At just $15 per month, State Farm is the cheapest option for a $30K coverage. Travelers is the most expensive at $44 a month, putting The Hartford ($27) on the higher end, but still not the priciest.

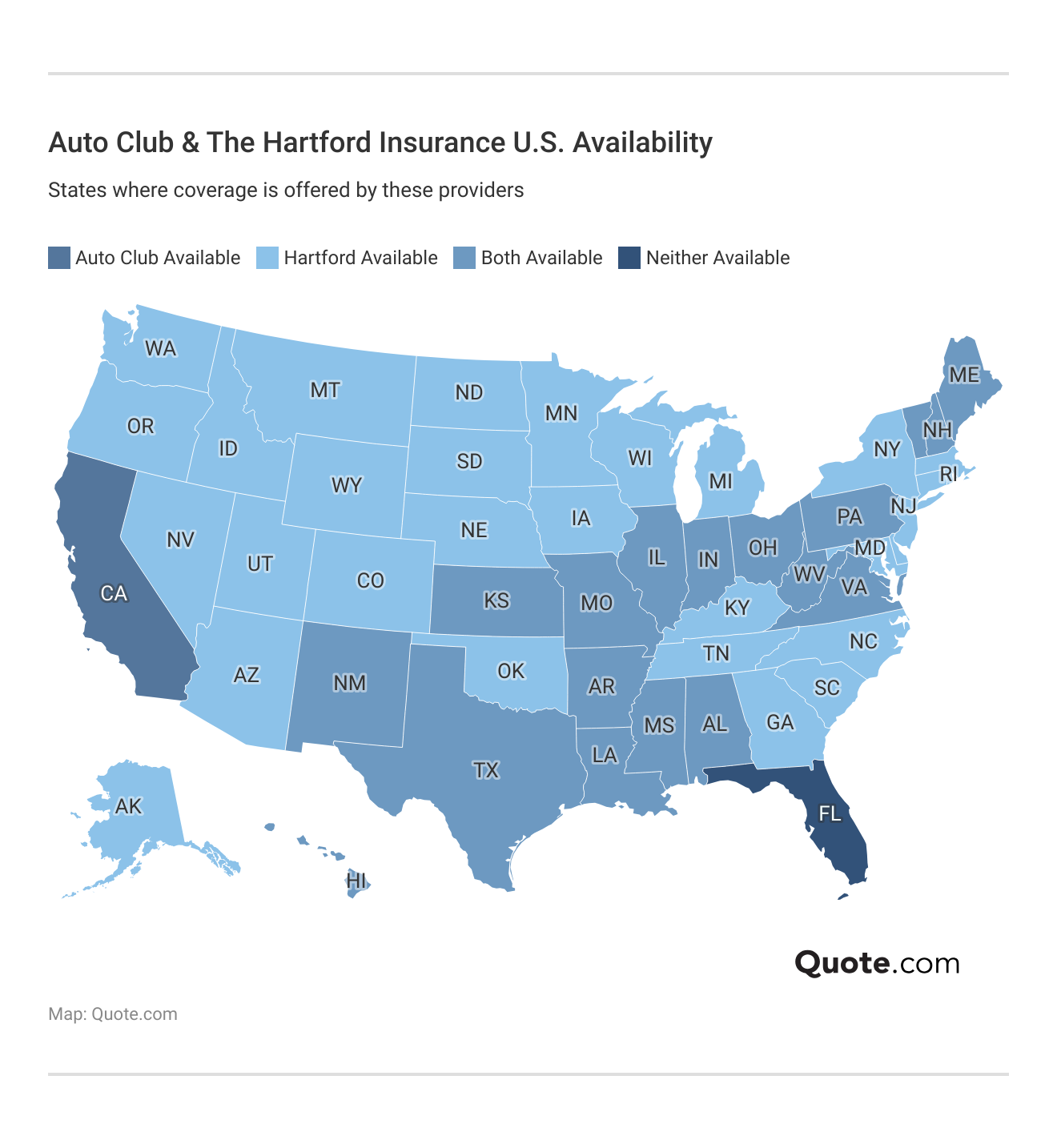

All in all, compared to the best renters insurance companies, Auto Club remains competitive, while The Hartford charges higher rates for renters insurance.