Best Luxury & Exotic Car Insurance in 2026

Liberty Mutual, Nationwide, and Amica have the best luxury and exotic car insurance. State Farm offers the cheapest luxury car insurance, with rates as low as $165 per month. Luxury car insurance goes beyond standard policies by offering higher limits and specialized coverage options.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Social Media Manager & Professor

Ashley Dannelly has a Master of Arts in English and serves as the Social Media Manager for Quote.com's portfolio of websites. Ashley also teaches English at Columbia International University and other higher education institutions. Ashley’s background in English and media has allowed her the unique opportunity to edit and create content for many publications, including Livestrong and DiveIn....

Ashley Dannelly

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Zach Fagiano

Updated January 2026

Liberty Mutual, Nationwide, and Amica offer the best luxury and exotic car insurance. State Farm has the lowest rates, starting at just $1,980 annually.

- Liberty Mutual has the best luxury auto insurance coverage in the U.S.

- Nationwide offers comprehensive policies tailored to exotic vehicles

- The cheapest luxury auto insurance comes from State Farm at $165/mo

These providers understand that the demand for exotic vehicles requires more than normal protection, since exotic cars have higher values, specialized parts, and repair needs that standard auto insurance policies aren’t designed to cover fully.

Aside from the expensive price tag and hefty maintenance fees, most people think very little about the insurance coverage when they buy a new car with high value.

Top 9 Companies: Best Luxury & Exotic Car Insurance| Company | Rank | Claims Satisfaction | A.M. Best | Best for |

|---|---|---|---|---|

| #1 | 730 / 1,000 | A | Customer Service |

| #2 | 729 / 1,000 | A+ | Comprehensive Coverage |

| #3 | 718 / 1,000 | A+ | Paying Dividends | |

| #4 | 716 / 1,000 | A++ | Reliable Plan | |

| #5 | 697 / 1,000 | A++ | Bundling Policies | |

| #6 | 693 / 1,000 | A+ | Accident Forgiveness | |

| #7 | 691 / 1,000 | A++ | Hybrid Vehicles | |

| #8 | 690 / 1,000 | A | Customizable Policies | |

| #9 | 673 / 1,000 | A+ | Online Aid |

This article will tell you everything you need to know about purchasing an exotic car insurance policy for your prized vehicle. Get the best luxury auto insurance quotes today with our quote comparison tool.

Luxury and Exotic Car Insurance Costs

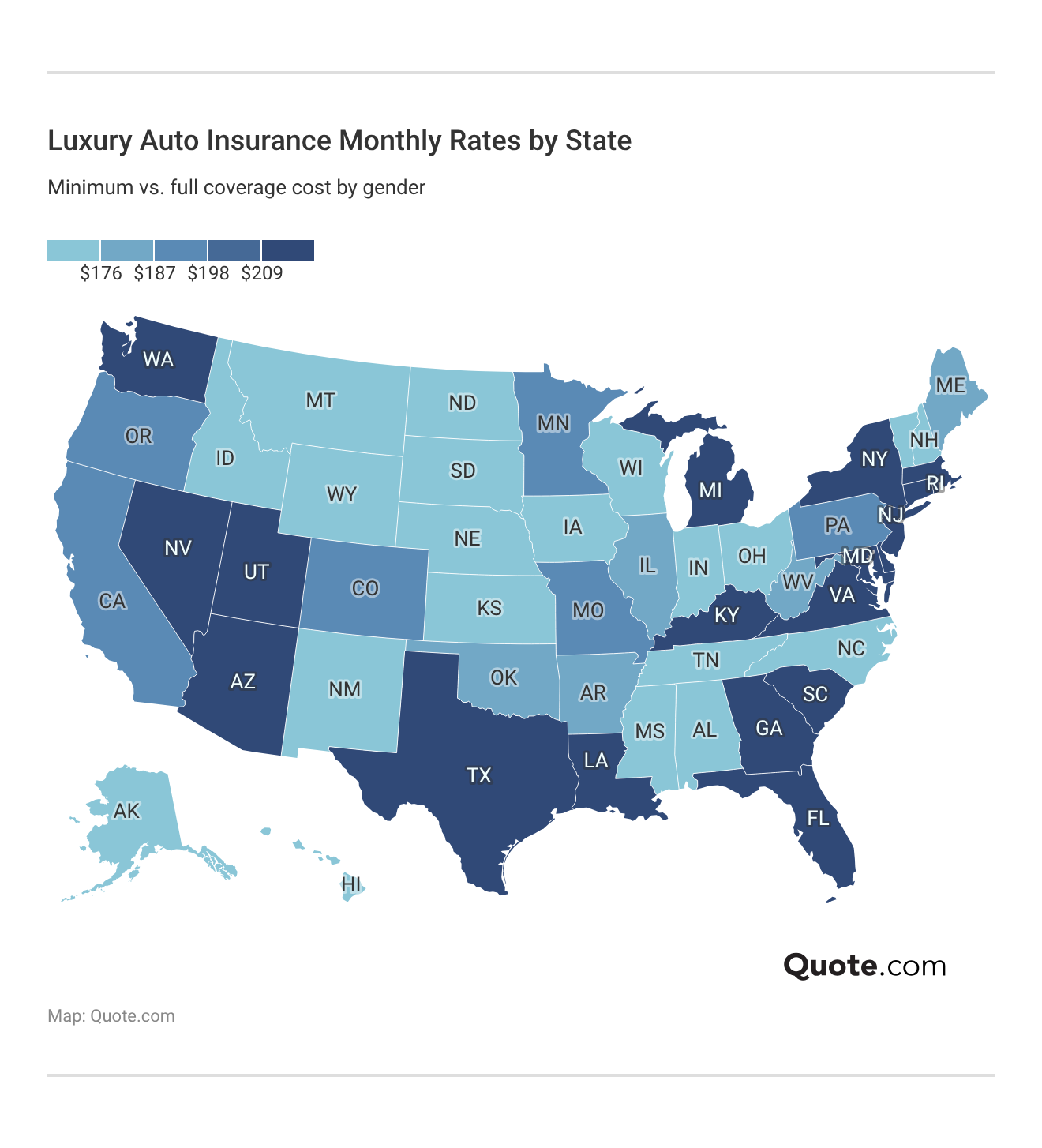

The national average cost of luxury auto insurance is $193, reflecting higher vehicle values, increased repair costs, and the need for more comprehensive coverage.

We found that State Farm exotic car insurance rates are the cheapest of all providers in our ranking, starting at just $165 per month.

Luxury Car Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $200 | $400 | |

| $190 | $381 | |

| $210 | $420 | |

| $180 | $360 | |

| $220 | $440 |

| $195 | $390 |

| $185 | $370 | |

| $190 | $380 | |

| $165 | $350 |

Luxury vehicles generally cost more to insure because of their higher values, as it would cost insurers more to repair or replace them after an accident.

We recommend comparing luxury car insurance quotes to find the lowest rates for your high-performance vehicle.

Factors That Affect Exotic & Luxury Car Insurance Rates

In general, car insurance costs are influenced by a driver’s age and driving history, where the vehicle is driven and stored, how much coverage is selected, and the overall cost of repairing or replacing the vehicle after an accident.

But why do luxury and exotic car insurance cost so much? Several factors contribute to higher rates for luxury and exotic cars:

- Higher Coverage Requirements: Most owners choose full coverage to protect their high-value vehicles and are willing to pay more for stronger protection.

- Slower Depreciation: Unlike economy vehicles, many luxury cars hold their value longer, which increases potential payout costs for insurers.

- OEM Repair Parts: Luxury and exotic vehicles require original manufacturer parts, which are more expensive and harder to source.

- Specialized Repairs: These vehicles need specialized tools and highly trained technicians, which raises labor and repair costs.

These high-performance sports vehicles also tend to attract young drivers who like speed and risky driving, which will raise your rates even with a clean record. Compare quotes for exotic sports car insurance to find your best deal.

Read More: The 17 Best Tips to Pay Less for Car Insurance

If you’re in the market for a new luxury or exotic car, knowing this insurance for expensive cars upfront can help you plan your budget and choose a provider that offers both premium service and competitive pricing.

How Location Impacts Luxury Auto Insurance Cost

Location plays a big role in luxury car insurance rates because insurers look at local risks like theft levels, traffic volume, weather patterns, and repair costs.

Urban areas often have higher insurance premiums due to more accidents and a greater risk of luxury car theft.

Rural and suburban areas are usually less expensive to insure. State-level factors such as crime statistics, weather exposure, population density, and local insurance laws can cause luxury car premiums to differ significantly even between similar urban areas.

Why Some Insurers Don’t Cover Exotic Vehicles

You may also wonder why ultra-exotic vehicles like Ferraris and Lamborghinis are often excluded from standard coverage options.

Very few insurance companies in the United States are willing to insure these brands. Those that do are highly selective about which models they cover and require strict eligibility guidelines.

Exotic car owners should prioritize agreed-value coverage over actual cash value to protect their investment against depreciation claims.

Kalyn Johnson Insurance Claims Support & Senior Adjuster

Ultra-exotic vehicles also draw significant attention, which makes them more likely targets for theft and vandalism.

That added risk is another reason top auto insurance providers treat a $400,000 exotic car very differently than a $30,000 sedan.

How Value Affects Luxury Car Insurance Cost

When it comes to purchasing a protection plan, it is essential to understand three key terms: agreed value, actual cash value, and replacement cost. They dictate how much your provider will reimburse you for the damage and/or total cost.

- Actual Cash Value: This is the amount the provider pays for damage, theft, or a total loss. It’s based on your car’s current market value minus depreciation.

- Agreed Value: This is a set amount agreed on by both you and the provider when the policy starts. If your vehicle suffers major damage, a total loss, or theft, this agreed-upon value determines your reimbursement.

- Replacement Cost: Similar to agreed value, this option usually applies to vehicles less than 3 years old. It covers the full cost to replace the car after a total loss or theft, without factoring in depreciation.

What we learned from analyzing 815 insurance companies is that, when shopping for a luxury/exotic automobile policy, inquire whether the company applies the agreed-upon value or replacement cost value.

If not, you may encounter a problem when you discover that they will only honor the actual cash value system and reimburse you for their maximum amount under their policies. Check out rates from the best luxury car insurance companies to see which one fits your vehicle.

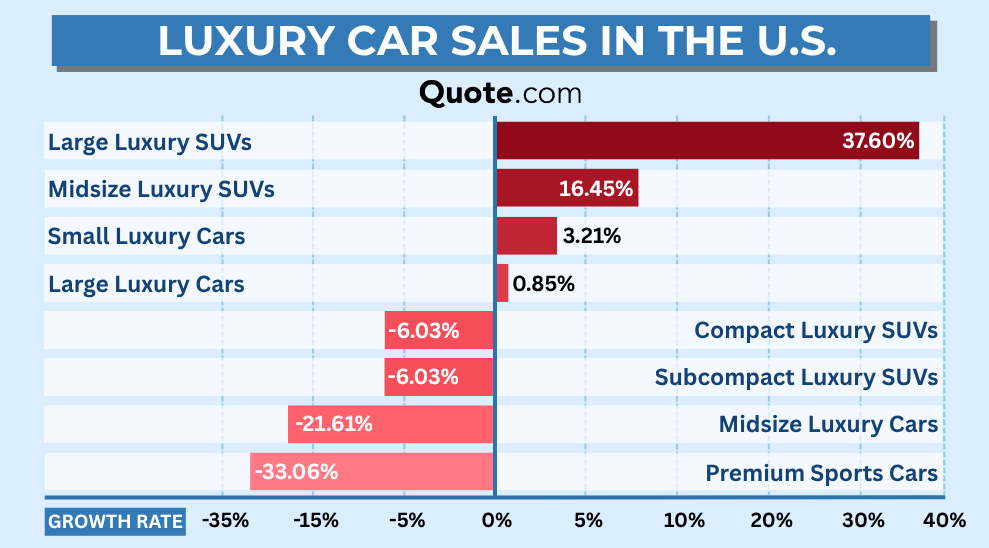

Luxury SUVs Are Driving Higher Insurance Costs

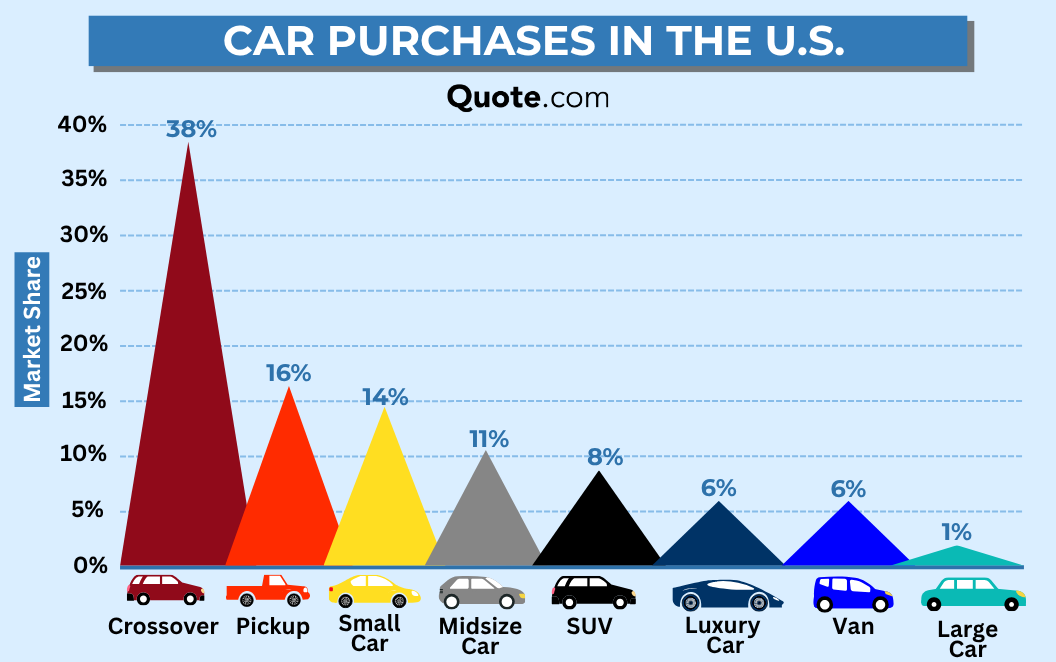

Luxury SUVs now dominate the U.S. luxury vehicle market, and that shift is driving higher auto insurance costs.

Large luxury SUVs lead all luxury segments with nearly 38% growth, followed by midsize luxury SUVs at more than 16%. Meanwhile, traditional luxury cars and premium sports cars continue to lose ground.

This mirrors broader U.S. buying trends, where crossovers and SUVs make up the largest share of vehicle purchases nationwide.

From an insurance standpoint, this trend matters because luxury SUVs typically:

- Cost more to repair due to their size, built-in sensors, and advanced safety technology.

- Have higher replacement values than most luxury sedans.

- Serve as daily drivers for many owners, which increases exposure to accidents and insurance claims.

As demand shifts toward larger and more complex vehicles, insurers adjust pricing to reflect higher repair severity and claim risk. That’s a key reason full coverage premiums for luxury SUV insurance remain high, even as interest in luxury sedans continues to fall.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Makes a Car Luxury vs. Exotic?

The difference between a luxury car and an exotic car lies in their purpose: luxury cars are built for comfort and daily use, while exotic cars prioritize speed, rarity, and bold design.

Luxury Vehicles

Luxury vehicles are designed with premium interiors, advanced safety technology, and convenient features that make daily driving feel effortless. They deliver a smooth, quiet ride while balancing strong performance with everyday practicality, which makes them ideal for commuting, road trips, and regular use.

The most common luxury brands seen on an everyday basis include Mercedes-Benz, BMW, Audi, Lexus, Acura, Infiniti, Jaguar, and Cadillac.

At the highest end of the luxury spectrum are ultra-premium brands such as Bentley and Rolls-Royce, which place an even greater emphasis on craftsmanship, exclusivity, and bespoke design.

Exotic Vehicles

Exotic cars fall into an entirely different category. They’re built for extreme performance and exclusivity, not everyday convenience.

These rare and collectible vehicles stand apart from standard cars in several important ways:

- Expensive to Maintain: Even routine services, such as oil changes, often require specialized tools and certified service centers. Using an unauthorized shop can void the vehicle’s warranty.

- High-Performance Engineering: Exotic cars are capable of extreme speeds and precision handling, demanding a high level of driver experience and control.

- Limited Production: Many exotic models are produced in very small numbers, with prices often exceeding $500,000. Rare or vintage collector cars can reach well into the millions.

- OEM-Only Parts: Repairs and replacements typically require original manufacturer parts, making ownership and maintenance significantly more expensive.

Exotic cars usually offer limited practicality, with low ground clearance, small cargo areas, and stiff suspensions that can make daily driving difficult. Insurance costs are often much higher because of the vehicle’s value, complex repairs, and hard-to-find parts.

As a result, exotic cars are typically saved for special occasions, track days, or private collections instead of everyday transportation.

Owners who have multiple luxury or exotic vehicles often look for cheap auto insurance for multiple vehicles that provides strong coverage for high-value cars without driving up costs.

Why Exotic Cars Need Specialty Insurance

Exotic cars need specialty insurance because standard auto insurance policies rarely include agreed-value coverage. Agreed value means your car’s value is set upfront, so you know exactly how much you’ll be paid if there’s a total loss.

Most traditional insurers calculate payouts using depreciation and strict coverage limits. That approach can leave you paying thousands out of pocket if a high-value vehicle is totaled. For example, if your luxury car is worth $250,000, a standard policy may only cover a portion of that amount.

Eligibility Requirements for Luxury & Exotic Car Insurance| Requirement | Description |

|---|---|

| Driving Record | Clean record with minimal violations |

| Minimum Age | Be age 25 with 5+ years driving experience |

| Secure Storage | Locked garage or secure storage required |

| Secondary Vehicle | 2nd car required; 2.5K-5K annual mileage limit |

| Title Ownership | Policyholder name must match vehicle title |

| Vehicle Modifications | Modified or altered vehicles often excluded |

| Vehicle Valuation | Value determined by insurer or appraisal |

Since many exotic cars feature custom upgrades, insurers often request photos and documentation of these additions to determine the car’s value and ensures the policy is tailored to your specific needs.

Like a regular auto policy, exotic car insurance premiums are based on several factors. Insurers consider the driver’s age and gender, annual mileage, vehicle modifications, and whether the car is the driver’s primary vehicle.

Specialty insurers understand exotic vehicles require beyond-standard protection, but their strict requirements often exclude younger enthusiasts and modified cars.

Scott Young Managing Editor

When you compare car insurance companies, specialized luxury car insurance companies are a better choice. These specialty providers are built to protect high-end and collectible vehicles. They understand the luxury car market, offer choice-of-repair options, and cover event-related damage that standard insurers may exclude.

Read More: Top 7 Ways You’re Wasting Money On Your Car (Right Now)

These limitations make specialty exotic car insurance challenging for younger drivers, those with imperfect records, or owners of modified vehicles.

Review these requirements carefully and learn what to do when you’re denied insurance coverage, as violating policy terms can result in denied claims or canceled coverage entirely.

Types of Luxury Car Insurance Coverage

Luxury cars don’t require completely different types of coverage, but they do need stronger protection. Since these vehicles cost more to repair or replace, having the right coverage limits is essential to avoid costly out-of-pocket expenses.

Here are the main types of car insurance for luxury vehicles to consider:

- Liability Insurance: You can choose your state’s minimum liability coverage, but those limits usually won’t come close to covering the cost of damage to a luxury vehicle.

- Collision Insurance: Collision insurance is essential because it’s the only coverage that helps pay for repairs or replacement if your car is damaged in an accident.

- Comprehensive Insurance: Comprehensive coverage isn’t required for every driver, but it’s often worth the cost if your car is stolen or damaged by something other than a collision.

The main difference you’ll notice is the policy’s overall cost. Insurers charge more because repairs or replacements cost more if you’re in an accident. You’ll likely want higher coverage to ensure the insurer pays most of those costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Lower Exotic Car Insurance Costs

Top auto insurance companies offer discounts tailored to luxury car owners, including savings for anti-theft and safety features, purchasing a new car, safe driving habits, and bundled policies.

Installing usage-based or telematics programs can also unlock additional savings by rewarding low mileage and consistently safe driving behavior.

Top Auto Insurance Discounts for Luxury & Exotic Vehicles| Company | Anti-Theft | Bundling | New Car | Safe Driver |

|---|---|---|---|---|

| 10% | 25% | 10% | 10% | |

| 18% | 30% | 10% | 15% | |

| 10% | 20% | 12% | 20% | |

| 25% | 25% | 10% | 15% | |

| 35% | 25% | 8% | 20% |

| 5% | 20% | 15% | 12% |

| 25% | 10% | 10% | 10% | |

| 15% | 17% | 15% | 20% | |

| 15% | 13% | 8% | 17% | |

| 15% | 10% | 10% | 10% |

While each insurer uses its own formula to calculate risk, most base premiums on signs that you’re a responsible driver and a reliable customer.

Where you live and how often you drive your luxury car can significantly impact your premium, especially if the vehicle is primarily used for leisure rather than daily commuting.

Ways to Lower Exotic Car Insurance Premiums| Tip | Reason |

|---|---|

| Add Anti-Theft Devices | Better security and qualifies for discounts |

| Avoid Adding Teen Drivers | Teen drivers increase risk and premiums |

| Compare Quotes | Multiple quotes help secure lower rates |

| Etch VIN on Windows | Deters theft and may qualify for discounts |

| Get Mileage-Based Discounts | Lower mileage signals reduced risk |

| Join Luxury Car Club | Membership can unlock insurer discounts |

| Park Securely | Secure parking reduces theft risk |

| Pay Small Claims | Avoiding claims helps keep rates low |

| Raise Your Deductible | Higher deductibles reduce premium cost |

| Reduce Unneeded Coverage | Removing excess coverage lowers cost |

| Take Driving Courses | Certified courses demonstrate safer driving |

| Use Manufacturer Insurance | Brand programs may offer better pricing |

Reviewing your policy annually and comparing quotes from multiple providers can help ensure you’re still getting the best rate as your driving habits and vehicle value change.

A strong credit history, a clean driving record with few accidents or traffic violations, and on-time payments can all help reduce your premium. These are valuable car insurance discounts you can’t miss.

Top Insurance Providers for High-End Cars

Liberty Mutual, Nationwide, and Amica are the leaders when it comes to luxury and exotic automobile insurance. State Farm has the cheapest luxury auto insurance rates at just $165 per month.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool to instantly compare prices for the best premium car insurance near you.

#1 – Liberty Mutual: Top Overall Pick

Pros

- Customer Service: Liberty Mutual has the highest customer satisfaction of the top luxury car insurance providers, with a 730 out of 1,000 from J.D. Power’s recent auto claims survey.

- Vehicle Replacement Benefit: As highlighted in our Liberty Mutual insurance review, its new-car replacement feature enhances luxury car insurance value.

- Teacher Discount Program: Educator incentives help reduce the insurance cost for luxury cars.

Cons

- Extended Processing Times: The lengthy approval process delays the confirmation of exotic car insurance rates.

- Costly Deductible Levels: Elevated deductibles increase out-of-pocket luxury vehicle insurance expenses.

#2 – Nationwide: Best for Comprehensive Coverage

Pros

- Complete Protection Packages: All-inclusive packages fortify the best auto insurance for luxury and exotic vehicles.

- Elite Service Reputation: Premium service reputation benefits high-end vehicle insurance clients. Learn more about its ratings in our Nationwide insurance review.

- Extended Accessory Coverage: Accessory coverage extends beyond fundamental luxury car insurance limits.

Cons

- Value Coverage Constraints: Agreed-value restrictions disappoint exotic car insurance seekers.

- Limited Expert Availability: The specialist shortage affects the availability of luxury auto insurance expertise.

#3 – Amica: Best for Paying Dividends

Pros

- Service Excellence Recognition: Amica is known for award-winning customer service, especially when it comes to luxury and exotic car insurance claims.

- Loyalty Reward System: As noted in our Amica insurance review, its dividend program rewards long-term exotic vehicle insurance customers with potential annual payouts.

- Collector Car Flexibility: Collector-friendly coverage options are designed to meet the unique needs of high-end and exotic car owners.

Cons

- Geographic Limitations: Regional availability can limit access to competitive exotic car insurance rates in some states.

- Fewer Discount Offerings: Discount offerings are more limited compared to larger, mainstream insurance companies.

#4 – State Farm: Best for Reliable Plan

Pros

- Personal Agent Access: Extensive agent network personalizes luxury auto insurance consultations.

- Authentic Parts Guarantee: As mentioned in our State Farm insurance review, its superior replacement part sourcing ensures authentic exotic car repairs.

- Bundle Discount Benefits: Multi-policy savings enhance the value of auto insurance plans for exotic cars.

Cons

- Slower Quote Process: The traditional quote process is slower than that of digital-first luxury car insurance companies.

- Performance Use Restrictions: Track-day exclusions limit coverage for performance-driven exotic owners.

#5 – Geico: Best for Bundling Policies

Pros

- Bundled Rate Advantages: Competitive exotic car insurance rates with bundling discounts for high-end vehicles.

- Digital Quote Innovation: Discover everything you need to know about Geico and its digital platform that delivers instant luxury car insurance quotes.

- Specialized Claims Expertise: Round-the-clock claims specialists trained in the best car insurance for luxury cars and exotic vehicles.

Cons

- Limited Collector Options: High-end auto policies lack customization for rare collector automobiles.

- Aftermarket Exclusions: Modification coverage excludes certain aftermarket upgrades on exotic models.

#6 – Allstate: Best for Accident Forgiveness

Pros

- Rate Preservation Feature: Allstate’s accident forgiveness protects rates for luxury and exotic car insurance policyholders after a claim. Learn more in our Allstate auto insurance review.

- Customized Coverage Solutions: Flexible coverage solutions allow luxury and exotic vehicle owners to tailor policies to their specific needs.

- Original Parts Promise: OEM parts are used for covered repairs, helping preserve authenticity and value during luxury car insurance claims.

Cons

- Higher Premium Costs: Allstate’s rates are typically higher than many other leading exotic car insurance providers.

- Complicated Policy Structure: Coverage options and policy details can feel overwhelming for first-time or less experienced high-end car owners.

#7 – Travelers: Best for Hybrid Vehicles

Pros

- Electric Luxury Expertise: Electric vehicle proficiency covers emerging luxury hybrid exotics. Read More: Travelers Auto Insurance Review

- Premium Protection Plans: Elite protection maximizes the best auto insurance for luxury and exotic vehicles.

- Manufacturer Parts Commitment: Factory parts ensure the preservation of high-end vehicle insurance policy integrity.

Cons

- Online Interface Issues: Web platform limitations frustrate the complexity of luxury car insurance quotes.

- Minimal Savings Opportunities: Discount scarcity reduces the optimization potential of exotic car insurance quotes.

#8 – Farmers: Best for Customizable Policies

Pros

- Adaptable Coverage Plans: Flexible coverage designs are perfect for the best auto insurance for luxury and exotic vehicles.

- Luxury Insurance Specialists: See everything you need to know about Farmers Insurance and its expert agents that specialize in luxury auto insurance complexities.

- Classic Vehicle Knowledge: Vintage expertise translates to classic, exotic car protection. Related: Best Classic Car Insurance

Cons

- Premium Pricing Structure: Above-market costs impact the competitiveness of luxury car insurance quotes.

- Tech Platform Weaknesses: Digital capabilities lag behind tech-savvy insurance providers.

#9 – Progressive: Best for Online Aid

Pros

- Advanced Quote Technology: Cutting-edge technology simplifies the quote process when shopping for the best insurance for exotic cars.

- Vehicle Value Protection: Agreed-value options protect the best auto insurance for luxury and exotic vehicles.

- Rate Optimization Tools: Learn everything you need to know about Progressive Insurance, as its price comparison tools help optimize exotic car insurance rates.

Cons

- Higher Deductible Requirements: Premium deductible levels pose a challenge to budget-conscious luxury owners.

- Limited Rare Car Focus: Ultra-rare vehicles receive less specialized attention than mainstream exotics.

Frequently Asked Questions

Who has the best car insurance for luxury cars?

Liberty Mutual, Nationwide, and Amica have the best insurance for luxury cars, offering agreed-value coverage, OEM part replacement, and personalized claims service. You can also find some of the cheapest classic car insurance with these top companies.

Is it more expensive to insure a luxury car?

Yes, owning a luxury car usually means you’ll pay around 20-60% more for car insurance. These vehicles cost more to repair or replace and often come with a higher theft risk. Insurance companies also consider advanced technology, specialized parts, and higher labor costs when setting luxury car insurance rates.

Comparing auto insurance rates by vehicle can help you see how luxury cars stack up against standard models before you buy.

How much does it cost to insure an exotic car?

Exotic car insurance costs around $193 per month on average, but rates can be much higher depending on the vehicle. Factors like the car’s value, limited production, repair costs, driving history, and coverage limits all play a major role in determining exotic car insurance premiums.

Explore your high-value car insurance options by entering your ZIP code into our free comparison tool today.

How are exotic car insurance rates calculated?

Exotic car insurance rates are based on the vehicle’s value, performance specs, driver history, and usage restrictions, often resulting in significantly higher premiums than standard auto insurance. Use our free comparison tool to find the best exotic car insurance in your area.

Which luxury car brand is the cheapest to insure?

Acura is usually one of the most affordable luxury brands to insure, making it easier to find the best Acura auto insurance rates. Repair costs are typically lower, safety ratings are strong, and theft risk is often less than with other luxury vehicles. Lexus and Volvo also generally have cheaper luxury car insurance than brands like BMW, Mercedes-Benz, or Audi.

What qualifies a car as exotic?

A car is typically considered exotic if it has a very high value, limited production, extreme performance, and expensive repair or replacement costs. Insurance companies also look at brand prestige, rarity, specialized parts, and higher risk when classifying an exotic car.

Are sports cars considered exotic?

Most sports cars aren’t considered exotic, but ultra-high-end models with limited production and steep price tags sometimes are. Insurers usually classify exotic cars separately based on rarity, value, repair costs, and performance.

Enter your ZIP code to compare rates instantly and find the best insurance for sports cars in your area.

Does State Farm insure luxury cars?

State Farm may insure some high-value or luxury vehicles, but it typically doesn’t specialize in true exotic car insurance. Many exotic cars require a specialty insurer because of higher values, limited production, and unique repair needs.

Does Progressive insure luxury cars?

Progressive generally covers exotic or luxury cars valued up to $150,000, including sports cars, muscle cars, and supercars.

What does high-end car insurance cover beyond regular policies?

High-end vehicle insurance can include agreed-value protection, custom parts replacement, and concierge services, which standard car insurance policies typically don’t provide for luxury or exotic vehicles.

What does luxury car insurance in California cover differently?

What’s typically included in exotic car rental insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.