CSAA vs. Mercury Insurance (2026)

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insurance...

Leslie Kasperowicz

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated December 2025

Before you even think about shopping for a new car, you should be shopping for auto insurance.

Comparison-shopping for insurance can be intimidating, especially if you’re new to it or haven’t shopped around in a while.

Yet, insurance also gives us peace of mind – and assurance that we won’t be on the hook for an enormous bill in a worst-case scenario.

Accordingly, it’s important to do your research and make sure the company you do business with is the best one for your particular needs.

Narrowing the field to the right insurer can be downright daunting.

In the course of your comparison-shopping, you might come across CSAA Insurance Group or Mercury Insurance Group.

CSAA Insurance Group is the insurer for AAA, perhaps best known for their roadside assistance.

CSAA was founded in 1914 when the board of the California State Automobile Association (CSAA) grew concerned about the high cost of insurance and voted to sell lower cost insurance through the CSAA Inter-Insurance Bureau.

Today, CSAA offers auto, home and personal lines of insurance through partnerships with AAA clubs in 23 states and the District of Columbia.

CSAA wrote $3 billion in direct premiums in 2016.

Meanwhile, George Joseph founded Mercury Insurance Group in 1961 as a low-cost alternative to larger insurance companies.

Today, Mercury Insurance Group is the fourth largest private passenger insurance company in California.

Working through 14 subsidiaries in 11 states, Mercury wrote $2.5 billion in direct premiums in 2016, the majority of those in California.

Insurance Coverage

CSAA Insurance Group may be best known for roadside assistance and auto insurance, but it also offers homeowners, renters, condo, and boat insurance, as well as a personal liability “umbrella” policy.

Mercury focuses primarily on auto and homeowners insurance, but it also offers personal liability insurance, business insurance, mechanical breakdown protection (like an extended warranty for a car), renters insurance, business and business auto insurance, and ride-hailing insurance.

Most of these policies, at either company, will cover property damage to others and may include coverage in the event of bodily injury.

Your deductible will depend on the plan you choose and the underwriting criteria the insurance company uses, but you can get a free quote from either company online or by phone.

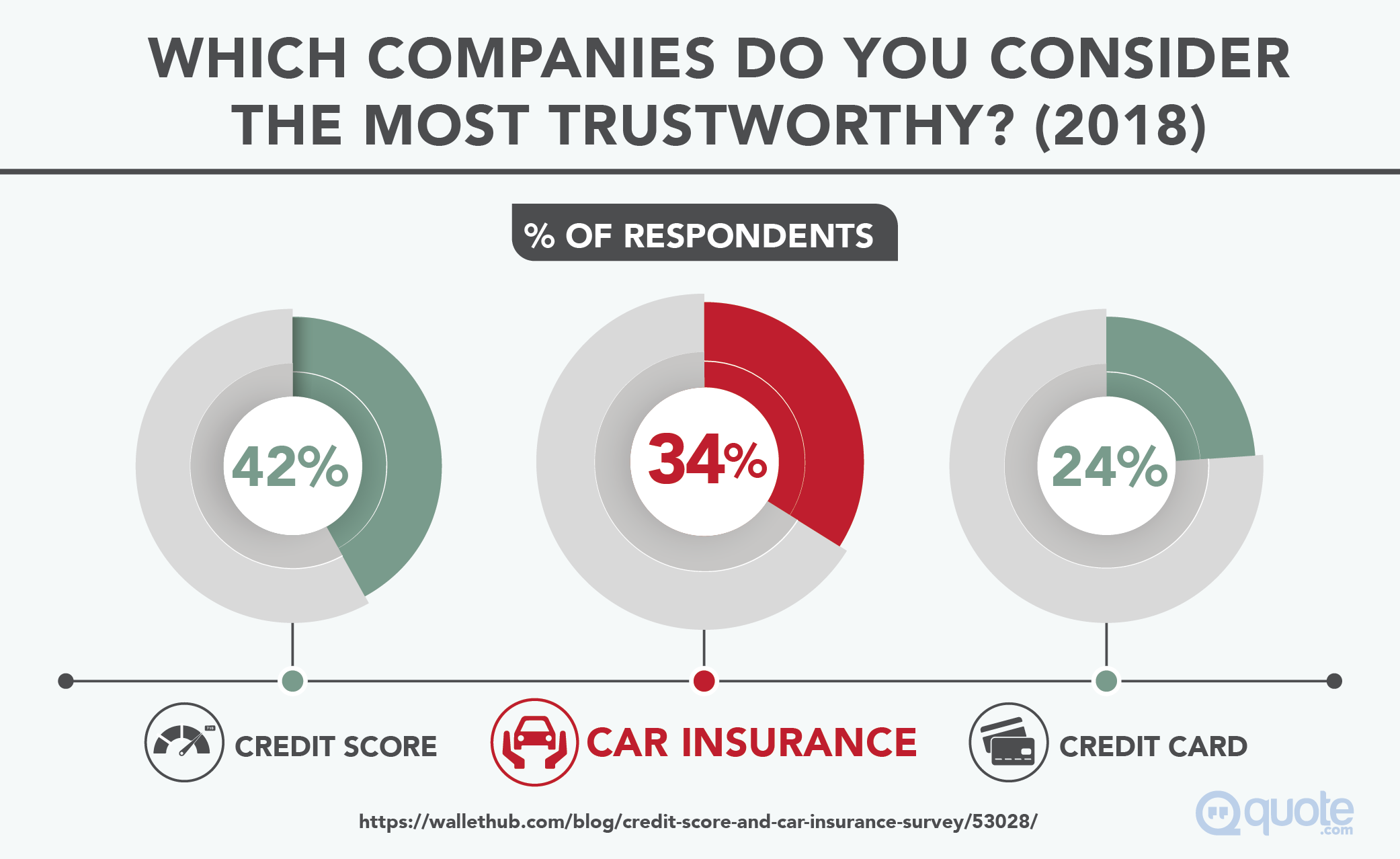

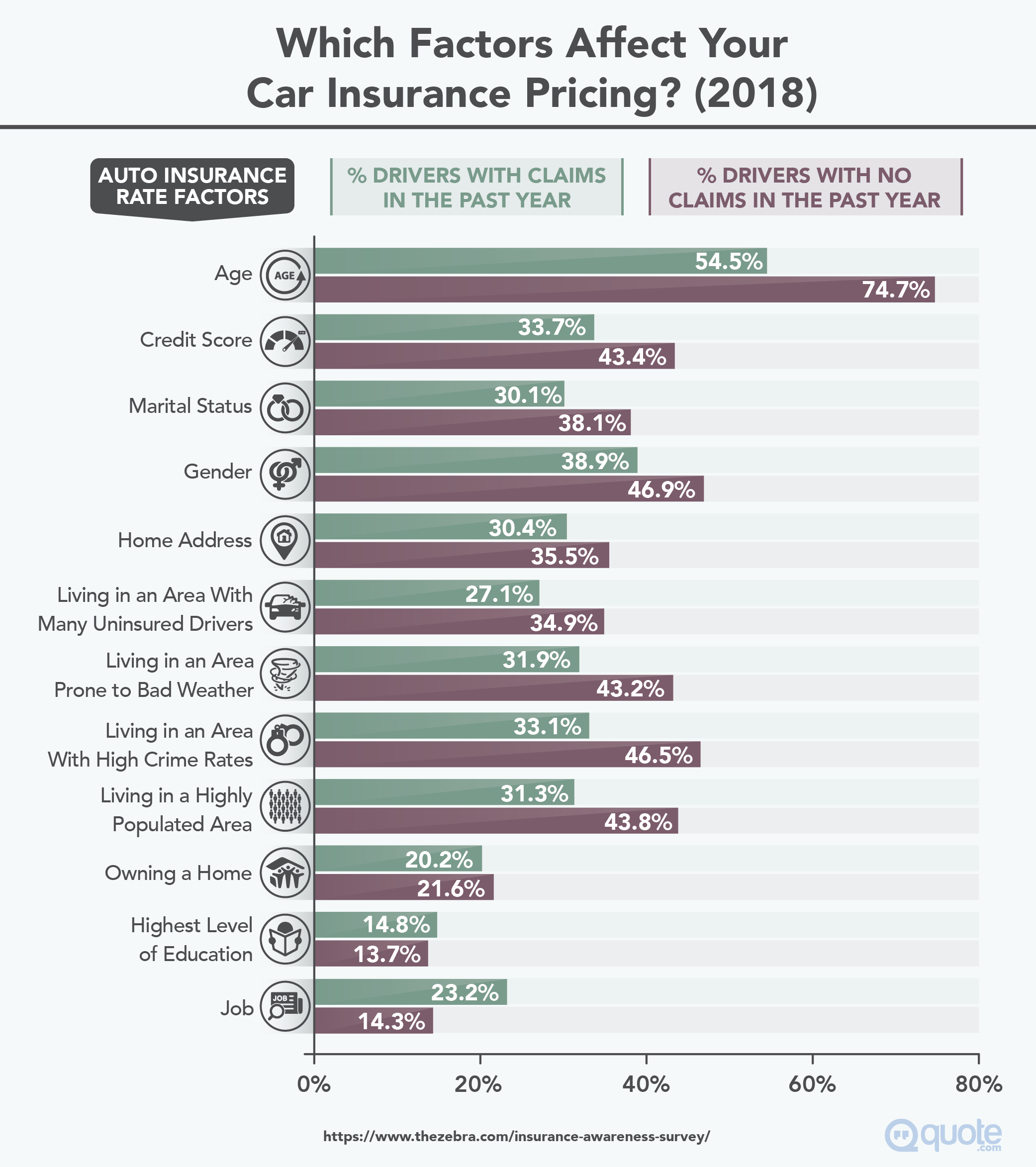

For both insurance companies, rates vary according to the consumer’s zip code and personal information, like your credit score.

When underwriting an auto insurance policy, either company might also evaluate a consumer’s past driving behavior.

Both insurance companies offer a variety of discounts on auto insurance, including discounts for good students, anti-theft devices, and air bags, as well as discounts for having multiple policies or multiple vehicles insured.

Likewise, customers of either car insurance company can get a discount when they pay their premium in full.

For homeowners and renters insurance, customers can sometimes get discounts for purchasing a home with a mortgage, living in a gated community or having a fire or theft protection system in their home.

Mercury Insurance Group also offers discounts for certain professionals through affiliate partners, like teachers, scientists, and medical professionals.

You can take out multiple policies with either or both companies, but it may be a good idea to ask each company about loyalty perks.

CSAA Insurance Group offers loyalty discounts for customers who have more than one policy with the company, and Mercury might also offer a similar perk for choosing them for more than one policy.

Both insurance companies also offer roadside assistance.

Being the insurer for AAA, CSAA’s customers can choose from among three tiers of roadside assistance.

These packages offer five, 100 or 200 miles of free towing, respectively.

Rates vary by zip code, but they can typically start between $50 and $60 per year for the basic package.

Mercury Insurance Group also offers its customers roadside assistance, including services like help with lockouts, jump starts, flat tire replacement, and fluid and fuel delivery.

Mercury does not specify how many miles of towing, for instance, are covered, so this might vary according to your zip code and level of coverage.

Customers of either insurance company can pay their bill online, by phone or by mail.

Mercury Insurance Group customers can also pay their bill in person at a payment center.

Mercury has seven payment centers in California and one each in Florida and Texas.

Though the best choice for you is going to depend on your particular needs, CSAA Insurance Group has rated particularly well among millennial consumers, with high marks for price, customer service, and claims service.

CSAA Insurance Group serves: Alaska, Arizona, Colorado, Connecticut, Delaware, Maryland, Montana, Nevada, Oklahoma, Oregon, South Dakota, Utah, Virginia, Washington DC and Wyoming; and portions of California, Idaho, Indiana, Kansas, Kentucky, New Jersey, New York, Ohio, Pennsylvania, and West Virginia.

Mercury Insurance Group is headquartered in Los Angeles and is currently the fourth largest auto insurance provider in the state of California.

Mercury also does business in Arizona, Florida, Georgia, Illinois, Nevada, New Jersey, New York, Oklahoma, Texas, and Virginia.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Claims

The claims process is fairly similar for both of these insurance companies.

The most important thing to do after an accident is to get to the nearest safe place and check for injuries.

You may or may not need the police to respond.

But if anyone is injured, if it’s a hit and run, or if it’s apparent that liability will be disputed, it’s a good idea to call them.

While it’s still fresh in your mind, document as much as possible, including weather, traffic and road conditions, the speed and direction vehicles were traveling.

Exchange contact, insurance, and automobile information with the other driver. Take photos of any vehicle damage and the scene of the accident.

For a homeowner’s insurance claim, you’ll need to contact police if you’re dealing with a theft or burglary.

Once it’s safe to do so, go room by room to take inventory of what’s been stolen or damaged.

Take pictures when possible, and don’t dispose of damaged items just yet.

The company may need to see them later to verify your claim.

Keep all receipts for temporary housing, repairs, and miscellaneous expenses.

You can start a claim by phone with Mercury or by phone or online with CSAA, but the most important thing you can do after an accident is document as much of it as you can.

To file a mechanical breakdown claim with Mercury, call its claims hotline at (800) 503-3724, take your vehicle to a pre-approved repair facility the claims representative recommends and the repair facility will contact Mercury.

Customer Service

The Better Business Bureau has rated Mercury Insurance Group A+, but the company is not accredited with the BBB.

The company has a number of complaints on the Better Business Bureau’s site, the majority of which relate to billing or collection issues or problems with products or services.

CSAA has been repeatedly rated an A+ by the rating agency A.M.

Best, affirming its sound financial underpinnings, and has earned accolades as a particularly good insurance company for millennial consumers.

CSAA is neither rated nor accredited by the Better Business Bureau.

It has three stars out of five on ConsumerAffairs.com, based on 213 ratings among 734 reviews.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Consumer Complaints

Many negative reviews at the site complained about poor customer service and billing or collection issues.

Positive reviews of Mercury Insurance Group, at both ConsumerAffairs.com and the Better Business Bureau’s site, praised their policies, rates, and customer service.

Positive reviews of CSAA at ConsumerAffairs.com cited low rates, abundant discounts, and reliable roadside assistance as strengths.

Mercury Insurance Group’s customer service can help you with claims, billing and payment information, and other general customer service inquiries.

Your insurance agent can help you with changes to your policy.

CSAA’s customer service can help you with claims, billing and payment issues, roadside assistance, and other general customer service inquiries.

The Verdict

Both insurance companies offer a suite of auto and personal insurance products that may fit your needs, as well as perks for good students, loyal customers, defensive drivers and more.

CSAA is a particularly good choice for younger consumers and veterans.

Customers choosing this package would likely also enroll in a AAA roadside assistance package with this, which is a good idea for those who do a lot of driving.

It would be wise, however, to also check out Mercury Insurance Group, as they are rated favorably by customers and consumer advocates and may offer a better rate for your area.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.