USAA Insurance Review for 2026

Discover more in our USAA auto insurance review to see how collision coverage starts at $29 per month, covers repairs for at-fault accidents after a $500 deductible, and includes up to 30% in good driver discounts, making it a strong option for military families seeking reliable protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated September 2025

With rates as low as $29 per month, USAA leads the pack in service quality and provides 17 car insurance discounts you won’t want to miss, making it a great value for qualified drivers.

USAA car insurance scores 4.8 for claims, coverage, and online service. Despite a 2.4 satisfaction rating, it’s a reliable, low-cost choice for military members.

- USAA offers auto insurance starting at just $29/month for qualified members

- Tailored benefits include military deployment perks and vehicle storage discounts

- Collision coverage includes up to 30% in good driver discounts for safe drivers

Compare insurance policies from more than one carrier to get a great bargain. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

USAA Auto Insurance Costs

USAA auto insurance monthly rates vary by age, gender, and coverage level, with younger drivers paying the most. For minimum coverage, 16-year-old females pay $137 and males $146, while 45-year-olds of both genders pay just $32.

USAA Auto Insurance Monthly Rates by Coverage Level| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $137 | $349 |

| 16-Year-Old Male | $146 | $356 |

| 18 -Year-Old Female | $111 | $257 |

| 18 Year-Old Male | $125 | $289 |

| 25 -Year-Old Female | $43 | $114 |

| 25 Year-Old Male | $46 | $122 |

| 30 -Year-Old Female | $40 | $106 |

| 30 Year-Old Male | $43 | $113 |

| 45 -Year-Old Female | $32 | $84 |

| 45 Year-Old Male | $32 | $84 |

| 60 -Year-Old Female | $29 | $75 |

| 60 Year-Old Male | $29 | $75 |

| 65 -Year-Old Female | $31 | $82 |

| 65 Year-Old Male | $31 | $82 |

Full coverage is highest for 16-year-olds at $349 for females and $356 for males, dropping to $84 for 45-year-olds.

Rates often drop with age and are lower for females. Start telematics early to save. For example, enrolling at 18 can lower premiums by your 20s.

Jeff Root Licensed Insurance Agent

At age 25, rates are $43 for females and $46 for males with minimum coverage, and $114 and $122, respectively, for full coverage. Overall, rates decrease with age, and males pay slightly more than females.

Auto Insurance Full Coverage Monthly Rates by Credit Score| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $115 | $150 | $200 | |

| $130 | $170 | $220 |

| $125 | $155 | $220 | |

| $110 | $160 | $210 | |

| $140 | $180 | $240 |

| $135 | $175 | $230 | |

| $118 | $165 | $215 | |

| $120 | $152 | $205 | |

| $128 | $160 | $230 | |

| $105 | $145 | $190 |

The table compares full coverage auto insurance rates by credit score, with USAA offering the lowest rates across all categories.

Prices range from $105 for good credit to $190 for bad credit, while other providers like Geico and State Farm follow closely. Liberty Mutual and American Family show higher rates, highlighting the impact of credit score on insurance costs. See our Liberty Mutual auto insurance review for more details.

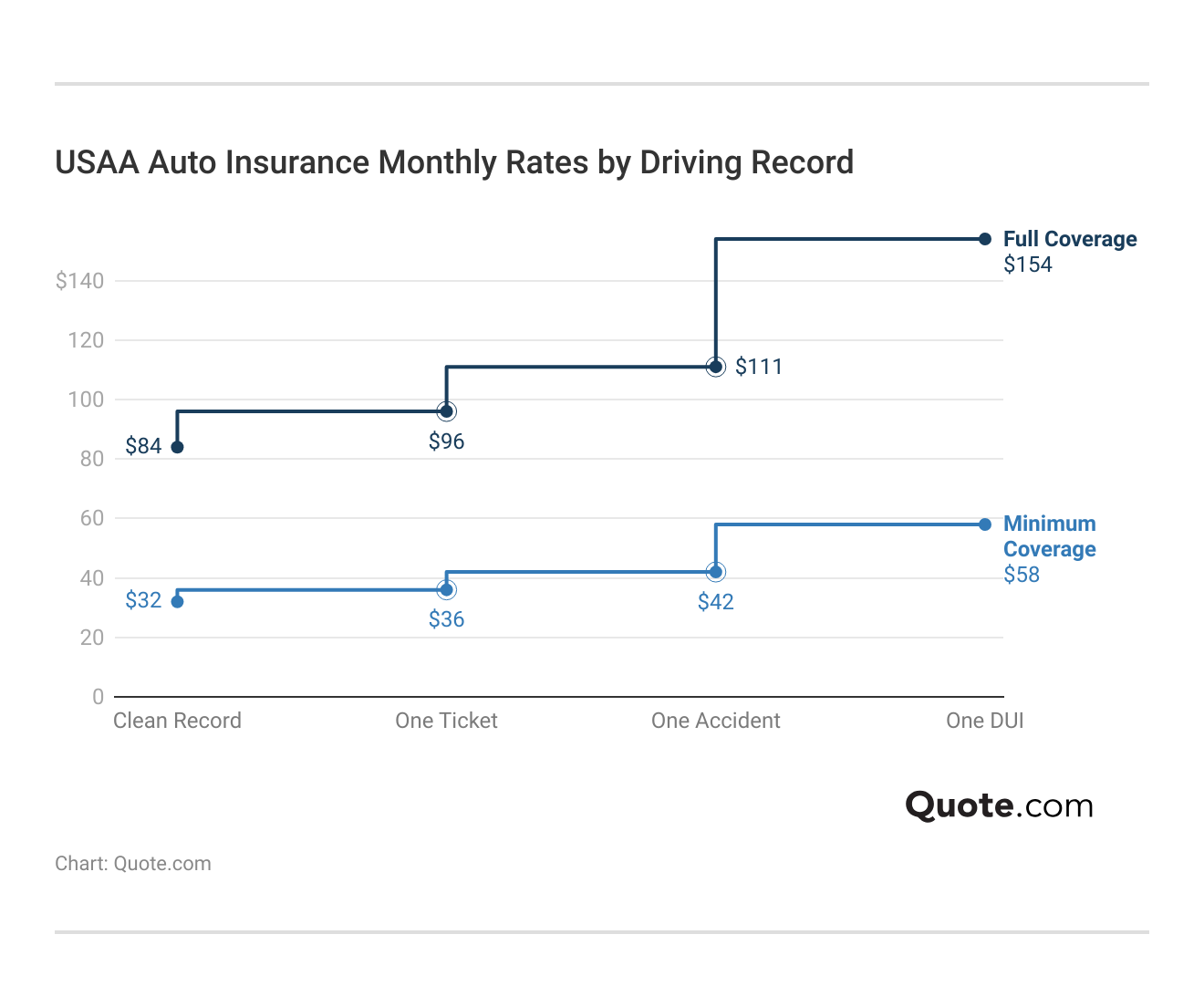

USAA’s auto insurance rates vary by driving record. Clean records cost $36 for minimum coverage and $140 for full coverage. Rates increase with violations, rising to $42 for one ticket, $96 for one accident, and up to $58 for minimum coverage and $154 for full coverage with a DUI. Keeping a clean record offers the best savings.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

Auto insurance rates by coverage level show USAA as the most affordable provider, with $32 for minimum coverage and $84 for full coverage.

Geico and State Farm also offer competitive rates, while Liberty Mutual and Allstate are among the most expensive. USAA consistently delivers the lowest premiums across both coverage options.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

USAA Auto Insurance Discounts and Savings Tips

USAA provides a range of discounts and savings opportunities to help its members afford coverage. Whether you’re a safe driver, a student, or a policy bundler, USAA offers many opportunities to bring down your rate and take full advantage of this great value.

Below are some of the most impactful discounts and innovative strategies to help lower your auto insurance costs.

USAA Auto Insurance Discounts by Savings Potential| Discount | |

|---|---|

| Anti-Theft | 15% |

| Bundling | 10% |

| Claims-Free | 20% |

| Defensive Driving | 5% |

| Good Driver | 30% |

| Good Student | 10% |

| Loyalty | 11% |

| Low Mileage | 20% |

| Multi-Car | 10% |

| Pay-In-Full | 20% |

If you’re unsure what to do if you can’t afford your auto insurance, request a quote for insurance from USAA to investigate savings.

- Choose a Higher Deductible: Choosing a higher deductible can lower your monthly premium, but make sure you can cover the cost if you need to file a claim.

- Drop Unnecessary Coverage: If your car is older and has low value, dropping collision or comprehensive coverage can help lower your premium.

- Review and Update Your Policy Regularly: Keep your policy up to date since changes like a shorter commute, lower mileage, or fewer drivers can help reduce your premium.

- Maintain a Clean Driving Record: Avoiding accidents and violations helps keep your rates low and may qualify you for better renewal offers.

- Usage-Based Insurance: Low-mileage drivers, like retirees or remote workers, can save by enrolling in usage-based programs or reporting lower annual mileage.

When USAA members take advantage of discounted opportunities and make smart coverage choices, they can save big on car insurance.

Regularly reviewing your policy, practicing safe driving, and exploring usage-based or low-mileage options can yield even more significant savings. Consider getting a USAA quote for personalized recommendations to see how much you can save.

USAA Car Insurance Coverage Options and Add-Ons

When it comes to protecting yourself, family, your passengers, and your vehicle, USAA auto insurance will ensure you have the right type of coverage for your personal needs and lifestyle, including active service members, veterans, and military families.

- Liability Coverage: Covers medical expenses if you’re responsible for injuring someone in an accident and covers repairs or replacement if you damage another person’s property (usually their vehicle).

- Comprehensive Coverage: This policy pays for damage to your car caused by non-collision events such as theft, fire, vandalism, hitting an animal, hail, flooding, or falling objects.

- Collision Coverage: Covers repair or replacement of your vehicle if it’s damaged in a crash, regardless of who is at fault (e.g., hitting another car, pole, or guardrail).

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Helps pay for your injuries or damages if a driver with no insurance or insufficient coverage hits you.

From essential protections like liability and collision to optional add-ons and specialty coverages, USAA ensures you’re prepared for everything from everyday accidents to unexpected events.

Understanding each type of coverage can help you build a policy that’s both effective and affordable.

Optional Add-On Coverages

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Medical Payments Coverage (MedPay): Helps pay for medical expenses for you and your passengers after an accident, no matter who caused it.

- Roadside Assistance: Provides towing, battery jump-start, flat tire help, lockout service, and fuel delivery. Requires Towing and Labor coverage.

- Rental Reimbursement: Helps cover the cost of renting a car while your vehicle is being repaired after a covered loss.

- Glass Coverage: USAA covers windshield repair or replacement in select areas with little to no deductible.

Choosing the right combination of USAA coverages, including personal injury protection (PIP) insurance, can provide peace of mind on the road and financial protection in the event of a loss. PIP helps cover medical expenses and lost wages, ensuring you’re protected regardless of who is at fault.

Specialty or Situational Coverages

- Vehicle Storage Discount Coverage: Allows coverage to be adjusted and discounted for vehicles stored long-term, such as during military deployment.

- Custom Equipment Coverage: Covers aftermarket additions or custom parts not installed by the manufacturer.

Whether you’re looking for basic liability coverage or additional benefits like roadside assistance and vehicle storage discounts, USAA offers flexible options to suit your situation.

Be sure to assess your personal needs and consult with a USAA representative to customize a policy that gives you the right level of protection at the best possible value.

Customer Reviews and Ratings for USAA Auto Insurance

USAA auto insurance scores well on important review sites, pointing to its strong finances and happy customers. USAA receives an A++ for excellent financial stability from A.M. Best and the BBB also scores it A++ for honest and ethical business practices.

USAA Auto Insurance Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A++ Superior Financial Strength |

| Score: A++ Excellent Business Practices |

|

| Score: 96/100 High Customer Satisfaction |

|

| Score: 882 / 1,000 Above Avg. Satisfaction |

|

| Score: 1.74 More Complaints Than Avg. |

Consumer Reports scores USAA 96 out of 100 for high customer satisfaction, and J.D. Power gives it 882 out of 1,000, indicating above-average satisfaction. However, the NAIC score of 1.74 suggests USAA receives more complaints than the industry average.

Comment

byu/NothingActual25 from discussion

inUSAA

A longtime USAA member since 1984 shared on Reddit that they’ve consistently received excellent service and reasonable rates.

Despite a few accidents over the years, including hitting a deer and being rear-ended, they reported no issues with repair coverage, which may have benefited from USAA’s support services, like traffic collision reconstruction to assess fault and damage. While recommending USAA, they also suggest comparing rates with other providers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of USAA Auto Insurance

USAA auto insurance is one of the most popular choices of military members and their families. It is an excellent balance of value, dependability, and program-specific bonuses for service members.

Pros

- Exceptional Rates for Eligible Members: USAA offers low auto insurance rates, with minimum coverage starting at just $32 per month, making it a top choice for military families.

- High Customer Satisfaction and Strong Financial Ratings: USAA receives top ratings, including A++ from A.M. Best, 96/100 from Consumer Reports, and high marks from J.D. Power for customer service.

- Tailored for the Military Community: USAA is built specifically for military members and their families, providing exclusive benefits like discounts on vehicle storage, freedom to alter due dates, and deployment–friendly details.

However, as with any provider, it’s important to weigh both the advantages and limitations to determine if USAA fits your needs.

Cons

- Eligibility Restrictions: USAA car insurance is only for the military, veterans, and their families, not the general public.

- Availability Varies by State: Discounts and coverage options such as glass coverage or usage-based program discounts may not be available in all states, reducing potential savings for certain members.

While USAA shines with its competitive rates, outstanding satisfaction scores, and military-focused perks, its limited eligibility and state-based restrictions may not suit everyone.

For those who qualify, however, USAA remains a top-tier choice for auto insurance that combines financial strength with tailored benefits for military life, including options like cheap auto insurance for disabled veterans to ensure accessible and affordable coverage.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Cheap USAA Auto Insurance for Military & Veterans

In this USAA auto insurance review, it’s clear that the company offers substantial value for military families. Standout strengths include low starting premiums from just $32/month, excellent customer service, and exclusive military-focused benefits like deployment flexibility and vehicle storage discounts.

USAA has restrictions due to its membership requirements on the one hand and the differences in particular discounts in each state on the other. Despite these drawbacks, USAA is still an excellent choice for eligible members and provides affordable coverage and reliable service that caters to the unique needs of servicemembers and their families.

Find out how to compare auto insurance companies to get the best coverage for the best price. Start comparing total coverage auto insurance rates by entering your ZIP code here.

Frequently Asked Questions

Does getting a USAA auto insurance quote affect my credit score?

No, requesting a USAA auto insurance quote does not impact your credit score. It involves a soft inquiry, not a hard credit check.

Are there any common complaints in USAA car insurance reviews?

Common criticisms include limited eligibility, coverage availability depending on location, and slower claims in certain cases, especially during disasters or high-volume times.

You can find the cheapest insurance coverage tailored to your needs by entering your ZIP code.

Is the USAA car insurance calculator accurate for monthly rate comparisons?

It provides a close estimate, but your final rate may vary based on full underwriting details, credit factors, and additional documentation. To help lower your costs, explore our 17 tips to pay less for car insurance for practical ways to save on your premium.

Can I customize coverage in a USAA automobile insurance quote?

Yes, USAA allows you to adjust coverage types, deductibles, and limits during the quote process to match your budget and needs.

Are military discounts available on USAA motorcycle insurance quotes?

Yes, military-specific discounts may apply through USAA’s partner providers, such as savings for safe driving, storage, and completing safety courses.

Does USAA bundle insurance for auto and home policies?

Yes, USAA offers bundling options that allow members to combine auto and home insurance for savings of up to 10%, making it one of the cheapest car insurance choices for eligible military families.

How much does USAA auto insurance cost for a 25-year-old?

USAA auto insurance for a 25-year-old typically starts at around $43/month for females and $46/month for males with minimum coverage, depending on driving history and location.

Do military cadets and midshipmen meet USAA auto insurance eligibility requirements?

Yes, cadets and midshipmen at U.S. service academies or in advanced ROTC programs are eligible for USAA auto insurance.

How does USAA’s best auto insurance review describe coverage flexibility?

The review shows that USAA offers flexible coverage options, including collision auto insurance, comprehensive, roadside assistance, and add-ons tailored to military lifestyles.

How does age affect the USAA car insurance monthly cost?

Younger drivers pay more, with 16-year-olds seeing rates over $130/month, while 45-year-olds may pay as low as $32/month.

Is USAA accident forgiveness included automatically?

Are customer service experiences different between MetLife and USAA?

How do I get USAA car insurance as a family member of a veteran?

Do USAA claims reviews report issues with claim approvals?

Can I use USAA car rental rates for long-term rentals?

How much does full coverage auto insurance in USAA cost per month?

Is USAA a good insurance company for young drivers?

Does USAA offer general liability insurance for individuals?

Does USAA have commercial auto insurance?

Can I customize USAA car insurance policies to fit my needs?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.