Allied Insurance Review for 2026

Allied, a Nationwide subsidiary, works through trusted local agents to offer drivers affordable and flexible coverage starting at $84 a month. Our Allied insurance review also found that safe drivers can save up to 20% and enjoy valuable extras like a $500 deductible credit and Rental Days Plus benefits.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson, a published insurance expert, is the fourth generation in her family to work in the insurance industry. Over the past two decades, she has gained in-depth knowledge of state-specific insurance laws and how insurance fits into every person’s life, from budgets to coverage levels. She specializes in autonomous technology, real estate, home security, consumer analyses, investing, di...

Melanie Musson

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated November 2025

Our Allied insurance review shows monthly rates of $84 with safe driver discounts of up to 20%, making it a smart way to buy auto insurance for budget-conscious drivers.

- Allied car insurance rates start at just $84 a month

- Only requires one deductible for joint home and auto claims

- Supports eco-friendly drivers with hybrid vehicle incentives

Allied Insurance is now more often seen under its parent company, Nationwide, though the Allied name still appears in some places.

Customers get a $10,000 accidental death benefit, unlimited rental days through Rental Days Plus, and homeowners save with credits for renovated roofs, updated plumbing, or by living in a gated community.

Allied Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 4.1 |

| Business Reviews | 4.0 |

| Claims Processing | 4.0 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.9 |

| Coverage Value | 3.9 |

| Customer Satisfaction | 4.2 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.0 |

| Policy Options | 3.4 |

| Savings Potential | 4.3 |

Nationwide is gradually phasing out the Allied brand while keeping these unique programs available through local agents. Use our free quote tool now to see your options.

Comparing Allied Auto Insurance Rates

As drivers gain experience and their risk levels change, so do the rates for Allied auto insurance. Your age and gender have a significant impact on what you pay and when you’re likely to find the cheapest car insurance available to you, which is why it’s smart to request an updated Allied car insurance quote as your situation changes.

Teen drivers pay the most, making family discounts or good student perks a smart way to reduce their average of $270. Midlife drivers see the lowest rates, a reward for years of safe driving. Rates go up slightly for seniors, so it’s worth reviewing your policy and asking about renewal discounts as your needs change.

Just like your age and experience affect what you pay with Allied, your driving record matters just as much. The table clearly illustrates how a single mistake can quickly escalate your costs.

Allied vs. Competitors: Car Insurance Monthly Rates by Driving Record| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $96 | $187 | $233 | $172 | |

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 |

One accident with Allied almost doubles your premium, making safe driving habits just as important as growing older. A DUI can send costs even higher than those of some competitors, so comparing your options is crucial if you have serious violations.

At the same time, companies like Geico and State Farm cater more to low-risk drivers with rock-bottom prices, and Allied appeals to those who prefer dependable service as their record improves.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Allied Home Insurance Rates

Allied’s home insurance costs change quite a bit depending on your home’s value, and it’s easy to see how what you pay each month depends on how much coverage you need. Knowing where you stand can help you plan your budget more confidently.

Allied vs. Competitors: Home Insurance Monthly Rates| Company | $200K | $300K | $500K | $1M |

|---|---|---|---|---|

| $82 | $98 | $121 | $165 | |

| $79 | $95 | $118 | $160 | |

| $84 | $100 | $125 | $169 |

| $85 | $101 | $123 | $167 | |

| $78 | $93 | $117 | $155 | |

| $80 | $97 | $122 | $164 |

| $81 | $96 | $120 | $162 | |

| $83 | $99 | $124 | $168 | |

| $77 | $92 | $116 | $153 | |

| $86 | $102 | $126 | $170 |

If your home’s around $200K, Allied’s homeowners insurance coverage runs about $82 a month—which isn’t bad—but Geico’s $78 could be a better pick if you’re trying to cut costs. For $300K homes, Allied’s $98 feels like a solid middle ground if you’re after reliable homeowners insurance coverage without going overboard.

If your home is worth $500K, the $121 premium feels a little high compared to State Farm, so it’s smart to consider whether Allied’s extra service makes up for the difference. And for $1M homes, the $165 rate stays competitive, but it’s worth shopping around to see if you can find a better deal.

Comparing Allied Commercial Insurance Rates

Allied’s commercial insurance pricing shows where your business can save and where it might pay to shop around. These numbers make it easier to see how each policy fits your budget and needs.

Allied vs. Competitors: Commercial Insurance Monthly Rates| Company | General Liability | Business Owner | Professional Liability | Commercial Auto |

|---|---|---|---|---|

| $42 | $68 | $59 | $97 | |

| $44 | $70 | $61 | $98 | |

| $46 | $72 | $63 | $99 |

| $43 | $69 | $60 | $95 | |

| $41 | $66 | $58 | $96 | |

| $45 | $71 | $62 | $100 |

| $47 | $73 | $64 | $101 | |

| $40 | $67 | $57 | $94 | |

| $48 | $74 | $65 | $102 | |

| $49 | $75 | $66 | $103 |

At just $42, Allied’s general liability is one of the most affordable options, making it a great pick for small businesses that just need basic coverage to get started. The $68 business owners’ policy combines liability and property at a reasonable price, which works well if you want everything bundled without overpaying.

Professional liability at $59 is competitive and a good fit for consultants or contractors who need solid protection without breaking the bank. But commercial auto at $97 is on the higher side compared to what’s noted in the Progressive insurance review, so if you run a fleet, it’s worth comparing a few quotes before deciding.

Best Allied Insurance Discounts

Allied’s discounts help lower your insurance premiums and make your policy feel more manageable. These car insurance discounts can really add up if you take advantage of the ones that fit your lifestyle, and reviewing Allied Insurance quotes regularly can help you spot even more savings opportunities.

Bundling your auto and home policies saves you up to 25%, which can put a nice chunk of change back in your pocket each year, especially helpful if you’re juggling a mortgage. Staying ticket-free gets you another 20% off, so keeping a clean driving record pays off.

Allied Insurance Discounts| Discount | |

|---|---|

| Bundling | 25% |

| Safe Driver | 20% |

| Good Student | 15% |

| Anti-Theft | 10% |

| Accident-Free | 10% |

| Defensive Driving | 10% |

| Early Quote | 10% |

| Low Mileage | 10% |

| New Vehicle | 10% |

| AutoPay | 5% |

| Homeowner | 5% |

| Paperless Billing | 5% |

Families with teen drivers can ease the sting of higher rates thanks to a 15% good student discount. Even little things, like driving fewer miles, adding an anti-theft device, or setting up autopay, can shave 5–10% off your bill — small changes that make a big difference over time.

You can also save with an Easy Pay discount just for setting up automatic payments, which means no more mailing checks and a one-time credit on your premium. If you’re switching from another insurer, the prior carrier discount gives you another break just for making the move to Allied.

Enrolling in autopay or going paperless often unlocks small discounts, which add up over the life of your policy.

Jeff Root Licensed Insurance Agent

Farm Bureau members in California, Ohio, Delaware, Maryland, or Pennsylvania can score even more savings on both personal and business auto policies. And if you insure both your car and home with Allied, the 12-month rate lock keeps your premium steady for a full year — a big relief if you like predictable costs.

Allied Homeowners Insurance Discounts

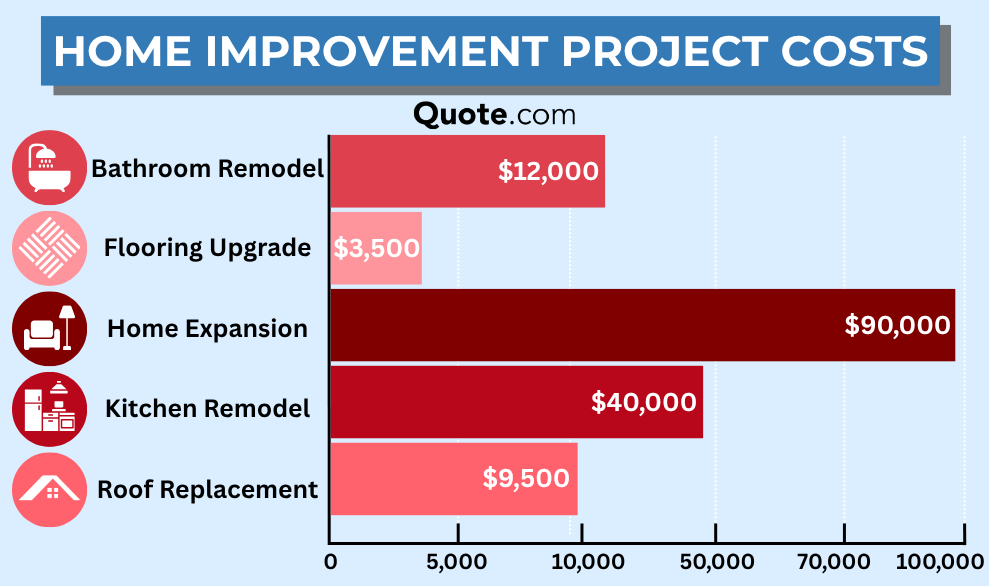

Allied makes it easy to save on your homeowners insurance by rewarding smart choices and safer homes. These discounts help you keep costs down while still protecting what matters most, as many allied homeowners insurance reviews point out.

- Multi-Policy Discount: Bundle your home and auto with Allied to save some cash and keep it all in one easy plan.

- Gated Community Discount: You’ll pay less if you live in a gated neighborhood, thanks to the added security.

- Home Renovation Discount: Updating things like your roof, plumbing, or wiring can earn you credits on your premium.

- Home Purchase Discount: Save more when you sign up for Allied homeowners insurance within a year of buying your home.

- Protective Device and Claims-Free Discounts: Install alarms, smoke detectors, or stay claims-free over time to unlock even more savings.

These discounts are a smart way to save on your insurance without giving up quality. With Allied, simple upgrades and good habits really do pay off — and taking time to compare homeowners insurance quotes can help you find the best deal.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allied Insurance Coverage Options

Allied gives you plenty of ways to customize your policy so it actually fits your needs. Here’s a quick look at what each coverage option does and why it can really help when life throws you a curveball.

Allied Insurance Coverage Options| Coverage | What it Covers |

|---|---|

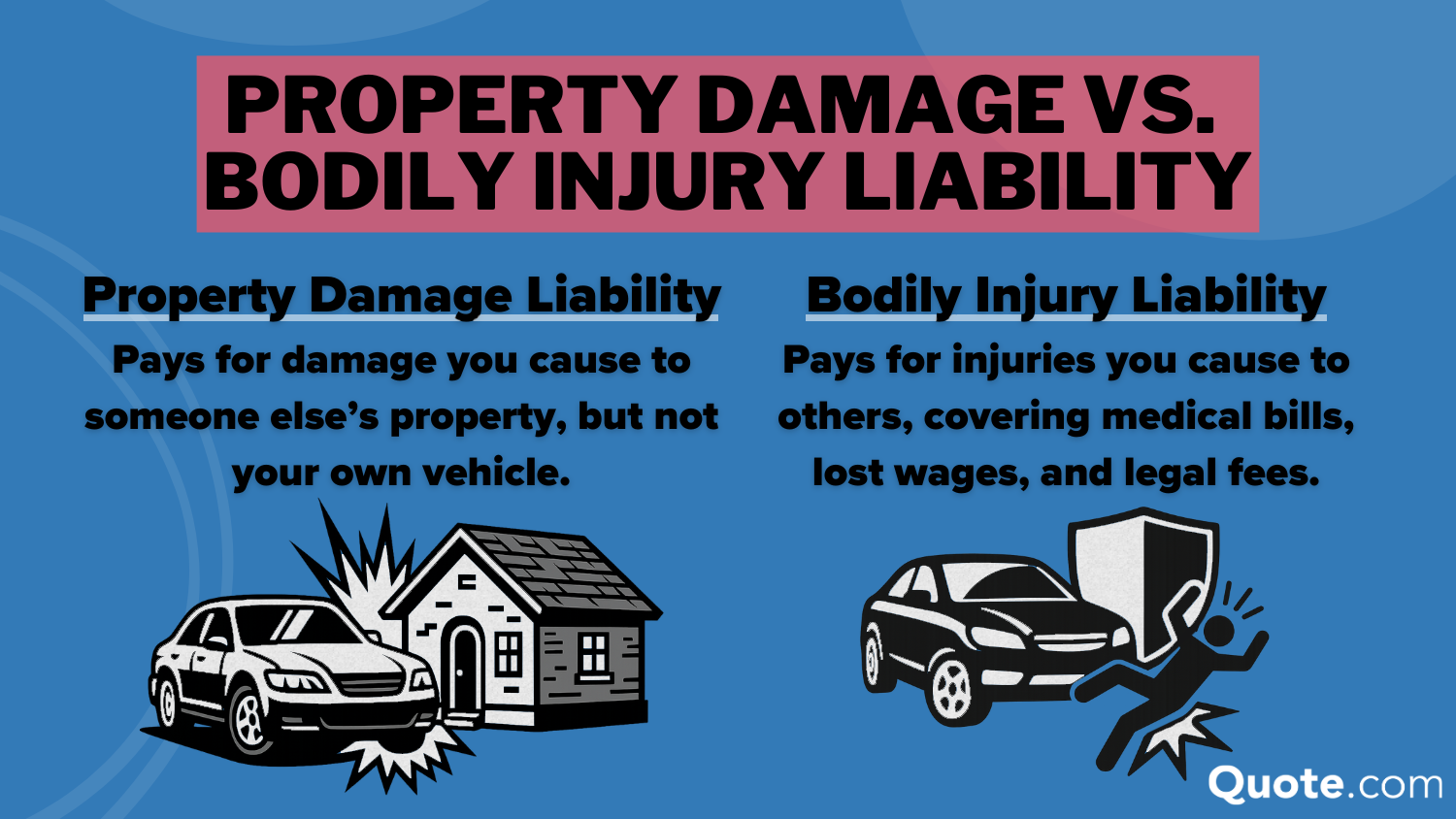

| Liability | Pays for damage/injuries you cause |

| Collision | Repairs/replaces your car after crash |

| Comprehensive | Covers theft, weather, or animal loss |

| Personal Injury Protection (PIP) | Covers medical bills and lost wages |

| Uninsured/Underinsured Motorist | Pays for injuries from uninsured drivers |

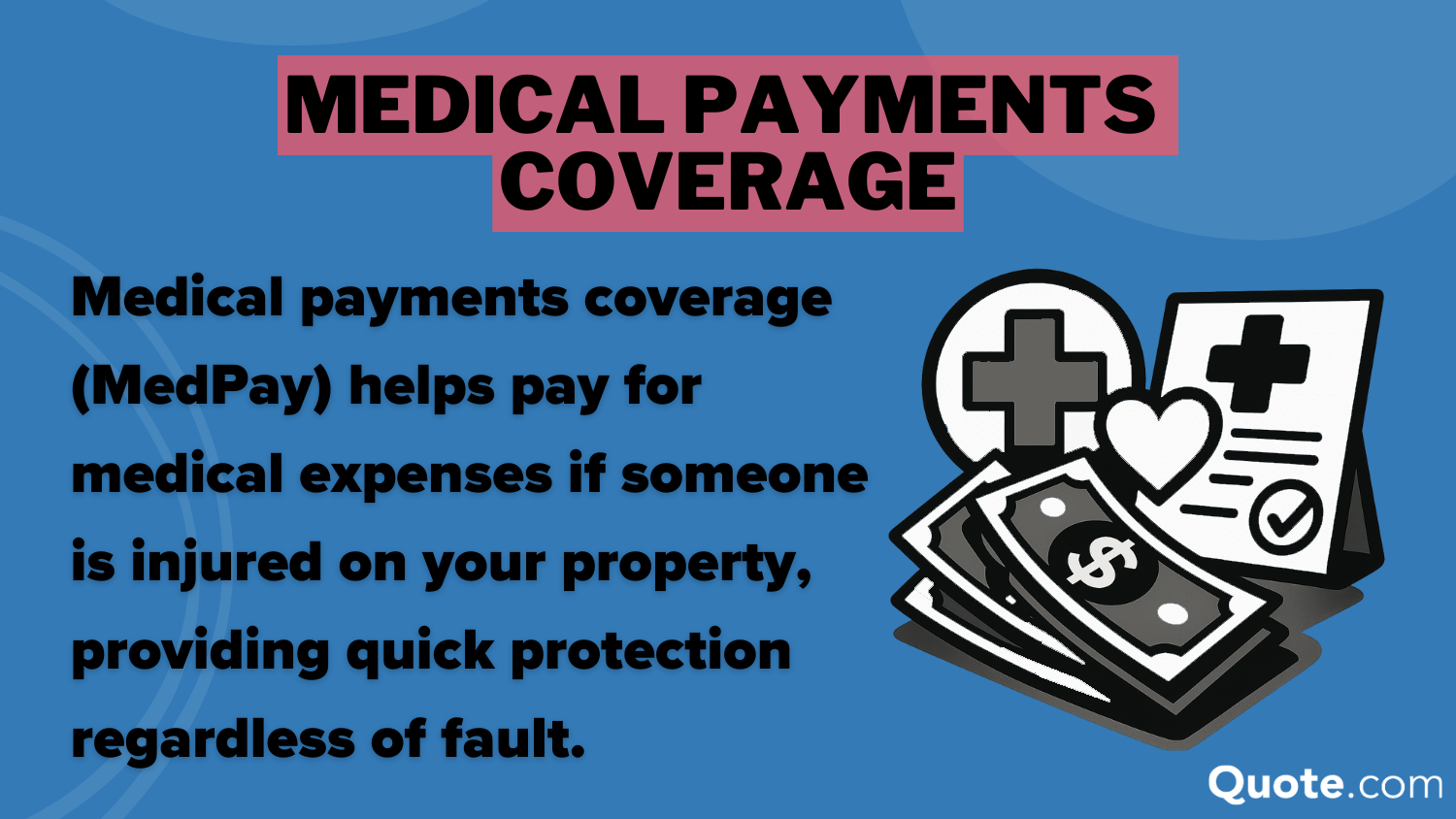

| Medical Payments (MedPay) | Covers med bills for you & passengers |

| Roadside Assistance | Covers towing, jumps, or lockouts |

| Rental Reimbursement | Pays for rental while car’s repaired |

| Gap Insurance | Pays loan balance if car is totaled |

| Accident Forgiveness | Prevents rate hike after first accident |

| Custom Equipment | Covers custom or added car parts |

| New Car Replacement | Covers new car after total loss |

Liability helps pay if you hurt someone or damage their property, and most states require it. Collision pays to repair your car if you hit something, while comprehensive takes care of things like theft, hail, or vandalism.

Personal injury protection (PIP) and MedPay help with your medical bills, no matter who’s at fault — a big help if your health insurance doesn’t cover everything.

Uninsured and underinsured coverage kicks in if the other driver doesn’t have enough insurance, and roadside assistance gets you back on the road with a tow or jump-start if you’re stuck.

You can also add rental reimbursement, gap insurance to cover what you still owe if your car’s totaled, plus perks like accident forgiveness, new car replacement, and custom equipment coverage for peace of mind.

Allied Homeowners Insurance Coverage

Allied offers a range of home insurance options to help protect your house and everything that makes it feel like home, which is why many consider it one of the best homeowners insurance companies.

Dwelling coverage helps cover repairs or even rebuild your home if it’s damaged by fire, hail, wind, or vandalism. It also covers your stuff —belongings such as furniture, electronics, and clothing, if they’re stolen or ruined.

Liability coverage’s got you if someone gets hurt at your place or you mess up someone else’s stuff — it even helps with medical bills and lawyer fees. And if a covered loss leaves your home unlivable, Allied helps cover hotel stays, meals, and other living expenses while you get back on your feet.

Allied even includes coverage for detached structures like fences, garages, and sheds, so your entire property is protected.

If you’ve got valuables like jewelry, antiques, or collectibles, you can add inland marine coverage to give them a little extra protection. Condo owners can also cover their upgrades, personal items, and liability, while renters can get affordable protection for their belongings with the option to add liability coverage as well.

Even small details matter — like cleaning up debris after a storm or replacing damaged trees and plants. With all these options, an Allied agent can help you customize a policy that truly fits your needs.

Allied Commercial Insurance Coverage

Allied makes it easy for businesses to get the right protection with options that fit real-world risks. Their general liability insurance covers you if a customer is injured at your shop or you accidentally damage someone’s property, even helping with medical bills and legal fees, much like how a fire engine responds quickly to minimize damage.

If you want more, a Business Owners Policy (BOP) bundles liability and property coverage together, protecting your building and inventory from risks such as fire, theft, or vandalism.

For professionals who offer advice or specialized services, professional liability insurance protects against lawsuits for errors or omissions. If your employees use company vehicles, commercial auto insurance helps cover accidents, vehicle damage, and injuries that occur while they’re on the road.

Digital Services of Allied Insurance

Allied’s mobile app makes managing your insurance simple and stress-free. You can grab it from the App Store or Google Play and use it to pay your bill, set up an Allied auto payment, get in touch with your agent, or file an auto insurance claim whenever you need.

If something happens, the app provides a simple checklist, directions to the nearest repair shop or tow service, and allows you to file a claim directly on your phone. You can even upload photos, add accident details, and let GPS fill in your location for you.

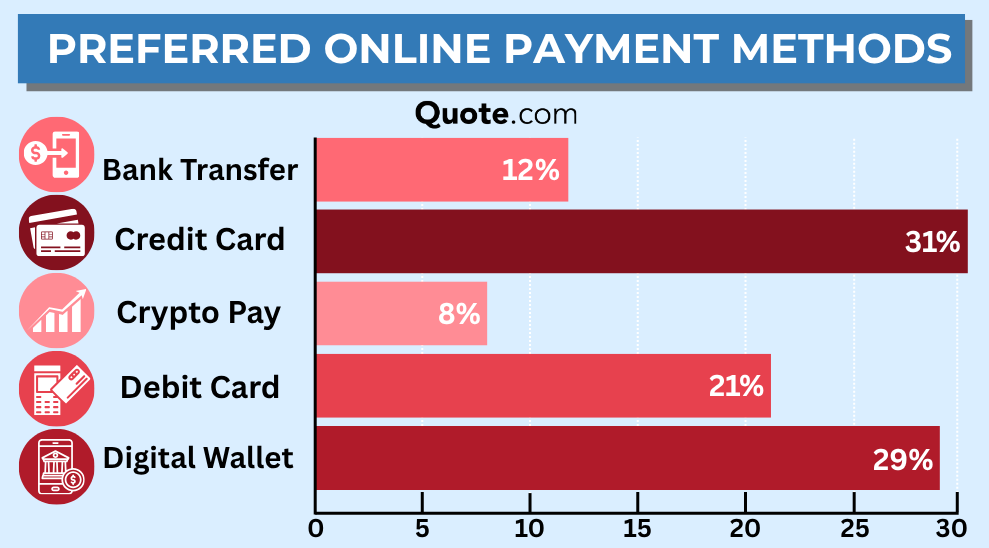

It’s also great for checking your claim status, viewing your policy, or seeing when your next payment is due. Since 31% of people prefer paying with credit cards and another 29% like using digital wallets, the app makes it easy to pay however you’re most comfortable — all right from your pocket.

How to Save on Allied Insurance

There are plenty of ways to save on your Allied policy that go beyond the usual discounts. A few smart tweaks can help lower your premium without cutting the coverage you actually need, especially if you’re carrying things like comprehensive auto insurance.

- Pick a Higher Deductible: Bumping your deductible from $500 to $1,000 could knock up to 15% off your premium, according to Allied agents.

- Drop Coverage You Don’t Need: If your car is older and paid off, you may save $200$300 a year by dropping collision or comprehensive coverage.

- Keep Your Policy up to Date: Check in with your agent and remove coverage for items you no longer own, such as old jewelry or a car you’ve sold.

- Pay Upfront: Paying your premium in full instead of monthly skips the installment fees and costs less overall.

- Adjust Your Limits: Ensure your home or auto coverage accurately matches your needs — there’s no sense in paying for more than necessary.

A quick conversation with your Allied insurance agent and a couple of simple adjustments can save you a significant amount. It’s an easy way to make sure you’re not overpaying for the protection you need.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allied Insurance Reviews & Complaints

Allied Insurance, now part of Nationwide, delivers fast, affordable home, auto, and life insurance with a personal touch. While the Allied name still appears occasionally, Nationwide is steadily phasing it out.

However, what customers value most is the personal service for which Allied is known, often highlighted in Allied car insurance reviews and even in honest Nationwide auto insurance reviews.

Since 1929, Allied has grown into one of the largest insurers in the U.S. while keeping its small-agency feel.

Many customers prefer working with local agents to obtain quotes that truly align with their budget and lifestyle.

Safe drivers, families bundling home and auto, and those who appreciate perks like accident forgiveness often see Allied as a great choice.

Allied customers appreciate how easy it is to reach a representative anytime and how quickly claims are handled, whether online or through the app.

Ratings back up this sentiment. Allied earns an A from A.M. Best for its financial strength and an A from the BBB for its fair business practices, making it a solid and ethical choice.

Allied Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A Excellent Financial Strength |

| Score: A Good Business Practices |

|

| Score: 76/100 Good Customer Feedback |

|

| Score: 825 / 1,000 Avg. Satisfaction |

|

| Score: 1.05 Avg. Complaints |

Allied Insurance reviews in Consumer Reports rate it 76/100, indicating that most customers are satisfied with their experience, although some note that communication could be improved. J.D. Power gives Allied an 825/1,000 rating for customer satisfaction, and NAIC shows that complaints are right at the industry average — steady, if not exceptional.

J.D. Power scores reflect overall customer satisfaction, so look for a provider with at least average or better ratings.

Michelle Robbins Licensed Insurance Agent

Allied insurance reviews on Reddit reflect the same trust and appreciation, with many users mentioning how much they value working with local agents and the reassurance of knowing their families are protected.

That kind of personal trust says a lot. Beyond the numbers, it’s clear many customers feel confident choosing Allied to protect what matters most, though it’s always smart to get multiple auto insurance quotes to make sure you’re getting the best deal for your needs.

Pros and Cons of Allied Insurance

Allied Insurance gives you personal service and some pretty great perks you won’t always find elsewhere. But like any company, it has its pros and cons, so here’s what to keep in mind.

Pros

- Local Agent Advantage: Allied works with independent agents who offer personal quotes and one-on-one help, perfect if you like sitting down with someone to talk through your options.

- Competitive Multi-Policy Discounts: Bundling your home and auto can save you up to 25%, which is more than what most other insurers typically offer.

- 12-Month Rate Lock: When you bundle your home and auto, Allied locks in your premium for a full year, so you don’t have to worry if rates go up.

Cons

- No Online Quotes: Allied requires you to visit or call an agent for a quote, which is inconvenient for customers preferring digital-first experiences.

- Limited Brand Visibility: With Nationwide phasing out the Allied name, customers may experience confusion when branding or documents reference both companies interchangeably.

Allied is a great choice if you prefer working with a local agent and securing favorable discounts.

If you’re more inclined to do everything online, though, it might not be the best fit — but you can still use the Allied Auto Insurance login to easily manage your account, check your policy, and make payments without calling in.

And don’t forget, bundling and asking about other discounts are always smart tips to pay less for car insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Find Affordable Coverage With Allied Insurance

Allied Insurance, now part of Nationwide, brings nearly 100 years of experience and backs it up with flexible coverage, affordable rates, and a claims process that’s refreshingly easy to deal with. It’s a solid pick if you like working with a local agent and want options like collision auto insurance; you can customize.

To keep your costs down, consider paying your policy in full and checking in with your agent to remove any coverage you no longer need.

However, you’ll need to request an Allied auto insurance quote through an agent since instant online quotes aren’t available. Standout perks, such as accident forgiveness and unlimited rental car coverage, make it a worthwhile consideration.

Simply enter your ZIP code online to compare quotes and ensure you’re getting the best deal for the coverage you want.

Frequently Asked Questions

Is Allied Insurance owned by Nationwide?

Yes, Nationwide fully owns Allied Insurance and benefits from its financial strength, as well as its A.M. Best A rating and extensive claims network.

Is Allied Insurance private?

Yes, Allied is a privately held insurer under Nationwide, which means you get the backing of a major company while still working with independent local agents.

What kind of insurance does Allied offer?

Allied offers many insurance coverage options, including auto, home, renters, and business insurance.

Does Allied offer health insurance?

No, Allied does not sell health insurance plans. It focuses on property, auto, life, and specialty coverages like identity theft and powersports insurance, so you’ll want to check out a complete guide to health insurance to explore your options for medical coverage.

Can you pay insurance in installments in Allied Insurance?

Yes, you can split your premium into monthly payments. However, paying your premium in full up front can save you on installment fees and lower your total monthly rate.

Does Allied offer dental insurance?

No, Allied does not provide dental insurance. You’ll need to look for a dedicated health or dental insurance provider to access these benefits.

What should you know about Safe Auto vs. Allied?

If you only need the state minimum liability to stay legal, Safe Auto may be a suitable option. Still, Allied provides added value with perks like a 12-month rate lock, accident forgiveness, and up to 25% savings when you bundle home and auto — a point often highlighted in more than one Safe Auto insurance review if you’re looking for more than just basic coverage.

How do I file a claim with Allied Insurance?

Whenever you need to file a claim, you can call Allied’s 24/7 line, get in touch with your local agent, or use the app to send photos, fill in the details, and check your claim instantly.

What is Allied’s customer satisfaction rating?

Allied’s customer satisfaction score from J.D. Power is 825 out of 1,000, reflecting above-average satisfaction among policyholders.

Is Allied Insurance good?

Allied is a reliable choice thanks to its A.M. Best A rating, strong Nationwide backing, and standout features like accident forgiveness, roadside assistance, and a claims process that customers consistently rate highly for being quick and stress-free.

How does Liberty Mutual vs. Allied compare?

What is Allied vehicle protection?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.