-of-network providers, though it costs more. A more expensive plan with a lower deductible may save you more overall, especially if you’ll have regular prescriptions, specialist visits, or planned procedures.

Comparing health insurance plans makes it easier to find the best value, not just the lowest premium.

What You Need to Know About Health Insurance

Health insurance terminology can make choosing a plan more daunting than it needs to be. Here’s how to speak your health plan’s language:

- Premiums: The amount you pay each month for health insurance.

- Deductibles: The insurance deductible is how much you have to pay before your health insurance kicks in.

- Copays: You pay this flat fee when you visit the doctor.

- Coinsurance: The percentage of the care charge you pay.

- In-network: These healthcare providers have contracts with your insurance company that provide plan members with discounted rates.

- Out-of-network: These providers don’t have contracts with your plan, so you pay more when you visit them.

- Enrollment Period: This is the critical time to enroll in plans through government or state healthcare exchanges.

Top 10 Health Insurance Tips

- Different states, different enrollment periods. That means you can enroll in insurance outside the usual enrollment period.

- Watch your savings. Plans purchased on the healthcare exchange offer special tax subsidies, but they can be lost under certain conditions.

- Stay healthy. Preventative care is covered under most health insurance plans. Staying healthy with these services helps keep your premiums low.

- Report your income. Report any increase or decrease in your earnings to maximize savings or prepare for a larger bill.

- Consider a Health Savings Account. These let you contribute pre-tax income, meaning you can be better prepared for an unexpected doctor’s visit.

- Ask for outside help. Treatment for some conditions or diseases may incur charges beyond your health insurance coverage.

- Get your steps in. A few insurance plans offer discounts for using Fitbits or similar devices. Check if you qualify for these savings.

- Prescription discounts. If your plan doesn’t provide adequate prescription drug coverage, check whether your medication’s manufacturer offers these savings.

- Freelancer tax deductions. If you’re a freelancer, you can get a tax deduction for the cost of your health insurance deductible.

- Consider your options. If both you and your spouse qualify for employer-provided plans, check whether one of them makes better sense for your coverage needs.

Pet Insurance: Coverage, Costs & Exclusions

Medical bills for pets can now exceed $1,000. If you want to get your animal companions the best medical care possible, you’ll need pet insurance.

For most pet owners, pet insurance may seem unnecessary when their pet is healthy. However, it can help you avoid tapping your savings to cover a $1,000 veterinary bill if your pet is injured or becomes ill.

Pet Insurance Coverage Breakdown| Category | What’s Covered | Details |

|---|---|---|

| Accidents | Broken bones, poisoning | In most plans |

| Alternative Therapies | Acupuncture, hydro | Limited availability |

| Behavioral Therapy | Training, behavior | Select insurers only |

| Dental Care | Cleanings, extractions | Preventive excluded |

| Diagnostic Tests | X-rays, MRIs, labs | Varies by plan |

| End-of-Life Care | Euthanasia, cremation | Coverage varies |

| Genetic/Congenital | Hip dysplasia, heart | Active policy required |

| Hospitalization | ER, surgery, overnight | Usually included |

| Illnesses | Cancer, arthritis, GI | Waiting period applies |

| Prescriptions | Antibiotics, pain meds | Supplements excluded |

| Preventive Care | Vaccines, flea/tick | Optional add-on rider |

| Specialists | Oncology, cardiology | May need referral |

A beloved dog was diagnosed with cancer later in life, leaving her owners facing both an emotional and financial crisis. The treatment cost exceeded the owners’ budget, but they chose to proceed to give their pet the best possible chance.

Find Out More: Best Pet Insurance for Dogs

While the treatments were successful and the dog went on to live several more happy years, the unexpected expenses placed a long-term strain on the family’s finances.

Without pet insurance, the owners were left paying the full cost of care out of pocket. You want a plan that will cover injuries and illnesses. Don’t think about pet insurance as a way of defraying costs for routine trips to the vet – it’s for emergencies only.

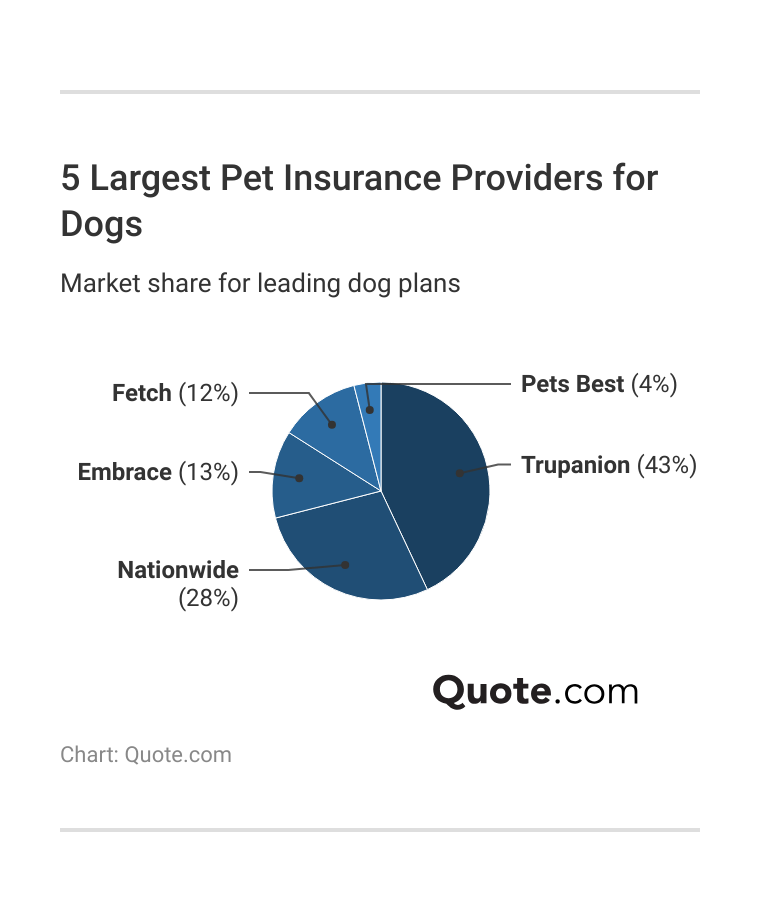

If you’re shopping for dog insurance, Nationwide, Fetch, and Trupanion often stand out as top picks for their broad coverage, flexible plans, and smooth claims processing.

Pet Insurance Cost & How to Save

Pet insurance typically costs less for cats than dogs, mostly because cats tend to have lower veterinary costs and fewer claims. Premiums also increase as pets age or when you add more benefits, such as higher reimbursement rates, lower deductibles, and wellness add-ons.

Pet Insurance Monthly Rates for Cats vs. Dogs| Insurance Company | Cats | Dogs |

|---|---|---|

| $20 | $40 |

| $30 | $50 | |

| $32 | $53 |

| $29 | $60 | |

| $30 | $50 | |

| $32 | $54 | |

| $29 | $50 | |

| $25 | $45 | |

| $30 | $55 |

| $25 | $45 |

If you’re trying to save, choose a higher deductible and a lower reimbursement percentage, and keep your annual coverage limit at a level that fits your budget. It’s also worth getting multiple quotes from insurance agents and comparing coverage details so you don’t pay extra for benefits you won’t use.

Discover More: 10 Best Pet Insurance Companies

What You Need to Know About Pet Insurance

Pet insurance doesn’t work like human health insurance. Instead of kicking in right when you pay your vet bill, you file a claim, and the insurance company reimburses you later.

The deductibles work differently as well, falling into one of three categories:

- Annual: The insurance pays out for the rest of the year once you’ve reached your deductible.

- Per Condition: Each condition has a deductible after which coverage begins.

- Per Visit: You must meet your deductible each time you take your pet in for treatment.

Important Read: Best Pet Insurance for Dogs

Need pet insurance advice before you buy? Keep reading for more.

Top 10 Pet Insurance Tips

- Purebreds beware. Some pet insurers don’t cover diseases and conditions that are genetically linked to certain breeds of pets. Read your policy carefully.

- Pets can have pre-existing conditions, too. That may exempt them from coverage under pet insurance.

- Young pets are cheaper to insure. Your puppy or cat can get the best care if they swallow something harmful or injure themselves while playing.

- Don’t buy pet wellness coverage. This covers vaccines and routine veterinary visits. However, it usually costs more overall than the visits.

- Think about liability insurance. If you have a particularly rambunctious animal, this could protect you from paying out money as a result of a lawsuit.

- Watch out for waiting periods. Some plans delay their insurance coverage for a certain amount of time after you purchase a policy, which could put you at risk of high vet bills.

- Always choose the highest deductible you can afford. Pet insurance is for emergencies, so you want a high deductible and a low premium.

- Watch out for capped payouts. Some plans cap how much they’ll cover, which can lead to a nasty surprise when filing a claim.

- Create a pet emergency fund. If you can’t afford pet insurance, set aside whatever you can to pay for any unexpected pet medical bills.

- Get a multi-pet discount. Some insurers reduce your rates if you insure more than one animal through them.

Learn More: 8 Questions to Ask When Considering Pet Insurance

Travel Insurance: Coverage for Trip Cancellation

Vacations, cruises, and trips can cost thousands of dollars, and that money can disappear if you have to cancel them at the last minute.

More than that, you can rack up jaw-dropping hospital bills if your health insurance doesn’t cover medical care in a foreign country.

If you're planning a globe-trotting vacation, it's worth spending a few extra dollars to ensure you don't lose all that cash if you can't go.

Laura Kuhl Managing Editor

The right kind of travel insurance can help you avoid these worst-case scenarios.

Cruises are a good example of why travel insurance can be worth the extra cost. Many travelers choose coverage to protect themselves in the event of a medical emergency requiring evacuation from the ship or a remote destination.

Top Travel Insurance Coverage| Coverage | What it Covers |

|---|---|

| Accidental Death & Dismemberment | Death or limb loss from a travel accident |

| Baggage Loss | Lost, stolen, or damaged luggage and items |

| Cancel for Any Reason | Partial refund if canceling for a non-covered reason |

| Emergency Medical | Medical expenses for illness or injury while traveling |

| Medical Evacuation | Transport to nearest facility during a medical emergency |

| Trip Cancellation | Reimbursement for canceled trip due to a covered reason |

| Trip Delay | Extra costs from travel delays due to a covered reason |

| Trip Interruption | Refund for unused trip if it ends early due to a covered reason |

Seeing a fellow passenger airlifted due to a serious cardiac emergency is often enough to highlight how quickly unexpected situations can arise and how expensive they can become without proper coverage.

Travel insurance can also provide flexibility when trips are disrupted. In cases where cruises are canceled due to severe weather, such as hurricanes, insured travelers may be eligible for a full refund or to rebook their trip on an alternative route, helping them avoid significant financial loss.

Explore your options for trip protection by reading our article about the 8 Best Travel Insurance Companies.

Essential Travel Insurance Plans

Depending on the kind of trip you’re taking, consider one of these forms of travel insurance:

- Travel Medical Insurance: Covers medical treatment abroad.

- Evacuation Insurance: Covers transportation to the nearest hospital or back home in the event of a medical emergency.

- Cancellation Insurance: Covers the cost of your trip if you can’t travel.

- Package Travel Insurance: Combines all of the above coverage types.

Travel Insurance Cost & How to Save

Travel insurance costs depend on factors such as your trip cost, destination, age, trip length, and the type of coverage you choose. The table below compares costs and core coverage limits across several providers.

Travel Insurance Basic Plan Cost and Coverage| Provider | Cancellation | Cost | Emergency | Evacuation | Interruption |

|---|---|---|---|---|---|

| $10K | $130 | $10K | $50K | $10K | |

| 100% trip cost | $140 | $25K | $100K | 100% trip cost | |

| 100% trip cost | $100 | $10K | $100K | 150% trip cost | |

| $10K | $160 | $100K | $500K | $15K | |

| $3K | $80 | $60K | $100K | $3K |

| 100% trip cost | $140 | $100K | $250K | 100% trip cost | |

| $10K | $120 | $35K | $100K | $15K | |

| $10K | $120 | $35K | $100K | $15K | |

| $2,5K | $150 | $100K | $300K | $2,5K |

To save money, start by buying only the coverage you actually need. If your trip is flexible, you may be able to choose lower cancellation limits or skip add-ons. Choosing a more limited plan type can also reduce premiums.

What You Need to Know About Travel Insurance

Your travel insurance will only kick in under certain conditions, so make sure you read your policy closely. For instance, most cancellation insurance plans will only cover your trip if the following prevent you from going:

- Sudden business conflicts

- Changing your mind

- Delays in processing your visa or passport

- An illness or injury

- Weather-related issues

Some policies won’t protect you if your trip gets canceled due to an accident on the way to the airport, jury duty, or a fire or flood in your house. Make sure you do your research when picking out the right policy.

Read More: What to Do When You’re Denied Insurance Coverage

Top 10 Travel Insurance Tips

- You may already be covered. Your credit card, health insurance, and car insurance may offer some of the same protections provided by travel insurance.

- Shop around. Don’t buy your policies directly from travel agents, as they may be selling the policy that yields the highest commission.

- Special insurance for adventurers. If you plan to scuba dive, ski, or skydive during your vacation, most basic plans won’t cover injuries from these activities.

- Use the Free Look Period. Every travel policy includes a 10-15-day Free Look Period, during which you can review, modify, or cancel your coverage as needed.

- Primary coverage. Travel insurance plans that act as primary coverage will kick in before other forms of insurance and save you from out-of-pocket expenses.

- Make sure your carrier is covered. Not all airline carriers and tour operators are covered under travel insurance policies. Make sure yours is before buying a policy.

- Medicare doesn’t cover you overseas. If this is your primary health insurance, get travel medical coverage.

- You may not need baggage insurance. If you check your bags, they’re covered by the airline in most cases.

- When you need rental car insurance. For domestic trips, regular car insurance will cover you. If you rent a car abroad, it may be covered by your travel insurance.

- Get it fast. Getting your travel insurance as soon as possible gives you the most time to cancel if you’re unable to travel.

Free Health Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Right Type of Insurance

The right type of insurance depends on your needs, budget, and risk tolerance. What works for someone else may not be enough or may be more than necessary for you.

Taking the time to understand this insurance sheet, what each policy covers, and how much protection you actually need can help you avoid costly surprises down the road.

Related: Best Insurance Comparison Sites

Any insurance tips that have saved you money or more? Have you found a workaround to obtain a specific type of insurance?

We’d love to know how many others out there have had similar experiences or perhaps similar experiences with very different outcomes!

Start comparing affordable insurance options by entering your ZIP code into our free quote comparison tool today.

Frequently Asked Questions

What are the most important terms in a life and health insurance cheat sheet?

A health insurance cheat sheet covers:

- Premium

- Deductible

- Copay and coinsurance

- Out-of-pocket maximum

- In-network vs. out-of-network

- Covered services/exclusions

A life insurance cheat sheet includes:

- Term vs. permanent coverage

- Death benefit

- Beneficiary

- Riders

- Premium guarantees

How is commercial insurance defined in a commercial insurance cheat sheet?

Commercial (business) insurance is coverage that protects a business from common risks, such as lawsuits, property damage, and employee injuries.

What does it mean to get an insurance quote?

An insurance quote is an estimate of your premium for a specific coverage level with a specific insurer. It’s used for comparison shopping and is based on the information you provide.

Related: Best Insurance Comparison Sites

How do you get home insurance quotes?

You can get home insurance quotes through:

- Insurer websites

- An independent agent

- Comparison tools

What are the best home insurance tips and tricks to lower your premium?

The most reliable ways to lower home insurance costs are:

- Shopping around regularly

- Raising your deductible

- Bundling home and auto coverage

- Improving home security/safety

How do you get the best quotes on business insurance?

To get the best business insurance deal:

- Assess your risks and required coverages

- Prepare accurate business info

- Shop multiple options

- Ask about bundles

What are the basics of insurance?

You pay a regular premium to an insurance company in exchange for coverage that helps pay for certain losses if something goes wrong. Most policies include an insurance deductible, which is the amount you must pay out of pocket before insurance begins to cover costs, and policy limits, which cap the amount the insurer will pay.

What are the 7 fundamentals of insurance?

Here’s what the 7 pillars of insurance are:

- Risk pooling

- Risk transfer

- Insurable interest

- Utmost good faith

- Indemnity

- Subrogation

- Loss probability

How to read insurance limits?

Insurance limits show the maximum amount an insurer will pay for a covered loss. They’re often written as:

- Per occurrence limit (per accident or event)

- Aggregate limit (maximum paid during the policy period)

Enter your ZIP code to start comparing premiums from highly-rated insurers in your area.

What are the five insurance policies?

The most common personal insurance policies are:

- Life insurance

- Health insurance

- Auto insurance

- Homeowners insurance

- Renters insurance

- Disability insurance

Learning how to get multiple auto insurance quotes is important because it helps you find the best price for the same coverage.

What is the insurance life cycle?

What is meant by an 80%-20% insurance coverage?

What death is not covered by life insurance?

What are the 5 main elements of an insurance contract?

What is the main goal of insurance?

How many types of insurance are there?

Is it better to have a $500 deductible or a $1,000 deductible?

What are the five main sections of an insurance policy?

What is the hardest insurance exam to pass?

What is not covered under liability insurance?

What is liability insurance?

Is ticket insurance worth it?

How to find out what insurance I have?

How much does a ticket affect insurance?

Do I need collision insurance on an old car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.