American Family Insurance Review for 2025 (Policies, Prices & More!)

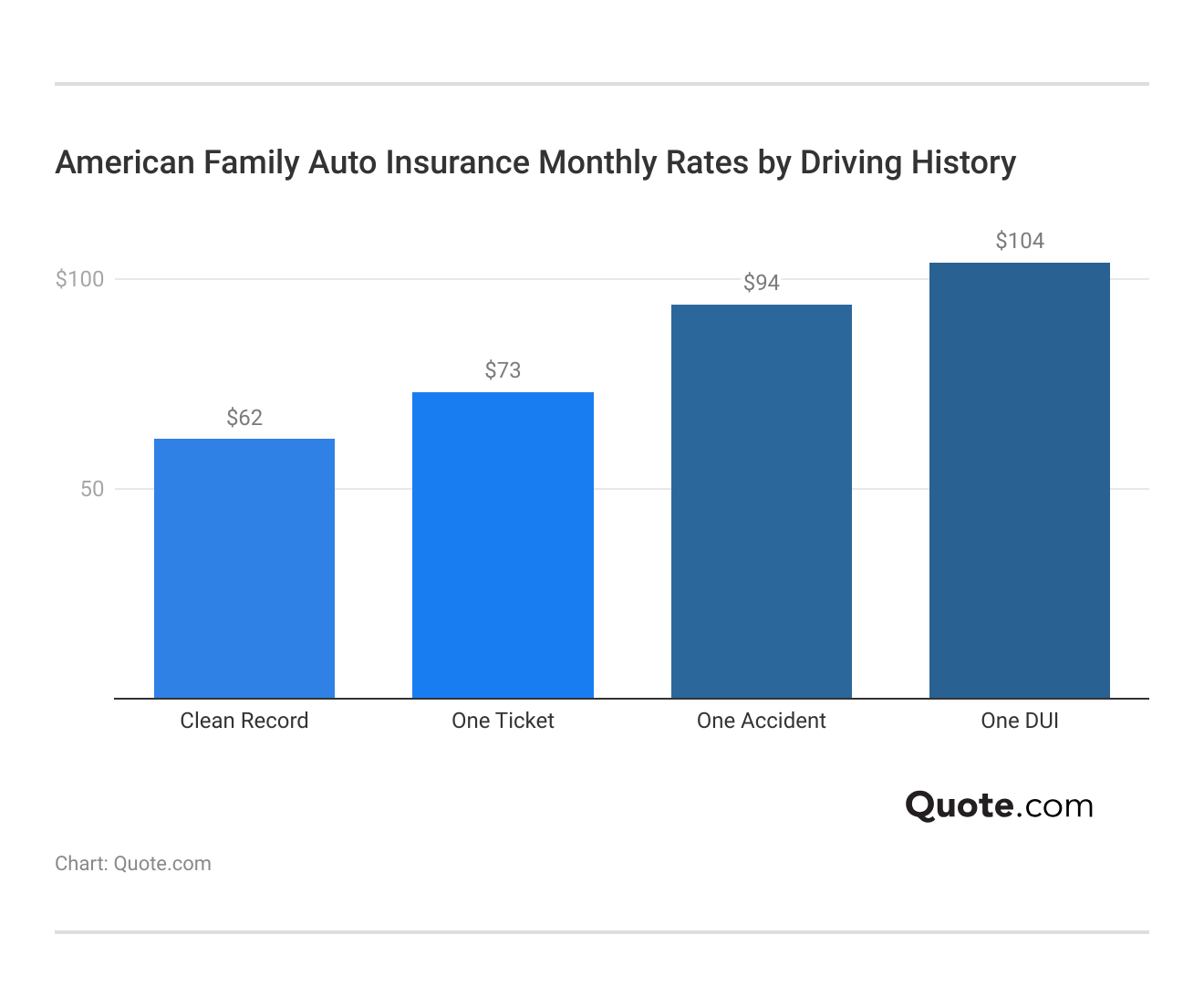

Our American Family insurance review highlights auto insurance rates starting at $62 per month for families and safe drivers, plus multi-policy discounts up to 25% on home, life, business, farm, and travel insurance plans. American Family DriveMyWay offers flexible protection for motorcycles, ATVs, and more.

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Insurance Agent

UPDATED: Apr 22, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Apr 22, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

American Family Insurance

Average Monthly Rate For Good Drivers

$32A.M. Best Rating:

AComplaint Level:

LowPros

- Bundling discounts available for home and auto policies

- Strong A.M. Best financial strength rating

- DriveMyWay rewards safe drivers through telematics tracking

Cons

- Rates increase sharply for high-risk or SR-22 drivers

- Coverage availability is limited to 19 states

Explore our American Family insurance review covering auto, life, farm, business, travel, and recreational vehicle insurance.

American Family Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 4.0 |

| Business Reviews | 4.0 |

| Claims Processing | 4.8 |

| Company Reputation | 4.5 |

| Coverage Availability | 3.9 |

| Coverage Value | 4.0 |

| Customer Satisfaction | 2.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4.5 |

| Policy Options | 3.4 |

| Savings Potential | 4.2 |

American Family DriveMyWay is a usage-based car insurance program that adjusts rates based on driving behavior, offering discounts for safe habits and enrollment. DriveMyWay rewards safe driving habits while bundling policies across home, life, and business to unlock extra savings.

- The AmFam insurance rating is 4.0/5 for its competitive rates

- American Family Insurance is only available in 19 states

- American Family has fewer insurance complaints than other companies

Auto policyholders benefit from accident forgiveness, early sign-up, and low-mileage discounts designed to lower costs across multiple coverage types and personal needs.

American Family Mutual Insurance Company is the fourth-largest provider, based in Wisconsin, and operates in 19 states through its exclusive agents. If AmFam isn’t available where you live, enter your ZIP code into our free online quote comparison tool to find local providers.

American Family Auto Insurance Costs

Monthly rates for American Family auto insurance are broken down by age, gender, and coverage level in this table. Teenagers spend the most, particularly teen males who pay $726 per month for full coverage.

American Family Auto Insurance Monthly Rates by Age, Gender, & Coverage Level| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $230 | $590 |

| 16-Year-Old Male | $296 | $726 |

| 18-Year-Old Female | $187 | $435 |

| 18-Year-Old Male | $253 | $591 |

| 25-Year-Old Female | $66 | $178 |

| 25-Year-Old Male | $78 | $210 |

| 30-Year-Old Female | $62 | $165 |

| 30-Year-Old Male | $73 | $195 |

| 45-Year-Old Female | $62 | $164 |

| 45-Year-Old Male | $62 | $166 |

| 60-Year-Old Female | $57 | $148 |

| 60-Year-Old Male | $58 | $150 |

| 65-Year-Old Female | $61 | $161 |

| 65-Year-Old Male | $61 | $163 |

As one ages, rates slowly decline. By age 60, they level off at approximately $150 a month. Usually, women get somewhat lower American Family insurance rates than men.

This table shows the monthly premiums for full coverage from big insurance companies. For drivers with no offenses, American Family charges $166, but if you have a DUI, the amount increases to $276. See why safe drivers often qualify for the cheapest car insurance available.

The chart below compares AmFam average monthly premiums for both minimum and full coverage against other top providers. USAA leads with the lowest rates for minimum coverage at half the price of AmFam, but American Family car insurance is still cheaper than Farmers and Nationwide.

American Family Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

American Family ranks among the most affordable full coverage options at $166. Liberty Mutual and Travelers show the steepest full coverage rates at $248.

Read More: Is it bad to cancel car insurance?

Other Auto Insurance Options From American Family

This table lists American Family auto insurance coverages. From liability for at-fault accidents to roadside assistance for unplanned breakdowns, every coverage has a particular use.

American Family Auto Insurance Coverage Options| Coverage Type | Description |

|---|---|

| Liability | Covers injuries & damage to others if you're at fault |

| Collision | Pays for your car’s damage after an accident |

| Comprehensive | Covers theft, vandalism, weather, & animal hits |

| Uninsured Motorist | Helps if an uninsured driver causes an accident |

| Underinsured Motorist | Covers costs if the other driver’s insurance is insufficient |

| MedPay | Pays medical bills for you & passengers, regardless of fault |

| PIP | Covers medical expenses & lost wages (varies by state) |

| Rental Reimbursement | Pays for a rental while your car is repaired |

| Roadside Assistance | Covers towing, jump-starts, & flat tires |

| Gap Insurance | Covers the loan difference if your car is totaled |

| New Car Replacement | Helps replace a totaled car with a new one |

| Accident Forgiveness | Prevents premium hikes after your first accident |

Policies providing longer financial protection include PIP and Gap Insurance. MedPay or PIP are state-specific choices that could affect your eligibility for benefits.

Drivers benefit from flexible coverage options and accident forgiveness with American Family Insurance.

Jeff Root Licensed Insurance Agent

American Family also offers vehicle-specific auto policies for ATVs, motorcycles, snowmobiles, and more, and remains a leading company for budget-conscious drivers who own and use different types of vehicles.

Learn More: A Visual Guide to How Auto Insurance Works

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

American Family Home Insurance Costs

Our American Family review for home insurance finds more competitive rates. USAA is the cheapest, but AmFam only costs around $10 more per month for the same coverage.

American Family Homeowners Insurance Rates by Provider & Policy Limit| Company | $250K Policy | $350K Policy | $450K Policy |

|---|---|---|---|

| $125 | $149 | $175 | |

| $115 | $138 | $162 | |

| $127 | $151 | $177 | |

| $118 | $140 | $165 | |

| $130 | $155 | $181 |

| $121 | $145 | $170 |

| $123 | $146 | $172 | |

| $120 | $142 | $167 | |

| $119 | $143 | $169 | |

| $105 | $127 | $151 |

When it comes to homeowners insurance coverage, American Family is cheaper than the most popular companies like Geico and State Farm, with $450,000 policies costing only $162 monthly.

List of Essential Insurance Coverage From American Family

American Family Insurance is well-known for providing home and auto insurance, but it has many different protection plans for personal and professional needs. Here are other types of American Family insurance policies you can get:

- Business Insurance: Covers property, liability, workers’ comp, and more.

- Life Insurance: Options include term, whole, and universal life policies.

- Umbrella Insurance: Adds extra liability protection beyond standard policies.

- Farm & Ranch Insurance: Protects dwellings, machinery, livestock, and crops.

- Travel Insurance: Covers trip cancellations, medical emergencies, and delays (Read More: Best Travel Insurance Companies).

American Family’s wide range of options allows people and families to safeguard every part of their lives or work all in one place. You can also stack your policies for a bundling discount of up to 25%.

American Family Insurance Savings Through Safe Driving & Discounts

Top American Family Insurance discount programs are highlighted in this table. The best savings are found by bundling policies and insuring multiple vehicles.

American Family Home and Auto Insurance Discounts & Savings Potential| Discount | |

|---|---|

| Auto Pay & Paperless | 4% |

| Bundling | 25% |

| Defensive Driving | 10% |

| Early Bird | 10% |

| Good Student | 20% |

| Home Security | 5% |

| Low Mileage | 20% |

| Loyalty | 18% |

| Multi-Vehicle | 20% |

| New Home | 10% |

| Renovated Home | 8% |

| Safe Driver | 18% |

| Steer Into Savings | 7% |

Small steps, such as registering early or setting up autopay, can significantly reduce your monthly rate. Notable discounts are also available for low mileage, a clean driving record, and safe driving habits.

Explore more of the top car insurance discounts you can’t miss that reward good grades, early sign-up, and clean driving records, helping you cut monthly costs.

Many American Family reviews note that its car insurance discounts are competitive, but its homeowner discounts are smaller when compared to other companies. For instance, the new home discount is only 10%. Compare discounts with the best homeowners insurance companies to ensure you’re getting the most savings.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

AmFam Insurance Ratings Reflect Reliability and Satisfaction

This table shows a comparison of American Family Insurance ratings with other dependable agencies. With high BBB ratings, American Family customer reviews are more positive than usual, and its financial backing is stable.

American Family Insurance Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 78/100 Positive Customer Feedback |

|

| Score: 692 / 1,000 Avg. Satisfaction |

|

| Score: 0.77 Fewer Complaints Than Avg. |

Reports from Consumer Reports and NAIC say that fewer complaints are being reported, with high consumer satisfaction. However, J.D. Power proposes that there is potential for improvement in the overall experience of consumers. Find out how to compare auto insurance companies for better coverage and rates.

American Family Insurance Benefits

Our American Family insurance review is 4.0/5 because of its competitive prices on both home and auto coverage. While it doesn’t have the cheapest car insurance, it does offer solid discount schemes, such as DriveMyWay. Its home insurance is much more competitive, with rates as low as $115 per month.

Home is where your family’s growing dreams thrive. Find out how we can help protect them at https://t.co/Pzkz7CS0vohttps://t.co/9a6Ci0eCd1

— American Family Insurance (@amfam) July 13, 2016

Though it is not the perfect match for high-risk drivers and its coverage is limited to only 19 states, its options for bundling, financial stability, and customer satisfaction ratings make it a trustworthy selection for households who need multiple types of insurance. Unlock bundling savings with local providers today with our free comparison tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What can you learn from American Family Insurance reviews on Consumer Reports?

Consumer Reports highlights that you may benefit from solid claims satisfaction and competitive monthly rates, especially with bundling. However, you might notice limited digital tools compared to top-rated providers. Find out if you’re living in the worst states for filing an auto insurance claim.

How does American Family Insurance review homeowners coverage?

You’ll likely find homeowners policies that receive favorable ratings for bundling discounts and extended dwelling coverage, though claims response times can vary by region.

Are American Family Insurance Google reviews generally positive?

Yes, you’ll see mixed-to-positive Google reviews, often praising helpful agents and DriveMyWay discounts. Still, some reviewers mention rate increases after policy renewals. Compare American Family insurance policies by entering your ZIP code into our free quote tool.

What should you know about American Family Insurance reviews and complaints?

You may encounter complaints related to claim delays or rate hikes, but overall satisfaction tends to remain above average, especially for customers who bundle home and auto.

How reliable are American Family Insurance reviews on BBB?

According to BBB reviews, you can expect reliable service and strong financial backing. However, unresolved claims or billing issues may appear in lower-star ratings. Learn by understanding the eight types of homeowners insurance policies.

Is American Family Insurance expensive compared to others?

Is American Family expensive insurance? No, American Family’s monthly rates are often affordable, around $166 for full coverage, especially with safe driving or multi-policy discounts.

How does American Family Insurance vs. State Farm compare for coverage and cost?

If you’re deciding between the two, know that American Family typically offers lower monthly rates for safe drivers, while State Farm provides broader availability and slightly better digital tools.

Read More: State Farm Auto Insurance Review

Is American Family Insurance a good company?

Yes, you’ll likely find American Family Insurance to be a solid option, especially if you’re a safe driver or bundling policies. Many customers appreciate the low monthly rates, which average around $166 for full coverage.

Does American Family Insurance pay claims well?

American Family handles claims fairly well, especially for property and auto policies. While some delays may occur, most users report positive outcomes and reliable support.

What is American Family Life Insurance ranked?

You’ll see American Family Life Insurance ranked among the top mid-size insurers. While not the highest nationally, it performs well in customer satisfaction and policy flexibility.

Read More: 10 Best Life Insurance Companies

Is American Family the most trusted insurance company?

Is American Family the number one life insurance company in the U.S.? No, American Family isn’t rated as the most trusted overall, but it maintains strong trust scores for reliability, particularly among families and homeowners in the 19 states it serves. You can compare the top companies near you by entering your ZIP code in our free rate checker.

What are the top five insurance rating agencies for American Family?

What is the American Family’s best rating? Top agencies like A.M. Best, Moody’s, and S&P give American Family favorable ratings. A.M. Best, for example, assigns them an “A” for financial strength.

What types of insurance does American Family offer?

You can purchase multiple types of coverage from American Family, including auto, home, renters, life, and business insurance, all tailored to your specific needs.

Does American Family Insurance offer health insurance?

No, American Family doesn’t offer traditional health insurance. Instead, you can buy supplemental coverage, such as accidental death or disability insurance, to enhance your overall protection.

What company owns American Family Insurance?

American Family Insurance is a mutual company, meaning it’s owned by policyholders like you, not outside shareholders.

Is American Family Insurance a good company to work for?

Yes, you’ll likely find American Family Insurance to be a strong employer if you’re seeking stability and growth. Employees often highlight flexible work options, competitive benefits, and a supportive workplace culture.

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.