State Farm Auto Insurance Review for 2026

State Farm auto insurance starts at $47 per month, and its Drive Safe & Save program rewards safe driving with discounts of up to 30%. Explore our State Farm auto insurance review to learn how this telematics-based coverage uses your driving data to personalize rates and help lower your premium.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated February 2026

This State Farm auto insurance review covers rates starting at $47 per month, with discounts of up to 35% for good students and up to 30% for safe driving.

- Rates start at just $47 a month with discounts for good students and drivers

- Drive Safe & Save offers up to 30% off based on real-time driving behavior

- State Farm auto insurance review covers strong financial ratings

With substantial financial ratings and broad coverage options, State Farm remains a top choice for budget-conscious and responsible drivers.

State Farm Auto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 4.3 |

| Business Reviews | 5.0 |

| Claim Processing | 4.3 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 2.1 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.5 |

| Policy Options | 3.8 |

| Savings Potential | 4.4 |

Its aggressive rates make it a strong option for high-mileage drivers looking for the cheapest car insurance, but those with previous claims may find better service elsewhere.

Compare coverage and pricing by entering your ZIP code in our free tool to see how your rates compare to those of top providers.

Compare State Farm Car Insurance Rates

State Farm auto insurance rates vary by age, gender, and coverage level, with younger drivers paying the highest premiums.

For example, 16-year-old males pay $208 for minimum and $498 for full coverage, while females the same age pay slightly less.

State Farm Auto Insurance Monthly Rates by Coverage Level| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $177 | $444 |

| 16-Year-Old Male | $208 | $498 |

| 18-Year-Old Female | $144 | $327 |

| 18-Year-Old Male | $178 | $405 |

| 25-Year-Old Female | $55 | $144 |

| 25-Year-Old Male | $60 | $158 |

| 30-Year-Old Female | $51 | $133 |

| 30-Year-Old Male | $56 | $147 |

| 45-Year-Old Female | $47 | $123 |

| 45-Year-Old Male | $47 | $123 |

| 60-Year-Old Female | $43 | $108 |

| 60-Year-Old Male | $43 | $108 |

| 65-Year-Old Female | $47 | $120 |

| 65-Year-Old Male | $47 | $120 |

Rates drop significantly by age 25 and level out by age 45, where both genders pay $47 for minimum and $123 for full coverage.

Men generally pay more than women, and full coverage costs twice as much as minimum.

Rates drop with age and are often lower for women. A defensive driving course can lower costs early. For example, an 18-year-old may save before turning 25.

Jeffrey Manola Licensed Insurance Agent

Overall, State Farm offers lower premiums to older, safer drivers with clean records, and using the tips from our 26 hacks to save more money on car insurance can help cut costs even further.

Auto insurance rates for full coverage increase as credit scores drop, with most providers charging $50–$90 more for bad credit.

Full Coverage Auto Insurance Monthly Rates by Credit Score| Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $130 | $160 | $210 | |

| $127 | $152 | $195 |

| $119 | $144 | $182 |

| $135 | $165 | $220 | |

| $115 | $140 | $175 | |

| $132 | $158 | $205 |

| $118 | $143 | $185 | |

| $125 | $150 | $190 | |

| $120 | $145 | $180 | |

| $110 | $130 | $160 |

USAA offers the lowest rates, from $110 to $160, while Farmers’ is the highest, at $220 for bad credit.

State Farm sits mid-range at $120 for good credit and $180 for bad, highlighting how credit history can significantly affect premium costs.

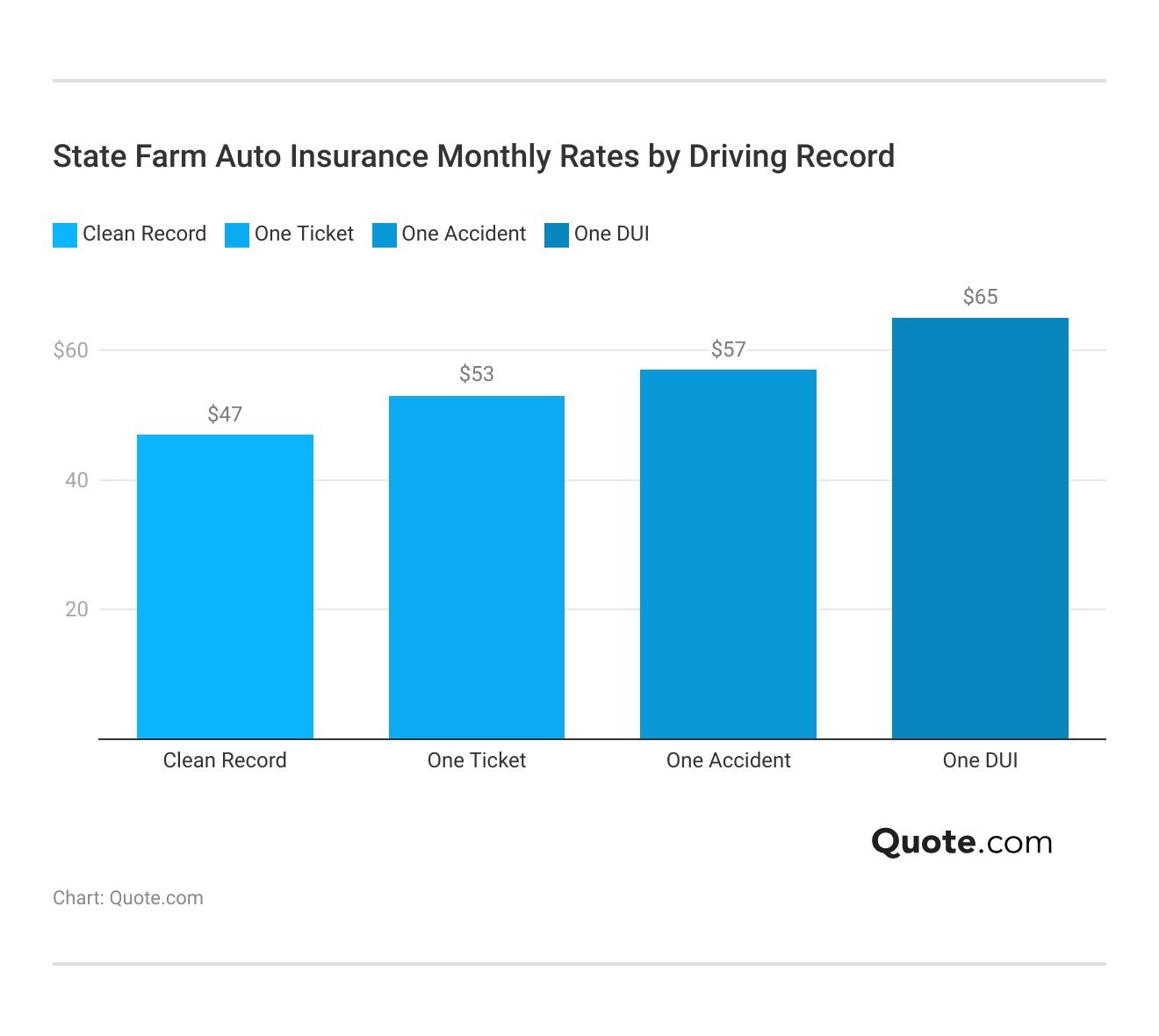

State Farm auto rates vary by driving history. A clean record costs the least, at $47 for minimum and $50 for full coverage; violations like a ticket or DUI can raise rates to $53–$65.

Auto insurance rates vary by provider and coverage level, with Erie and USAA offering the lowest premiums, $32 for minimum coverage and $84 for full coverage.

Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $32 | $84 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $32 | $84 |

State Farm is still budget-friendly at $47 minimum/$123 full coverage level, and Liberty Mutual and Allstate offer the most expensive policies, over $85 minimum/$225 full.

This comparison demonstrates the significance of shopping for value and not just finding the lowest prices on coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save on State Farm Auto Insurance

State Farm offers several discounts based on your driving habits, lifestyle, and even if you have safety features in your vehicle.

Here’s a quick look at the top ways to save on auto insurance.

State Farm Auto Insurance Discounts by Savings| Discounts | |

|---|---|

| Accident-Free | 25% |

| Anti-Theft Device | 15% |

| Defensive Driving | 15% |

| Drive Safe & Save™ | 30% |

| Good Student | 35% |

| Multi-Car | 20% |

| Multi-Policy | 17% |

| Safe Driver | 8% |

| Safety Features | 15% |

| Student Away | 15% |

State Farm offers auto insurance discounts up to 35% for good students and 30% for using Drive Safe & Save.

Raising your deductible can reduce your monthly premium, making it a smart option for low-risk drivers who can afford higher out-of-pocket costs in a claim.

Daniel S. Young Managing Editor

It also provides added savings for accident-free driving, multi-car policies, bundling, safety features, and more, making it a smart option for those seeking cheap auto insurance for multiple vehicles.

- Opt for Paperless Billing and AutoPay: Enrolling in paperless billing and AutoPay with State Farm can result in small savings and reduced fees.

- Maintain Continuous Coverage: Keeping continuous coverage helps avoid higher rates and shows you’re a reliable policyholder.

- Downsize or Choose a Low-Risk Vehicle: Cars with lower repair costs and better safety reduce premiums, while sports or luxury models are more expensive to insure.

- Avoid Unnecessary Coverage on Older Vehicles: For older cars with low value, dropping full coverage can save money, as the cost may outweigh the benefit.

- Relocate to a Lower-Risk ZIP Code: Your location impacts car insurance costs, so relocating to a safer, lower-risk area may lead to noticeable savings on your premium.

There are plenty of built-in discounts with State Farm. But digging into not-so-common methods, such as changing your coverage, type of vehicle, or billing preferences, could yield even bigger savings.

Whether you’re a student, a responsible driver, or just trying to save a little extra money, combining these tips with a personalized quote review can ensure you get the best coverage value.

State Farm Car Insurance Coverages

State Farm offers a variety of auto insurance plans to protect you, your family, and others. Whether you’re in an accident, experience weather damage, or come across an uninsured driver, a basic option like collision auto insurance can offer essential financial protection.

- Liability Coverage: Physical injury and property damage liability to others caused by you in an at-fault accident. Most states require this.

- Collision Coverage: Pays to fix or replace your car if it’s damaged during a collision, no matter who was at fault.

- Comprehensive Coverage: Provides coverage for first-party damage to your vehicle caused by collision with another vehicle or object.

- Uninsured/Underinsured Motorist Coverage: Covers your medical expenses or vehicle damage if you’re hit by a driver with little or no insurance.

- Medical Payments Coverage (MedPay): Helps cover medical or funeral costs for you and your passengers after an accident, regardless of fault.

Knowing these types of coverage options can help you customize protection based on how you drive, your finances and your tolerance for risk.

State Farm makes it easy to tailor a policy to your life, whether you need the basics of liability coverage or the additional protection of full coverage.

It offers the confidence and protection you need in your busy life on the road.

State Farm Auto Insurance Reviews

State Farm receives strong ratings across multiple industry benchmarks, reflecting customer satisfaction and financial reliability. J.D. Power gives State Farm a score of 710 out of 1,000, indicating above-average customer satisfaction, while Consumer Reports rates it 75 out of 100 based on positive customer feedback.

State Farm Auto Insurance Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A+ Superior Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 75/100 Positive Customer Feedback |

|

| Score: 710 / 1,000 Above Avg. Satisfaction |

|

| Score: 0.84 Fewer Complaints Than Avg. |

State Farm has a low complaint ratio of 0.84, indicating fewer issues than the industry average. It also holds an A+ rating from A.M. Best for superior financial strength and an A+ from the BBB for excellent business practices. Explore our 17 tips to pay less for car insurance for additional ways to save.

A Yelp user from Escondido, CA, shared a glowing review of his 32-year experience with State Farm, including over 20 years with agent Bob Yancey.

He praised the company’s consistently professional, polite, and helpful customer service, especially when handling policy changes, and gave a special shoutout to “Team Francy” for their ongoing support.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of State Farm Auto Insurance

Selecting the right insurer involves a balancing act of strengths and weaknesses. State Farm has a good reputation, large coverage selections and useful discounts, though like any insurer, it also has its downsides. Here is a quick rundown of its pros and cons.

Pros

- Wide Range of Discounts: Offers generous savings, such as 35% for good students, 30% through Drive Safe & Save, and discounts for bundling policies.

- Strong Financial Stability: Backed by an A+ rating from A.M. Best, State Farm is financially reliable and capable of covering large claims.

- Diverse Coverage Options: Provides everything from liability and full coverage auto insurance to homeowners, renters, life, and umbrella insurance, simplifying bundling.

These strengths make it a reliable and appealing choice for drivers and homeowners seeking both affordability and dependable protection backed by a trusted national provider, especially when you compare homeowners insurance quotes to find the best value for your needs.

Cons

- Mixed Claims Satisfaction: While many reviews are positive, some customers report delays or denials in the claims process.

- Fewer Digital Tools for Complex Policies: While the mobile app is strong for basic tasks, managing more complex policies may require direct agent support.

However, those who prioritize digital management tools or have complex insurance needs may find some limitations.

Reviewing these pros and cons can help determine if State Farm aligns with your personal insurance goals.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Save Now With State Farm Auto Insurance

With monthly rates starting at $47 for minimum coverage and $123 for full coverage, State Farm offers competitive pricing and discounts up to 35% for good students and 30% with Drive Safe & Save.

Its A+ financial strength, a low 0.84 complaint ratio, and strong customer service through a network of 19,000+ agents stand out.

However, the State Farm auto insurance review notes some downsides like higher rates for high-risk drivers, no traditional Gap insurance, and limited digital tools. Knowing how to compare auto insurance companies can help you decide if State Farm is the right fit.

To see if you can get lower auto insurance rates, enter your ZIP code into our free quote tool and easily compare rates from multiple companies in your area.

Frequently Asked Questions

Can I customize my State Farm car insurance quote?

Absolutely. State Farm allows you to adjust coverage limits, deductibles, and add-ons like roadside assistance to see how changes affect your premium.

How much is State Farm car insurance per month for minimum coverage?

State Farm’s minimum coverage starts around $47 per month, though the exact rate depends on age, driving record, and location.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Do State Farm car insurance ratings and reviews mention mobile app usability?

Reviews often highlight the mobile app’s convenience for accessing ID cards, filing claims, and managing policies. Expert resources offer step-by-step guidance on how to file an auto insurance claim and win it each time.

Does State Farm offer short-term car insurance policies?

State Farm does not offer short-term car insurance, such as coverage for a few days or weeks. Policies are typically issued for six-month or one-year terms, but you can cancel early without penalties if your needs change.

Can I remove someone after State Farm adding a new driver if they no longer drive my car?

Yes, you can contact your agent to remove a driver if they can no longer access your vehicle or live in your household.

Who offers better customer service, 21st Century vs State Farm?

The 21st Century Insurance review indicates that, while the company appeals to tech-savvy users with its digital-first approach, State Farm generally receives higher ratings for customer service due to its extensive agent network and stronger J.D. Power scores.

Can I transfer my existing policy to new car insurance at State Farm?

You can easily update your existing State Farm policy to cover a new vehicle by contacting your agent or updating your account online.

Does State Farm extend to new car purchase with liability-only coverage?

Yes, but only liability coverage will transfer; if desired, you must add collision or comprehensive separately.

How do I qualify for the good student State Farm auto discount?

You may qualify if you’re a full-time student under 25 with a GPA of 3.0 or higher, are on the honor roll, or rank in the top 20% of your class, and it’s just one of the 17 car insurance discounts you can’t miss.

Can I compare a State Farm auto insurance rate quote with other insurers?

Comparing quotes from multiple providers, including State Farm, helps ensure you get the best coverage and price for your needs.

Will State Farm cancel my auto insurance after a DUI?

Does a State Farm insurance rider policy increase my premium?

Does the State Farm driving discount apply to all vehicles on my policy?

Is there a monthly premium included in the State Farm gap insurance cost?

Are there any State Farm auto insurance coverage options for young or new drivers?

Do I need to start both policies at the same time to get State Farm multi-policy insurance savings?

Are State Farm coverages customizable to fit individual needs?

Can I purchase State Farm car insurance online without speaking to an agent?

Does my insurance cover rental car State Farm if my vehicle is in the shop?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.