National General Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

The Verdict

National General is good if you’re a General Motors employee, motorcyclist, and/or RV owner

National General is a mid-size insurer that offers its policies in every state in America.

Find out how if the company is worth your time and money with this in-depth National General car insurance review.

High price, average service. Car insurance from National General comes with premiums 9% higher than average and just middling customer service.

That means most drivers can find better options elsewhere, with a few exceptions.

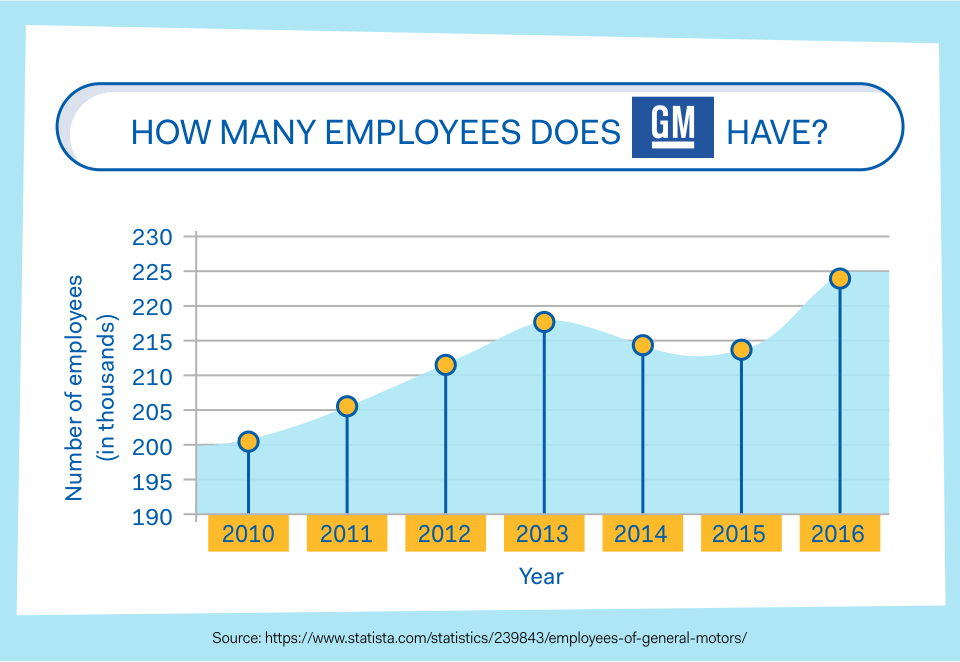

Cheaper for General Motors employees and their families. If you’re an active or retired General Motors employee, you and your family can get a discount from National General.

This includes your extended family, from your grandchild to grandfather-in-law.

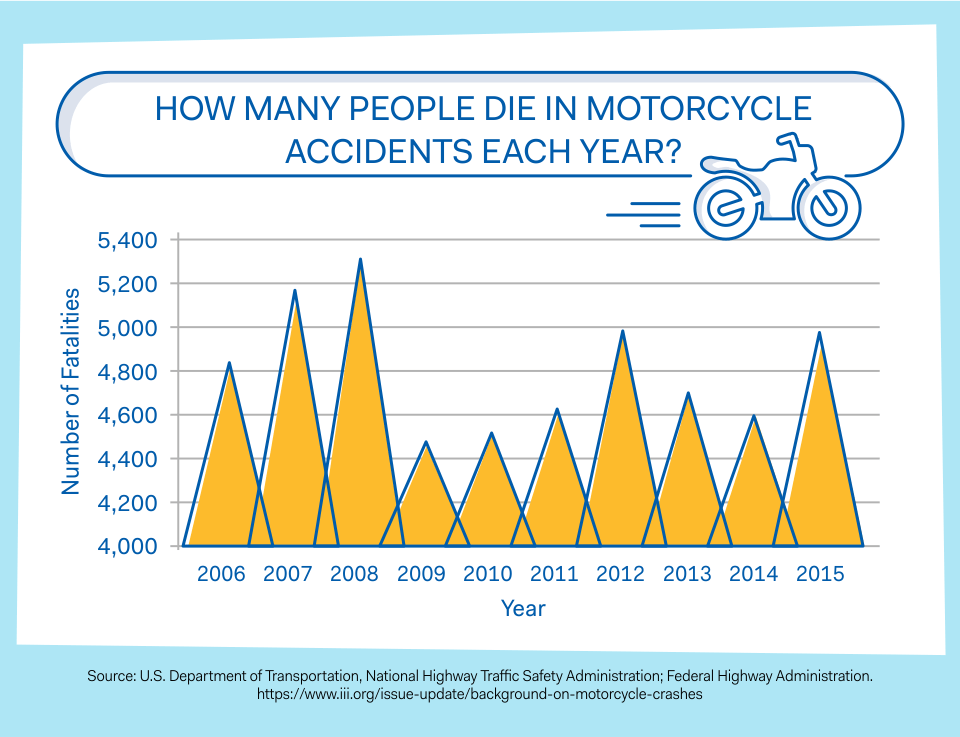

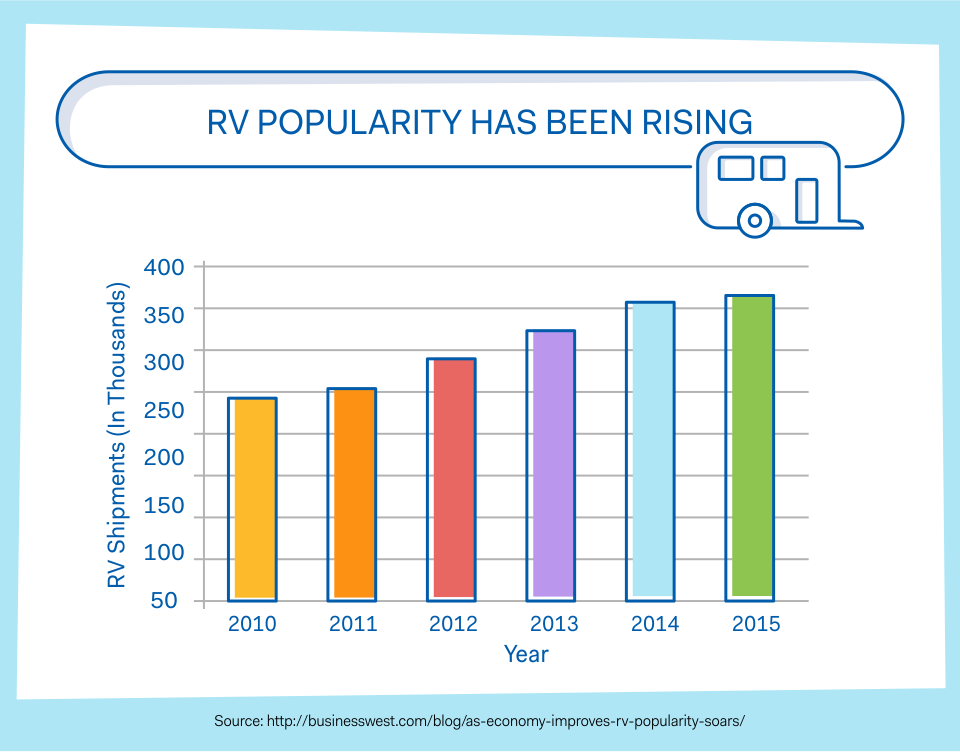

Good for RVs and motorcycles. National General offers strong plans for motorcycles and RVs.

Bundling coverage for these vehicles with your regular car insurance will also earn you a nice discount.

Extra protection. National General throws in additional coverage for free with some of its plans.

The company provides a lifetime guarantee on any repairs made by a recommended mechanic after a claim, for instance.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Competition

National General competes with Amica Mutual Insurance

National General is ranked the 22nd largest auto insurer in the country while Amica holds the 20th spot.

That makes both companies comparable in size and services offered.

Better prices from Amica. Annual premiums for Amica are around $99 cheaper than average, while policies from National General may cost up to $400 more than average.

Good additional services. Both insurers go the extra mile in a few areas.

Amica basically offers a free year of gap coverage if you insure a recently-purchased new car, while National General will cut your deductible by $250 if you’re not happy with how the company handled your claim.

More than car insurance. For those looking to bundle different types of insurance with one company, both Amica and National General also provide home, small business, and life insurance.

However, National General does not provide its life insurance directly, instead connecting you with a separate company that will sell and service your policy.

Satisfaction varies based on location. These two car insurance companies sell policies in all 50 states and Washington D.C.

However, industry analysts found customer satisfaction levels varied for each company across different regions.

While National General only made the J.D. Power rankings in the Southeast where it received an “about average” rating for its services, Amica claimed the title as the best car insurance company in New England.

What that means for you. If you live on the East Coast or want a better chance at lower prices, consider Amica.

Alternatively, National General may offer additional services that better fit your insurance needs.

The Question Everyone Is Asking Now

“What’s the difference between National General and GMAC insurance?”

Reason for the name change. National General was originally called General Motors Acceptance Corporation, or GMAC, back when it was actually owned by General Motors.

The car manufacturer spun off the insurance company in 2008 under the name Ally Financial, which after another name change became National General.

What’s the same and what’s different. The biggest change is that National General is no longer owned by General Motors, even though it still offers discounts for the company’s employees.

National General still offers many of the same products as when it first began.

We dive into more FAQ questions below.

Strengths

National General is strong because of its discounts

General discounts for General Motors. Owing to its former ownership by the car manufacturer, National General offers great discounts for insuring autos made by General Motors.

Any current or retired General Motors employees and their families are also eligible for a discount on an auto insurance policy.

Other available discounts include:

- Paid-in-full discount. For paying all your premiums upfront.

- Multi-vehicle discount. For insuring more than one car.

- Safe-driver discount. In some states, for completing a defensive driver course.

- RV and auto discount. For bundling insurance on both vehicles together.

- Motorcycle discounts. For safe riders and insuring multiple bikes.

- OnStar subscriber discount. For having an active OnStar subscription.

- Low mileage discount. For OnStar subscribers that drive less than 15,000 miles per year,

- Affinity discount. For members of certain organizations.

- GM supplier discount. For employees of businesses that work with General Motors.

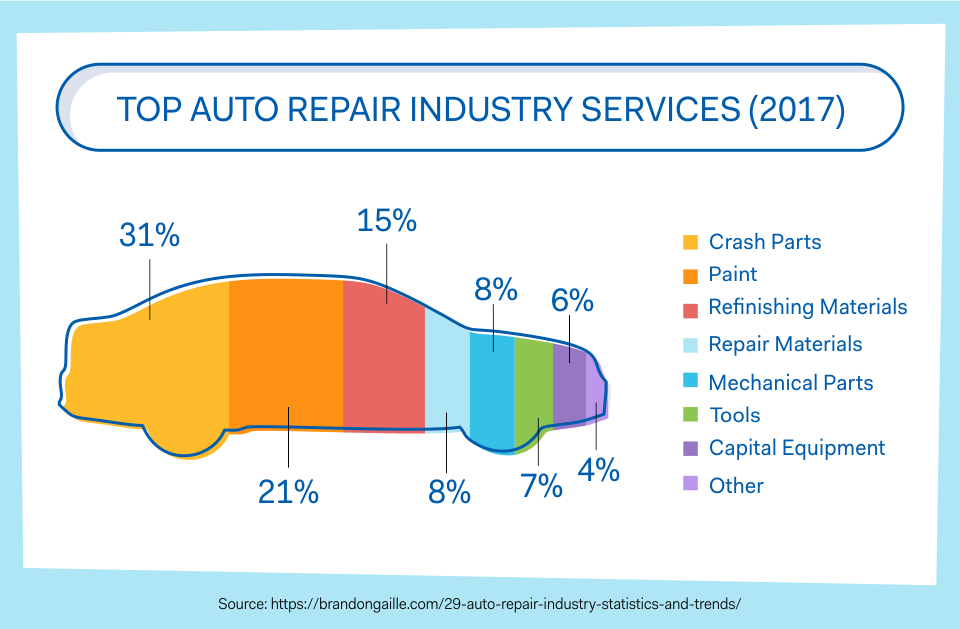

Extra protection and services. The additional coverage and services available from National General were a big selling point for AutoInsuranceEZ.com.

These include free inspections for the quality of any repairs resulting from a claim, as well as providing up to $500 for food, lodging, and travel expenses if your vehicle gets totaled while you’re far away from home.

Great insurance for other vehicles. National General offers great insurance for more than just cars.

The company offers good plans for people that travel or live out of their RVs, and both serious and casual motorcycle riders can find solid insurance for two-wheeled vehicles.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Weaknesses

National General is weak because of its cost

Pricey policies. The additional services and protections offered by the company come at a cost.

Premiums for an auto insurance policy from National General are about 9% higher than average.

Poor consumer feedback. National General receives more complaints than other insurers its size.

That and its “about average” J.D. Power ranking for customer satisfaction means your interactions with this insurance company may not always be the best.

Is National General Right for You?

You should use National General if you work for General Motors

If any of the following characteristics sound like you, National General’s auto insurance is worth your consideration:

- I am an active or retired General Motors employee or related to an employee by blood or marriage.

- I drive one or more vehicles made by General Motors.

- I want to insure my motorcycle or RV and my car with the same company.

- I’m willing to pay more for extra services and coverage that other insurers may not offer.

Company History

National General used to be owned by General Motors

From car manufacturer to insurer. National General used to be known as GMAC, or General Motors Acceptance Corporation.

It was spun off as its own company in 2008 and now continues to offer insurance under its current name.

National General works best if you’re somehow connected with General Motors

Available everywhere. National General offers insurance in all 50 states.

Discounts for General Motors cars, employees and more. Active or retired GM employees and their relatives, employees of companies that do business with GM, or people who drive a GM car are eligible for discounts.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

More on National General

This is what and how National General works for you

National General offers all the standard types of car insurance, like liability, comprehensive, and collision insurance.

What particularly sets the company apart is its quality plans for other vehicles, including motorcycles and RVs.

Liability insurance

Doesn’t cover your car. If you’re in an at-fault accident, liability insurance will cover property damages and medical expenses for other parties involved in the wreck.

It doesn’t cover your medical bills or damages to your car.

Drive less, pay less. Driving less is a great way to save on car insurance if your insurer offers a low-mileage discount.

National General offers a low-mileage discount that can cut your rates by up to 53%, so infrequent drivers should make sure to ask about whether they qualify for these savings.

Comprehensive insurance

For non-collision related damages. Comprehensive insurance pays out if your car gets stolen, vandalized, or otherwise damaged outside of a collision.

Save by installing OnStar. Since OnStar can track your vehicle if it ever gets stolen, signing up for a subscription can cut your comprehensive insurance costs by 20%.

That means getting a new OnStar subscription could actually pay for itself.

For example, a subscription for OnStar’s Security plan costs $249.90 per year, or about $20.83 per month.

If your comprehensive insurance costs $210 per month, your 20% OnStar discount would be $42 per month—that’s a total of $21.17 in savings after the cost of your subscription.

Collision insurance

Pays out after a wreck. Collision insurance pays for damages to your car resulting from an at-fault wreck.

Set a low deductible and save. Increasing your deductible lowers your monthly or annual premiums.

Make sure you set your deductible as high as you can reasonably afford to save money on your car insurance.

Motorcycle insurance

Covers your bike. National General offers specialty motorcycle insurance.

Most of its policies are similar to those it provides for cars, including liability, comprehensive, and collision insurance.

Insure your aftermarket parts. If you’ve made modifications to your bike such as adding aftermarket parts, get a policy that covers these enhancements.

Standard motorcycle insurance doesn’t factor in these additions unless specifically addressed in your policy, so make sure the full value of your bike is covered.

RV insurance

Protects your RV and its contents. RV insurance is somewhat like a cross between a home and car insurance policy.

It can protect your vehicle while you’re on the road or at a campsite, as well as cover its contents or damages in a collision or from other circumstances.

Bundle up. Combining your RV and car insurance with National General makes you eligible for up to a 20% discount in premiums.

What People Love About It

People love this company because of its extra services

Guaranteed satisfaction. One thing that stands out about National General is its guaranteed claims satisfaction.

If you’re not happy with the service you receive, the company will waive $250 of your deductible.

Good follow-up after claims. Some consumers loved the services National General provides after an accident.

The company ensures only parts from the original manufacturer are used when repairing your vehicle.

If your vehicle is totaled after an accident, National General will also assign a car-buying expert to help you track down and purchase a vehicle that meets your specifications, taking a lot of the legwork out of car shopping.

Biggest Consumer Complaints

The biggest consumer complaints about National General center on slow service

Even though National General holds an A+ with the Better Business Bureau, it still has quite a few complaints related to its services.

Slow to cancel. T.P. writes in their review that they received charges from National General even after canceling their policy:

“Provided information needed to delete auto from insurance coverage. Still being charged 4 months later.”

Delays in paying claims. Robin K. noted that they had great difficulty in getting the company to pay for a claim:

“There was a major hail storm (made national news) and National General stated that no storm was reported for the area on that date and time. They stated that they were not going to cover damages from the storm until I went as far as submitting security camera footage, photos and news reports to support the claim.”

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Key Digital Services

National General’s website lacks many common functions

The website is just okay. National General’s website lets you get a quote, find an independent agent that sells their policies, file a claim, pay your bill, and manage your policy.

There’s no option for tracking a claim though, which is unusual for an insurer of its size.

No app or other digital features. Another thing missing from National General’s digital presence is any sort of app or usage-based insurance program.

The website is really its only feature.

How to Get Started

Call or go online to start using National General

Multiple ways to get insured. You can sign up for a policy on National General’s website, contacting an agent using the agency locator tool, or by calling 1-800-462-2123.

Pay upfront and save. If possible, get the paid-in-full discount by paying for your policy all upfront.

Doing this instead of opting for monthly premiums will save you money.

How to Cancel

The easiest way to stop using National General is to call customer service

Call to cancel. If you want to cancel your insurance, contact customer support.

The number you call will vary based on your policy, so check the website to find out what to dial.

Watch out for fees. Canceling your insurance before the end of the term can result in extra fees.

Make sure you read over your policy carefully to see when you can switch insurers without a penalty.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

FAQ

The answers to the most frequently asked questions about National General

Hopefully, this National General auto insurance review answered all your burning questions about the company.

In short, the higher-than-average cost and adequate customer service of National General auto insurance make the company only worth your time if you need the extra services it offers.

However, General Motors employees and their families can get some great discounts from the company, as well as anyone who drives a car made by the auto manufacturer.

Anyone looking to bundle RV or motorcycle insurance with their car insurance can get a great deal as well.

Do you use National General?

How has the company worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.