MetLife® Insurance Review

Founded in 1868, MetLife has 149 years of experience insuring people against financial loss. Their insurance products include auto, dental, home, and life policies. Our MetLife insurance review will help you learn why MetLife is one of the largest and oldest insurance companies in the world.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jun 29, 2022

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Jun 29, 2022

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

Few things in life are as important as ensuring your family.

Whether you need auto insurance, home insurance, or life insurance, almost all forms of insurance boil down to protect against catastrophic financial loss.

MetLife is no exception. Where the company is exceptional, however, is their age and experience.

Having been around for nearly 150 years, MetLife provides multiple insurance options for consumers no matter what type of insurance they are looking for.

If you aren’t already insured against loss, don’t wait.

Not only is a lack of insurance illegal in some instances (liability for auto, or state-mandated health insurance), but a lack of life insurance can cost your family greatly if something happens to you.

Funeral costs, final expenses, and any outstanding debt could fall on their shoulders to handle at a time when the last thing anyone wants to think about is money.

Read our MetLife Insurance review to learn everything you need to know.

History and Origin

Founded on March 24, 1868, MetLife has 149 years of experience insuring people against loss, making it one of the largest—and oldest—insurance companies in the world.

The company’s original name was the National Union Life and Limb Insurance Company and was created to ensure Civil War soldiers against disabilities obtained during their service.

In 1868, five years after being founded, the National Union Life and Limb Insurance Company changed its name to Metropolitan Life Insurance Company and became the company we know today.

Plans to Split

Due to fines and penalties imposed on the company because of “too big to fail” regulations, MetLife set about reducing its total size in 2012 and focusing on the insurance side of the company, but these efforts were unsuccessful.

In 2016, MetLife announced plans to split its retail business away from the core company into a secondary company called Brighthouse Financial, which launched on March 6, 2017, as an independent company with a primary focus on life insurance and annuities.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

MetLife Products and Services

MetLife didn’t grow to be as big as it is overnight but rather found its success due to quality product offerings in a wide range of areas.

Take a look at what the main products and services offered by the company are:

Auto Insurance

MetLife Auto & Home provides basic auto insurance coverage that includes liability protection, collision and comprehensive coverage, personal injury protection, uninsured motorist coverage, and underinsured motorist coverage.

Dental Insurance

MetLife provides basic dental coverage, as well as more advanced plans like HMOs for specialty work. Dental insurance can be obtained individually or through your employer.

Home Insurance

MetLife Auto & Home also provides homeowners, condo, mobile home, and renters insurance alongside their automotive coverage options. Landlords can also obtain coverage for their rental properties.

Life Insurance

MetLife is most well known for its life insurance policies. Offering term and whole life insurance, and every variable in between, MetLife helps you make sure your family is protected in case something happens to you. Whether you need to cover your family against a loss of income, education costs, household debts, or even basic funeral expenses, MetLife’s life insurance policies can help.

Other Policies

In addition to these types of policies, MetLife offers additional coverage. Employers can get Group Vision insurance through MetLife for their employees. The company also offers disability and accident & health insurance policies.

What is their most popular MetLife product?

The most commonly sought out MetLife insurance policy is, without a doubt, their life insurance policy.

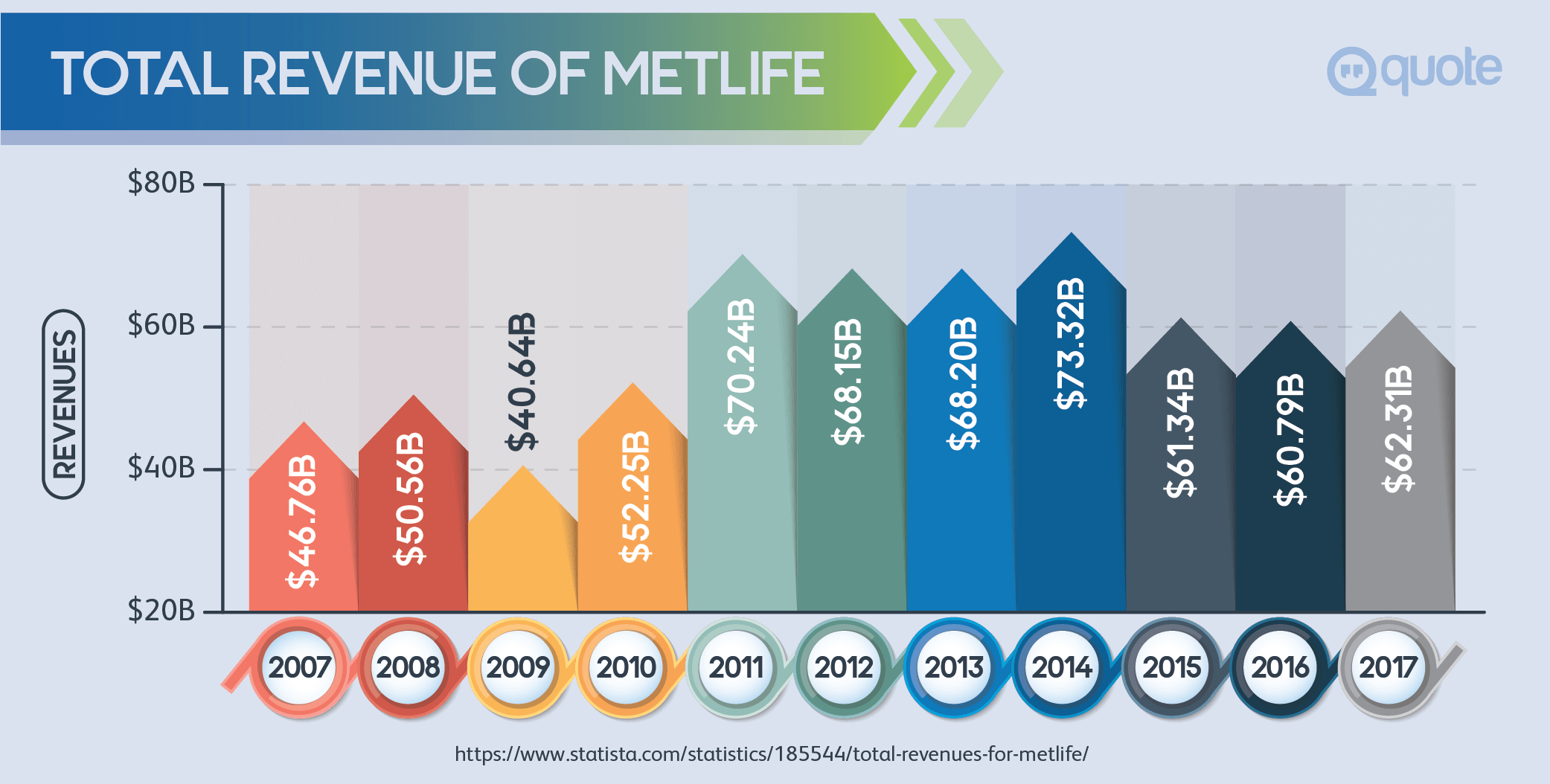

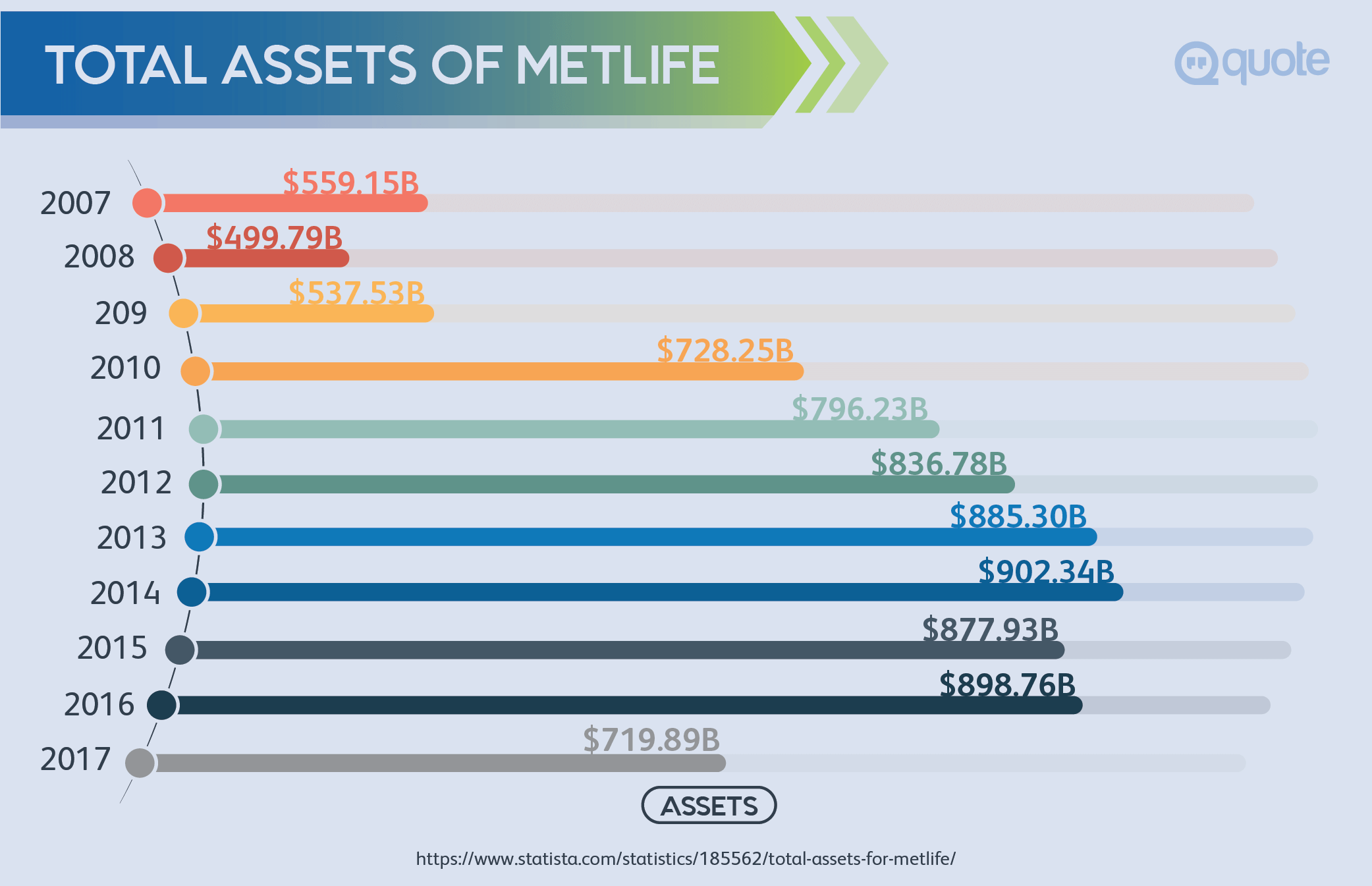

The company does the majority of its business within the United States, even though MetLife is now a global presence with a total worth of $917.43 billion as of Q1 2016.

MetLife Auto Insurance

MetLife auto insurance provides the protection you need when behind the wheel.

Here are the main things you need to know about their policies:

Liability, Collision and Comprehensive

In 48 out of 50 states, drivers are required by law to have liability insurance. Many car dealerships will not lease a vehicle unless you provide collision and comprehensive coverage for the vehicle upon purchase. These basic types of coverage are necessities and are included in MetLife’s auto policies.

Vanishing Deductibles

When you make a claim against your auto insurance, you are required to pay a minimum amount out of pocket. This is called a deductible. With MetLife’s Deductible Savings Benefit, each year you don’t make a claim you earn $50 toward your next claim, up to a maximum of $250.

No Accident Forgiveness

Many insurance companies offer accident forgiveness policies that prevent your rates from increasing after your first at-fault accident. MetLife, unfortunately, does not. This oversight on their part makes their auto policies lag behind the competition; after all, a foot slipping from the brake might not result in any damage, but if a claim is made for that then you’ll pay significantly more in the long run for insurance.

Estimated Rates

MetLife provides quotes over the phone and via their website. However, keep in mind that the website requires a lot of personal information in order to provide you with a quote. Estimates put monthly premiums at an average of $217 per month, although MetLife claims most customers save an average of $536 per year.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

MetLife Home Insurance

In addition to auto insurance, MetLife provides a bevy of different home insurance options.

Here are the main ones you’re likely to encounter:

Home Insurance

MetLife’s home insurance options include homeowners insurance, condo insurance, renters insurance, mobile home insurance, and insurance for landlords. Each of these policies covers essentially the same area, but with a different slant to each.

What do these policies cover?

The main thing to keep in mind about MetLife home insurance is the replacement coverage. This policy provides you with the necessary funds to completely replace your home if something happens to it without considering depreciation. This means that even if your home has suffered the usual wear and tear over the years and dropped in value, MetLife still provides you with the amount you need to start over from the ground up.

The usual damages covered by homeowners insurance include damages caused by aircraft, vehicles, explosions, fire, and lightning, riot or civil commotion, smoke damage, theft, vandalism, volcanic eruption, and windstorms and hail. Earthquakes and floods are usually not covered under homeowners’ policies, although you can get flood coverage through the National Flood Insurance Program.

MetLife’s Umbrella Policy

An umbrella policy is designed to provide you with additional coverage, most often in cases of litigation. If you are sued for liability, your insurance coverage might not be enough. When this happens, an umbrella policy usually fills in the gap. Umbrella coverage ranges from as low as $5,000 in coverage to more than one million, and usually for low premium amounts. In fact, some umbrella policies start at just $20 per month.

Estimated Rates

Like with auto insurance, you can receive an estimated quote for MetLife homeowners insurance either on the phone or over the internet, but not all states qualify for online quotes. As a result, it can sometimes be difficult to get a comprehensive quote. MetLife costs tend to be a bit higher than competitors’.

MetLife Dental Insurance

Dental insurance tends to be overlooked in lieu of health insurance.

While this is understandable, multiple studies have linked dental health to your overall health, and as anyone who has ever needed a filling knows, dental services can be expensive.

MetLife provides two primary types of dental insurance: TakeAlong Dental and employer-provided policies.

TakeAlong Dental

TakeAlong Dental is a personal dental insurance policy for you and your family that provides coverage regardless of your employer. This is a PPO program that covers procedures like cleanings, x-rays, dentures, orthodontic work, root canals, and more. If you want to ensure your family has dental insurance and your employer does not provide dental coverage options, then MetLife’s TakeAlong Dental plan is a good option.

Employer-Provided Dental Insurance

MetLife provides PDP and PDP Plus programs through a number of employers across the country. These plans provide a large network of dentists to choose from, and most preventative care is completely covered. If you happen to live in California, Florida, New Jersey, New York, or Texas, then you may qualify for the HMO or managed dental care plans. These plans have no deductibles and offer basic medical services at lower-than-average rates.

Estimated Rates for Dental Insurance

MetLife provides affordable dental insurance rates that start at just $22.00 per month for single-person policies. Rates will vary based on your location and a number of other factors.

If something were to happen to you, how would your family handle it? Would their financial needs be met?

If you don’t already have life insurance, take the time to evaluate MetLife’s offerings and see what might be right for you.

Term Life Insurance

MetLife provides term life insurance policies through workplace options. This is the most affordable type of life insurance, but it’s also temporary and most often only used to protect you during your working years. That said, term life insurance usually has a higher principal amount than whole life because of its temporary nature.

Permanent Life Insurance

Permanent life insurance refers to whole life, universal life, and variable life policies. It sets itself apart from term life in that it remains with you throughout your entire life; there is no expiration date on a permanent life insurance policy.

Whole Life Insurance

Whole life insurance is the most recommended type of life insurance, as it covers you throughout your entire life with no time restrictions. Whole life premiums tend to remain the same throughout your entire life with no increases, and the cash value of the policy will continue to grow throughout your life. This cash value also means you can borrow against your life insurance policy and withdraw early.

Universal Life Insurance

A universal life policy is similar to a whole life policy in the length of its coverage, but it allows you to pay above and beyond the premiums into a single account. These policies also come with a minimum interest rate, ensuring that you’ll earn at least a steady base rate.

Variable Life Insurance

Variable life insurance is very similar to universal life insurance, except that it provides multiple investment options. Like universal life, variable life insurance policies have a minimum base rate. You can withdraw against the cash value at any time with no penalties, and you can start or stop making additional premium payments anytime you wish.

MetLife Insurance Discounts

The easiest way to save money on your insurance premiums is to take advantage of discounts, and MetLife offers multiple discounts, depending on the type of insurance you have with them.

Auto Insurance Discounts

MetLife’s auto policies have more discount options than the other policies. These are the most common choices:

Group insurance discounts are available to those with employer-provided insurance options.

Multi-policy discounts are available to those with more than one policy through MetLife.

Safe driver discounts are available to those with no marks on their driving record for the past three years.

Driver training discounts are available to those whom complete an approved driver safety course.

Mature driver discounts are available for customers between the ages of 50 and 65.

Multi-car discounts are available to those that insure more than one car through MetLife.

Restricted mileage discounts are available to those who drive less than 7,500 miles annually.

Antilock brake discounts are available to those whose vehicles have computerized anti-lock brakes.

Safety features discounts are available to those whose vehicles are equipped with automatic seatbelts, air bags, and other safety features.

Antitheft system discounts are available to those with systems installed to reduce theft.

Good student discounts are available to full-time students who maintain a B average or higher.

Home Insurance Discounts

MetLife offers two main discounts for homeowners:

Home and car bundles can save up to 10% per month on premiums.

Professional, academic, and community group memberships provide a variety of different discounts depending on the specific membership.

Other discounts include employer-specific benefits, group rates, and more.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How to Cancel Your MetLife Insurance

Your MetLife insurance policy can be cancelled at any time, but if you use the phone service to cancel, the representatives will talk with you about your options and what steps you can take to keep your service.

To cancel, use the online services page or call the company at 1-800-638-5000 to speak with a representative.

MetLife Strengths

Here are the areas where MetLife soars over the competition.

- You can receive instant quotes for insurance.

- MetLife offers a diverse range of services compared to other insurance providers.

- MetLife has the highest rated life insurance options according to A.M. Best.

- Making claims is a simple, straightforward process.

MetLife Weaknesses

Despite the multiple strengths of the company, there are a few areas where MetLife could stand to improve.

- Payment options are limited to only a select few.

- The online services leaves a lot to be desired.

- MetLife lacks the online educational resources of its competitors.

How to File a MetLife Claim

Filing a claim is as simple as calling 1-800-854-6011 or visiting the online claims page to get started.

Representatives are available 24 hours per day, 365 days a year to assist you in filing a claim.

You can submit claims online for more specialized services like auto glass repairs or be towing.

You would use this same process to report an accident or damage.

Once the accident takes place, ensure the safety of everyone present and then contacts MetLife to report the event.

The Most Common Complaints About MetLife Dental and Life Insurance

The main complaints customers have about MetLife revolve around their billing and customer service.

Multiple customers report issues with billing.

One customer switched their billing from one bank account to another, but the change didn’t finalize until her policy was drafted from the first account and caused her to overdraw.

Other customers report spending hours on the phone trying to get in touch with a representative to make a policy change, inquire about the status of a claim, and multiple other issues.

Those that got in touch with representatives say they are always courteous, but provided inadequate or incorrect information.

State-to-State Variations

The services and products offered by MetLife will vary based on your location. While the differences aren’t usually extreme, they are determined by the individual laws and regulations of the state in which you live. That said, some states have drastically different insurance laws that will limit the availability of certain services.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Thinking of going with MetLife? Our Verdict

MetLife is one of the oldest and most trusted insurance companies in the world, and while there are a few glaring downsides to certain policies (no accident forgiveness on their auto insurance, lack of potential discounts for homeowners insurance, etc.), MetLife excels at providing life insurance.

Their policies are flexible and customizable, and more importantly, life insurance is something everyone needs—particularly with the increasing cost of funerals.

Take the time to evaluate what MetLife has to offer before making your decision.

Figure out your needs and then place a call to MetLife to retrieve a quote and find out what your premiums would be.

Purchasing a life insurance policy is a life-long commitment, so do your research before pulling the trigger.

That said, we highly recommend finding some form of life insurance if you are not already insured elsewhere.

Do you have experience, negative or positive with MetLife?

We’d love to hear from you!

Share your thoughts in the comments below!

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.