Usage-Based Auto Insurance (2026 Guide)

Usage-based auto insurance tracks driving habits, like mileage, speed, and braking, to set personalized rates. While usage-based insurance discounts can save you 40%, most drivers save about 12%. UBI programs use apps or plug-in devices to collect driving data.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Chris Abrams

Updated February 2026

Usage-based auto insurance (UBI) is one of the great hacks to save more money on car insurance, as you only pay for what you use, lowering your rates by 40%.

- UBI gives instant feedback on your habits, helping you drive better

- Get personalized rates that may be way lower than what you pay now

- Usage-based apps can track your car down if it’s stolen

While UBI may help you save a bundle of cash, its savings come from letting insurers track how, when, and where you drive. Also, if you sign up for the wrong type of user-based insurance, you may actually end up paying more than you were before.

Use this guide to easily find out how usage-based insurance works and take advantage of lower auto insurance premiums with UBI. Enter your ZIP code to start comparing usage-based car insurance quotes from local companies right now.

Usage-Based Auto Insurance Explained

UBI prices rely on your individual driving habits, rather than a collection of statistics based on your demographic and other drivers in your city.

The definition of usage-based insurance is right in the name. “Usage” refers to how drivers use their cars.

Individual premiums are calculated based on:

- How You Drive: Driving over the speed limit and slamming on your brakes can negatively impact UBI rates.

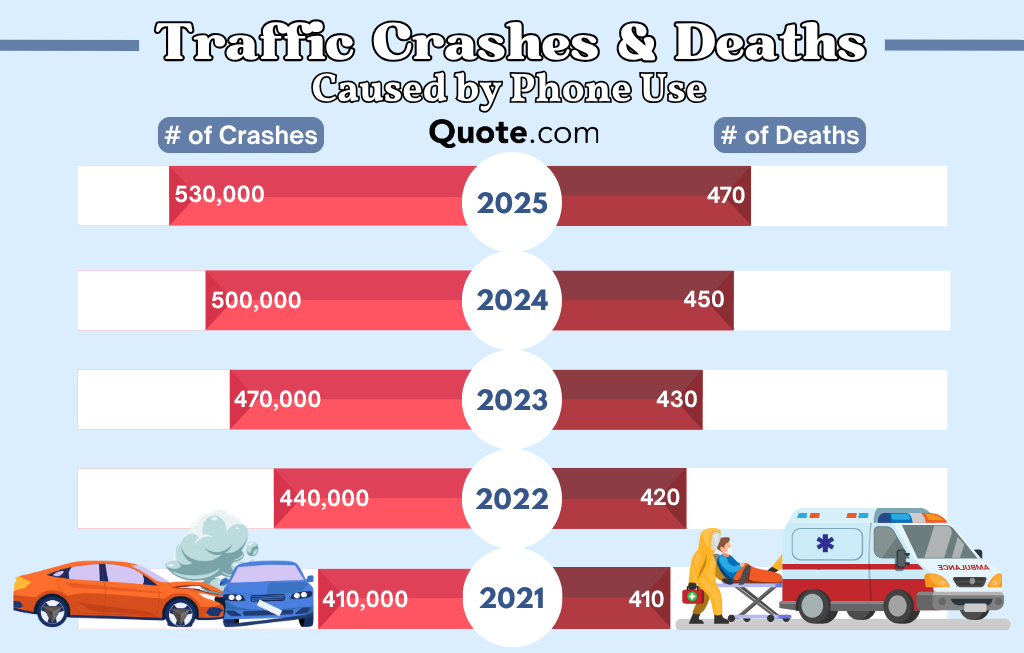

- When You Drive: Is it at night, when the risk of a fatal crash is three times higher, or during safer daylight hours?

- Where You Drive: Do you put a lot of miles on your car with a long commute, work from home, or take public transit?

Instead of assuming that everyone in a certain group is at the same risk of being involved in an accident, UBI allows insurers to calculate rates for car insurance based on driving habits.

Since safe or infrequent drivers are in fewer wrecks, insurers spend less money on paying out their claims. UBI lets you prove you’re one of these low-risk drivers and slashes your premiums as a result.

None of the UBI plans currently on the market are mandatory or auto-enroll drivers, so you’ll need to sign up to see if you qualify for a discounted rate.

Learn how to get multiple auto insurance quotes to compare companies and find the right type of UBI for you.

Different Types of Usage-Based Insurance

Driver-based insurance plans are either pay-as-you-go (PAYG) or pay-how-you-drive (PHYD) car insurance, both of which target specific kinds of drivers.

Signing up for the wrong plan will hit your pocketbook. Here’s how to figure out which one you should use.

Pay-As-You-Go (PAYG)

Also known as pay-as-you-drive insurance (PAYD), PAYG drivers pay a base rate plus a few cents per mile driven. A car in a garage gets in fewer accidents than a car on the road.

That’s the underlying philosophy behind PAYD and PAYG car insurance. Related: Best Pay-As-You-Go Auto Insurance Companies

It’s also known as pay-per-mile insurance or mileage-based car insurance, since it only tracks mileage and doesn’t consider driving habits.

This plan is perfect for people who work from home or rarely drive, as well as high-risk drivers who need affordable coverage that won’t weigh their driving record against them.

Pay-How-You-Drive (PHYD)

Pay-how-you-drive insurance is usage-based coverage for careful drivers. Mileage factors into rates, but premiums are also impacted by speeding, hard braking, time of day, and other driving habits.

Companies typically track driving behavior through a mobile app or a plug-in device in the vehicle. If you can’t afford auto insurance, this type of UBI could work for you if you don’t drive in a big city or at night.

Before picking a plan based on how much or how safely you drive, you can scroll to the end of this article for an easy quiz to determine which type of usage-based car insurance is best for you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Usage-Based Insurance vs. Standard Policies

Usage-based car insurance and traditional policies provide the same type of coverage and protection while you’re on the road. Find Out More: Auto Insurance Guide

UBI policies meet minimum state requirements with liability, MedPay, and PIP, but also offer full coverage and add-ons like roadside assistance and rental reimbursement, just like traditional coverage.

Auto Insurance Coverage Types: Details on What’s Covered| Coverage | What it Covers |

|---|---|

| Collision | Crash damage to your car |

| Comprehensive | Non-crash damage: theft, fire |

| Custom Parts & Equipment | Aftermarket parts damage/loss |

| Gap Insurance | Loan vs. car value difference |

| Liability | Injuries, damages to others |

| Medical Payments (MedPay) | Your medical bills only |

| Personal Injury Protection (PIP) | Medical bills, lost wages |

| Rental Reimbursement | Rental car during repairs |

| Roadside Assistance | Towing, flat tire, lockout |

| Uninsured/Underinsured Motorist | If other driver isn't covered |

The main difference is how each insurance plan calculates rates. Traditional insurance bases premiums on local statistics and demographic data.

Companies look at a customer’s age, whether they drive a luxury vehicle, whether they frequently get into accidents, and a huge number of other factors.

Insurance companies traditionally calculate rates based on how often people with similar characteristics, like age, gender, credit score, and ZIP code, file claims.

Heidi Mertlich Licensed Insurance Agent

Basically, you could be overpaying for car insurance because this pricing method relies on estimates of how people like you probably drive, rather than how you actually behave on the road.

For example, even if an 18-year-old driver is a good driver, traditional auto insurance will still charge them a higher rate because teens statistically get into more fatal auto accidents — three times more than drivers over the age of 20, according to the Insurance Institute for Highway Safety (IIHS).

If that same 18-year-old driver enrolls in UBI, the car insurance company could see that they don’t treat driving like an audition for The Fast and the Furious franchise and would offer the teenager a lower rate for their good driving habits.

More Details Here: How Traffic Collision Reconstruction Works

The Best Usage-Based Insurance Companies

Drivers considering enrolling in a UBI program have a variety of choices. The usage-based car insurance market is very competitive, with some insurers specializing only in UBI and other traditional companies offering PAYG and PYHD plans.

Here’s a selection of some of the different plans from the nation’s most popular auto insurance companies.

Top Usage-Based Auto Insurance (UBI) Programs

Company Program Savings System

Drivewise 40% Mobile App

DriveMyWay 20% Mobile App

TrueRide 30% Mobile App

YourTurn 30% Mobile App

RightTrack 30% Plug-in Device

SmartRide 40% Mobile App or Plug-in

Snapshot 30% Mobile App

Drive Safe & Save 30% Mobile App or Plug-in

TrueLane 25% Mobile App

IntelliDrive 30% Mobile App

Nationwide offers the biggest UBI discount of 40%, compared to Liberty Mutual, which offers as low as 5% off rates.

Scroll down to compare various usage-based insurance examples from top providers and find the best auto insurance for good drivers.

Allstate Drivewise & Milewise UBI

Allstate’s usage-based insurance includes both a PAYG and a PHYD option. Its PHYD program, Allstate Drivewise, uses a mobile app to track your speed, braking, time of day, and phone use while driving.

It also offers other useful features drivers can use to improve their habits or get help after a serious collision.

Allstate Milewise is the pay-as-you-go version, only tracking mileage. Milewise charges around $1.50 per day based on your age, gender, and driving record, and then drivers pay six cents for each mile driven. Important Read: Allstate Auto Insurance Review

High-mileage drivers can still qualify through Allstate Milewise Unlimited if they don’t qualify with other providers.

American Family DriveMyWay & MilesMyWay

Drivers must download the MyAmFamDrive app in order to enroll in DriveMyWay, which is American Family’s usage-based insurance program. DriveMyWay is available in every state American Family operates in.

Drivers can also save 20% with a telematics insurance discount from American Family, but AmFam DriveMyWay will raise rates for speeding and other bad driving habits, so high-risk drivers might want to choose the PYAG MilesMyWay.

MilesMyWay does not track drivers, but AmFam just requires a picture of your odometer at the end of the year. Drive less than 8,000 miles annually to save up to 25%, with no penalties for going over.

Farmers Signal App

Our review of Farmers insurance shows its UBI program comes with a unique feature that other companies don’t offer.

Signal UBI comes with a unique feature that other companies don’t offer. UBI policyholders have access to CrashAssist, which detects when you’ve been in an accident and alerts EMS.

Another benefit of Signal is that discounts are applied every month based on your focused driving score. Scores of 80% or higher get bigger discounts, and safe drivers can earn up to $100 in monthly rewards.

Geico DriveEasy UBI

Geico’s DriveEasy program tracks hard braking, how fast you turn corners, and how often you use your phone while driving through the DriveEasy app. The dashboard tracks each trip and provides feedback to improve driving and your score. The higher your score, the bigger the discount. See More Details: Geico Insurance Review

Risky driving with Geico’s usage-based insurance will raise your rates, and many drivers complain that the app does not always recognize them as passengers. This means your score could suffer if you get a ride with a bad driver.

Liberty Mutual RightTrack

Liberty Mutual offers a hefty 15% discount to drivers who sign up for RightTrack UBI, but its savings potential isn’t as competitive. Drivers can save up to 30%, but most save between 5% and 12% at policy renewal.

Rates will also increase for bad driving habits, like speeding or driving at night. RightTrack UBI scores each trip, and drivers can analyze their driving habits and get feedback on the app’s dashboard.

Nationwide SmartDrive PHYD & SmartMiles PAYG

SmartDrive from Nationwide uses a smartphone app or plug-in device to track mileage, hard braking and acceleration, idle time, and nighttime driving. You can save 40% for safe driving with Nationwide SmartDrive, making it one of the best usage-based car insurance programs.

However, discounts aren’t applied to premiums until after 4-6 months of enrollment.

On the other hand, Nationwide SmartMiles only tracks mileage, helping low-mileage drivers save around $40 per month on average. Our Nationwide insurance review also found that safe drivers get an extra 10% off SmartMiles rates, but premiums won’t go down for bad driving habits.

Progressive Snapshot UBI

In our review of Progressive, you’ll notice its Snapshot program uses a mobile app to track mileage, the amount of time spent driving, the time of day spent driving, hard braking, rapid acceleration, and vehicle identification number. Snapshot also tracks location data for research and development purposes, but this is not used to calculate rates.

When you enroll in Progressive’s usage-based insurance, you’ll receive a 10% initial discount. You can save up to an additional 30% on your car insurance premium if you drive safely. However, there is a possibility of higher rates. If you speed or drive at night, you might end up paying as much as 10% more than you were before.

State Farm Drive Safe & Save

Drive Safe and Save from State Farm is one of the PHYD plans that connects via the OnStar and SYNC platforms. Drivers can also use the smartphone app for Drive Safe and Save Mobile, and they get a 5% participation discount immediately after signing up.

State Farm’s usage-based insurance discount can save safe drivers up to 30% on rates, but you will lose any low-mileage discounts if you are tracked driving over 7,500 miles per year.

Get the Details: State Farm Auto Insurance Review

TrueLane From The Hartford

TrueLane uses a plug-in device to track the time of day and amount of time spent driving, mileage, hard braking, and acceleration. By practicing safe habits behind the wheel, drivers can save money with the TrueLane safe driving app.

Drivers immediately earn a 5% participation discount, and most participants average a final discount amount between 10%-12% during the policy renewal.

The Hartford also offers insurance exclusively for AARP members.

Unfortunately, not everyone can sign up for TrueLane UBI. Diesel, hybrid, and electric cars are also ineligible for TrueLane.

Travelers IntelliDrive

Travelers UBI uses a mobile app to track time of day, speed and acceleration, and braking habits. When reviewing Travelers, we noticed its UBI program also tracks distracted driving, which is based on phone use, so talking or texting while driving could raise your rates.

Travelers offers IntelliDrive in 39 states and the IntelliDrive 365 program in four states.

The only difference between the two is that IntelliDrive 365 has a more interactive dashboard that allows drivers to earn safe-driving streaks and additional discounts.

Other Insurance Companies Specializing in UBI

Certain insurance providers specialize in behavior-based insurance coverage and only offer PHYD or PAYG policies, such as Root, Mile Auto, Metromile, and Lemonade. We didn’t feature these companies in the table because they are only selling policies in a handful of states.

For instance, our analysis of Lemonade found it’s only available in 12 states. It expanded its market after purchasing Metromile, and both insurers are popular options for pay-as-you-go UBI.

Lemonade and companies like it use a plug-in device to track mileage only, charging a few cents per each mile driven. The average American drives around 13,000 miles per year, but your pay-per-mile premiums will increase if you drive more than 10,000 miles annually.

How Much Usage-Based Auto Insurance Costs

How much can you expect to save with usage-based car insurance plans? That depends on the company and how you drive. Different insurers offer different savings when it comes to UBI.

The Drive Safe and Save plan promises discounts of up to 30% for good drivers, while Nationwide SmartRide advertises a potential 40% rate reduction. See how these discounts affect premiums in the table below:

Usage-Based Auto Insurance Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$110 $222

$50 $161

$84 $248

$95 $208

$484 $530

$60 $193

$89 $169

$65 $128

$60 $180

$45 $146

Despite having the biggest discount, Nationwide UBI is relatively expensive when compared to other companies.

Travelers Intellidrive and American Family KnowYourDrive have the best rates for minimum coverage, but State Farm Drive Safe & Save offers the cheapest car insurance if you have full coverage and usage-based insurance.

The key thing to remember is that when you drive safely and drive less, you save money. If you take fewer risks, you’ll save more money. Drivers who save the most money with UBI follow these safety-minded habits. Get Savings Now: 17 Tips to Pay Less for Car Insurance

If you don’t learn about all the different factors that can affect your insurance costs, you risk getting a negligible reduction, or worse, increased rates if you drive poorly. In reality, most drivers will not qualify for the maximum discount.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Companies Collect UBI Driver Data

Before buying usage-based insurance, there’s a whole host of other factors to consider. You need to think about what data you’re comfortable sharing with insurers and how they collect it.

Without data on your driving, UBI plans can’t accurately calculate your hopefully reduced rates. Different plans use different methods for collecting this information. Regardless of the data-tracking choice you make, it will be a form of what is called telematics.

What are telematics? In a nutshell, telematics are the different methods for transmitting data from your car to your insurer. That makes them the engine powering all UBI programs, as this data is necessary for a car insurance company to calculate your personalized rate.

Most drivers will be familiar with at least one of the three forms of UBI telematics insurers use to collect information:

- OnStar and SYNC: Anyone who’s called for a tow using OnStar or sent a text using SYNC is already familiar with telematics. Usage-based insurance programs use these built-in car communication platforms to monitor mileage and other driving habits.

- Plug-In Devices: Many insurers offer a small telematics device that plugs into a vehicle’s onboard diagnostic port (though it needs to be an OBD-II port, as the ports on older cars built before 1996 are not compatible). This allows your provider to track mileage, speed, braking, and more.

- Smartphone App: Most companies offer a mobile app that uses your phone’s sensors to track location, driving habits, and phone usage. It runs in the background, automatically logging trips and sending data to your insurer for more accurate pricing.

Both PHYD and PAYG plans use these devices to monitor the safety and frequency of enrolled drivers. Compare auto insurance companies because each uses a different method.

By understanding the various ways insurers monitor your driving habits, you can decide which methods you’re comfortable with and which you’d rather avoid.

Usage-Based Insurance Statistics

Your device wants to help you drive, and some telematics can improve your driving in real time. For example, Progressive Snapshot and Allstate Drivewise provide real-time feedback after each ride to let drivers know where to improve.

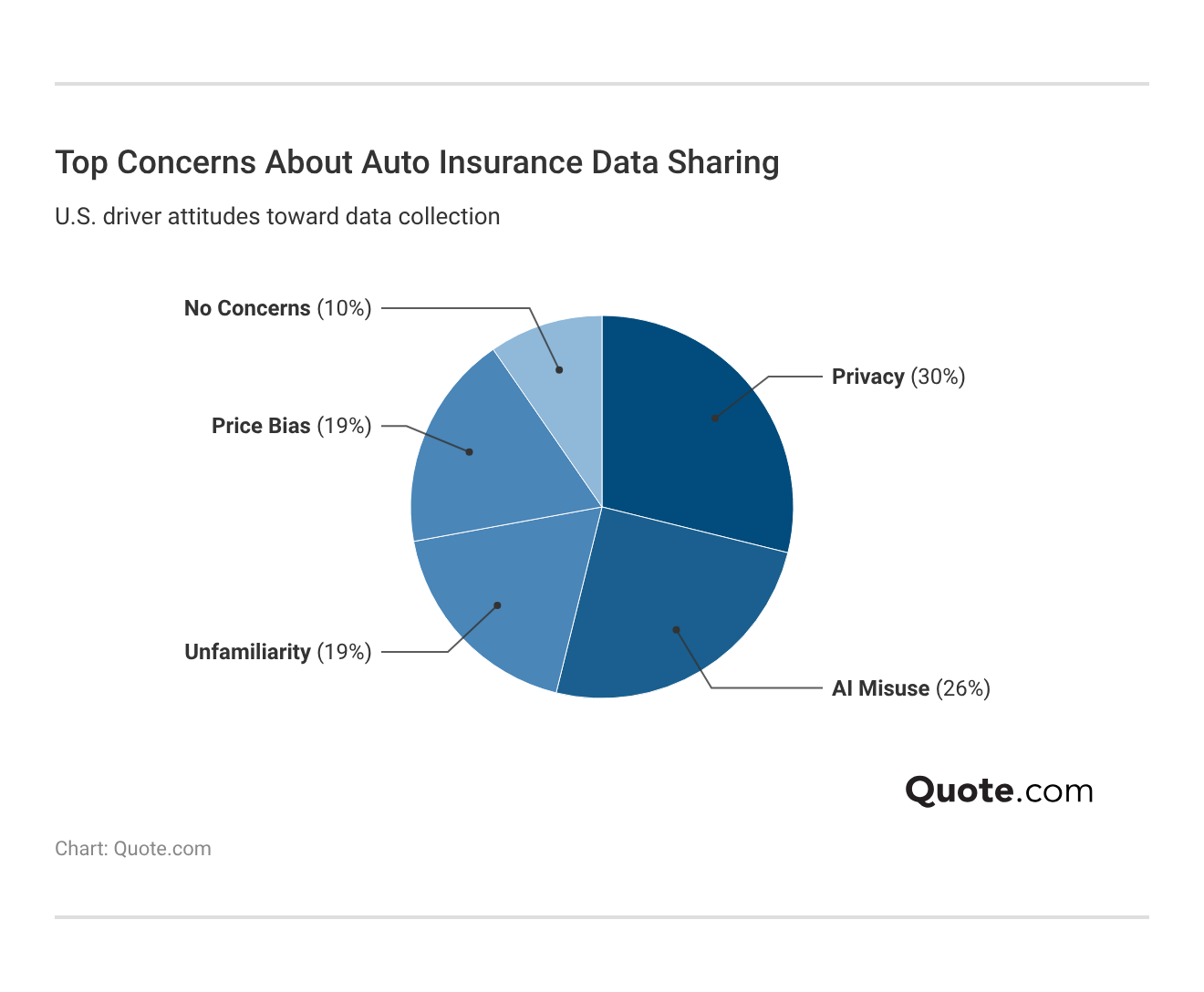

The real big question you need to chew on is how much driving data you’re comfortable sharing with your insurer through this device.

For 10% of drivers, being tracked is acceptable if it leads to cheaper rates and better coverage.

Nearly half appreciate the personal feedback that can improve their driving habits and eventually lead to cheaper auto insurance. Read More: These 3,000 People Got Auto Insurance Right

But the thought of the details of every trip ending up in a database can make folks nervous. Should I worry about my car insurance company tracking my driving data?

When it comes to telematics, focus on what data your insurance company collects. Protect your privacy by discovering what UBI plans can do with your data:

- UBI plans can only collect so much data. Every plan limits what it collects and how it’s used. For instance, pay-per-mile programs monitor only a car’s mileage and GPS location, while PHYD plans detect the number of miles driven, as well as hard braking and acceleration, idle time, and night driving.

- UBI programs don’t sell data to third parties. Insurance companies don’t currently sell driver information directly to third parties, but data aggregators like LexisNexis may have access to your information and use it to study trends related to vehicle theft, fraud, and insurance coverage.

- UBI can track a stolen car. Sometimes knowing where your vehicle is at all times can come in handy. If someone finds their set of wheels stolen, their car can be easily tracked down if it’s equipped with a location-monitoring device.

- UBI monitors insurance fraud. Telematics tracks movement and habits, and can confirm or deny collision claims, rat out people who live in an expensive area but register their car in a cheaper one, or anyone using their personal vehicle for rideshare or business use without the right policy.

- Use UBI to defend against lawsuits. Insurance companies will provide data to law enforcement in the event of a crime or warrant, but you can also use UBI data to defend against wrongfully issued speeding tickets, hit-and-run accusations, or collisions where other drivers are claiming you are at fault.

So, should I be scared about sharing my data? Insurers primarily use this data to adjust premium prices.

There are a few instances when UBI plans can share personal data with outside parties, but there are limits to how much personal information UBI providers can collect and what they can and cannot do with it.

Since all this data tracking makes people nervous, UBI insurers are being very careful with data right now. Metromile allows you to turn off the location tracking feature on its plug-in device, while Allstate promises that personal driver data is not available to insurance agents handling your policy.

You can choose what you share with your insurer, which ensures that your insurance agent doesn’t keep tabs on your comings and goings. You can use this knowledge to pick a plan that’s right for your expected level of privacy.

Other Ways to Save on UBI Coverage

If you’ve decided letting insurers track your driving capabilities is worth lowering your monthly premiums, it’s time to plan how you can maximize your potential discount, which clocks in at around 12% for good drivers.

Most of these plans even offer ways to make you drive safer, helping you cut your premiums even more than average.

The average driver saves around 5%, or $45 monthly, with UBI. Safer drivers save about 12%, while low-mileage drivers often get the best rates.

Schimri Yoyo Licensed Agent & Financial Advisor

Some programs also offer lower premiums just for signing up. For instance, people who enroll in the Nationwide SmartRide program instantly get 10% off their rates just for joining.

When will my discount take effect? PHYD plans usually apply all discounts at policy renewal, typically every six or 12 months.

Top Car Insurance Discounts by Savings Potential| Company | Bundling | Defensive Driving | Good Driver | Good Student |

|---|---|---|---|---|

| 25% | 10% | 25% | 35% | |

| 25% | 5% | 25% | 25% |

| 20% | 10% | 30% | 20% | |

| 25% | 15% | 25% | 26% | |

| 25% | 10% | 20% | 12% |

| 20% | 10% | 40% | 15% | |

| 10% | 30% | 30% | 10% | |

| 17% | 15% | 25% | 25% | |

| 13% | 20% | 20% | 10% | |

| 10% | 5% | 15% | 30% |

PAYG or pay-per-mile plans are typically discounted every month when your company totals your miles driven.

Drivers driving less than 8,000 miles per year get the lowest possible UBI rates.

Usage-Based Insurance Pros and Cons

One of the biggest advantages of usage-based insurance is the potential for lower rates. The good news is that some UBI plans, like SmartDrive from Nationwide, won’t increase rates even for drivers who speed or drive at night. Other ways usage-based car insurance may benefit you include:

- Cheaper Rates: Safe drivers, especially teens and those in high-risk categories, can lower their rates by allowing insurers to track their good driving habits and provide discounts.

- Stacking Discounts: Any discounts earned through UBI can be stacked with other savings opportunities, including bundling, continuous coverage, low mileage, and more.

- Flexible Coverage: Most companies offer all policy options with usage-based coverage, including liability, full coverage, and roadside assistance. State Farm is one of the few providers that offers UBI with rideshare policies.

The bad news is that some programs will raise your rates, either by removing discounts or punishing bad driving habits with premium increases. Drivers with a long commute could also see rates go up using both PHYD and PAYG programs.

- Rate Increases: Bad driving increases UBI prices for some plans, including Progressive Snapshot. And while State Farm won’t raise Drive Safe & Save rates for poor habits, you could lose a low-mileage discount if you’re tracked driving more than 7,500 miles per year.

- Constantly Monitored: UBI tracks driving behavior through a plug-in device or smartphone app, and your data stays with the insurer even if you cancel the plan. Only a few PAYG companies, like Mile Auto, don’t track drivers and just ask for a picture of the odometer. Related Info: Mile Auto Insurance Review

Insurers are serious about making you pay per mile. By knowing your mileage and carefully considering how you drive, you can avoid UBI rate increases. However, it may be unavoidable for certain drivers.

City commuters who spend a lot of time in rush-hour traffic or those who work night shifts would not benefit from UBI. Choose the plan that fits your driving style, or seek out other insurance options.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

See if Usage-Based Insurance is Right For You

Do you have a smartphone or drive a vehicle built after 1996? If the answer is yes, then you can sign up for UBI, or usage-based insurance. You could start saving right away for being an infrequent or good driver, and stack your savings with other discounts.

But UBI doesn’t fit everyone’s lifestyle. Ask yourself these four simple questions to learn if usage-based auto insurance is right for you:

1. How much do you drive in a year?

- A. Under 10,000 miles

- B. Over 10,000 miles but less than 13,000 miles

- C. Over 15,000 miles

2. Have you had any accidents, traffic tickets, or other rate-raising incidents over the past year?

- A. No

- B. No, but I filed insurance claims for comprehensive or UM/UIM damages.

- C. Yes

3. Do you typically drive late at night or during rush hour?

- A. I don’t drive at night or during peak traffic hours.

- B. I drive during rush hour, but less than 20 miles a day.

- C. I have a long commute in rush hour traffic.

- D. I regularly drive late at night.

4. Are you comfortable sharing driving and GPS data with your insurer?

- A. Somewhat comfortable

- B. Very comfortable

- C. Not at all comfortable.

If you answered A or B to all of these questions, then usage-based car insurance was made for you. And if you want feedback on your driving and tips to lower your rates, many UBI companies offer real-time scores after each trip to help you track your discount.

Low-mileage drivers who travel during the day and aren't prone to speeding, tailgating, or distracted driving will get the cheapest rates.

Dani Best Licensed Insurance Producer

American Family, Travelers, and State Farm have the best UBI rates for most drivers, but Nationwide has the largest potential discount of up to 40% if you’re a safe driver. If you’re an AARP member, you may want to check out TrueLane by The Hartford. Compare More: State Farm vs. Farmers, Geico, Progressive, Allstate

Whether a usage-based insurance company is the right solution for you, it’s always worth taking a minute to compare quotes and find ways to lower your insurance premiums. Enter your ZIP code to compare quotes from local companies and get personalized insurance rates with UBI.

Frequently Asked Questions

How does usage-based car insurance work?

Unlike standard coverage, usage-based insurance (also known as user-based insurance) uses plug-in devices or mobile apps to track a driver’s habits and set more accurate, personalized rates.

Instead of relying only on traditional rating factors, insurers calculate your premium based on usage, including speed, mileage, braking habits, and the time of day you drive.

Companies track and weigh driving behaviors differently, so it’s important to compare options and find the right UBI provider for your needs using our free comparison tool.

Does usage-based insurance save you money?

Yes, usage-based car insurance can save you 40%, especially if you drive safely and spend little time on the road. These telematics programs track driving habits like speed, braking, and mileage.

If you drive fewer miles and avoid risky behavior behind the wheel, usage-based insurance could be a simple way to cut your monthly car insurance premium.

Who offers usage-based auto insurance?

Many popular auto insurance companies offer a usage-based insurance program. What is a usage-based insurance product? These include State Farm Drive Safe & Save and Liberty Mutual RightTrack. Nationwide SmartRide UBI auto insurance has the highest customer satisfaction. Don’t Miss It: Liberty Mutual vs. Nationwide Auto Insurance

What was the first usage-based insurance company?

Insurers worked on UBI for years before they began selling it, with Progressive patenting a device for determining personalized car insurance rates as far back as 1996.

What is the USAA usage-based program?

After reviewing USAA insurance, we found it partners with Noblr to offer pay-how-you-drive insurance plans to veterans and their families. Noblr tracks mileage and scores driving habits through its mobile app. Low mileage and better scores lead to lower rates.

How does Allstate pay-per-mile work?

Allstate Milewise is a type of pay-per-use car insurance that tracks mileage only, not driving habits. It charges a base daily rate (around $1.50) plus a six-cent per-mile charge. Drivers use the Milewise app to track monthly miles.

Does Progressive offer daily insurance?

No, Progressive auto insurance coverage lasts for six or 12 months. You can cancel your auto insurance at any time with Progressive, but it may charge a fee based on state law and the terms of your policy.

When did usage-based insurance start?

According to the NAIC, vehicles have been equipped with event data recorders since 2008, allowing insurance companies to easily track mileage, speed, and braking habits of drivers. Find out how to buy car insurance based on usage if you drive a model older than 2008.

How does usage-based auto insurance track drivers?

UBI companies track drivers through a mobile app, in-car OnStar software, or a plug-in device that connects to the car’s OBD diagnostic port. That’s the same port mechanics use to get the error code for whatever turned the check engine light on.

Connecting the telematics device to the OBD-II port allows it to gather data about when, how, and where you drive. This information is then sent straight to your insurer.

What’s the cost of a UBI plug-in device?

Right now, there’s no charge for any of these devices. It’s similar to Google, where you can use it for free in exchange for letting the UBI insurance company peek at some of your data. The plug-ins are also easy enough to install that you can do it yourself. Just don’t lose one, or that could run you $100 or more to replace.

Is usage-based insurance worth it?

What if I cancel my UBI plan?

What are usage-based pricing plans?

What are the problems with usage-based insurance?

What are the average miles driven per year?

Is it better to pay out of pocket or use insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.