Progressive vs. State Farm Auto Insurance (2026)

When comparing State Farm and Progressive auto insurance, safe drivers pay just $43/mo with State Farm, while high-risk drivers pay $50/mo with Progressive. This State Farm vs. Progressive auto insurance review highlights their usage-based programs, such as Drive Safe & Save and Snapshot, which reward safe driving.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Copywriter

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, AllWom...

Rachel Bodine

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Insurance Claims Support & Senior Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she had similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated February 2026

With State Farm and Progressive auto insurance, drivers can take advantage of usage-based discounts and accident forgiveness programs, making them ideal for cautious and high-risk drivers.

- Progressive vs. State Farm auto insurance offers distinct perks

- Progressive uses AI to adjust rates in real-time for Snapshot users

- State Farm tracks driving through Bluetooth beacons for discounts

State Farm operates in 47 states, excluding California, Massachusetts, and Rhode Island. Its Indemnity Company is licensed in Illinois and New Jersey, but sells auto insurance only in New Jersey. The State Farm app allows users to manage their insurance, file claims, and access roadside assistance.

State Farm vs. Progressive Auto Insurance Rating| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.3 | 4.3 |

| Business Reviews | 5.0 | 4.0 |

| Claim Processing | 4.3 | 3.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.3 | 4.2 |

| Customer Satisfaction | 2.1 | 2.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.0 | 4.4 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.8 | 5.0 |

| Savings Potential | 4.4 | 4.6 |

| State Farm Review | Progressive Review |

Progressive Insurance operates in all 50 U.S. states and Canada, offering auto, home, and personal coverage. It’s a free app that lets users manage policies, pay bills, and file claims. Uncover expert tips to qualify for the cheapest car insurance available.

Compare State Farm vs Progressive auto insurance rates and coverage options by entering your ZIP code into our free quote comparison tool today.

State Farm & Progressive Rate Comparison

When you look at rates by age and gender, several clear patterns emerge. Teen drivers pay the highest rates, with 16-year-old males insured by Progressive spending the most.

State Farm vs. Progressive Auto Insurance Monthly Rates| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $177 | $440 |

| 16-Year-Old Male | $208 | $467 |

| 30-Year-Old Female | $51 | $69 |

| 30-Year-Old Male | $56 | $72 |

| 45-Year-Old Female | $47 | $59 |

| 45-Year-Old Male | $47 | $56 |

| 60-Year-Old Female | $43 | $50 |

| 60-Year-Old Male | $43 | $52 |

State Farm usually offers lower premiums across all groups. The rates go down a lot by the time you reach 60 years old, with prices being almost the same for men and women. The gap between the two insurers narrows as drivers mature.

How Driving History Impacts Auto Insurance Rates

Look at how your history affects what you pay. For State Farm, if you have a clean record, the cost is $123; for Progressive, it is $150. If you’re in an accident that’s not your fault, Progressive’s price increases to $265. But State Farm keeps it at $146.

State Farm vs. Progressive Insurance Monthly Rates by Driving Record| Driving Record | ||

|---|---|---|

| Clean Record | $123 | $150 |

| Not-At-Fault Accident | $146 | $265 |

| Speeding Ticket | $137 | $199 |

| DUI/DWI | $160 | $200 |

If you drive too fast or drink and drive (DUI), prices increase for both companies, but State Farm always gives better rates in these cases.

Read More: What to Do if You Can’t Afford Your Auto Insurance

State-by-State Auto Insurance Rate Comparison

Looking at auto insurance rates offered by Progressive and State Farm across different states, it is easy to see that the price difference between these major insurance companies can vary significantly by location.

In Alabama, for example, State Farm’s monthly rate is $154, while Progressive charges $163 per month. This shows that in Alabama, State Farm has a slight cost advantage.

State Farm vs. Progressive Auto Insurance Monthly Rates by State| State | ||

|---|---|---|

| Alabama | $154 | $163 |

| Alaska | $117 | $125 |

| Arizona | $158 | $167 |

| Arkansas | $156 | $164 |

| California | $179 | $154 |

| Colorado | $192 | $200 |

| Connecticut | $142 | $150 |

| Delaware | $167 | $175 |

| Florida | $177 | $225 |

| Georgia | $163 | $171 |

| Hawaii | $125 | $133 |

| Idaho | $117 | $125 |

| Illinois | $125 | $133 |

| Indiana | $125 | $133 |

| Iowa | $133 | $142 |

| Kansas | $158 | $167 |

| Kentucky | $183 | $192 |

| Louisiana | $233 | $242 |

| Maine | $98 | $106 |

| Maryland | $142 | $150 |

| Massachusetts | $142 | $150 |

| Michigan | $183 | $192 |

| Minnesota | $158 | $167 |

| Mississippi | $167 | $175 |

| Missouri | $163 | $171 |

| Montana | $175 | $183 |

| Nebraska | $158 | $167 |

| Nevada | $167 | $175 |

| New Hampshire | $104 | $113 |

| New Jersey | $158 | $167 |

| New Mexico | $167 | $175 |

| New York | $154 | $163 |

| North Carolina | $142 | $150 |

| North Dakota | $138 | $146 |

| Ohio | $117 | $125 |

| Oklahoma | $175 | $183 |

| Oregon | $138 | $146 |

| Pennsylvania | $154 | $163 |

| Rhode Island | $167 | $175 |

| South Carolina | $167 | $175 |

| South Dakota | $183 | $192 |

| Tennessee | $138 | $146 |

| Texas | $167 | $175 |

| Utah | $150 | $158 |

| Vermont | $108 | $117 |

| Virginia | $121 | $129 |

| Washington | $133 | $142 |

| Washington, D.C. | $179 | $188 |

| West Virginia | $167 | $175 |

| Wisconsin | $138 | $146 |

| Wyoming | $146 | $154 |

As a result, tables turn in states like Colorado, where Progressive comes in at $200 compared to State Farm’s $192. The details of this pattern of competing advantages are covered in our car insurance prices by state analysis, highlighting the competitive nature of pricing strategies between the two companies.

Rate gaps shift by region for State Farm and Progressive. For instance, Delaware drivers often find State Farm slightly more affordable.

Michelle Robbins Licensed Insurance Agent

Generally, Progressive tends to be slightly more expensive in states like Florida and Alaska, whereas State Farm car insurance shows a cost benefit in states like Connecticut and Delaware.

Such disparities suggest that consumers should consider regional pricing as a significant factor when comparing these insurers, especially when considering the best time to buy a new car.

How Credit Score Affects Car Insurance

State Farm and Progressive have noteworthy discrepancies in monthly auto insurance rates based on credit metrics. State Farm had the highest rate at $269 for those with good credit, compared with Progressive’s $142.

For those with fair credit, the difference is slightly smaller; State Farm charges $334, compared to Progressive’s $177.

State Farm vs. Progressive Auto Insurance Monthly Rates by Credit| Credit Score | ||

|---|---|---|

| Good Credit | $269 | $142 |

| Fair Credit | $334 | $177 |

| Poor Credit | $471 | $300 |

For those with bad credit, the gap widens more; State Farm’s rate increases to $471, while Progressive’s rate is lower at $300.

Still, these figures highlight Progressive’s more consumer-friendly pricing and ability to offer coverage to drivers with all credit scores, which could help cost-conscious drivers save money on car insurance while still seeking full coverage.

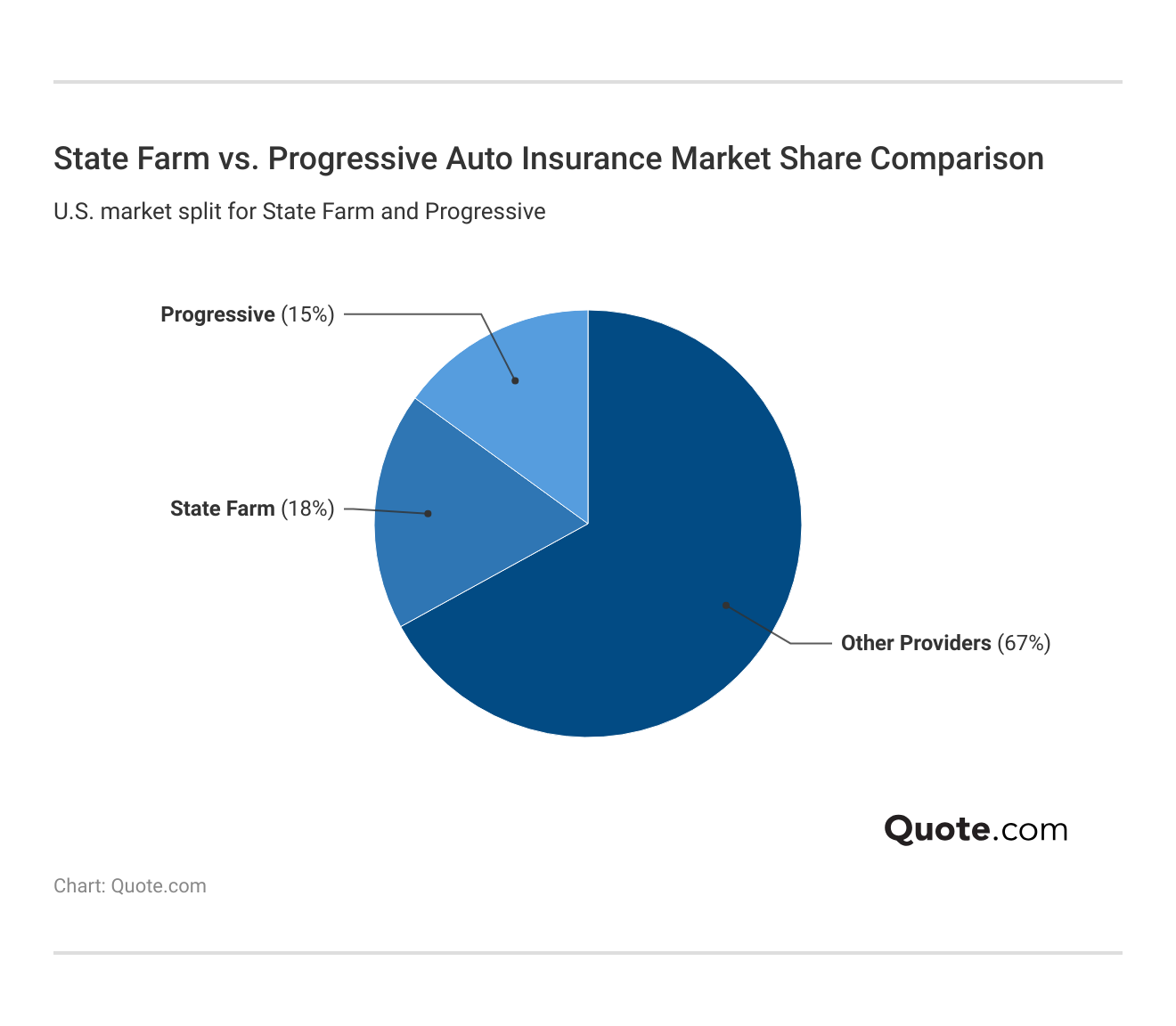

Breakdown of State Farm and Progressive Market Presence

See how market dominance is reflected in actual numbers. State Farm is number one with 18.30% of the auto insurance market, just ahead of Progressive at 15.30%.

The remaining 66.40% is divided among other providers. This difference shows that State Farm has significant nationwide influence, while Progressive remains strong as a digital-first competitor.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm vs. Progressive Coverage Options

Both State Farm and Progressive offer the standard auto insurance coverages:

- Liability Coverage: Covers bodily injury and property damage if you’re at fault in an accident.

- Collision Coverage: Pays for damage to your vehicle from a collision with another vehicle or object.

- Comprehensive Coverage: Protects against non-collision events like theft, fire, hail, or hitting an animal.

- Medical Payments/Personal Injury Protection: Covers medical expenses for you and passengers.

However, State Farm and Progressive differ in their optional coverage offerings. For example, State Farm offers roadside assistance, rental car reimbursement, rideshare driver coverage, and glass repair.

Despite the above add-ons, Progressive has a wide array of extras, including gap/loan/lease payoff, custom parts & equipment, and even pet injury coverage.

Ways to Save With State Farm & Progressive

Comparing State Farm and Progressive discounts reveals the advantages and disadvantages of each insurer.

State Farm and Progressive offer an extensive list of discounts for multi-policy, multi-vehicle, safe driver, good student, and defensive driving, indicating that they target a wide range of customers seeking ways to save on auto insurance.

State Farm vs. Progressive Auto Insurance Discounts| Discount | ||

|---|---|---|

| Accident-Free | 20% | 31% |

| Anti-Theft | 15% | 10% |

| Bundling | 25% | 12% |

| Defensive Driving | 15% | 10% |

| Distant Student | 25% | 10% |

| Good Student | 25% | 10% |

| Homeowner | 5% | 10% |

| Low Mileage | 30% | 15% |

| Multi-Vehicle | 20% | 12% |

| Safe Driver | 30% | 30% |

| Usage-Based | 30% | 30% |

| Safety Features | 40% | 10% |

State Farm does not offer a pay-in-full discount, unlike Progressive among all providers, which could be appealing to customers who can pay their premium upfront and want to save on their bill.

Conversely, State Farm does not offer a paperless discount, unlike Progressive, which appeals to environmentally conscious consumers who prefer electronic transactions and documentation.

This comparison shows that while both companies offer robust car insurance discounts, factors like pay-in-full versus paperless options may convince customers to choose one over the other, depending on their individual situations.

State Farm vs. Progressive Reviews & Ratings

Check how State Farm and Progressive auto insurance rank in reviews. People rate State Farm higher in J.D. Power satisfaction and have fewer complaints.

State Farm vs. Progressive Insurance Ratings & Reviews| Agency | ||

|---|---|---|

| Score: 710 / 1,000 Avg. Satisfaction | Score: 672 / 1,000 Below Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 75/100 Positive Customer Feedback | Score: 72/100 Avg. Customer Feedback |

|

| Score: 0.84 Fewer Complaints Than Avg. | Score: 1.11 Avg. Complaints |

|

| Score: A++ Superior Financial Strength | Score: A+ Superior Financial Strength |

Both companies get an A+ or above for financial strength, but State Farm does slightly better in customer reviews. Progressive trails slightly in service, though it still performs solidly in business practices and reliability.

According to the National Association of Insurance Commissioners (NAIC), State Farm has fewer customer complaints than average, while Progressive has an average complaint ratio.

This array of ratings underscores the nuanced choices consumers face, highlighting how to compare auto insurance companies by thoughtfully weighing customer service satisfaction, ethical business practices, and financial stability.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Progressive Auto Insurance

Progressive auto insurance offers strong digital tools and many discount opportunities, though it does have downsides. Here’s a look at some of the major pros and cons based on customer experiences.

Pros

- Responsive Customer Service: Progressive keeps customers updated on claim status.

- Innovative Tools: Features like Name Your Price and Snapshot leverage real driving habits to personalize coverage and potentially lower rates.

- Discount Options: Multiple discounts are available, including multi-policy, safe driver, and autopay rewards, which can further reduce premiums.

Cons

- Inconsistent Agent Experience: Customer experiences can vary depending on the representative.

- Rate Fluctuations: Premiums may increase unexpectedly. Policyholders need to regularly shop for coverage to ensure competitive rates.

The Reddit user highlights their positive experience with Progressive, particularly the superior customer service and the regular updates they received on claim status.

This underscores Progressive’s strength in customer relations and everything you need to know about Progressive insurance. Their intention to revert to Progressive demonstrates the power of responsive and caring service on customer loyalty and satisfaction.

Pros and Cons of State Farm Auto Insurance

State Farm auto insurance offers a mix of benefits and challenges for drivers, especially those with complex driving histories.

Here’s a closer look at what it provides and some potential drawbacks to consider.

Pros

- Competitive Rates for High-Risk Drivers: State Farm offers lower premiums for drivers with a bad driving history.

- Customizable Coverage: Customers can choose from full coverage or liability-only options, tailoring their plan to their specific needs.

- Reputation for Stability: With a history of strong financial ratings, State Farm ensures reliable claim payments.

Cons

- Mixed Customer Service: Some customers report efficient claims handling, while others complain about limited communication.

- Higher Down Payments: Initial payments can be high, potentially discouraging new or switching customers.

This Reddit user’s review of State Farm mentions mixed quality-based customer satisfaction with the services, with an emphasis on low pricing for drivers with a bad driving history, as well as non-quality-based complaints about customer service.

State Farm is the only car insurance that has given me a fair quote. Everyone else said heck no! Yet I hear state farm is TERRIBLE. Is the service worth the low rate? byu/Susano-o_no_Mikoto inInsurance

This reflects the varied experiences individuals may have with State Farm Insurance, suggesting that while it may offer financial benefits for some, the service aspect could be inconsistent, something often discussed in Allstate vs. State Farm comparisons.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Comparing State Farm & Progressive Auto Insurance

When comparing State Farm and Progressive auto insurance, your choice largely hinges on what matters most to you. If you prefer direct access and personalized services, State Farm’s network of agents offers a more localized touch.

Choosing State Farm or Progressive depends on your habits. For example, Snapshot fits tech-savvy, high-risk drivers seeking lower rates.Laura Kuhl Managing Editor

Progressive, on the other hand, appeals to drivers who prefer to manage their insurance online. It also offers newer tools, such as its Snapshot program, which allows the company to adjust rates based on driving habits.

Both insurers offer robust coverage options, but how to compare auto insurance companies might ultimately hinge on whether you prefer the hands-on assistance of an agent or the convenience of digital management. Unlock better coverage with Progressive vs. State Farm insurance by entering your ZIP code today.

Frequently Asked Questions

Is Progressive or State Farm cheaper for young drivers?

Progressive is often cheaper for young drivers under 25, with average rates starting around $148 per month, compared to State Farm’s $172. Progressive’s Snapshot program can further lower rates for safe drivers. Request a Progressive auto insurance quote and find the best coverage now.

Is State Farm better than Progressive for car insurance overall?

State Farm tends to score higher in customer satisfaction, especially for claims handling and local agent support, while Progressive often wins on price and tech features.

Where does State Farm rank among auto insurance companies?

State Farm consistently ranks in the top three U.S. auto insurers by market share and customer satisfaction. It’s one of the largest auto insurance companies in the U.S., holding over 16% of the market.

Is Progressive better than State Farm for bundling home insurance?

Progressive’s home insurance is underwritten by third-party home insurance companies, while State Farm underwrites its own. This makes State Farm more consistent in bundling, often leading to more seamless claims and discounts averaging 17% for bundling.

Does Progressive raise car insurance rates after 6 months?

Yes, Progressive policies have a typical six-month term, and rates may increase at renewal. Rate hikes are often tied to changes in driving history, location, or Progressive’s loss trends, even if you haven’t filed a claim.

Is State Farm good at paying claims?

State Farm receives high marks for claims satisfaction. In J.D. Power’s latest study, it scored above the industry average in claim resolution time, process clarity, and customer communication.

What are the key differences between State Farm and Progressive auto insurance?

State Farm offers a traditional agent-based approach, while Progressive operates more digitally, allowing customers to manage policies online. Progressive also offers usage-based car insurance through its Snapshot program, while State Farm provides discounts through its Drive Safe & Save program. Coverage options are similar, but Progressive is often more flexible with high-risk drivers.

Does State Farm have high car insurance rates?

State Farm’s rates are generally competitive. On average, drivers pay $96 per month for full coverage with State Farm, which is lower than the national average of $140 and cheaper than many competitors, including Progressive. Get a State Farm auto insurance quote today to see how much you could save.

Why is State Farm so expensive for some drivers?

State Farm rates can appear high for drivers with a DUI, poor credit, or those who are new drivers with no driving history. It also doesn’t offer as many deep discounts as Progressive for low-mileage or usage-based programs.

What payment methods are available for paying a State Farm bill?

State Farm allows customers to pay their bills online, through their mobile app, by automatic bank draft, by phone, or by mailing a check. The company also offers tips to pay less for car insurance, including payment plans and automatic deductions, to make managing premiums more convenient.

Is State Farm cheaper than Progressive for auto insurance?

How does Progressive customer service handle claims and policy questions?

How does State Farm vs. Geico compare in terms of cost and coverage?

Should you choose MetLife or State Farm for your car insurance?

Is 21st Century or State Farm better for your auto insurance needs?

What is the Name Your Price insurance tool, and how can you use it?

Does Progressive’s comprehensive car insurance meet your protection needs?

How much is State Farm car insurance a month on average?

How do State Farm, Progressive, and Geico stack up overall?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.