Farmers vs. USAA Auto Insurance in 2026

When comparing Farmers vs. USAA auto insurance, you should consider the coverage options, monthly premiums, and membership requirements from each company. USAA auto insurance is cheaper at $32 per month, while Farmers starts at $76. However, you need to qualify for USAA membership to buy a policy.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated December 2025

Comparing Farmers vs. USAA auto insurance shows USAA is often more affordable and has higher customer satisfaction.

- USAA tends to be significantly cheaper than Farmers

- Farmers offer coverage options that USAA does not, like gap insurance

- You need a membership to purchase USAA car insurance

USAA may offer the cheapest car insurance, but not everyone qualifies for USAA membership. If you don’t qualify, Farmers will be a better option.

While USAA has a lot of benefits, Farmers has more coverage options. For example, Farmers offers gap insurance, while USAA does not.

Farmers vs. USAA Auto Insurance Rating| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.2 | 4.8 |

| Business Reviews | 4.0 | 4.5 |

| Claims Processing | 3.3 | 5.0 |

| Company Reputation | 4.5 | 5.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.7 |

| Customer Satisfaction | 2.0 | 2.4 |

| Digital Experience | 4.5 | 5.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.6 |

| Plan Personalization | 4.5 | 5.0 |

| Policy Options | 5.0 | 4.7 |

| Savings Potential | 4.5 | 4.8 |

| Farmers Review | USAA Review |

Read on to compare USAA insurance with Farmers to see which provider is the best choice for you. Then, enter your ZIP code into our free comparison tool to see personalized rates in your area.

Farmers vs. USAA Car Insurance Rates

A USAA quote for auto insurance is typically one of the most affordable options drivers will find, while Farmers’ rates are average. However, you can only purchase USAA car insurance if you meet the membership requirements. To be a USAA member, you’ll need to be either an active or retired military member or a direct family member.

If you don’t qualify for USAA membership, you can still shop with Farmers. Farmers isn’t as cheap, but it still has affordable rates. Check below to see how much you might pay at either USAA or Farmers.

Farmers vs. USAA Auto Insurance: Monthly Full Coverage Rates| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $1,156 | $349 |

| 16-Year-Old Male | $1,103 | $356 |

| 30-Year-Old Female | $228 | $106 |

| 30-Year-Old Male | $239 | $113 |

| 45-Year-Old Female | $199 | $84 |

| 45-Year-Old Male | $198 | $84 |

| 60-Year-Old Female | $171 | $75 |

| 60-Year-Old Male | $183 | $75 |

As you can see, USAA offers lower rates to every age bracket. That’s particularly true for teens and younger drivers.

When it comes to auto insurance rates, USAA is hard to beat. For most drivers, USAA auto insurance quotes are the cheapest on the market.

When you’re trying to figure out how to buy auto insurance, comparing quotes is your best option to find affordable rates. You can visit USAA and Farmers’ websites and fill out their quote request form to see personalized rates.

If you don’t want to take the time to fill out applications, you can always enter your ZIP code into our free comparison tool to see multiple quotes at once.

Farmers vs. USAA Auto Insurance Rates by Driving Record

While many factors affect your Farmers and USAA auto insurance quotes, one of the most important is your driving record. Drivers with a clean record can pay half as much for car insurance compared to people with accidents, speeding tickets, and DUIs.

Between Farmers and USAA, Farmers sees the highest increase in premiums after a driver receives a traffic violation, while USAA stays relatively low.

Kristine Lee Licensed Insurance Agent

Check below to see how USAA and Farmers compare when it comes to your driving record.

Keeping your driving record clean is crucial to keep your rates low. If you have bad marks on your driving record, they’ll eventually fall off as long as you don’t get additional violations.

In addition to higher rates, you’ll also likely need SR-22 insurance to keep driving for a few years.

Read more: Is it bad to cancel your auto insurance?

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers vs. USAA Auto Insurance Options

As two of the largest insurance companies in the country, you can get a Farmers or USAA car insurance quote with a variety of coverage options. These include the following basic types of coverage:

- Liability Insurance: Purchase liability auto insurance to ensure you can pay for any damages or injuries you cause in an at-fault accident.

- Collision Insurance: Collision auto insurance covers your vehicle after an accident, no matter who is at fault.

- Comprehensive Insurance: If you want protection from unexpected events like fire and theft, you need comprehensive auto insurance.

- Uninsured/Underinsured Motorist: Uninsured/underinsured motorist insurance protects you against drivers without enough coverage.

- Medical Payments/Personal Injury Protection: Get either medical payments or personal injury protection insurance so your health care costs are always covered.

These basic types of insurance offer everything you need for either a minimum or full coverage policy. If you want additional coverage, both Farmers and USAA offer these add-ons:

- Rideshare Insurance: If you drive for a rideshare company like Uber or Lyft, rideshare insurance will protect you while you work.

- Accident Forgiveness: To prevent your rates from increasing after your first accident, USAA and Farmers offer accident forgiveness.

USAA doesn’t offer other add-ons, which leaves some drivers wanting. However, Farmers offers a few more add-ons, including new car replacement, loss of use, custom equipment, and OEM parts coverage.

Farmers vs. USAA Car Insurance Discounts

Like most insurance companies, USAA and Farmers offer a variety of discounts to help you save. Although USAA car insurance quotes are usually cheaper, Farmers typically offers more discounts.

Most insurance discounts will apply automatically to your account, but you may need to submit proof for some. Take a look below to compare Farmers Insurance vs. USAA auto insurance discounts.

Farmers vs. USAA Auto Insurance Discounts| Discount | ||

|---|---|---|

| Good Driver | 30% | 30% |

| Bundling | 20% | 10% |

| Safety Features | 15% | 15% |

| Loyalty | 12% | 11% |

| Low Mileage | 10% | 20% |

| Anti-Theft | 10% | 15% |

| Defensive Driving | 10% | 5% |

| Safe Vehicle | 5% | 5% |

| Paperless | 3% | 3% |

| Military | X | 30% |

In addition to the discounts listed above, Farmers offers a variety of savings opportunities that USAA does not. These discounts include savings for employees in certain industries, signing up for paperless documents, adding a teen to your policy, and driving an electric vehicle.

Read More: 26 Hacks to Save More Money on Auto Insurance

Farmers vs. USAA Usage-Based Insurance

If you’re worried that you cannot afford your auto insurance, usage-based insurance can help you save.

Both USAA and Farmers offer a UBI program to help you save. USAA offers SafePilot, while Farmer’s UBI program is the Signal app. Both programs have a maximum discount of 30%.

Before signing up for a UBI program from either company, you should understand what they track to make sure it’s a good fit for you. UBI programs typically track the following driving behaviors:

- Sudden Stops

- Rapid Acceleration

- Time of Day

- Mileage

- Phone Use

If you’re worried about how your driving behaviors will affect your insurance rates, a UBI program might not be the right choice for you.

USAA’s SafePilot won’t increase your rates, but you may see higher premiums with Farmers’ Signal if your driving score is low.

Jeff Root Licensed Insurance Agent

If you’re interested in UBI savings, USAA and Farmers don’t offer the largest maximum discount. That honor goes to Allstate and Nationwide, who offer savings of up to 40%.

Farmers vs. USAA Insurance Reviews

When you compare USAA vs. Farmers auto insurance, customers are generally more pleased with the former.

USAA’s affordable rates, military-centric discounts, and excellent customer service appeal to most drivers. It’s also easy to get a quote when you use the USAA website.

Farmers, on the other hand, is a little more hit-or-miss with its customer reviews. Many drivers enjoy the coverage options Farmers offers, while others are shocked by the number of rate increases they see.

In general, Farmers gets fewer positive reviews than USAA because it costs more. If you choose to shop with Farmers, use our 17 tips to save on your auto insurance.

Both companies receive strong third-party ratings for business reviews. The table below shows how well each does.

Insurance Business Ratings & Consumer Reviews: Farmers vs. USAA| Agency | ||

|---|---|---|

| Score: 706 / 1,000 Lower-Than-Average Satisafaction | Score: 882 / 1,000 Above Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: A++ Excellent Business Practices |

|

| Score: 82/100 High Customer Satisfaction | Score: 96/100 High Customer Satisfaction |

|

| Score: 1.32 More Complaints Than Avg. | Score: 1.74 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A++ Superior Financial Strength |

According to the NAIC, USAA does a little better than Farmers with most third-party rating companies, but it receives slightly more complaints. The USSA Better Business Bureau (BBB) rating is also higher than Farmers’.

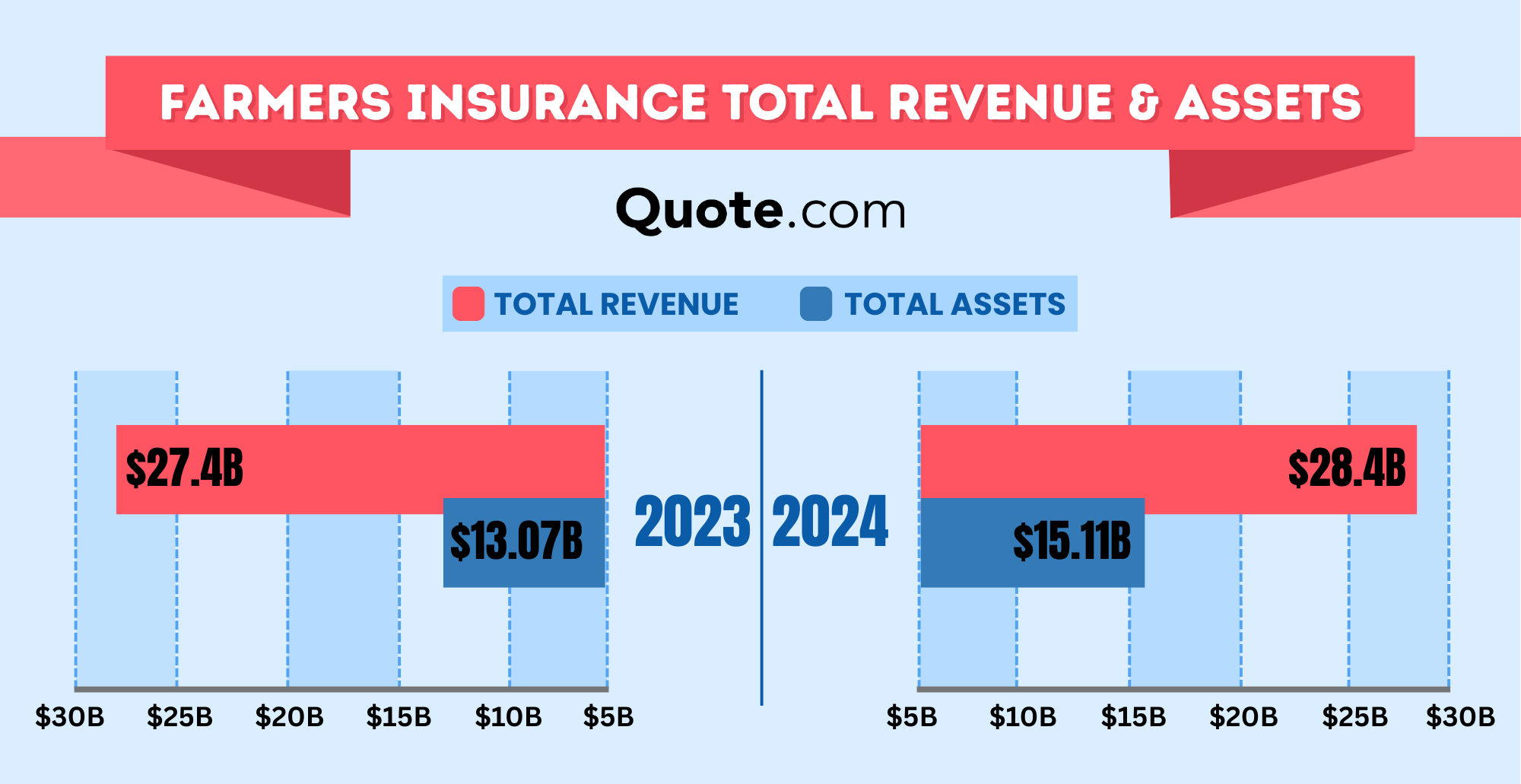

Curious to see how USAA and Farmers do for sales? Check below to see each company’s total market share in the U.S.

Despite having strict membership requirements, USAA sells more auto insurance policies than Farmers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers Auto Insurance Pros and Cons

A simple pros and cons list can’t tell you everything you need to know about Farmers, but it’s a good start. The benefits of shopping at Farmers includes:

- Generous Discounts: With over 20 discounts to help you save, Farmers strives to keep its rates as low as possible.

- Excellent Coverage Options: Farmers offers plenty of ways to customize your car insurance policy.

- Strong UBI Program: The Signal app offers a solid discount of up to 30%, and most drivers find it easy to use.

As with all companies, Farmers has its downsides, too. Make sure to look out for the following before you buy a Farmers policy:

- Unexpected Rate Increases: Aside from having overall higher rates, many drivers report that their premiums increased unexpectedly.

- Slow Claims Process: Many drivers say they are unsatisfied with the Farmers’ claims process, saying it is too slow.

Now that you have an idea of the pros and cons of Farmers, next up is USAA.

USAA Auto Insurance Pros and Cons

USAA is one of the most popular insurance choices due to its low rates, but it’s not the best choice for everyone.

Before you buy a policy, take a look at the best and worst parts of USAA car insurance reviews:

- Military Savings: USAA is known for having the best auto insurance for disabled veterans, active members, and their families by helping them save.

- Affordable Rates: No matter what type of driver you are, USAA is probably your cheapest option for insurance.

- Excellent Customer Service: USAA customer service has a reputation for being helpful, friendly, and professional.

Even the best insurance companies have weaknesses. You’ll need to be aware of the following if you’re interested in USAA auto insurance:

- Membership Required: Only active and retired military members and their families are eligible for USAA membership.

- Limited Coverage Options: Despite being such a popular option, USAA has a small variety of coverage add-ons. Most notably, USAA doesn’t offer gap insurance.

Keep in mind that most USAA auto insurance reviews are positive despite the company having a few shortcomings.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Compare Farmers vs. USAA Auto Insurance

When you compare Farmers and USAA auto insurance reviews, USAA tends to outdo Farmers. However, Farmers is an excellent choice for drivers who aren’t retired or active military members.

Now that you know how to get multiple auto insurance quotes from USAA and Farmers, your next step should be to compare rates with other companies. To get started, enter your ZIP code into our free comparison tool today.

Frequently Asked Questions

Is USAA a good insurance company?

USAA is considered one of the best car insurance companies. While it struggles with some customer complaints, and you need to be a member before you can purchase coverage, many drivers love USAA. Read our USAA auto insurance review to learn more.

Is Farmers a good insurance company?

Most drivers consider Farmers a good insurance option when they want more coverage than a basic insurance policy. However, Farmers may not be the best choice if you need the cheapest insurance possible.

Is USAA better than Farmers?

Whether or not USAA is better than Farmers depends on your specific insurance needs. USAA is typically more affordable than Farmers, making it a great choice for those seeking to save. However, only active or retired military members and their families can purchase USAA insurance. If that doesn’t apply to you, Farmers will be the better option.

Who is better, Farmers, USAA, or 21st Century?

When you compare 21st Century vs. USAA, you’ll see that USAA is more affordable and has better overall ratings. Similarly, comparing 21st Century vs. Farmers also shows that Farmer is the overall stronger choice for insurance. Learning how to compare auto insurance companies will help you make the right decision.

Who qualifies for USAA membership?

Active and retired military members and their direct families qualify for USAA membership.

Is The General better for high-risk drivers than USAA?

When you compare The General vs. USAA for high-risk drivers, USAA is usually the cheaper option. However, The General sells coverage to people struggling to get insurance from a standard company. If USAA won’t sell you a policy because you have too many traffic violations, The General is a good option.

Does Farmers or USAA offer farm insurance?

Looking for auto insurance for farmers? Farmers offers coverage designed for agricultural machines, while USAA doesn’t have specialized policies. However, you can get coverage for building on your farm through USAA. Other companies may have better coverage. For example, compare Farmers and USAA vs. Farm Bureau to find the best farm coverage. To learn more, check out our Farm Bureau auto insurance review.

Is Farmers or USAA auto insurance cheaper?

USAA’s monthly rates start at $32, while Farmers rates start at $76 per month. Not only is USAA often cheaper than Farmers, but there tends to be a significant difference in prices. To see rates from other Farmers and USAA auto insurance competition, enter your ZIP code into our free comparison tool.

Is Root better for pay-as-you-go auto insurance than USAA?

Comparing Root vs. USAA car insurance options for low-mileage drivers shows that Root is a better option because its policies are designed for infrequent drivers. Although USAA offers a solid pay-per-mile option, Root is generally considered one of the best pay-as-you-go auto insurance companies on the market.

Does Farmers or USAA offer gap insurance?

Neither USAA nor Farmers offers gap insurance. However, you may be able to get some coverage for a new car loan by talking with Farmers Insurance customer service.

Is State Farm cheaper than USAA?

Does USAA or Farmers offer accident forgiveness?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.