What to Do If You Can’t Afford Your Auto Insurance in 2026 (Follow These 5 Steps)

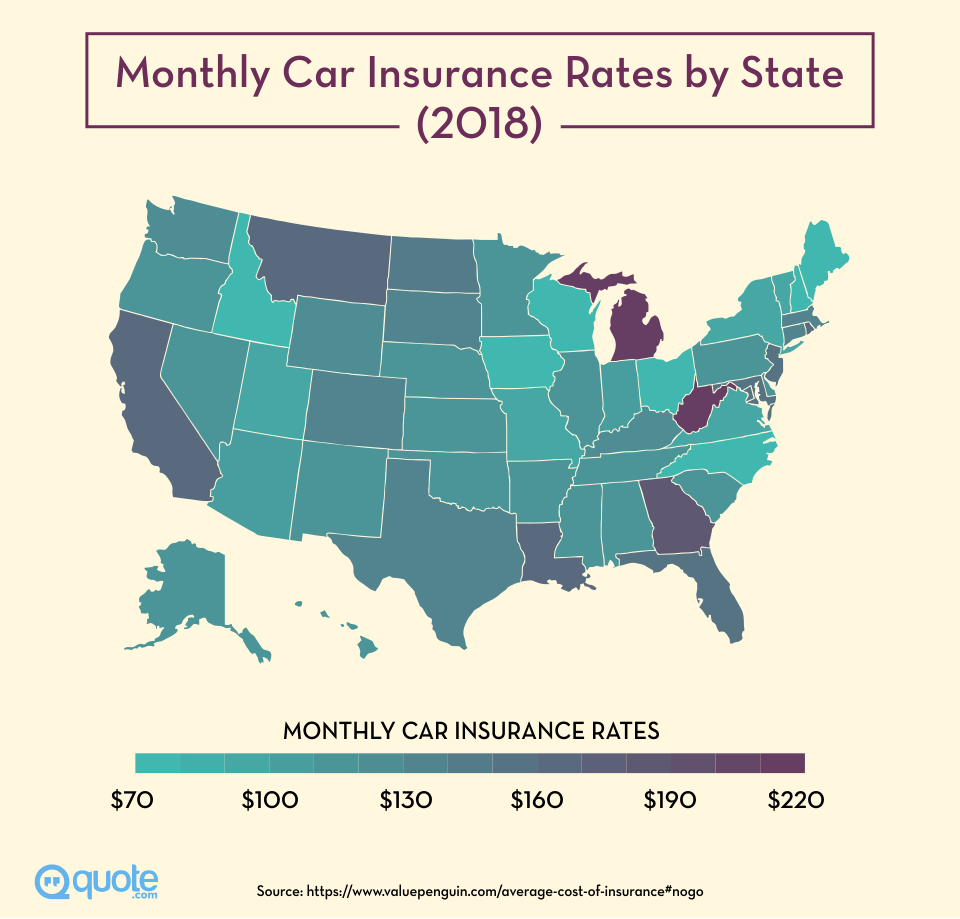

With car insurance rates increasing up to 17% in some states, cutting costs is crucial. Getting discounts, state assistance, or making coverage adjustments is what you do if you can't afford auto insurance. Check out the steps below to learn what happens if you can't afford your car insurance this month.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as ...

Justin Wright

Updated January 2026

You could be thinking about what to do if you can’t afford your auto insurance. If you can’t afford car insurance, switching insurers or negotiating with your provider can help save money.

- Step #1: Contact Your Insurance Provider – Ask about payment plans or discounts

- Step #2: Adjust Your Coverage – Reduce extras or raise your deductible

- Step #3: Shop for Better Rates – Compare quotes to find a lower premium

- Step #4: Look for Discounts – Check for safe driver or bundling discounts

- Step #5: Reduce Your Mileage – Drive less to qualify for lower rates

Finding the cheapest car insurance, modifying coverage, or applying for state aid can make coverage more affordable without compromising protection.

Struggling with high insurance costs? Premiums have increased by 17%. Enter your ZIP code into our free quote tool above to find lower rates.

5 Steps to Take If You Can’t Afford Insurance

If you cannot afford auto insurance payments, a few strategies exist to reduce costs without sacrificing coverage.

Being responsible can help you keep your insurance, avoid penalties, and find more affordable options. Here are some of the five most essential actions to take.

Step #1: Contact Your Insurance Provider

The initial step is to contact your insurance provider to explore options for reducing your premium, such as payment plans, temporary hardship assistance, or policy modifications. Additionally, learning how to lease a car when you can’t afford to buy one may be a viable solution, as leasing often requires lower upfront costs and includes maintenance benefits.

If you cannot afford car insurance, discussing alternatives with your insurer can help prevent policy cancellation, which could negatively impact your future rates and financial stability.

Step #2: Adjust Your Coverage

Your existing policy can help you pinpoint areas where you can save money. Understanding how to compare auto insurance companies can help you find better coverage at a lower cost. If your car is older, dropping collision or comprehensive coverage might make sense, but it may not be worth the risk.

Increasing your deductible can lower your monthly premium but ensure you have enough savings to cover a higher out-of-pocket expense if needed. If you can’t afford your car insurance this month, adjusting your coverage wisely can help you stay protected while reducing costs.

Step #3: Shop for Better Rates

Quote comparisons from various insurance providers can get you a less expensive policy. Using free insurance comparison websites like this one can help you compare quotes from multiple companies at once.

Certain providers cater to low-budget insurance, while others offer significant discounts for accident-free driving or multiple-policy purchases. Comparing prices ensures you get the best premium rate while keeping your necessities covered.

Step #4: Look for Discounts

Insurance companies offer various discounts that can lower your premium. Exploring hacks to save more money on car insurance can help, including safe driver discounts, low-mileage savings, and bundling home and auto policies.

Asking your insurer about available discounts ensures you maximize your savings.

Step #5: Reduce Your Mileage

Driving fewer miles can lower your insurance rates since some insurers offer discounts for low-mileage drivers. According to this guide to usage-based car insurance, reducing overall mileage by taking the bus, carpooling, or biking can lead to significant savings. Cutting down on driving not only decreases insurance costs but also reduces maintenance and fuel expenses.

By taking these actions, auto insurance can be more affordable while ensuring you are legally covered. Going through all possible options can reduce financial burdens and keep you safe on the road.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Happens if You Don’t Pay Your Premium

Although insurance providers have the right to cancel your payment even if you miss paying your premium by the day, they tend to have a grace period for people who are late on their payments.

Note that if you pay your fee late, a late fee will be applied to the cost. But once your second payment is due and you fail to catch up, they will definitely begin the process of canceling your policy.

Driving without car insurance is illegal. However, the good news is that they are legally required to notify you of the issue in writing and allow you enough time to rectify it.

Tell them about your situation and how much you can afford to pay for it. These agents are here to help, and there may be ways they can whittle down your plan to a bare minimum and allow you to keep your policy at a lower price.

However, once you fail to submit a payment before the final deadline, you are officially uninsured.

Do not let the situation roll into a bigger snowball because the sooner you buy coverage, the sooner you can pay less.Brandon Frady Licensed Insurance Agent

Unfortunately, this does not end here. Your insurer will then notify the DMV of your changed status. The DMV will allow you time to get a new policy or explain your status (e.g., sometimes people forget to transfer the title after selling their car).

If the DMV doesn’t hear from you or your provider, they may revoke your registration and tags.

Try Your Best Not to Drop Your Coverage

Dropping your policy may save you some money, but it will cause a lapse in your coverage history. During this time, you still need to properly store your automobile and purchase a storage protection plan in case it is vandalized or stolen (unless you sell the automobile as well).

Without coverage, any accidents that occur could make traffic collision reconstruction more difficult, potentially affecting fault determinations and insurance claims. The worst part is that when you apply for a new policy in the future, the lapse in coverage will label you as a higher-risk driver, resulting in significantly higher costs.

Backdating Plan: The Gray Area

If your policy gets dropped, many companies will give you a second chance to reactivate your policy within 30 days of the cancellation, as long as you are willing to pay for the duration that you lapsed. This is called “backdating”. In usual cases, backdating is illegal.

But if you are backdating because you are paying back for the lapse to reactivate your old coverage, then this is regarded as legal. In order to complete this process, you must sign a form to verify that you were not involved in an accident during the lapse.

Do Not Attempt to Drive Without Coverage

According to the government, driving is a privilege and not a necessity. Sadly, it is an essential need for many people who live in more rural areas and rely on driving as the only means of transportation. With the exception of New Hampshire, all states require drivers to carry some form of assurance or financial proof in order to enjoy this freedom.

State Auto Insurance Relief Programs| Program Name | State(s) | Type of Assistance | Who Qualifies? | Description |

|---|---|---|---|---|

| California Low-Cost Auto Insurance Program (CLCA) | California | Subsidized Liability Insurance | Low-income drivers with good driving records | Offers basic liability insurance for as low as $20/month to help meet state minimum coverage |

| New Jersey Special Automobile Insurance Policy (SAIP) | New Jersey | $365/year Medical Coverage Policy | Drivers eligible for Federal Medicaid | Covers emergency medical care related to auto accidents for Medicaid recipients |

| Pay-Per-Mile Insurance Plans | Available in Most States | Usage-Based Billing | Low-mileage drivers & those working from home | Helps reduce premium costs by charging only for miles driven (offered by insurers like Metromile, Allstate, etc.) |

| Temporary Premium Relief Programs | Select States (e.g., NY, MI, IL) | Payment Deferral / No-Cancellation | Drivers impacted by job loss or emergencies | Some states and insurers offer grace periods or deferments after job loss or disasters |

| Good Driver Discounts & Requalification Programs | Nationwide | Discounts / Reinstatement | Drivers with prior good driving records | State DMVs and insurers may help requalify for discounts or affordable plans after hardship |

| State Insurance Department Complaint & Mediation Services | All 50 States | Billing Dispute Help & Resources | Any driver facing insurer issues | Helps negotiate payment plans, resolve cancellations, or explore low-cost options |

If you get pulled over by law enforcement and cannot provide proof of insurance, you will receive a violation ticket. Practicing responsible driving habits, such as maintaining coverage and following up with buckling up behaviors, can help you avoid penalties.

Depending on your state, fines range from $100 to $1,500—an amount that could equal your annual premium. If you fail to provide proof of financial responsibility within 24 hours, your license may be suspended until you show evidence of the required minimum coverage.

In addition, your automobile registration may also be suspended or, worse, impounded. If you do not know how the impounding lot works, every day, your vehicle is charged an expensive fee. This whole ordeal of trying to save a few dollars can actually land you in even more financial turmoil. Moreover, when you can start affording policy again, you may need to jump through your state’s requirements before any providers accept your application.

In the worst-case scenario, you will need to submit an SR-22 form. Once this is attached to your profile, you will find that some companies will deny you for no reason. Others will charge you a considerably more expensive plan for the next 3 to 5 years, depending on your credit history and driving record. So, whatever you do, do not attempt to drive without coverage.

Ways to Cut Down Your Premiums

This question hinges on whether you own the vehicle outright or you are currently put on an installment leasing payment plan:

If you own the vehicle outright, the good news is that you can cut your rate down to the minimum requirement according to your state’s regulations.

If you are currently leasing a car, you may not have this option as the lender requires you to purchase both collision and comprehensive coverage along with the minimum liability protection.

- If you can, try to buy it outright.

- If this option is not viable, negotiate with your lender and try to work out a new installment plan with a longer term but lower monthly payments. If you have been good with keeping up with the payments, they may take your offer.

- If they will not budge on renegotiation, do not worry. There are still ways that can help you keep your coverage and vehicle. Check out the Tips on Keeping Your Insurance to see how you can still afford a policy plan.

- Another option is selling your leased vehicle and buying an older, used one. If you’re struggling with payments, learning how Wankel rotary engines work can help you find a fuel-efficient, affordable car. This lowers costs while keeping you on the road. A well-maintained used vehicle may only cost $30 per month to insure. Read on for tips on finding the best option.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips on Keeping Your Car Insurance Policy

Once you realize you are struggling with your payment, do not wait to see if your situation will resolve itself. Act immediately so you can stop paying your current price today (you can sometimes even prorate your current monthly payment and forward the refund as part of next month’s payment).

Learning how electric cars work may also help you find insurance discounts. Here are some tips that can help you:

Reduce to Minimum: You will be amazed at how affordable the plan becomes. Discuss dropping all unnecessary options with an agent. If yours is relatively old and the market value has significantly depreciated, you should highly consider dropping comprehensive and collision options. Although it is not ideal to have the most minimal basic coverage, it can be an effective short-term solution until you can resolve your financial situation.

Increase Deductible

If you increase your insurance deductible, your premium can drop significantly. Be careful with this option. If you get into an accident, remember that you will have to pay out-of-pocket for that amount before your policy kicks in and starts paying for the rest of your damage.

Remove Other Drivers

Assign yourself as the designated driver for now. This can save you some money, as your provider sees it as a lower risk profile.

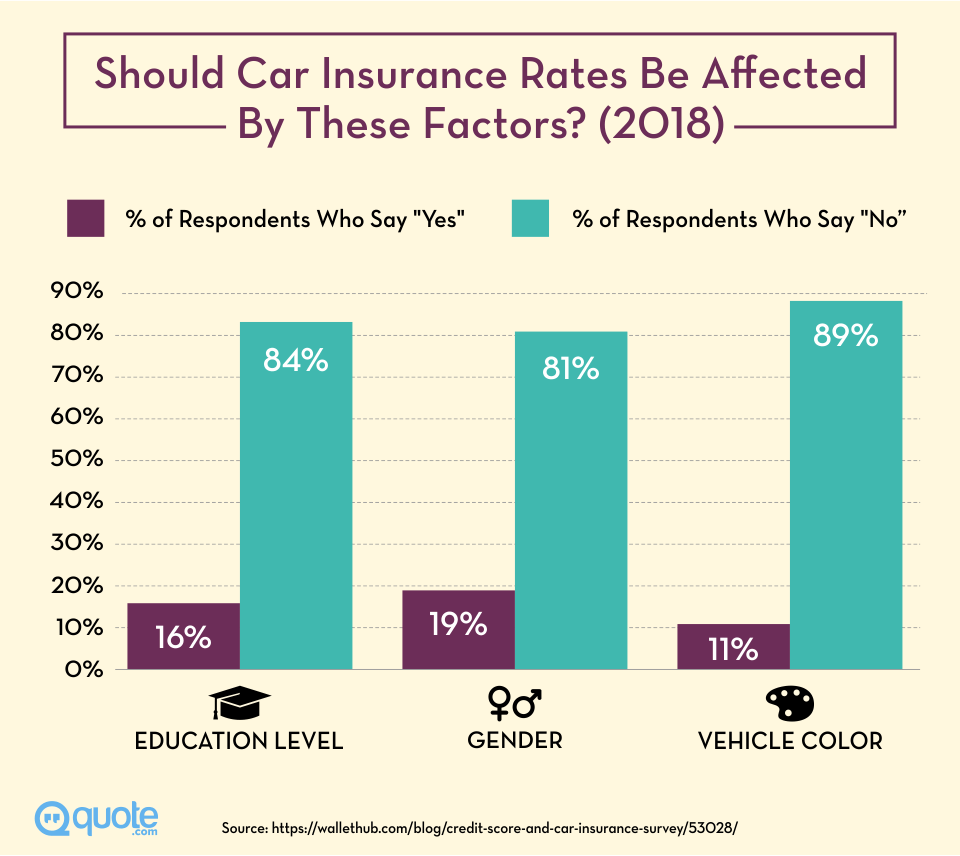

Women drivers tend to receive lower quotes than men regarding premiums. On average, women pay 12% less than men.

Request Discounts

Just taking a defensive driving course can already drop your rate by 5-10%, depending on your insurer’s policy. Another quick discount is to install anti-theft devices and alert your company of your proactive, responsible owner diligence. This trick can earn you another 5-10% discount on your plan.

Other easy discounts are paperless statement discounts, good student discounts, company-switching discounts, good driver discounts, and auto-payment discounts. Sometimes, owning an account or credit card from a certain bank can also earn you an affiliation discount.

Compare Provider Rates

There are certain companies that work with low-income households.

Try Pay-As-You-Drive: See if this can lower your cost. If you want to minimize your driving quota, you may want to start carpooling with your coworkers or join a carpooling program.

Drive Less

Decreasing your annual traveling mileage can significantly decrease your rate. . Some carriers will also offer low-rate plans for individuals who only drive short distances or occasionally.

Use Tracking Device

Some companies offer an incentive to lower your rate if you volunteer to be their study subject. And if you drive responsibly and exhibit great defensive skills, they will even reward you with further rebates or cash prizes.

Check Public Option Coverage

Some states offer very affordable plans for low-income households. Call your local DMV to see if your city has similar programs or financial assistance for individuals in your situation.

Get Married

Being married or claiming domestic partnership status has its perks; you get a better tax rebate, and carriers view you as a more responsible adult. Just being married can score you a much lower rate.

Find Low-Income Policies

Each state tends to have its own insurers that are willing to offer very affordable plans for households struggling with their financial situation.

Look for Low-Income Coverage

There are smaller, lesser-known companies that cater to low-income families. Here is a list of these insurers:

- Progressive

- GMAC

- Infinity

- Bristol West

- Eastwood Insurance

- Western General

- Carnegie General

- Western United

- Access General

Federal Coverage Options for Low-Income Households

Although some states recognize that driving is essential and now offer low-cost sponsored coverage to low-income households, there is no federal funding program to assist the rest of the country. Comparing plans and getting an insurance plan that works for you can help you find affordable options. For those in eligible states, this low-cost coverage is known as public auto insurance (also called government car insurance) and is available in:

- California

- Maryland

- New Jersey

- Hawaii

- Michigan

California’s Low-Cost Automobile Insurance Program (CLCA)

To quality, you must:

- Maintain a good driving history

- The minimum age requirement is 19 years of age

- Own a current, effective driver’s permit

- Own a vehicle that has a market value of $20,000 maximum and does not have any unpaid loans attached

- Your maximum income must be less than:

- – 1 person household – $29,700

- – 2 people household – $40,050

- – 3 people household – $50,400

- – 4-person household – $60,750

If you qualify for CLCA, the maximum annual premium ranges from $241 to $556, depending on your situation. Knowing how to file an auto insurance claim & win it each time can improve your chances of maximizing coverage. You may also apply for a discount if you are a licensed driver with at least three years of a clean driving record.

The coverage will include:

- $3,000 coverage on property damage

- $10,000 coverage on bodily injury and/or per person’s death

- $20,000 coverage on bodily injury and/or death

For more information on the CLCA program or to complete the online application, please visit mylowcostauto.com. If you do not have internet access or require further assistance, please call the information hotline at 1-866-602-8861 or toll-free at 877-401-9550.

New Jersey’s Special Automobile Insurance Policy

The New Jersey low-income auto protection program is called Special Automobile Insurance Policy (SAIP). Unlike in California, you can request SAIP via most underwriting agencies in New Jersey.

In order to be qualified for SAIP, these criteria must be met:

- Must be currently registered in Medicaid.

- Currently hold a valid driver’s permit.

Your SAIP annual premium will cost differently depending on your payment method:

- $360 annually if you submit in 1 single payment.

- $365 annually if you submit in 2 portions for every 6 months throughout the year.

SAIP covers emergency medical treatment fees related to accidents and provides up to $250,000 for severe neural or vertebral injuries. However, it does not include liability coverage or medical expenses already covered by New Jersey Medicaid. Everything you need to know about United Healthcare includes understanding programs like SAIP, which allow you to retain coverage until expiration, even if you lose Medicaid eligibility.

New Jersey's Special Automobile Insurance Policy (SAIP) provides an affordable solution for eligible drivers facing financial hardship.

Heidi Mertlich Licensed Insurance Agent

Note that afterward, you are not qualified to renew your SAIP policy and will be required to purchase a plan from private marketplace insurers. For additional information on how to purchase an SAIP plan, you can search for an SAIP provider at the New Jersey Banking and Insurance Department’s official website or call 1-800-652-2471.

Hawaii’s Disability Auto Coverage Program (AABD)

The expert guide to Medicare outlines that free liability and personal injury coverage is available for motorists or permanently disabled individuals who cannot drive and receive public assistance through direct cash disbursements. Additionally, the state provides free coverage to residents receiving financial aid from the Aid to the Aged, Blind, and Disabled (AABD) program. To qualify for AABD assistance, you must meet these requirements:

- You must be 65 years or older

- You are legally blind

- You are currently suffering from physical and/or mental disability for a minimum of 12 months, and the condition is preventing you from maintaining a job.

- You are currently having a terminal medical condition that is preventing you from acquiring and maintaining a job.

- You are currently having a terminal medical condition where your social security funding or supplemental security income does not provide sufficient financial support for you to purchase a policy.

- You are currently living with someone who is receiving AABD financial assistance, and you are taking care of their needs.

If you are qualified for the Hawaii low-cost disability auto coverage program, your coverage will be free of charge. You can apply by visiting the Hawaii Department of Human Services official website or by calling 808-586-4892. For more information, contact the Hawaii Department of Commerce and Consumer Affairs.

Michigan Affordable Insurance Placement Facility (MAIPF)

Michigan has a very different system from the rest of the country. It requires all residents to purchase property protection, personal injury coverage, and residual bodily injury and property damage liability protection. To learn more about the program and how to apply for a policy, please visit the official MAIPF website. If you do not have internet access, you may contact their hotline at 737-464-1100.

Maryland Auto Insurance (or Maryland Public Insurance Program MAIF)

Maryland residents can apply for the state’s low-income auto insurance program, Maryland Auto Insurance. Established in 1972, this program provides affordable liability coverage for low-income households. As technology evolves and self-driving car technology continues to shape the industry, these programs remain essential for ensuring accessible coverage. This policy offers:

- At least $20,000 per person bodily

- At least $15,000 in property damage

In order to qualify for the program, you must meet these requirements:

The State of Maryland provides interested applicants with a quote at the Maryland Auto Insurance official website. If you do not have internet access, you may contact their information hotline at 800-492-7120.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Swapping for a Lower Premium Used Vehicle

As you have already learned, different brands and types of automobiles have certain reputations. Trucks tend to be bigger and can do more damage on the road. Cops are often faster in speed and driven by younger adults. These automobiles tend to be at higher risk, according to carriers’ surveys. Consequently, they cost more to insure. Having said that, there are exceptions to the rule.

Car Types With Lowest Monthly Premium Cost| Rank | Car Type | Monthly Rates |

|---|---|---|

| #11 | Coupe | $159 |

| #10 | Crew Cab | $159 |

| #9 | Convertible | $158 |

| #8 | SUV | $152 |

| #7 | Sedan | $152 |

| #6 | Minivan | $151 |

| #5 | King Cab | $150 |

| #4 | Double Cab | $148 |

| #3 | Hatchback | $148 |

| #2 | Station Wagon | $142 |

| #1 | CrewMax Cab | $140 |

For example, CrewMax Cab trucks are usually owned by responsible, middle-aged drivers, making them a lower-risk option. The same applies to certain luxury and exotic brands. Everything you need to know about luxury and exotic car insurance can help you find the best coverage options. Here is a chart of the cars with the most affordable premiums.

| Vehicle Brands With the Lowest Average Premium Annual Cost | ||

|---|---|---|

| Rank | Brand | Average Annual Premium Cost |

| 18 | Acura | $1,933 |

| 17 | Buick | $1,915 |

| 16 | BMW | $1,908 |

| 15 | Chevrolet | $1,902 |

| 14 | Honda | $1,899 |

| 13 | GMC | $1,897 |

| 12 | Chrysler | $1,893 |

| 11 | Ford | $1,892 |

| 10 | Dodge | $1,877 |

| 9 | Hyundai | $1,801 |

| 8 | Mercedes Benz | $1,801 |

| 7 | Nissan | $1,763 |

| 6 | Subaru | $1,761 |

| 5 | Jeep | $1,752 |

| 4 | Toyota | $1,752 |

| 3 | Mazda | $1,712 |

| 2 | Kia | $1,706 |

| 1 | Volkswagen | $1,695 |

After balancing the average car value and the 2016 accident surveys, the Toyota Tundra is the most affordable car to insure, even though it is a large truck. Adding Toyota, its dependability, and CrewMax Cab into the equation, it easily becomes the best-used car on the market.

| 2017 Most Affordable Automobile to Purchase | ||||

|---|---|---|---|---|

| Rank | Brand | Type | Average Value | Average Premium |

| 1 | Toyota Tundra | CrewMax Cab | $35,617 | $1,680 |

| 2 | Mazda CX-5 | SUV | $21,022 | $1,695 |

| 3 | Volkswagen Golf | Hatchback | $17,614 | $1,695 |

| 4 | Kia Optima | Sedan | $20,195 | $1,703 |

| 5 | Kia Sorento | SUV | $25,087 | $1,703 |

| 6 | Kia Sportage | SUV | $21,060 | $1,703 |

| 7 | Kia Soul | Wagon | $14,305 | $1,703 |

| 8 | Jeep Compass | SUV | $17,288 | $1,710 |

| 9 | Volkswagen Jetta | Sedan | $17,167 | $1,711 |

| 10 | Jeep Patriot | SUV | $15,728 | $1,715 |

| 11 | Kia Forte | Sedan | $13,541 | $1,717 |

| 12 | Volkswagen Passat | Sedan | $16,959 | $1,718 |

| 13 | Toyota Sienna | Minivan | $29,370 | $1,720 |

| 14 | Jeep Wrangler | SUV | $29,319 | $1,721 |

| 15 | Toyota Camry | Sedan | $20,922 | $1,722 |

| 16 | Mazda 3 | Sedan | $17,929 | $1,728 |

| 17 | Toyota Corolla | Sedan | $15,729 | $1,734 |

| 18 | Nissan Pathfinder | SUV | $30,625 | $1,737 |

| 19 | Nissan Rogue | SUV | $20,797 | $1,738 |

| 20 | Toyota Prius | Hatchback | $16,181 | $1,738 |

| 21 | Nissan Murano | SUV | $29,011 | $1,745 |

| 22 | Subaru Impreza | Hatchback | $17,907 | $1,749 |

| 23 | Nissan Versa | Sedan | $10,818 | $1,750 |

| 24 | Subaru Forester | SUV | $21,631 | $1,760 |

| 25 | Subaru Legacy | Sedan | $20,342 | $1,764 |

| 26 | Nissan Sentra | Sedan | $14,468 | $1,765 |

| 27 | Toyota Highlander | SUV | $33,834 | $1,768 |

| 28 | Subaru Outback | SUV | $25,165 | $1,771 |

| 29 | Toyota Tacoma | Double Cab | $25,064 | $1,791 |

| 30 | Mercedes-Benz C-Class | Sedan | $36,256 | $1,801 |

| 31 | Nissan Frontier | King Cab | $22,476 | $1,801 |

| 32 | Nissan Altima | Sedan | $19,922 | $1,807 |

| 33 | Hyundai Tucson | SUV | $19,710 | $1,833 |

| 34 | Chevrolet Traverse | SUV | $28,160 | $1,886 |

| 35 | Chevrolet Trax | SUV | $10,340 | $1,886 |

| 36 | Chrysler 200 | Sedan | $16,815 | $1,886 |

| 37 | Dodge Challenger | Coupe | $30,579 | $1,886 |

| 38 | Dodge Charger | Sedan | $32,957 | $1,886 |

| 39 | Dodge Dart | Sedan | $13,252 | $1,886 |

| 40 | Dodge Durango | SUV | $31,790 | $1,886 |

| 41 | Ford Expedition | SUV | $36,099 | $1,886 |

| 42 | Ford Focus | Sedan | $14,370 | $1,887 |

| 43 | Ford Explorer | SUV | $28,735 | $1,891 |

| 44 | Ford Mustang | Convertible | $29,497 | $1,892 |

| 45 | Ford Taurus | Sedan | $22,690 | $1,892 |

| 46 | Honda Civic | Sedan | $19,807 | $1,892 |

| 47 | Honda CR-V | SUV | $24,060 | $1,892 |

| 48 | Chevrolet Tahoe | SUV | $47,126 | $1,892 |

| 49 | Dodge Journey | SUV | $20,559 | $1,892 |

| 50 | GMC Terrain | SUV | $23,922 | $1,892 |

| 51 | Chevrolet Impala | Sedan | $24,253 | $1,893 |

| 52 | Ford Edge | SUV | $26,228 | $1,893 |

| 53 | Chevrolet Equinox | SUV | $22,627 | $1,899 |

| 54 | Honda Odyssey | Minivan | $27,695 | $1,899 |

| 55 | Chrysler 300 | Sedan | $25,625 | $1,900 |

| 56 | Honda Accord | Sedan | $21,493 | $1,900 |

| 57 | Hyundai Accent | Hatchback | $11,340 | $1,901 |

| 58 | GMC Acadia | SUV | $34,706 | $1,901 |

| 59 | Chevrolet Malibu | Sedan | $15,472 | $1,901 |

| 60 | Hyundai Elantra | Sedan | $15,997 | $1,902 |

| 61 | Honda Pilot | SUV | $31,239 | $1,902 |

| 62 | Chevrolet Colorado | Crew Cab | $26,890 | $1,907 |

| 63 | BMW 3-Series | Sedan | $32,277 | $1,908 |

| 64 | Chevrolet Cruze | Sedan | $14,875 | $1,909 |

| 65 | Chevrolet Sonic | Hatchback | $12,715 | $1,909 |

| 66 | Honda Fit | Hatchback | $15,229 | $1,910 |

| 67 | Buick Encore | SUV | $20,033 | $1,915 |

| 68 | Ford Fiesta | Sedan | $12,308 | $1,916 |

| 69 | Jeep Cherokee | SUV | $21,272 | $1,919 |

| 70 | Acura MDX | SUV | $39,411 | $1,933 |

What to Do If Your Premium Is Still Too Expensive

For example, CrewMax Cab trucks are usually owned by responsible, middle-aged drivers, making them a lower risk than other vehicles. The same applies to certain brands. To get the lowest rate possible, explore car insurance discounts you can’t miss, along with this chart of cars with the cheapest premiums.

If you hate public transportation, there are other options to consider. Here are some possible suggestions:

- Ask if your co-workers or neighbors would like to carpool with you in exchange for paying gas or favors.

- Join an online carpool system. Many cities have government-funded and private programs to lower air pollution and bridge the gap where public transportation fails. The great thing about these programs is that you do not need to drive at all. That means more time for you to sneak in another nap, read a book, or catch up on your favorite TV shows. And in doing so, you can save some more money, help out the environment, and even make some new friends.

- Get an electric bicycle. These days, these hybrid bicycles can travel as fast as a scooter or motorcycle. If you live in dense traffic areas, they can actually be your best way to commute to work or go grocery shopping. It is another great way to save money and help the environment. What is awesome about the electric bicycle is that you can also get some exercise every day. Now you have no reason to skip out on working out. If you decide on this option, remember to check with your local state regulations concerning the speed allowed. For example, in California, you can ride your electric bicycle in the bike lane if it is under 20MPH. If it travels faster than that, you must share the motorcycle or use a specialized protected lane.

- Relocate closer to work. Moving closer to where you work can save you both money and time. You no longer need to be stuck in traffic. On average, most people spend about 2 hours in traffic on a daily basis. Imagine what you can do with these extra 2 hours.

Smart Solutions When Auto Insurance Becomes Unaffordable

We hope that our article has provided you with some useful information on how to make your plan more affordable so that you can continue using your vehicle for all your needs. Please note that at any point, if you have any concerns about your coverage, do not let it slide.

By being proactive and reaching out to an agent, you may discover that even in the worst states for filing an auto insurance claim, there are still viable solutions. Waiting too long can limit your options, so take action now to secure better coverage and savings.

If you have any personal tips and stories you wish to share with our fellow readers, please leave us a comment. We will be more than delighted to hear from all of you.

Find the most affordable coverage options by using our free quote comparison tool—just enter your ZIP code.

Frequently Asked Questions

How much does Chrysler 200 car insurance cost?

The average cost of Chrysler 200 car insurance ranges from $1,400 to $1,900 per year, depending on factors such as location, driving history, and coverage levels.

What factors affect Dodge Dart insurance rates?

Key factors impacting Dodge Dart insurance rates include the driver’s age, location, driving history, annual mileage, and chosen coverage levels.

How can I afford car insurance on a tight budget?

To afford car insurance on a budget, explore hacks to save more money on car insurance, compare multiple quotes, increase your deductible, qualify for discounts, and consider state-sponsored insurance programs if eligible.

How can you afford car insurance at 17 without breaking the bank?

To save on car insurance at 17, stay on a parent’s policy, maintain good grades for a student discount, take a defensive driving course, and drive a low-risk vehicle.

What are the best ways to afford car insurance at 18?

Eighteen-year-olds can lower insurance costs by choosing liability-only coverage, maintaining a clean driving record, and bundling policies with family members.

What options are available if I can’t afford car insurance in Michigan?

Michigan offers low-cost insurance programs, such as the Michigan Auto Insurance Plan (MAIP), and allows for minimum liability coverage to help reduce costs. Read this ultimate guide on the best time to buy a new car.

How can I get low-income car insurance in Colorado?

Colorado does not have a state-sponsored low-income car insurance program, but drivers can apply for discounts, reduced coverage options, or usage-based insurance.

Are there programs for low-income car insurance in Maryland?

Yes, Maryland offers low-income car insurance through MAIF (Maryland Auto Insurance Fund) for drivers who cannot get coverage from private insurers.

How do I qualify for low-income car insurance in New Jersey?

New Jersey provides the SAIP (Special Automobile Insurance Policy), which offers basic coverage for Medicaid-eligible low-income drivers.

Get personalized insurance quotes in seconds—simply enter your ZIP code into our free comparison tool.

What are the different MAIF policy options available?

MAIF offers liability coverage, uninsured motorist protection, personal injury protection (PIP), and optional comprehensive and collision coverage.

How can I get an MAIF quote in Baltimore?

Where can I find an MAIF quote in Maryland?

What happens if I can’t afford my car insurance, and what should I do?

How much is Jeep Patriot insurance, and what affects the cost?

What are the average rates for Mazda CX-7 car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.