Infinity Insurance Review for 2026

Infinity Insurance provides auto coverage starting at $62 per month. Infinity, acquired by Kemper in 2018, focuses on non-standard policies for high-risk drivers. Our Infinity insurance review highlights SR-22 support, roadside assistance, plus savings of up to 15% for bundling and flexible coverage choices.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insurance...

Leslie Kasperowicz

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated November 2025

Explore our Infinity Insurance review to see how this provider—bought by Kemper in 2018, delivers auto coverage starting at $62 per month.

- Bundle policies and save up to 15% for even more value and protection

- Auto coverage from Infinity Insurance starts at $62 per month

- Perfect for high-risk drivers with SR-22 filing and stable premium choices

Long known for specializing in non-standard coverage, Infinity focuses on high-risk drivers who need flexible options and SR-22 support.

Rates are determined by key factors like your driving record, vehicle type, and location, making it a strong choice for those seeking cheap auto insurance for high-risk drivers.

Infinity Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 3.7 |

| Business Reviews | 4.0 |

| Claims Processing | 2.5 |

| Company Reputation | 3.5 |

| Coverage Availability | 4.3 |

| Coverage Value | 3.6 |

| Customer Satisfaction | 1.0 |

| Digital Experience | 4.0 |

| Discounts Available | 4.3 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.0 |

| Policy Options | 3.8 |

| Savings Potential | 4.1 |

Infinity Insurance is recognized for its customizable options and extras such as roadside assistance, making it a good choice for drivers who are budget-conscious.

Infinity allows you to tailor coverage for high-risk drivers, cars with multiple drivers, or businesses. High insurance rates can be set against you. Enter your ZIP code now to compare low rates and receive the protection you deserve from best rated insurers.

Infinity Auto Insurance Review

Infinity Insurance provides custom coverage and discounts. Premiums are higher than some competitors, but consistent pricing and lower rates for seniors make it a good option for cheap auto insurance for seniors. With savings for bundling, good driving, and more, Infinity is a reliable option for drivers seeking personalized protection.

Cost of Infinity Auto Insurance

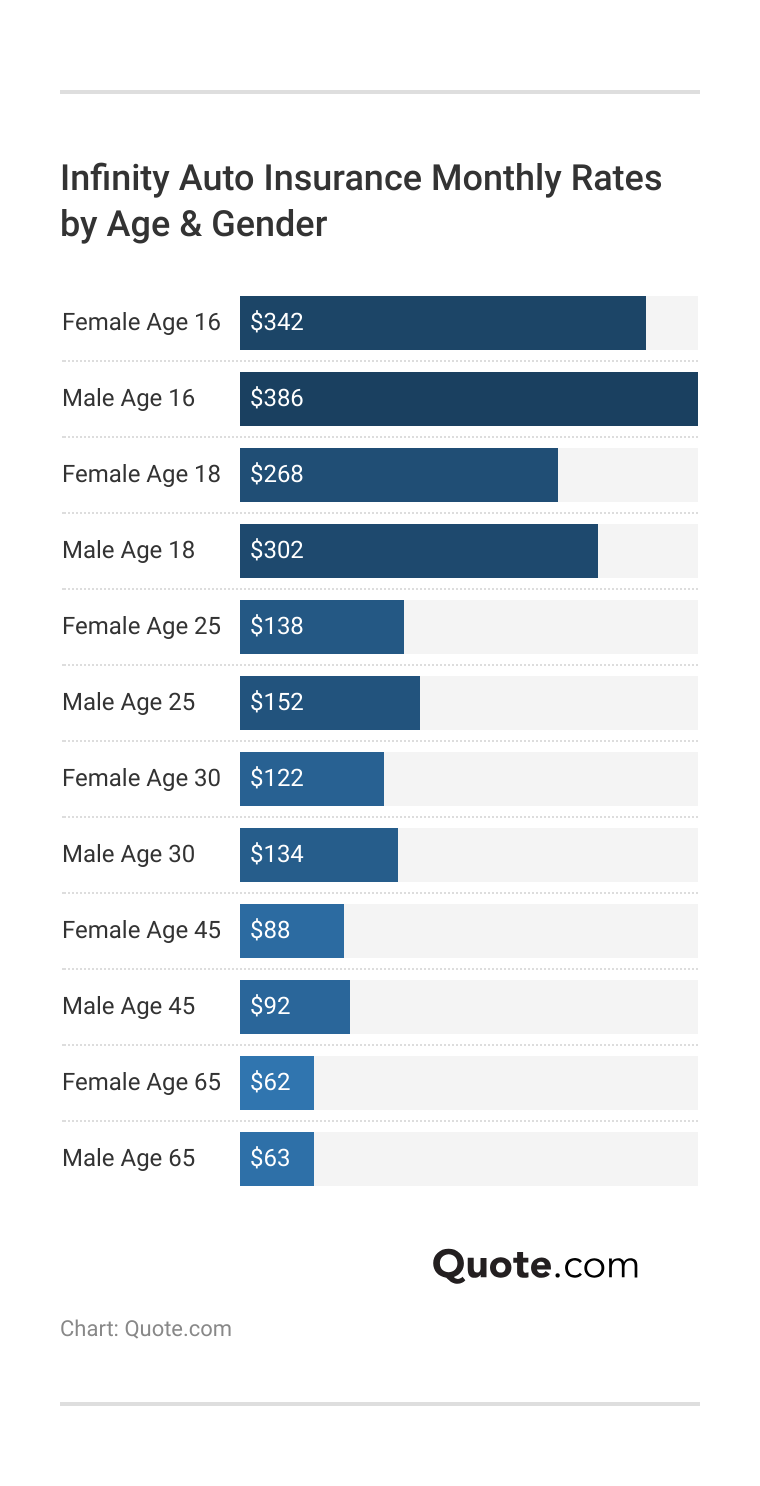

Infinity Insurance, bought by Kemper in 2018, sets auto rates that vary by age and gender. Teens pay the highest premiums—16-year-old females average $342 and males $386. Rates fall as experience grows, with 25-year-old females paying $138 and males $152.

The lowest rates are for seniors at age 65, with females at $62 and males at $63. Overall, males generally pay slightly more, especially at younger ages. This highlights the value of exploring cheap auto insurance for teens to help reduce high costs for young drivers.

Infinity’s rates vary by age and gender, with young males paying more. For example, using a telematics program can cut costs by tracking and rewarding safe driving.

Jeff Root Licensed Insurance Agent

Infinity Insurance offers competitive and stable rates for drivers with incidents, making it a strong option for those considered high-risk. For example, drivers with accidents or DUIs pay about $83 per month, while those with tickets pay around $58.

Infinity vs. Competitors: Car Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $92 | $83 | $83 | $58 | |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

These rates are often lower than competitors after violations, though Infinity’s $92 clean record rate is slightly higher than average. Safe drivers may find cheaper options, but Infinity’s stable pricing benefits those rebuilding their records or managing past infractions.

Infinity vs. Competitors: Car Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $92 | $284 | |

| $65 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Infinity Insurance Agency, Inc. minimum coverage costs $92 and its full coverage costs $284, which is high compared to the average amongst the best car insurance companies such as USAA, Geico, and State Farm, which offer to insure you for lower rates in both categories.

Though Infinity’s prices are higher than average, especially for its Infinity Insurance full coverage policy, it remains competitive with providers such as Allstate and Travelers. Finding a broader coverage package or specialized service could be the reason for considering them.

Infinity Auto Insurance Coverage

Infinity Insurance, which Kemper purchased in 2018, provides non-standard auto insurance with a focus on delivering flexible coverage that meets both the legal and the everyday needs of drivers. Its auto insurance policies offer basic coverages that are suitable for many drivers, from new to high-risk ones.

- Liability Coverage: If you’re in an accident and you’re at fault, this pays for other people’s bodily injury and property damage. It is often a legal necessity in many states.

- Collision Coverage: This coverage can help pay for damage to or replacement of your automobile if it’s damaged in a collision with another vehicle or object, regardless of who is at fault.

- Comprehensive Coverage: Protects against other damage to your vehicle not from collision including theft, vandalism, fire, or acts of mother nature.

- Uninsured/Underinsured Motorist Coverage: Protects you if you are hit by a driver who has no coverage or has inadequate coverage to pay for your damages.

- Medical Payments Coverage (MedPay): Assists with medical costs for you and your passengers following an accident, no matter whose party is at fault.

Since its integration into the Kemper family of companies in 2018, Infinity has strengthened its position in the market by continuing to specialize in non-standard policies tailored for drivers who may struggle to find coverage elsewhere.

Infinity General Insurance Agency offers reliable, affordable policies, flexible coverage and friendly, professional service. Infinity provides non-standard coverage options and prices competitive for the risk profiles people and businesses.

Car Insurance Discounts Offered by Infinity

Infinity Insurance Agency, Inc. provides discounts including 15% for bundling, 10% for claim-free, good driver, or multi-car policies, which means the company is a good fit for people who need cheap auto insurance for multiple vehicles, and 7% for paying in full.

Infinity Auto Insurance Discounts| Discounts | |

|---|---|

| Bundling | 15% |

| Accident-Free | 10% |

| Good Driver | 10% |

| Multi-Vehicle | 10% |

| Pay-in-Full | 7% |

| Good Student | 5% |

| Prior Coverage | 5% |

| Safety Features | 5% |

| Senior Driver (Defensive Course) | 5% |

| Paperless Renewal | 3% |

Good student, prior continuous coverage and vehicles equipped with safety features qualify for an extra discount of 3–5%. Seniors may qualify for discounts after taking a defensive driving course. Insured can also avail the benefit of paperless renewal for added convenience.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Infinity Motorcycle and ATV Insurance Review

Infinity Insurance provides competitive motorcycle and ATV rates, with liability coverage starting at just $42 to $46 per period and full coverage as little as $66 to $72 per period. Slightly higher than USAA and Geico, but comparable to State Farm and Travelers.

From liability auto insurance to collision, comprehensive, watercraft and ATV submersion options, Infinity provides drivers with the reliability and security they need. Policies are flexible, covering accidents, theft and weather damage. This fact makes Infinity a smart option for your trips on-road or off it.

Infinity Motorcycle and ATV Insurance Cost

Infinity General Insurance Agency offers competitive monthly rates for motorcycle and ATV coverage, with liability vs. full coverage auto insurance options priced from $42–$46 for minimum (liability) coverage and $66–$72 for full coverage.

Infinity vs. Competitors: Motorcycle & ATV Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $47 | $73 | |

| $45 | $69 |

| $46 | $72 | |

| $38 | $58 | |

| $42 | $66 | |

| $44 | $66 | |

| $39 | $61 | |

| $44 | $68 | |

| $46 | $70 | |

| $36 | $56 |

Infinity, which Kemper acquired in 2018, isn’t the cheapest but still stacks up against State Farm, Nationwide and Travelers. With fairly higher rates than USAA or Geico, Infinity offers affordable pricing for riders who want a good balance of cost, coverage, and customer service.

Infinity Motorcycle and ATV Insurance Coverage

A company acquired by Kemper in 2018, Infinity Insurance brings its commitment to flexible, non-standard coverage to motorcycle and ATV riders. With variety of coverage options is available to safeguard everyone, no matter what level of coverage is right for your driving needs.

- Collision Coverage: Pays for repairs to your motorcycle or ATV or for the vehicle’s replacement if you’re in an accident, regardless of who was at fault. A deductible may apply.

- Comprehensive Coverage: Covers damage from non-collision events such as theft, fire, vandalism, or natural disasters. Also subject to a deductible.

- Submersion Coverage (ATV only): Helps pay for damage if your ATV is submerged in water, depending on the event and policy specifics. Coverage availability may vary by state.

- Liability Coverage: Pays for bodily injury and property damages to others if you’re at fault in an accident while using a motorcycle or ATV. Legal necessity in many states to ride.

By offering these specialized protections, Infinity provides riders with policies that can be customized to their needs, whether they prioritize liability compliance, safeguarding their investment, or managing unique risks like ATV submersion.

Whether you’re seeking collision vs. comprehensive auto insurance or need them both, Infinity has a variety of options to keep you covered. This flexible approach makes Infinity a practical option for those seeking both affordability and comprehensive protection in recreational vehicle insurance.

Infinity Commercial Auto Insurance Review

Infinity Insurance offers affordable commercial auto insurance, as low as $139 for minimum coverage and $191 for full coverage. Its rates fall in line with what Geico and Progressive offer and just below what Nationwide and Travelers offer.

With coverages such as collision, comprehensive, uninsured motorist protection, and discounts available for safe driving and multi-vehicle policies in 17 car insurance discounts you can’t miss, Infinity provides dependable and affordable coverage for business vehicles.

Cost of Infinity Commercial Insurance

Infinity Insurance, which has been a part of the Kemper family since 2018, provides competitive commercial auto insurance rates with the minimum from just $139 and the full average from about $191 monthly. Pricing sits mid-range—slightly higher than Progressive and Geico but lower than Nationwide, State Farm, and Travelers.

Infinity vs. Competitors: Commercial Car Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $145 | $199 | |

| $142 | $194 |

| $144 | $196 | |

| $135 | $185 | |

| $139 | $191 | |

| $148 | $204 | |

| $133 | $183 | |

| $146 | $202 | |

| $150 | $206 | |

| $136 | $188 |

When compared with top competitors, Infinity’s pricing demonstrates strong value for business owners managing tight budgets. These rates are in line with major providers like Geico and Progressive, and slightly lower than Nationwide and Travelers. Find the full list in our Travelers auto insurance review.

Commercial auto rates reflect vehicle use and driver history. Updating routes or mileage can reduce costs. For example, shorter or safer routes may lower your premium.

Michelle Robbins Licensed Insurance Agent

Businesses can tailor coverage to include essentials like liability, collision, comprehensive, and uninsured motorist protection. With flexible policy options for small fleets and solo operators, Infinity is a solid choice for businesses seeking affordable and reliable commercial auto coverage.

Infinity Commercial Auto Insurance Coverage

For companies that rely on vehicles, commercial auto insurance is critical. Infinity Insurance, which has been part of the Kemper family since 2018, provides customized coverage for a single vehicle or a fleet. Its insurance covers a wide variety of risks and helps companies remain in business following unexpected accidents or damage.

- Collision Coverage: This can pay for repairs or replacement of a vehicle used for business whose been involved in a covered accident. A policy and deductible limits may apply.

- Comprehensive Coverage: Covers non-collision damage to your business vehicle, including theft, vandalism, fire, animal strikes, and weather events. Includes a deductible and may have coverage limits.

- Uninsured/Underinsured Motorist Coverage: Ensures that if your commercial vehicle is struck by a driver without insurance, your repair and medical bills they can’t pay are still addressed.

Commercial auto insurance is often legally required, Infinity makes it easier for companies to meet state rules while tailoring coverage. Whether you run one delivery van, a small fleet, or multiple vehicles, its flexible plans help protect business assets, drivers, and the bottom line.

With protection for collisions, non-collision events, and uninsured motorists, Infinity is a strong choice for entrepreneurs needing affordable, reliable, and customizable commercial auto insurance. Learn how to get multiple auto insurance quotes to compare options and build a policy that fits your operation.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Infinity Commercial Auto Insurance Discounts

Managing insurance costs is a priority for every business, and Infinity Insurance—part of the Kemper family since 2018—offers a range of commercial auto insurance discounts to help reduce premiums without cutting back on protection.

- Proof of Prior Insurance Discount: Demonstrating continuous past insurance coverage, even from a different policy, can help lower your rate by showing you’re a responsible policyholder.

- Business Experience Discount: Companies with a proven history of operation and reliability may receive reduced premiums, as they’re viewed as lower risk.

- Multi-Vehicle Discount: Insure multiple business vehicles under one policy to receive a lower rate and simplify your coverage.

- Good Driver Discount: Businesses with clean driving records—no recent accidents or traffic violations—can qualify for this discount, rewarding safe driving.

These discounts reward safe, responsible business practices and encourage cost-saving strategies that benefit companies of all sizes. By combining these savings opportunities, companies can significantly reduce the overall cost of coverage.

Through prior insurance history, business experience, or safe driving, Infinity rewards steps that lower risk while protecting operations. Available discounts help businesses keep premiums affordable while maintaining dependable commercial auto coverage.

Infinity Business Insurance Review

Infinity Insurance offers cheap business insurance, with general liability insurance starting at $46, business owners policy insurance starting at $61, and professional liability insurance starting at $67. These competitive prices also covers general liability, property, product, professional liability and business interruption.

While not listed among the cheapest homeowners insurance companies, Infinity provides flexible, reliable protection for small and growing businesses.

Cost of Business Insurance With Infinity

Kemper purchased Infinity Insurance in 2018 and now its business is offering business insurance to small businesses and middle market companies at affordable rates. Its policies offer basic coverage at low monthly rates, and caters to the needs of entrepreneurs who have to find a balance between coverage and cost.

Infinity vs. Top Competitors: Business Insurance Monthly Rates| Company | General Liability | Business Owners Policy | Professional Liability |

|---|---|---|---|

| $44 | $59 | $65 | |

| $46 | $61 | $67 |

| $46 | $61 | $67 | |

| $40 | $55 | $62 | |

| $45 | $60 | $66 | |

| $43 | $58 | $63 | |

| $43 | $58 | $63 | |

| $41 | $56 | $61 | |

| $46 | $60 | $65 | |

| $42 | $57 | $64 |

These rates are consistent with the industry leaders, so Infinity is a great option for cheap, yet quality business coverage. With general liability and BOP pricing comparable to others, it offers solid value for small businesses. Get a complete view in our Progressive insurance review.

Infinity Business Insurance Coverage

Infinity Insurance, owned by the Kemper family since 2018, has you covered with varying lines of business insurance to safeguard against unforeseen financial losses. No matter whether you are a small, mid-size or rapidly growing company, Infinity’s solutions fit your business processes, people and future.

- General Liability Insurance: Protects against claims by other parties for bodily injury or property damage that occurs during business.

- Commercial Property Insurance: Assists with repair or replacement for damage to business-owned buildings, equipment and inventory caused by a covered event, such as fire or vandalism.

- Product Liability Insurance: Provides coverage for damage or injury caused by products that your business manufactured, distributed, or sold.

- Professional Liability Insurance (Errors & Omissions): Covers claims related to mistakes, negligence, or unsatisfactory work performed by your business, including legal and settlement costs.

- Business Interruption Insurance: Provides for lost income or extra expenses if your business can’t operate, like the best renters insurance companies protect tenants from financial loss.

Infinity’s ability to bundle and tailor these coverages ensures that businesses can address their unique risks without overspending. Startups might start simple with liability coverage only, while companies that have been around for a while might opt to bundle property, product and professional liability for more comprehensive coverage.

Infinity’s rates reflect coverage and risk. To save, avoid overlaps and classify usage correctly. For example, matching vehicle logs to policy terms can reduce premiums.

Melanie Musson Published Insurance Expert

With affordability and flexibility, Infinity allows business owners to protect their investments and concentrate on growth. With the proper combination of policies, companies can have confidence they can weather hardships and keep the show on the road, even when they are hit with surprise losses.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ways to Save Money on Infinity Insurance

Infinity Insurance assists in lowering individual and business premiums with a combination of discounts and intelligent policy tactics. With proactive changes and possible discounts programs, policyholders can help to keep coverage cost effective and strong.

- Enroll in Auto-Pay or EFT: Setting up automatic bank payments can lower admin costs and may earn you a small discount for the added convenience.

- Complete a Business Safety Audit: Sharing results of a safety audit can show you’re a low-risk client, potentially leading to premium discounts.

- Choose a Higher Deductible: Choosing a higher deductible can reduce your monthly premium, ideal if you can cover minor claims out-of-pocket while keeping protection for major incidents.

- Maintain Low Annual Mileage: If your vehicles are driven less or stay within a small area, you may qualify for a low-mileage discount, as fewer miles often mean lower risk.

- Bundle Commercial and Employee Coverages: Bundling coverages like workers’ comp or EPLI with commercial auto or liability may qualify your business for extra discounts.

Saving money on insurance is not about cutting on coverage; it’s about making smart, proactive decisions. By finding the best strategy, you could even lower your premium, all while keeping the policy that cares for what is most important to you.

When these strategies are combined, policyholders can have affordable coverage that is convenient and comprehensive, providing financial security for individuals and businesses that will help them get the most value from their insurance.

Infinity Insurance Reviews & Complaints

Infinity Insurance holds solid ratings across major industry review platforms. It has an A- rating from A.M. Best for strong financial stability, and according to Infinity Insurance reviews BBB, it holds a B rating for fair business practices.

Infinity Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A- Excellent Financial Strength |

| Score: B Fair Business Practices |

|

| Score: 70/100 Mixed Customer Feedback |

|

| Score: 790 / 1,000 Avg. Satisfaction |

|

| Score: 1.25 Avg. Complaints |

Consumer Reports scores it 70/100, indicating mixed feedback from buyers, and J.D. Power rates it 790/1,000, signifying moderate satisfaction from buyers.

With an NAIC complaint index of 1.25, it has a slightly higher than average number of consumer complaints, making Infinity a so-so stand as far as insurance companies go, but there’s potential for improvement when it comes to quality of service.

This Yelp review notes slow responses and language barriers at Infinity, but praises Mr. Rayor and Mr. Flores for efficient claim handling. It shows the company is improving. For tips, see how to file an auto insurance claim & win.

Pros and Cons of Infinity Insurance

Infinity Insurance Agency, Inc. has strengths and weaknesses, especially for high-risk drivers. Reviewing Infinity insurance company pros and cons helps weigh perks like SR-22 support against drawbacks like limited options and mixed service.

- Strong Financial Backing: IIA earns an A- rating from A.M. Best, indicating excellent financial strength and reliability.

- Coverage for High‑Risk Drivers: Specializes in non‑standard auto insurance, ideal for drivers with DUIs, multiple violations, or SR-22 auto insurance needs.

- Live Chat and Roadside Assistance: Offers convenient tools like 24/7 live chat and a free roadside assistance program (Infinity DriverClub), enhancing user support.

Infinity is known for its non-standard car insurance, which separates it from the big brands that will slap you with high premiums or deny coverage altogether. Supported by a rating of A- (Excellent) by A.M. Best, it forms the foundation of financial strength and stability for those it serves.

Extras such as roadside assistance and 24/7 live chat provide policyholders even more convenience.

- Limited Coverage Options: Primarily offers non-standard auto policies, with few add-ons or broad coverage choices.

- Poor Customer Satisfaction: Reviews frequently mention slow or unhelpful claims handling and poor communication.

Infinity has limits, offering fewer optional coverages and mixed reviews on claims service. Drivers who want extras, such as accident forgiveness or gap insurance, may find it doesn’t offer enough. To get even wider coverage or friendlier service, Geico, Progressive or State Farm are worth considering.

Ultimately, Infinity fills an important niche by giving high-risk drivers access to reliable and competitively priced coverage. By carefully weighing its pros and cons, customers can decide whether Infinity provides the right balance of affordability, flexibility, and dependability for their insurance needs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Explore Affordable Infinity Insurance Options

Infinity Insurance, bought by Kemper in 2018, provides flexible personal and commercial coverage with rates starting at $62 per month. In this Infinity Insurance review, it stands out for high-risk driver support, SR-22 filings, roadside assistance, and solid discounts.

However, drawbacks include higher full coverage rates and mixed customer reviews. Still, Infinity remains a solid choice for flexible, affordable coverage and high-risk driver support among the best car insurance companies.

Getting affordable rates should be quick and easy. Enter your ZIP code now to compare top providers and secure the best coverage at the lowest price.

Frequently Asked Questions

Is Infinity a good insurance company?

Yes, Infinity Insurance offers solid coverage options, especially for high-risk drivers, with features like SR-22 support and roadside assistance.

Do Infinity auto insurance reviews suggest it’s a good fit for high-risk drivers?

Yes, reviews often praise Infinity for stable pricing and coverage availability for drivers with accidents, tickets, or DUI records.

Find the right coverage at the best price. Enter your ZIP code now to compare personalized insurance quotes tailored to your needs.

How does pricing differ in State Farm vs. Infinity for full coverage?

State Farm averages $211 per month for clean drivers, while Infinity averages $284 per month but remains steadier at $83 after violations. Read our State Farm auto insurance review for more.

How much does Infinity business insurance cost?

Infinity business insurance rates start around $46 per month for general liability, with BOP and professional liability starting slightly higher. Costs vary by business type, location, and coverage limits.

Does Infinity Insurance company offer discounts?

Yes, Infinity Insurance company offers discounts for bundling, safe driving, multiple vehicles, full payments, and more. Discounts can help lower your premium by up to 15%.

Which offers better commercial auto insurance between Infinity vs. Safeco?

Infinity is often preferred by small business owners for its flexible and competitively priced commercial auto policies, whereas Safeco may cater better to larger operations. Check out our Safeco auto insurance review to see how it compares in coverage, pricing, and features.

Are there any recurring complaints in Infinity Insurance claims reviews?

Yes, recurring themes include slow claim approvals, lack of timely updates, and occasional issues with repair shop coordination. Some users report needing to escalate complaints to get results.

Does Infinity Insurance cover rental cars?

Infinity may extend coverage to rental cars used as a temporary replacement during repairs, but only if rental reimbursement is included in your policy.

How does Nationwide vs. Infinity compare in supporting high-risk drivers?

Infinity typically supports high-risk drivers better, offering SR-22 filings and steady rates after violations, while Nationwide may increase rates more sharply. Learn more in our Nationwide auto insurance review.

Does the Infinity Insurance rating affect premium costs?

Not directly, but insurers with stronger ratings may offer better pricing stability and customer trust, while weaker-rated ones might charge more to offset risk.

Can I customize my Infinity car policy to fit my needs?

What’s the difference in coverage options between Geico vs. Infinity?

How much does Infinity motorcycle insurance cost per month?

Who qualifies for Infinity insurance company discounts for senior drivers?

What are the key coverage differences between American Family vs. Infinity?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.