How to File an Auto Insurance Claim & Win in 2026

The first step in how to file an auto insurance claim is to collect essential information, such as police reports. Then contact your auto insurance company and make sure to save all receipts of costs. The most common type of claim filed is collision claims, making up 33% of claims filed.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

The first step in the process of how to file an auto insurance claim is to collect evidence, such as police reports. Then, contact your insurance company to let them know about the accident. It is important to keep all paperwork and receipts until the claim is resolved.

- Get photos, statements, and a police report to support your case

- Keep all paperwork and receipts until your claim is fully resolved

- Follow up regularly with your claims adjuster to get fast approval

Along with buying auto insurance, filing a car insurance claim is something all of us will most likely have to deal with at some point, so it’s important to know exactly how to do it right. We have researched how to file an insurance claim for a car accident, so you can be confident you’ll get the best results every single time.

Filed a car insurance claim and need to find auto insurance with a better rate? Enter your ZIP code in our free quote tool to find affordable companies in your area and get a free quote.

3 Easy Steps to Filing an Auto Insurance Claim

Filing an auto insurance claim may sound intimidating, but it’s actually a simple procedure, even if you live in one of the worst states for filing auto insurance claims. Basically, you do it by calling your insurance company and following their instructions on how to submit your statement and the evidence.

The important thing is to know your story and to document everything that supports your version of the accident and the damages it caused to you, especially when filing a collision or comprehensive claim, which are some of the most common claims.

5 Most Common Auto Insurance Claims in the United States| Rank | Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|---|

| #1 | Collision Accidents | 50% | $4,000 |

| #2 | Weather-Related Damage | 18% | $3,000 |

| #3 | Theft and Vandalism | 12% | $3,800 |

| #4 | Animal Collisions | 10% | $3,600 |

| #5 | Glass and Windshield Damage | 10% | $500 |

Since there is a right result here: getting paid for your damages and the grievances caused by the accident with a reasonable insurance claim quote. It can be achieved if you follow the right steps.

Step 1: Gather Essential Information

Contacting the police and the DMV when it’s required by your state’s law is an essential first step after an accident and before filing your auto insurance claim.

If you didn’t do it at the scene of the accident, contact the police. Besides being mandatory in some states to call the police after an accident, the police report comes in handy when you need to file your insurance claim, such as a liability auto insurance claim.

Having a police report is also valuable if you were a victim of a hit-and-run accident.

You may need to contact the DMV. Some states also require that you contact the DMV after an accident, especially if there were injuries or substantial damage to a vehicle.

Step 2: Contact Your Insurer

Tell your insurance company about the accident right away. As soon as you can, call your insurer and inform them that you’ll be filing a car accident claim. The need to get in touch with your car insurance company is even more important if the accident caused a total loss of the vehicle and you are filing a gap insurance claim.

Don’t forget that you’re fighting to get the largest possible sum. It can be easy to forget that even if you’re paying the insurance company, the insurance adjuster works for them, so be careful what information you give, even when working with one of the best companies for auto insurance claims.

10 Best Auto Insurance Companies for Claims Handling| Company | Rank | Claims Satisfaction | Best for |

|---|---|---|---|

| #1 | 733 / 1,000 | High reviews, regional availability |

| #2 | 728 / 1,000 | Quick online claim tools | |

| #3 | 717 / 1,000 | 24/7 claims, mobile app support |

| #4 | 710 / 1,000 | Fast claims, large agent network | |

| #5 | 706 / 1,000 | Weather delays, solid handling | |

| #6 | 692 / 1,000 | Online focus, fewer agents | |

| #7 | 692 / 1,000 | Strong local agent presence |

| #8 | 691 / 1,000 | Claim guarantee, mobile tools | |

| #9 | 684 / 1,000 | Consistent but slightly slower | |

| #10 | 672 / 1,000 | Easy digital access, mixed reviews |

You don’t need to tell every detail of the accident to your insurance company. Just tell the claims adjuster that you are going to file a claim and that you want to know what the steps are.

If the accident was caused by the other driver, briefly explain how it happened, and make sure to follow all the necessary steps of how to file an insurance claim against another driver.

Don’t share your medical records with your insurance company. You have the right to go see the doctor of your choice if you were injured in any way by the car accident.

This step is essential not only for taking care of yourself but for documenting the injuries and the extent of your personal damages. Remember: if the insurance company suggests that you should go see a doctor they have picked, you don’t have to do it.

Ask about the terms of your insurance policy. It’s essential that you know what you’re dealing with and what your rights are under your insurance contract.

Step 3: Save All Receipts

This includes costs and expenses connected to any impact caused by the accident, from repairs to the car to medical expenses and missed work days.

Don’t give any estimation of the damages from the accident. If you rush to provide them with a sum before you know the exact amount of the damages, you’re most likely setting the claim quote amount that the company will offer.

Settling a claim quickly before knowing the final damage amount could be a mistake if the personal or property damages end up being higher than you estimated.

Daniel Walker Licensed Insurance Agent

Prepare yourself to give an interview. The insurance company’s claims adjuster will probably request to interview you about the accident. You may want to write down what happened during the accident before this interview.

That will help you not get confused or contradict yourself when the insurance adjuster asks about tiny details of the accident to create a traffic collision reconstruction.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Handling an Auto Insurance Company Claim

When handling a claim, be polite, keep your cool, and don’t settle for less than the cost of your damages. If you accept a settlement too soon and your damages keep going up, you will end up paying them out of pocket.

Instead, examine the company’s offer and negotiate. Keep the following in mind as you handle a claim:

- See Who Your Adjuster Is: You should get the name, email, and phone number of the person who has been assigned to manage your case.

- Keep the Adjuster on Your Side: Being friendly and polite during the insurance adjustment process will increase your chances of getting the largest possible settlement.

- Avoid Blaming Yourself: If it was your fault, the evidence would show it, but don’t blame yourself in any way.

- Focus on Other Driver’s Behavior: For instance, for an intersection accident, say: “The other driver hit me when I was at the intersection.”

- Don’t Accept First Offer: They may make you an offer right away before you have a clear idea of the total amount of your damages.

You have no obligation to accept the cheapest car insurance offer made by your insurance company, much less to do it right away. You can take your time to study the offer and to ask exactly how they came up with that number.

If you think your damages are higher than what you were offered, present the documents to prove it.

How to Negotiate With the Claims Adjuster

The insurance adjuster is not your friend. It’s actually a bit like a frenemy. You need to keep him/her on your side while pushing for the highest possible settlement.

So stick to these points when conducting the insurance claim process and the negotiation. Yes, you can handle this negotiation on your own.

- Show Good Faith: Even if negotiations become difficult or you feel that they are disrespecting you by offering a low amount the first time around, don’t lose your patience.

- Gradually Lower Your Offer: Once you are sure you know the extent of your damages and have provided all the evidence, you can make a counteroffer that is smaller than your original demand.

- Settle Once Agreement Reached: You shouldn’t agree to settle unless the sum will cover all your most important damages and costs derived from the accident.

If you keep your head cool and gather all the necessary information and documents, you should be able to secure a satisfactory settlement.

You also want to stick to the facts that support your story. You should demonstrate to the adjuster that you are well informed of the details of the accident and that you understand both your rights and the value of your claim.

The facts will come from your own account of the accident, but be on the lookout for sections from the police report, statements from witnesses that support your version of the crash. Be aware of what you and others post on social media, as this could impact the outcome of your claim settlement.

Next, have the total sum of your damages, and be ready to explain every item, such as medical bills, if making a medical payments coverage claim. In the end, the insurance company should reimburse you for the damages up to the limits of your insurance policy if you have the documents to prove them.

In other words, if there is no question about who is at fault for the accident (either because it’s clear or because you’re in a no-fault state), the insurance company will want to settle with you.

Know the minimum you are willing to take, but aim high in the beginning. It will put a threshold for the initial low offers you can expect from the company, it will give you the incentive to go above it, and it will tell you when you have reached a satisfactory settlement.

This is, perhaps, the most important aspect of this negotiation process. Keep in mind that the insurance company will try to make you settle for as little as possible until you build a solid case for your damages.

The important thing, though, is to be tough in the beginning when the insurance settler tries to offer a low sum. If you think the settler is not giving your claim or your demands enough professional attention, you can always ask to speak to his or her supervisor, or even to switch to a different adjuster.

What to Do if You Can’t Reach an Agreement

Sometimes, the negotiation can reach a deadlock. You may think the insurance agent is not taking your demands seriously or is not giving your claim the attention it deserves. Not being able to reach an agreement with the insurer is not the end of the road

There are several options if you feel the company is not giving your claim the respect it deserves. Here’s what to do:

- Speak to a Supervisor: Even though the adjuster will probably try to talk you out of this, if you request to speak with a supervisor, they must escalate the claim.

- Call Your State’s Insurance Department: When you reach out to them, you’ll be arguing that the company has not shown good faith during the negotiation and settlement process.

- Contact an Attorney: Hiring an attorney with experience in car accidents can tell you if your compensation request has merit, conduct the negotiations on your behalf, and even sue.

If you go with the first option, it is likely that the supervisor will try to find a solution to the claim, especially if you show that you have a good case and you’re willing to escalate your claim in case there’s no satisfactory resolution.

If you do this, gather any information (emails come in handy here) about delays in the negotiation, as well as documents that prove that they’re not making offers that actually do justice to the merits of your claim.

If you decide to get in touch with an attorney, the mere involvement of an attorney in an insurance claim may make the company increase its offer.

Dani Best Licensed Insurance Producer

When all is settled, consider moving to a new insurance provider and bundling your policies so that if you get life insurance, for example, you get a discount on car insurance (Learn More: Car Insurance Discounts You Can’t Miss).

Things to Do Immediately After an Accident

Being in a car accident is obviously a stressful experience, but what you do right after getting out of your car can determine the results of your auto insurance claim. So it’s important to know and follow these steps in the scene of the collision.

What to Do After a Traffic Accident: 10 Steps to Take| Step | Action | Details |

|---|---|---|

| #1 | Ensure Safety | Move to safety, check for injuries |

| #2 | Document the Scene | Take photos of damage and area |

| #3 | Exchange Information | Share contact and insurance info |

| #4 | Contact the Police | File report if required or serious |

| #5 | Notify Your Insurer | Call or file online or app |

| #6 | Submit Documents | Photos, reports, and statements |

| #7 | Get an Estimate | Insurer or shop inspects damage |

| #8 | Review Coverage | Limits, exclusions, and deductible |

| #9 | Repair Your Vehicle | Use approved repair shop |

| #10 | Follow Up | Track claim and payment staus |

The keys here are staying calm and gathering evidence. You should not argue with the other driver, even if you believe you have absolutely no responsibility for the accident. Arguing with the other driver may make them angry and not want to cooperate, which can hurt your no-fault claim.

It may also make them try to blame the accident on you, even if it wasn’t your fault. Some other steps to follow include:

- See if Anyone Is Injured: Most legislation doesn’t require you to give help, but you could be sued if you don’t help an injured party and it turns out that the accident was your fault.

- Don’t Admit Guilt: Don’t put yourself in the position of saying anything you may regret later when dealing with the car insurance company or in a court of law.

- Call the Police: When the officers come and take your statement, give them a precise and truthful version of what happened.

- Get the Other Driver’s Info: You’ll need the other driver’s name, driver’s license number, vehicle model, license plate number, and the name of their insurance company.

- Take Pictures of the Scene: These photos, as well as any details you write down that help you remember what happened, will be useful when you deal with the insurance company later on.

For instance, if it was raining or if a tree branch was blocking a stop sign, you should write it down and take a photo for your comprehensive claim (Read More: Collision vs. Comprehensive Auto Insurance). If anyone saw what happened, take their name and contact information, and ask them if they can stick around until the police show up.

If you think your car could qualify for a total loss, get it towed. If your car is totaled, the claim might take longer.

A good tip here for speeding up the damage claim is to get it towed to your insurance company’s preferred body shop.

Learn the Basics of Auto Insurance

There are two types of car insurance, and which kind you have depends on where you live. If you live in a fault state, you’ll want minimum coverage at the very least.

Auto Insurance Monthly Rates by Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $32 | $84 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

The rules the states have put in place fall into one of these two categories: “full tort insurance” and “no-fault.” The bottom line is that on top of the quality of insurance you have, your home state will also impact your coverage.

Auto Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $32 | $45 | $60 | $38 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

In a “full tort insurance” system, whoever caused the accident pays. This doesn’t mean that the driver actually pays out of pocket: his/her insurance company does. So, if you live in a full tort insurance system and the accident was caused by the other driver, you will be seeking compensation from their car insurance company.

Most states have a tort system, but the specific regulations vary from state to state, so it’s helpful to find out what the laws are in your state before filing a claim.

In the “no-fault state” system, you deal with your own insurance company. Under these regulations, your insurance provider automatically pays for your damages, regardless of who was at fault, up to a limit. In no-fault states, you can only sue the other driver when the accident and the personal and property damages meet certain conditions.

In other words, there is a “threshold” under which you can’t sue. The following states currently have true no-fault insurance laws: Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, Puerto Rico, and Utah.

The state you live in may not only determine the possible outcome of your insurance claim, but it may also impact the cost of your insurance premium the following year, as claims will increase rates if you lose out on a claims-free discount.

Best Claims-Free Auto Insurance Discounts by Savings| Insurance Company | Savings | Eligibility |

|---|---|---|

| 31% | 5+ years clean record | |

| 30% | 5+ years accident-free |

| 26% | 5 years no claims | |

| 25% | 3+ years no accidents | |

| 25% | No at-fault accidents, 3 years |

| 25% | 5 years claims-free, clean record | |

| 23% | 3+ years clean driving record | |

| 20% | 3+ years no claims | |

| 20% | 5 years claims-free history | |

| 20% | 5+ years no claims |

If you lose the discount, your rate will go back to the higher cost it was before the claims-free discount was applied. And if the claim was for an at-fault accident, the rates may increase even more.

Auto Insurance Monthly Rates Before and After Filing a Claim

| Company | No Claim | Liability | Collision | Comprehensive |

|---|---|---|---|---|

| $87 | $122 | $127 | $103 | |

| $32 | $67 | $72 | $48 |

| $76 | $111 | $116 | $92 | |

| $43 | $78 | $83 | $59 | |

| $96 | $131 | $136 | $112 |

| $63 | $98 | $103 | $79 | |

| $56 | $91 | $96 | $72 | |

| $47 | $82 | $87 | $63 | |

| $53 | $88 | $93 | $69 | |

| $32 | $67 | $72 | $48 |

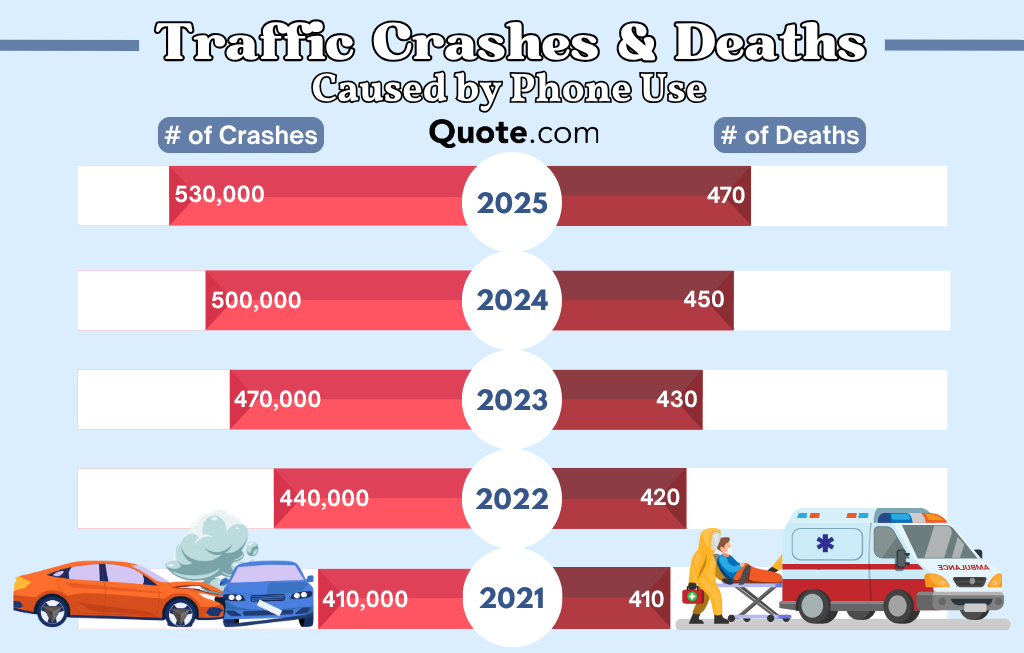

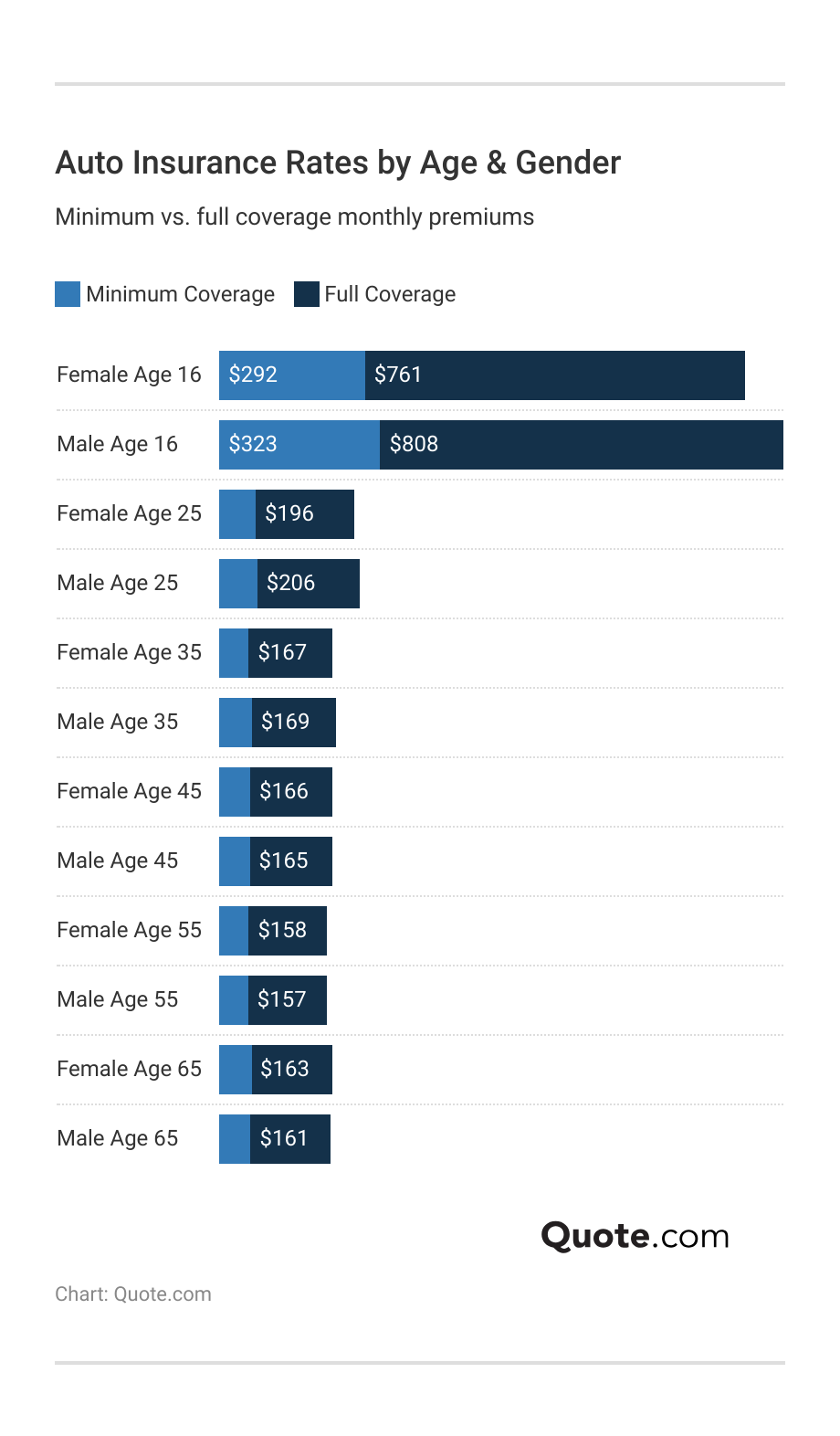

Your age and gender will also impact what you pay for auto insurance, no matter what state you live in. Younger drivers are more likely to file claims than older drivers, driving up the cost of insurance.

Other concepts you should know include “comprehensive auto policy.” Under a comprehensive auto insurance policy, your car is protected against a number of extra damages, including those caused by animals and natural disasters (Read More: When Animals or Natural Disasters Damage Your Vehicle).

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Get the Most From Your Car Insurance Claim

Knowing how to file an auto insurance claim will help the process go smoothly. The insurance company will certainly try to pay you a low amount if they can, but they’re also supposed to negotiate and settle in good faith. If they don’t, it may be time to find a new auto insurance company.

Learn More: How to Compare Auto Insurance Companies

If you follow the steps mentioned above, you should win car insurance claims and get a reasonable settlement. The key elements here are documenting your damages, negotiating politely, and not settling for anything that is less than fair.

Need a quote from a quote company to find reasonable auto insurance prices? Use our free quote tool to shop for affordable auto insurance near you.

Frequently Asked Questions

What are the three steps to filing an automobile insurance claim?

Wondering what are 3 important tips on filing an auto insurance claim? First, make sure to gather essential information like police reports. Then, contact your auto insurance provider and provide them with the accident information. Finally, make sure to save all receipts during the claims process.

When someone hits you, do you call your insurance or theirs?

Even if the other driver is at fault, call your insurance first. They will handle filing a claim against the other company.

How do I claim insurance if it’s not my fault?

If you are filing a comprehensive auto insurance claim for damages that weren’t your fault, such as a tree falling on your car, you simply call your insurance company. Likewise, if you are hit by another driver, you should still call your insurance company to report the incident.

How long after an accident do you have to file a claim?

It is best to file a claim right away, as states have a statute of limitations on how long you have to file a claim. The statute of limitations can range anywhere from a year to a few years, depending on the state.

Is it better to file a claim with your insurance or theirs?

Call your insurance company for assistance in an accident. If the other driver was at fault, your insurance company will help resolve the claim with the other company.

What is the best way to make an insurance claim?

Insurance companies offer plenty of ways to file an insurance claim. You can choose the best way that works for you, whether it’s calling your insurance company or filing a collision auto insurance claim online.

What not to say when you hit a car?

Do not admit fault if you hit a car. Instead, let insurance companies sort out the claim.

Should I file a claim if I’m not at fault?

If you are not at fault, you should still contact your insurance company to start a claim. Need to find a new auto insurance company after a claim? Use our free quote tool to find affordable coverage in your area.

Can you get insurance claim quotes?

Yes, you can get an insurance claim quote from auto body shops for the estimate of repairs. Let the shop know, “I need a quote for estimated repairs.” You should also make sure you are choosing a repair shop with reasonable repair fees (Read More: 7 Ways You’re Wasting Money on Your Car).

What is the downside of filing an insurance claim?

If you are at fault for an accident, the downside of filing an insurance claim is that it will raise your auto insurance rates.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.