Farmers Insurance Review for 2026

Our Farmers insurance review found it offers comprehensive coverage starting at $62 per month, with drivers saving up to 45% through safe driving, multi-policy, and pay-in-full discounts. While rates vary by record and state, Farmers delivers wide coverage options across auto, home, renters, and more.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health insu...

Rachael Brennan

Updated September 2025

Our Farmers insurance review breaks down how its customizable coverage options, digital tools, and broad policy offerings stack up against cheaper providers.

Farmers Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 4.2 |

| Business Reviews | 4.0 |

| Claims Processing | 3.3 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.1 |

| Customer Satisfaction | 2.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.3 |

| Plan Personalization | 4.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.5 |

With rates starting at $62 per month, Farmers delivers strong value for households needing auto, home, renters, and life insurance in one place. Its policies come with a wide range of discounts and optional add-ons like rideshare coverage, accident forgiveness, and roadside assistance.

- Farmers insurance rates start at $62 per month with bundling discounts up to 20%

- Offers customizable coverage tools to match risk level, car value, and usage

- Farmers covers auto, home, life, renters, and more under one digital account

Shopping for insurance can feel overwhelming, but you don’t have to do it alone. Enter your ZIP code into our free comparison tool to get started.

Farmers Auto Insurance Review

Our review shows how Farmers offers a balance of flexible coverage options, reliable service, and low rates for drivers seeking the best auto insurance for good drivers.

Farmers Auto Insurance Cost

This shows how sharply Farmers auto insurance rates drop as drivers get older—and how close the rates are between genders at each age bracket. At 16, both males and females pay the same steep rate of $452 per month. But by age 25, rates drop significantly, approaching the cheapest car insurance at $168 for females and $179 for males.

That downward trend continues with each age group, dipping to just $62–$63 by age 65. While men tend to pay slightly more than women up until their mid-40s, the gap is fairly small. If you’re a younger driver or shopping for a teen, this chart is a helpful reminder of how expensive premiums can be early on—and how much more affordable coverage becomes as drivers build experience and avoid claims.

Auto Insurance Rates by Company

If you are comparing Farmers car insurance rates to those of other major auto insurers, the differences stand out right away. Farmers charges $76 per month for minimum coverage and $198 for full coverage, which places it in the middle range.

Farmers vs. Top Competitors: Auto Insurance Monthly Rates| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $65 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Geico and USAA Insurance are the most affordable options, offering minimum coverage at $43 and $32 per month, respectively. On the other hand, Liberty Mutual, Allstate, and Travelers have much higher rates. For full coverage, Farmers is more affordable than Liberty Mutual at $248 and Allstate at $228, but it is not as low as Geico at $114 or USAA at $84.

When it comes to driving history, Farmers starts at $76 per month for minimum coverage if you have a clean record. A single ticket raises it to $95, while an accident brings it up to $109. For full coverage, a clean record costs $198 per month, but one ticket increases it to $247, and an accident pushes it to $282.

To figure out what coverage fits you best, start with your car’s value and driving habits, then adjust with Farmers digital tools to match your risk level.

Jeff Root Licensed Insurance Agent

Farmers auto insurance reviews often highlight how violations can sharply impact costs. A DUI results in a monthly rate of $275, but Farmers car insurance discounts help safe drivers keep premiums lower, showing the value of maintaining a clean record.

Rates by Driving Record

Looking at these rates, you can see how much driving history affects what you’ll pay. Farmers, at $76 a month for a clean record, lands in the middle compared to others—cheaper than Liberty Mutual’s $96 but higher than Geico’s $43 or USAA’s $32. After an accident or DUI, rates jump noticeably for every company, with Liberty Mutual topping the chart at $178 after a DUI.

Farmers vs. Top Competitors: Auto Insurance Monthly Rates by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

Even a single ticket pushes premiums up, though USAA and State Farm keep those increases relatively modest. If you’re shopping around, this makes it clear that your record can swing your monthly bill by a wide margin, and some insurers are much more forgiving than others.

Farmers Auto Insurance Coverage

The key auto insurance coverage options available through Farmers, showing exactly what each type protects. Liability coverage handles costs if you injure someone or damage their property. Collision coverage pays for repairs to your car after a crash, while comprehensive coverage takes care of non-collision events like theft or hail damage.

Car Insurance Coverage Options Offered by Farmers| Coverage | |

|---|---|

| Liability | Covers bodily injury and property damage to others. |

| Collision | Covers damage to your car from a collision. |

| Comprehensive | Covers non-collision events like theft or hail. |

| Medical Payments (MedPay) | Pays for medical expenses regardless of fault. |

| Personal Injury Protection (PIP) | Covers medical costs and lost wages. |

| Uninsured/Underinsured Motorist | Covers you if the other driver lacks insurance. |

| Rental Car Reimbursement | Pays for rental while your car is repaired. |

| Roadside Assistance | Covers towing, battery jump, lockouts, and more. |

| Rideshare Coverage | Extends coverage for Uber/Lyft drivers. |

If you’re hurt in an accident, medical payments coverage and personal injury protection (PIP) help with medical bills, and PIP can also cover lost wages. Farmers also offers uninsured/underinsured motorist coverage to protect you if the other driver isn’t properly insured.

Extras like rental car reimbursement help you stay mobile during repairs, roadside assistance covers common breakdown needs like towing and jump-starts, and rideshare coverage extends protection if you drive for Uber or Lyft. This range of options gives you flexibility to build a policy around your specific driving and lifestyle needs.

Farmers Auto Insurance Discounts

This table lists some of the key auto insurance discounts Farmers offers, and it’s worth reviewing if you’re looking to lower your premium. Discounts are available for practical things like bundling auto and home insurance (Multi-Policy), owning a home, or insuring more than one car (Multi-Car).

List of Auto Insurance Discounts With Farmers| Discount | |

|---|---|

| Good Student | 20% |

| Safe Driver | 20% |

| Signal® Program | 15% |

| Multi-Policy | 14% |

| Multi-Car | 12% |

| Homeowner | 12% |

| Distant Student | 10% |

| Anti-Theft | 10% |

| Pay-in-Full | 10% |

Students can benefit from savings through the good student discount or the distant student discount if they live away from home without a vehicle. Safe drivers with clean records also qualify for lower rates, and there’s a usage-based Signal Program that can offer up to 30% off based on driving behavior.

Farmers also reward specific choices like paying your premium in full, installing anti-theft devices, or maintaining a clean driving history. These discounts aren’t just checkboxes—they can make a real difference in how much you pay each month.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers Home Insurance Review

Farmers is widely known for its home insurance, which covers common risks like fire, theft, and storm damage. While standard homeowners policies don’t include earthquake or flood protection, Farmers offers optional coverage for those. This insurance helps protect both your property and belongings, and can even help cover legal costs if you’re sued for an accident involving injury or property damage.

When choosing a Farmers home insurance coverage policy, it’s important to consider the value of your home, the amount of liability coverage you need, and any unique or high-value items. Farmers homeowners insurance reviews often note that agents can help estimate these costs and may recommend adding a Personal Article Floater to increase coverage limits on valuables.

Farmers Home Insurance Coverage

Farmers home insurance provides solid protection for your home, your belongings, and even some of the outdoor features on your property. It’s designed to help you recover from a range of unexpected events—not just the obvious ones like fire or theft, but also lesser-known risks that could catch you off guard.

- Beyond Fire & Theft: Farmers protect against damage caused by fire, smoke, lightning, windstorms, hail, and even riots or civil disturbances. Explosions and falling objects are included, too.

- Limited Water Damage Coverage: If a water heater or steam system suddenly breaks, or pipes freeze and burst, you’re likely covered, so long as it’s sudden and accidental.

- Covers Personal Belongings: Your policy helps replace or repair stolen or damaged belongings like jewelry, art, and important documents, though limits may apply for high-value items.

- Covers Detached Structures: Sheds, fences, and other detached structures are included. Farmers will also cover trees, shrubs, and your lawn—up to $750 per item—if they’re damaged in a covered event like a fire or a car crash.

- Covers Weather & Surges: Things like sudden smoke damage, vandalism, vehicle impact, or damage from snow and ice buildup are covered, along with electrical surges from artificially generated currents.

If you’re unsure about whether a specific item or event is covered, your best move is to compare homeowners insurance quotes with a Farmers agent, who can explain the fine print and help you fine-tune your policy.

Farmers Home Insurance Discount

If you’re looking for ways to save on home insurance with Farmers, these two tables show how generous their discount structure really is. These highlights percentage-based savings, with bundling home and auto policies offering the largest break at 20%.

List of Home Insurance Discounts With Farmers| Discount | |

|---|---|

| Bundling | 20% |

| Home Security | 15% |

| Claims-Free | 10% |

| Green Home | 5% |

| New Home | 10% |

| Safety Device | 8% |

| Security System | 10% |

| Loyalty | 5% |

You can also cut costs by having a home security setup (15%), staying claims-free (10%), or simply owning a newer or greener home. Even features like safety devices and loyalty to the company bring added savings. Dives into the eligibility behind those discounts. It shows that Farmers rewards responsible homeowners—things like upgraded plumbing or a new roof could earn you extra savings.

Paperless billing, being part of a professional group, or living in a recently built home all qualify, too. Bottom line: if you’ve invested in your property’s safety, energy efficiency, or maintenance, Farmers gives you plenty of ways to lower your monthly premium, keeping it competitive with the cheapest homeowners insurance companies.

Farmers Home Insurance Rates by Policy Amount

This compares Farmers home insurance rates to several top competitors across different coverage amounts, and it shows how they hold up across the board. At $200,000 in coverage, Farmers comes in at $64 per month, which is slightly higher than Geico and USAA but lower than Liberty Mutual and Allstate Insurance.

Farmers vs. Top Competitors: Home Insurance Monthly Rates by Policy Amount| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $66 | $93 | $140 | $208 | |

| $61 | $86 | $129 | $195 |

| $64 | $90 | $136 | $202 | |

| $58 | $82 | $124 | $188 | |

| $67 | $95 | $143 | $210 |

| $62 | $88 | $133 | $199 | |

| $60 | $85 | $128 | $192 | |

| $59 | $83 | $125 | $186 | |

| $63 | $89 | $134 | $200 | |

| $56 | $79 | $120 | $182 |

As the policy amount increases, the trend continues. For $500,000 in coverage, Farmers charges $136 per month, which places them near the middle of the pack. Geico and State Farm stay more affordable at this level, while Liberty Mutual and Allstate cost more.

At the $1 million coverage level, Farmers charges $202 per month, which is still cheaper than Liberty Mutual but higher than USAA. Overall, Farmers offers competitive pricing, especially when compared to companies like Liberty Mutual and Allstate, but they may not always be the lowest-cost option depending on your coverage amount.

Farmers Life Insurance Review

According to Farmers life insurance reviews, life insurance is a very personal decision. Farmers can help you protect the well-being and secure the financial future of your loved ones through their policies. Although life insurance is not something many of us want to think about, the last thing you want to do is burden your family with unforeseen expenses.

Farmers Life Insurance Cost

This breaks down life insurance rates for both 20-year term and whole life policies across the top providers. For a 20-year term, most companies fall between $29 and $39 per month, with Pacific Life Insurance offering the lowest rate and Northwestern Mutual the highest. Farmers is not listed here, but if you’re comparing providers, this gives a good sense of the pricing landscape.

Farmers vs. Top Competitors: Life Insurance Monthly Rates| Company | 20-Year Term | Whole Policy |

|---|---|---|

| $32 | $390 |

| $34 | $410 | |

| $31 | $385 |

| $36 | $455 | |

| $33 | $472 | |

| $39 | $475 | |

| $29 | $395 | |

| $37 | $400 |

| $38 | $435 | |

| $30 | $380 |

On the whole life side, rates are more spread out. Geico and Transamerica offer lower-cost whole life policies at $385 and $380, while Guardian, Lincoln Financial, and Northwestern Mutual come in above $450.

If cost is your priority, term life is more affordable. For lifelong coverage, prices add up, so consider your budget and long-term needs.

These rates show just how much life insurance premiums with Farmers vary by age, gender, and policy type. For whole life insurance, younger applicants pay the least—just $42 to $49 per month for $100,000 in coverage at age 16, compared to up to $225 for the same amount at age 65.

Farmers Whole Life Insurance Monthly Rates by Coverage Amount| Age & Gender | $100,000 | $250,000 | $500,000 |

|---|---|---|---|

| 16-Year-Old Female | $42 | $99 | $195 |

| 16-Year-Old Male | $47 | $109 | $215 |

| 18-Year-Old Female | $45 | $105 | $205 |

| 18-Year-Old Male | $49 | $115 | $225 |

| 25-Year-Old Female | $55 | $130 | $255 |

| 25-Year-Old Male | $62 | $145 | $285 |

| 30-Year-Old Female | $72 | $175 | $340 |

| 30-Year-Old Male | $82 | $195 | $390 |

| 45-Year-Old Female | $100 | $240 | $475 |

| 45-Year-Old Male | $110 | $260 | $515 |

| 60-Year-Old Female | $170 | $410 | $810 |

| 60-Year-Old Male | $190 | $455 | $895 |

| 65-Year-Old Female | $200 | $490 | $965 |

| 65-Year-Old Male | $225 | $550 | $1,080 |

Bumping coverage up to $500,000 more than quadruples the cost, with the highest rate hitting $1,080 for a 65-year-old male. Term life insurance, on the other hand, is much more affordable across the board. A 25-year-old female, for example, pays $13 per month for a 10-year term, $18 for 20 years, and just $28 for 30 years.

Farmers Term Life Insurance Monthly Rates by Term Length| Age & Gender | 10-Year Term | 20-Year Term | 30-Year Term |

|---|---|---|---|

| 16-Year-Old Female | $10 | $13 | $19 |

| 16-Year-Old Male | $11 | $15 | $21 |

| 18-Year-Old Female | $11 | $14 | $20 |

| 18-Year-Old Male | $12 | $16 | $23 |

| 25-Year-Old Female | $13 | $18 | $28 |

| 25-Year-Old Male | $14 | $21 | $31 |

| 30-Year-Old Female | $14 | $20 | $32 |

| 30-Year-Old Male | $16 | $23 | $35 |

| 45-Year-Old Female | $23 | $37 | $61 |

| 45-Year-Old Male | $27 | $43 | $70 |

| 60-Year-Old Female | $44 | $82 | $150 |

| 60-Year-Old Male | $50 | $92 | $170 |

| 65-Year-Old Female | $57 | $105 | $190 |

| 65-Year-Old Male | $64 | $118 | $210 |

But the rates rise steeply with age—by 65, that same 30-year term jumps to $190 for a woman and $210 for a man. These charts make it clear: the younger you buy, the more you save—especially if you’re deciding between term and whole life coverage, as explained in our life insurance guide.

Farmers Life Insurance Coverage Options

Farmers offers term coverage, whole life insurance, and universal life insurance. With term coverage, you have set premiums that are locked in for a certain term. In some cases, these can be converted to lifelong coverage, which can build cash value regardless of your health. They are simple life insurance plans to help cover basic expenses.

Whole life insurance policies have a level premium with guaranteed cash values that you can use to reach a variety of financial goals. If you’re looking for permanent, lifelong coverage, you may wish to look into whole life insurance, as the cash value, premium requirements, and death benefits do not vary based on things like interest rates or market performance.

Universal life insurance is for those who have changing life insurance needs through marriage, parenthood, retirement, and beyond. You decide how much and when to pay toward your insurance policy. Because universal life insurance is linked to market indexes, there may be a greater opportunity for cash growth.

Farmers also have individual policies within these broad categories. You’ll want to speak with a local agent to determine the best options for your needs and the needs of your family.

Farmers Pet Insurance Review

Farmers pet insurance is designed to provide pet owners with an easy way to deal with unforeseen vet bills without extra hassle. It’s not necessarily the most affordable or far-reaching option, but its true value lies in flexibility and dependable support.

When comparing Farmers to the best pet insurance companies, it’s important to weigh its coverage limits, exclusions, and claims process against competitors to see if it delivers the right balance of protection and convenience.

Farmers Pet Insurance Cost

Farmers pet insurance reviews note that the company charges $25 per month to insure cats and $40 for dogs, placing it in the middle of the pack. Rates are slightly higher than providers like Pets Best, which offers the lowest prices at $22 for cats and $35 for dogs. Trupanion remains the most expensive at $30 for cats and $47 for dogs.

Farmers vs. Top Competitors: Pet Insurance Monthly Rates| Insurance Company | Cats | Dogs |

|---|---|---|

| $24 | $39 | |

| $25 | $40 | |

| $28 | $44 | |

| $27 | $41 | |

| $27 | $43 | |

| $25 | $38 |

| $22 | $35 | |

| $26 | $40 |

| $26 | $40 | |

| $30 | $47 |

Farmers is priced slightly higher than Allstate, which comes in at $24 for cats and $39 for dogs. If you’re comparing your options, these small monthly differences can add up over time, especially with multiple pets. That’s why it’s worth weighing cost against features like coverage limits, exclusions, and claims processes.

Farmers Pet Insurance Coverage

Farmers pet insurance is here to help keep you on track through your pet’s vet bills, providing you with financial support if something unexpected happens, and offering flexibility to create the perfect pet insurance policy for you and your furry and non-furry family members. Here’s what you need to know:

- Customizable Limits: You can choose annual coverage limits that fit your budget and your pet’s health risks.

- Deductible Options: Plans let you pick from different deductible amounts, balancing monthly costs with out-of-pocket expenses.

- Reimbursement Choices: You decide what percentage of the vet bill is reimbursed, usually ranging from partial to near-full coverage.

- Comprehensive Protections: Coverage plans include accidents, illnesses, surgeries, prescriptions and chronic conditions.

- Optional Wellness Add-Ons: Preventive care like checkups, vaccines, and dental cleanings can be added for broader protection.

Farmers pet insurance coverage gives you control over cost and protection, making it a practical choice if you want dependable support tailored to your pet’s health and your budget. When weighing options, it helps to consider the questions to ask when considering pet insurance, such as coverage limits, exclusions, deductibles, and how quickly claims are processed.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers Insurance Other Products

Farmers isn’t just about auto, home, or life insurance—they also offer a range of specialty coverage options that many people overlook. If you’re trying to cover more than just the basics, here are five other Farmers products worth knowing about:

- Business Insurance: Farmers business insurance review shows Farmers offers tailored coverage for small businesses, including liability, property, and workers’ comp.

- Motorcycle Insurance: Farmers offers policies for cruisers, sport bikes, and scooters, covering liability, collision, comprehensive, and optional protection for custom parts or medical bills.

- Boat and Watercraft Insurance: Covers fishing boats to jet skis with theft, damage, and liability protection, plus optional trailer coverage or emergency services.

- Off-Road Vehicle Insurance: Farmers covers ATVs, dune buggies, and snowmobiles for both vehicle and rider, protecting you on trails or private land.

- Umbrella Insurance: Adds extra liability protection beyond home, auto, or rental policies, covering costs if a major accident or lawsuit exceeds standard limits.

If you’re already a Farmers customer, these add-on policies can round out your coverage, and knowing how to get multiple auto insurance quotes can help you compare bundling savings.

Renters Insurance

Many tenants underestimate the value of what they own, but Farmers renters insurance coverage can help replace furniture, electronics, clothing, appliances, jewelry, books, art, or instruments after a loss—costs that can be incredibly expensive without protection.

In addition to protecting personal belongings, renters insurance can also provide liability coverage if someone gets hurt on the property, such as a guest tripping over shoes left in a stairwell and filing a lawsuit for negligence. Farmers renters insurance can help cover those costs and more.

If the rental becomes unlivable due to serious damage, the policy also helps pay for necessary living expenses like temporary housing and meals.

Condo and Mobile Home Insurance

For condos, many associations have some basic form of insurance policy in place, which may lead you to believe that you don’t actually need condo insurance – but you should, since this insurance can cover things that the association’s insurance does not, such as accidental damage to any improvements you make in your unit.

Mobile and manufactured homes differ from traditional houses, which is why Farmers offers policies tailored for mobile homeowners.

Condo coverage can also include your personal belongings (up to your policy limits) and can protect your assets from liability claims as well.

Mobile home coverage covers most direct, sudden, and accidental incidents as well as liability coverage. Similar to homeowners insurance coverage, there are many customization options so you can protect against things such as debris removal, food spoilage, trees, shrubs, plants, and additional living expenses.

Farmers Insurance Discounts

Most regularly insured with discounts on Farmers, giving you lower premiums based on safety, good driving, and policy decisions. As discount rates are not consistent across all states, you should reach out to a local agent and see which ones work in your favor. Savings may be available for:

- Policy & Payment Choices: Bundling home and auto, paying in full, enrolling in EFT or paperless billing, and shopping early all come with rate reductions.

- Driver Education & Safe Habits: Discounts apply for completing defensive driving or training courses, maintaining a good student GPA, being claims-free at renewal, or staying accident-free over time.

- Vehicle Safety & Tech Features: You could get extra savings if your car has features like anti-lock brakes, electronic stability control, passive restraints, daytime running lights, or an anti-theft system.

- Lifestyle & Eligibility Factors: Homeowners, active military members, seniors, members of certain professions, and those who live in retirement communities may be eligible for exclusive discounts.

- State-Specific Programs: Farmers offers unique discounts in select states for VIN etching, shared family vehicles, alternative fuel use, loyalty, and transitioning from a parent’s policy to your own.

To make sure you’re getting every discount you qualify for, it’s best to review your situation with a Farmers agent who can walk you through all the options in your state.

Farmers Insurance Ratings & Consumer Reviews

Farmers insurance reviews and ratings are mixed, but still provide valuable insight. Financially, the company is strong, earning an A rating from A.M. Best for stability. The Better Business Bureau also gives Farmers an A, often noted in Farmers insurance reviews and complaints, where customers highlight transparency but point out rising premiums and claims delays.

Farmers Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A Good Business Practices |

|

| Score: 82/100 High Customer Satisfaction |

|

| Score: 706 / 1,000 Avg. Satisfaction |

|

| Score: 1.70 More Complaints Than Avg. |

On platforms like Farmers Insurance reviews Reddit, policyholders share both positive agent experiences and frustrations with customer service, while Farmers Insurance Google reviews reflect a similar split between satisfied long-term customers and those citing issues with claims processing.

These varying perspectives show that while Farmers remains dependable financially, customer satisfaction can vary depending on the agent and region. One Yelp reviewer praised his Farmers agent for consistently saving him money and providing fast responses. He called her the best agent he’s worked with in 50 years (Learn More: The Worst States for Filing an Auto Insurance Claim).

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

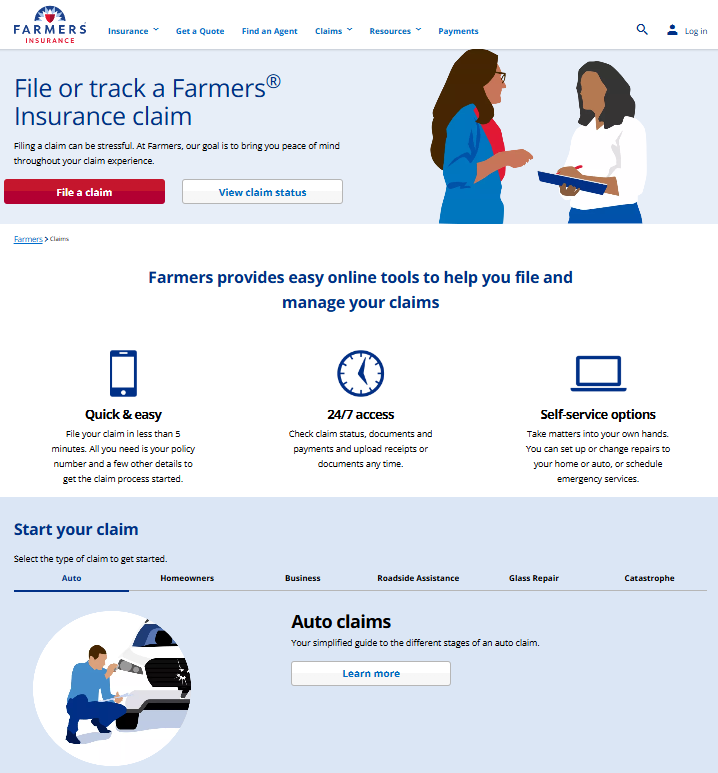

How to File a Farmers Insurance Claim

With Farmers Insurance, filing a claim is simple and allows you to start the process via phone, online or on the mobile app. Here is a step-by-step guide that breaks the whole process down for you:

- Submit Supporting Info: Use the online tool or app to upload photos of the damage, add relevant documents, and review a summary before submitting.

- Schedule Services: The online system lets you schedule services like repairs, rentals, or emergency clean-up immediately after submitting your claim.

- Stay in Touch: After your claim is submitted, you’ll receive the contact details of your assigned claims representative so you can follow up as needed.

Whether you’re on your phone or computer, Farmers makes it easy to report and manage a claim quickly. Use whichever method fits your situation best.

If you’re unsure about anything during the process, your claims representative can walk you through the next steps. If your repair or settlement gets delayed, you’ll get real-time updates so you’re not left wondering what’s happening.

Read More: How to File an Auto Insurance Claim & Win.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

How to Cancel Farmers Insurance

Canceling your insurance with Farmers isn’t as simple as just walking away—different states have different requirements, and Farmers may need a signed cancellation form, a written notice, or a phone call to confirm your request. Always contact Farmers customer service directly to learn the correct steps for your location.

If you’ve got a clean driving record, bundling your Farmers auto and home policies can lower your monthly costs and simplify claims down the road.

Melanie Musson Published Insurance Expert

Never stop paying your premiums without officially canceling, as this could send your account to collections, damage your credit, and raise red flags with future insurers. Most importantly, don’t let your coverage lapse before securing a new policy. Driving uninsured, even briefly, can lead to fines, higher premiums later on, or full liability if you’re involved in an accident (Learn More: What Happens If You Cancel Auto Insurance).

Farmers Insurance Pros and Cons

Pros

- Strong Digital Tools: The Farmers mobile app lets you track claims, view documents, and use Farmers roadside assistance coverage to get help with just a few taps.

- Solid Bundle Savings: You can bundle home, auto, life, and specialty coverage, which may lower your rates across multiple policies.

- Helpful Add-On Options: Farmers offers coverage upgrades like accident forgiveness, Farmers new car replacement, and original parts replacement.

Cons

- Above-Average Prices: Farmers rates tend to be higher than those from Geico, State Farm, or USAA, especially for full coverage.

- Mixed Customer Satisfaction: While tools are strong, some customers report inconsistent experiences with claims handling and support.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Decide if Farmers Insurance Is Right for You

Our Farmers Insurance review shows that it’s a solid option for people who want customizable coverage and access to digital tools that make managing policies easier. Farmers offers strong bundling options and covers a wide range of needs, from standard auto to life and home insurance.

However, its rates can be higher than budget-friendly competitors, and customer satisfaction ratings vary by location and agent. If you’re looking for flexible policy options with decent digital features and don’t mind paying a little more for them, Farmers could be a good fit (Learn More: What We Learned Analyzing 815 Insurance Companies).

Searching for more affordable premiums? Insert your ZIP code to get started on finding the right provider for you and your budget.

Learn More: How to Compare Auto Insurance Companies

Frequently Asked Questions

Is Farmers Insurance a reputable company?

Yes, Farmers Insurance is considered reputable, holding an A rating from A.M. Best for financial strength and an A from the Better Business Bureau, which is often highlighted in Farmers Insurance reviews on BBB. While there have been past mentions of a Farmers Insurance scandal, the company today maintains strong financial stability and trusted business practices.

Are Farmers good about paying claims?

Farmers have a mixed reputation with claims. Farmers Insurance reviews consumer reports give the company a solid 82 out of 100 for satisfaction, but J.D. Power scores it slightly below the industry average at 706 out of 1,000. This shows the claims experience can vary depending on the agent and region.

How much does Farmers umbrella insurance cost?

Farmers umbrella insurance typically starts around $150 to $300 per year for $1 million in extra liability coverage, and people can get auto insurance right by using it to expand protection beyond standard policies.

Is Farmers the most expensive insurance?

Farmers is not the cheapest, but it’s also not the most expensive. On average, minimum coverage starts at $76 per month and full coverage at $198, which places it in the mid-range compared to competitors like Geico or USAA, who often come in lower.

What insurance is better, Farmers or Progressive?

Progressive usually offers cheaper rates, with minimum coverage averaging $56 per month compared to Farmers at $76. However, Farmers tends to stand out for its agent support and wide coverage options, while Progressive is stronger in usage-based discounts and online tools.

How can I get a Farmers motorcycle insurance quote?

You can request a Farmers motorcycle insurance quote online, through the Farmers mobile app, or from an agent. Premiums often start around $75 to $100 per year for basic liability, with higher rates for full coverage and add-ons like roadside assistance.

Is Farmers or Allstate better?

Both are large insurers with strong financial ratings, but their pricing differs. Farmers full coverage averages $198 per month, slightly lower than Allstate’s $228, while Allstate tends to score higher in J.D. Power satisfaction surveys. The better option often depends on whether you value lower rates (Farmers) or higher service ratings (Allstate).

Who is the most trusted insurance company?

USAA consistently ranks as the most trusted, scoring well above the industry average in customer satisfaction and affordability. However, eligibility is limited to military families. Among widely available insurers, State Farm often scores highest in trust and claims satisfaction, while Farmers sits closer to the middle of the pack.

Does Farmers Insurance have accident forgiveness?

Yes, Farmers offers accident forgiveness in some states, and traffic collision reconstruction may be used to assess fault, allowing qualified drivers with three to five years of clean driving to avoid a rate increase after their first at-fault accident.

Are Farmers known for denying claims?

Farmers is not widely known for denying claims outright, but NAIC data shows their complaint index is 1.70, meaning they receive more complaints than average. Many of these complaints relate to delays or disputes in the claims process rather than outright denials.

Start comparing affordable insurance options by entering your ZIP code into our free quote comparison tool today.

What is included in Farmers comprehensive coverage?

Does Farmers Insurance offer a military discount?

What is the history of Farmers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.