How Airbags Affect Auto Insurance Rates in 2026

Airbags affect auto insurance rates positively, with auto insurance companies often lowering rates for cars with airbags that do well in crash testing. Some companies offer a discount as high as 40% on medical coverage for cars that have driver and passenger airbags.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Head of Content

Meggan McCain, Head of Content, has been a professional writer and editor for over a decade. She leads the in-house content team at Quote.com. With three years dedicated to the insurance industry, Meggan combines her editorial expertise and passion for writing to help readers better understand complex insurance topics. As a content team manager, Meggan sets the tone for excellence by guiding co...

Meggan McCain

Senior Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated November 2025

If you’re wondering how airbags affect auto insurance rates, they can help lower costs by reducing the risk of severe injuries and minimizing the likelihood of large injury claim payouts.

- Airbag auto insurance discounts can be as large as 40%

- Cars with great airbag and safety ratings will be cheaper to insure

- There are several types of airbags, from front to side airbags

Since vehicles with airbags are considered safer, having newer airbag models that perform well in crash tests can often lead to lower rates or a safety discount.

Read our auto insurance guide on airbags to learn how airbags can help you save on auto insurance policies, as well as how airbags work to protect you and your passengers in an accident.

Looking for affordable auto insurance to cover your car? Our free quote tool will help you find the best deal on auto insurance in your area. Just enter your ZIP to get started.

How Airbags Help You Save Money on Auto Insurance

You may not think that airbags have an effect on your auto insurance rates, but auto insurance companies do consider the safety features in your car when basing rates.

If your vehicle is equipped with airbags, you may be eligible for an airbag safety feature discount at most insurance companies.

Best Airbag Auto Insurance Discounts by Provider & Savings| Company | Rank | Savings Potential | New Monthly Rate | Eligibility |

|---|---|---|---|---|

| #1 | 40% | $26 | Driver & passenger airbags on PIP/MedPay | |

| #2 | 40% | $28 | Any airbag qualifies with PIP/MedPay | |

| #3 | 30% | $43 | Front or dual airbags on PIP/MedPay |

| #4 | 30% | $46 | Steering wheel/dashboard airbags qualify | |

| #5 | 20% | $50 | Driver or dual front airbags eligible | |

| #6 | 15% | $82 | Any airbag-equipped vehicle qualifies |

| #7 | 12% | $49 | Front + side airbags get discounts | |

| #8 | 10% | $70 | Varies by vehicle safety features | |

| #9 | 8% | $72 | Factory-installed airbags only | |

| #10 | 3% | $59 | Basic PIP/MedPay airbag discount |

Airbags reduce the risk of serious injury, which in turn reduces the amount of money an auto insurance company has to pay out for medical coverage in an accident.

When you look at auto insurance rates before and after airbags are applied, you will see that at most companies, you can save at least a few dollars a month.

Auto Insurance Monthly Rates Before & After Airbag Discount| Company | Before Discount | After Discount |

|---|---|---|

| $62 | $43 |

| $65 | $46 | |

| $78 | $70 | |

| $43 | $26 | |

| $96 | $82 |

| $63 | $50 | |

| $56 | $49 | |

| $47 | $28 | |

| $78 | $72 | |

| $61 | $59 |

Geico and State Farm have some of the cheapest average rates after an airbag discount is applied. You can read our Geico insurance review or State Farm insurance review to learn more about these two companies.

On the other hand, even with a great discount on safety features like airbags, your rates may still be expensive if you are with a pricer company like Liberty Mutual or Farmers. Make sure to shop around and compare rates with a few different companies before committing to a company.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Airbag Types, Locations, and Crash Test Scores

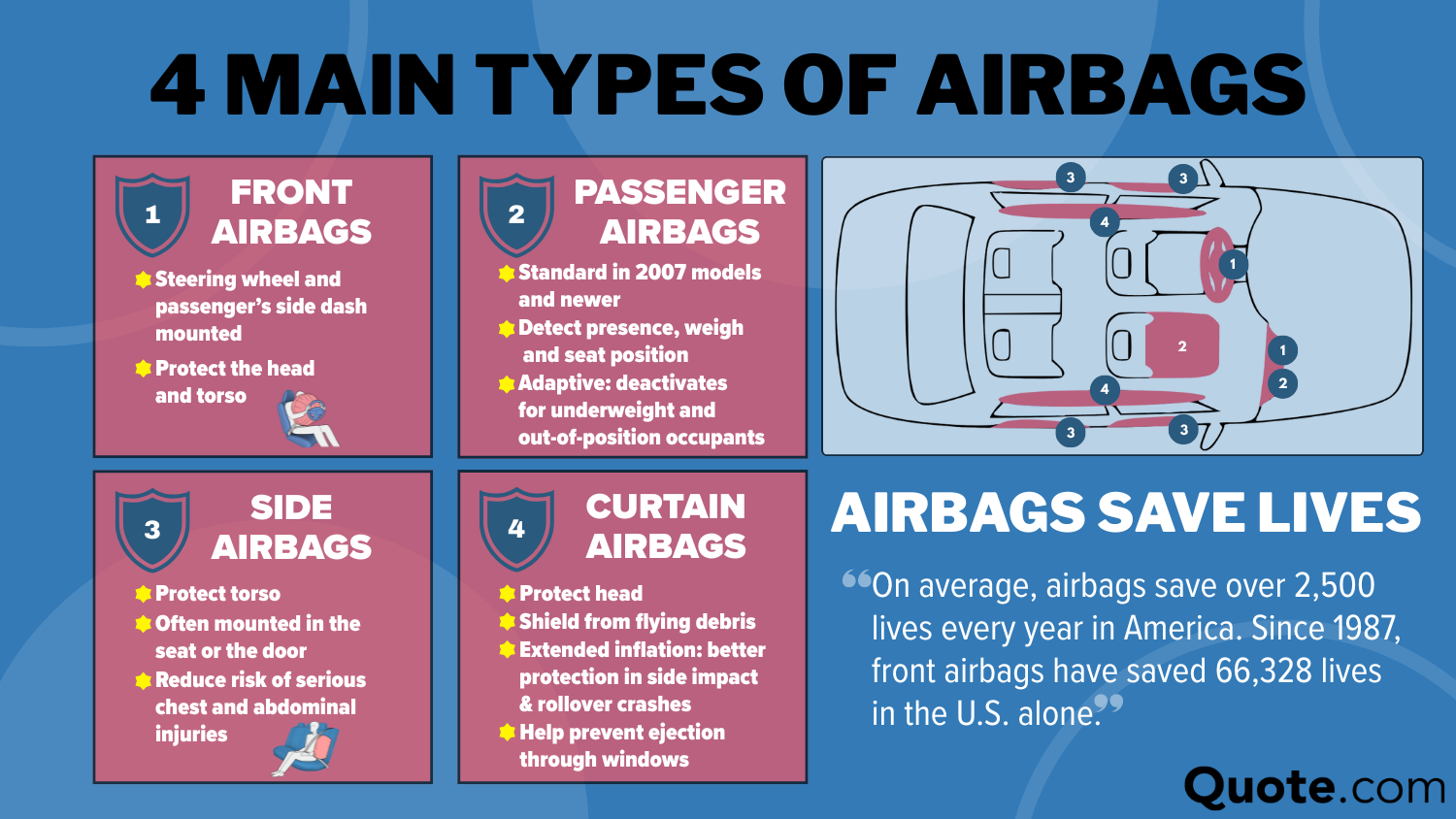

When looking into how airbag works, it is important to understand the different types. While you might think of just front airbags when you think of airbags, there are several types of airbags in cars when you look at a how do airbags work diagram, especially in newer car models.

Newer models of cars built in 2007 or later will include passenger airbags, which help protect occupants even if they are underweight or out of position.

The more types of airbags you have in your vehicle, the more likely it is that your vehicle has received a higher safety rating in testing.

If you own a vehicle that has a good safety rating, which is based partly on airbag protection in crash testing, your auto insurance rates will also be lower.

Vehicles With Best Airbag Crash-Test Scores From NHTSA| Make & Model | Airbag Location | Rating | Results |

|---|---|---|---|

| Tesla Model Y | Front, side, curtain, knee & rear | ⭐⭐⭐⭐⭐ | Excellent side crash performance |

| Mazda CX-90 | Front, side, curtain & knee | ⭐⭐⭐⭐ | Great front crash prevention |

| Volvo XC90 Recharge | Front, side, curtain & knee | ⭐⭐⭐⭐⭐ | Best for occupant protection |

| Honda Accord | Front, side, curtain & knee | ⭐⭐⭐⭐⭐ | Comprehensive crash test performance |

| Toyota Camry | Front, side, curtain & knee | ⭐⭐⭐⭐⭐ | Excellent crashworthiness |

| Mazda CX-50 | Front, side, curtain & knee | ⭐⭐⭐⭐ | Great crash test results with advanced features |

| Genesis G80 | Front, side, curtain & knee | ⭐⭐⭐⭐⭐ | Superb crash protection |

| Hyundai Ioniq 6 | Front, side, curtain & knee | ⭐⭐⭐⭐ | Excellent safety features |

| Ford Mustang Mach-E | Front, side, curtain & knee | ⭐⭐⭐⭐ | Strong crash protection and assistance features |

| Subaru Forester | Front, side, curtain & knee | ⭐⭐⭐⭐⭐ | Top crash ratings with advanced tech |

Picking a car with great airbags and safety ratings will reduce your auto insurance rates and help keep you and your passengers safer in a crash.

You can check sites like the Insurance Institute for Highway Safety (IIHS) for safety and crash test ratings on vehicles (Learn More: What does the Insurance Institute for Highway Safety do?). Read on to learn more about how airbags work to protect you.

How Airbags Work: Reducing Injuries and Saving Lives

What is an airbag? Airbags serve as a Supplemental Restraint System (SRS), which is secondary to the seatbelt system. When a crash happens, sensors send data to a central “brain” that evaluates all incoming information to decide if air bag deployment is necessary, and if needed, deploys specific air bags.

The process usually happens in under 0.03 seconds, and before a human body would move toward it because of the crash. Wondering what is the purpose of an airbag? The main function of airbags is to save lives.

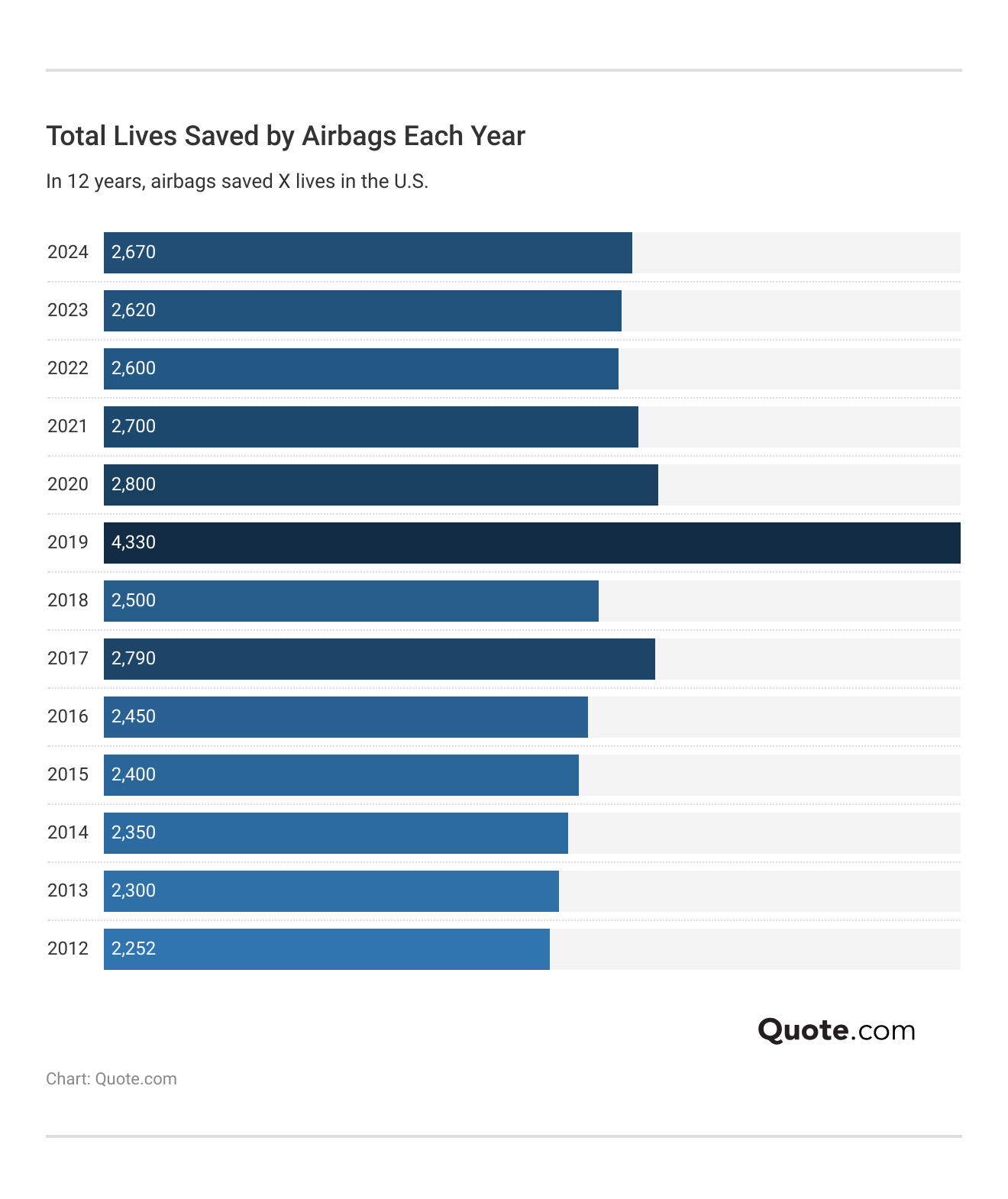

Every year, airbags save thousands of lives with this technology, whether it’s a collision with a telephone pole or an animal (Read More: When Animals or Natural Disasters Damage Your Vehicle). For example, in 2024, airbags saved a total of 2,670 lives.

Over the course of 13 years, airbags have saved over 30,000 lives in crashes. Read on to learn more about airbag components and function.

How Airbags Sense and Evaluate a Crash

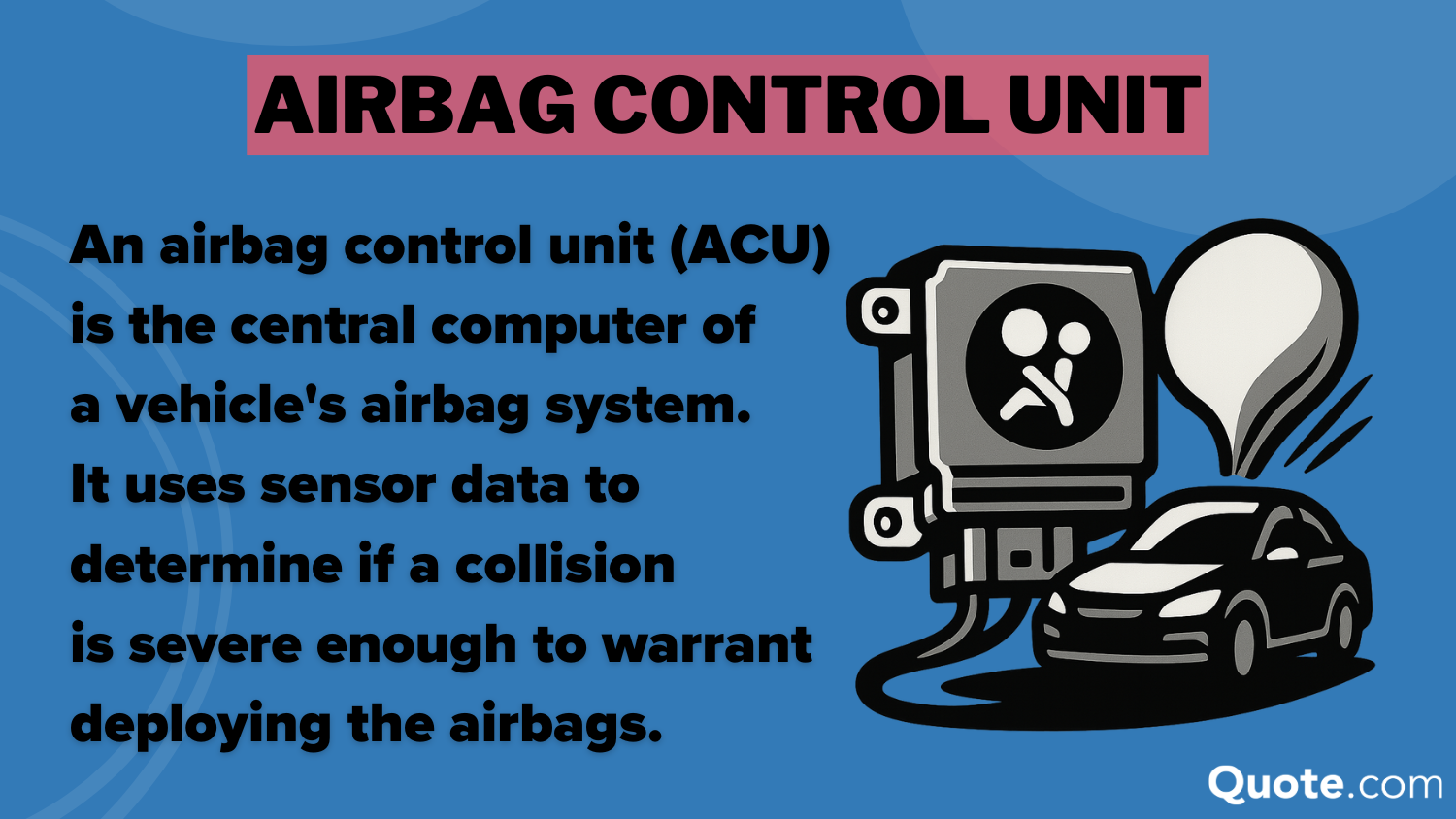

When it comes to how an airbag works to detect a crash, there are several moving parts to an airbag that need to work together to decide if airbags need to be deployed in a crash.

These parts are the same in all types of airbags. Airbag technology senses and evaluates a crash through the following components:

- Wheel Speed Sensors: Wheel speed sensors use a toothed wheel attached to the vehicle’s wheel and a magnet surrounded by a coil to determine wheel speed. As the teeth pass by the magnet, the magnetic field fluxes and creates a current.

- Seat Occupancy Sensor: The seat occupancy sensor uses a silicone bladder on top of a pressure sensor to sense the weight of the passenger. If a passenger is detected, the sensor sends a signal to the ACU, and the corresponding air bag is deployed.

- External Sensors: External sensors have a force collector, such as a spring or diaphragm, to determine the amount of pressure being applied and convert the pressure into an electrical signal.

All of these sensors work in unison under the Airbag Control Unit (ACU), which is essentially a central computer, to decide whether to deploy an airbag or not. The ACU data saved after airbag deployment also helps with traffic collision reconstruction.

The ACU also consists of an accelerometer and a gyroscope, two important parts that help the ACU determine whether to deploy airbags.

The accelerometer detects changes in acceleration by measuring the displacement of a small mass, and then converting the movement into an electrical signal. Frontal crashes cause rapid deceleration, while side crashes cause rapid acceleration.

A vibrating gyroscope senses angular velocity (change in rotational angle over time) by measuring the directional change of vibration (as the vehicle’s orientation rotates) in the mechanical structures and converting the movement into an electrical signal.

Airbag Inflation and Construction

When you are in an accident, whether an at-fault accident or a non-fault accident, proper airbag inflation is important. Curious about the science of airbags? The airbag is inflated by a pyrotechnical inflator or a heated gas inflator (HGI). A pyrotechnical inflator inflates airbags with propellant and an initiator.

The initiator heats a solid propellant that rapidly decomposes and produces nitrogen gas. The most common propellant chemicals used are phase-stabilized ammonium nitrate and nitroguanidine.

The initiator is an electric match, which is a bridgewire (an electrical conductor) wrapped in combustible material. Electrical currents heat up the bridgewire, which ignites the combustible material.

A heated gas inflator, however, inflates airbags with a few more components. What’s in an airbag with a heated gas inflator? The main components are:

- Diffuser: The heated gas exits the cylinder through the diffuser and into the air bag.

- Second Burst Disk: The internal pressure increases enough to rupture the second burst disk.

- Compressed Gas Cylinder: The compressed gas consists of hydrogen, oxygen, and nitrogen.

- First Burst Disk: The initiator ruptures the first burst disk and heats the compressed gas.

- Initiator: Similar to pyrotechnical inflators, the initiator in HGIs is also an electric match.

Now that you know how airbags inflate, let’s take a closer look at what materials airbags are constructed of. All airbags are made up of woven nylon fabric and have powder and vents.

The airbag assembly typically includes talcum powder or cornstarch as a lubricant to prevent the airbag from getting stuck during deployment. Additionally, the vents at the back allow the airbag to slightly deflate, providing cushioning for the vehicle’s occupants upon impact.

Airbags are folded and stored in a compartment inside the vehicle, which has designated seams that tear open during deployment.

Airbag Deployment Impact on Insurance Claims

If airbags are deployed in an accident, it may help verify your injury claim to your auto insurance company (Read More: How to File an Auto Insurance Claim & Win).

Deployed airbags indicate a more serious crash, which supports injury claims, as you are more likely to be injured in an accident where airbags were deployed.

If airbags malfunctioned and did not deploy even in a serious crash, make sure to have evidence of this when filing a claim.

Brandon Frady Licensed Insurance Producer

If you were injured in an accident, make sure to seek prompt medical treatment and keep thorough records of medical bills and injuries.

Insurance adjusters will take your medical treatment and airbag deployment into account when verifying the validity of an injury claim.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance Policies That Cover Airbags

If your airbags were deployed, you will need to get them replaced. However, not all auto insurance policies will help pay to replace airbags after an accident.

Typically, liability-only coverage policies will not help cover the costs of airbag replacements, so you may not get reimbursed if you have a minimum coverage policy.

However, collision and comprehensive coverage will usually help pay for airbag replacement as part of repairs, after your deductible is met (Read More: Collision vs. Comprehensive Auto Insurance).

Bear in mind, however, that even if you have collision and comprehensive coverage, insurance companies may choose to total a car if the cost of repairs is too great.

Driver Injuries Caused by Airbags

Airbags were designed to save lives, and they do protect a number of drivers and passengers each year in serious vehicle crashes.

However, it is also still possible to be injured by an airbag deployment, as airbags are employed with some force to prevent more severe injury. Some common injuries that airbags can cause include:

- Facial Injuries: An airbag hitting a face could cause bruising, fractures, and more.

- Neck/Spine Injuries: The force of hitting an airbag could cause whiplash.

- Chest Injuries: There may be bruising, rib fractures, internal bleeding, and more.

Even if you feel fine after an accident, it is still very important to get checked out by a medical professional if your airbags deployed in an accident.

There may be an injury that could get worse later, or adrenaline may be masking injury pain. It is also good to have a record of medical treatment if you need to file a personal injury protection (PIP) claim later.

Vehicle Safety Features Lower Car Insurance Rates

Airbags are not the only safety features that can save you money on your car insurance policy with a discount (Read More: 17 Car Insurance Discounts You Can’t Miss).

Some other safety features in your vehicle that can result in lower auto insurance rates on your policy include:

- Collision Warning Systems: Front or rear cameras that detect incoming collisions and warn the driver.

- Lane Departure Warning: Alerts drivers if they start to drift out of their lane.

- Electronic Stability Control: Automatically helps drivers regain control of the car.

Any feature that helps prevent a car accident is a bonus to auto insurance companies, as it helps them avoid having to pay out a claim.

Looking to find affordable auto insurance for your vehicle today? Enter your ZIP code in our free tool to get quotes from companies today.

Frequently Asked Questions

What are airbags for?

Airbags are intended to prevent serious injury or death to drivers and passengers in a car accident.

Will insurance total a car if the airbags deploy?

Wondering do they total a car when airbags deploy? The deployment of airbags doesn’t automatically mean a car will be totaled by an insurance company. The insurance company will also look at the extent of other damages and consider the total cost of repairs before declaring a car totaled.

What has the biggest impact on car insurance?

Your driving record has one of the biggest impacts on your auto insurance rates. If you have a poor driving record and higher rates, make sure you are low risk in other areas, such as driving a safe car with multiple safety features (Read More: Cheap Auto Insurance for High-Risk Drivers).

Why do insurance companies ask if airbags are deployed?

Airbags are deployed only in more serious accidents, so knowing if airbags were deployed helps insurance companies determine the severity of the crash. Airbag replacement is also expensive, so it is calculated into a company’s insurance payout estimate.

How much does airbag deployment affect car value?

One of the indisbutable airbag facts is that airbag deployment negatively affects a car’s value. The value of a car decreases after an accident, and airbags are typically deployed only in more serious accidents, indicating structural damage.

Is it worth fixing a car with airbags deployed?

It depends on several factors, such as the extent of damage, the age of the car, and your personal financial situation. If the car is relatively new and the damage is mostly cosmetic, then it might be worth fixing the car if insurance covers your claim (Learn More: Best Auto Insurance Companies for Claims Handling).

At what speed do airbags deploy?

It depends on the vehicle, but generally, auto airbags will deploy when hitting an object at a speed of 10 mph or greater if the airbags are working.

Do vehicle safety features impact auto insurance rates?

Yes, having vehicle safety features often lowers auto insurance rates, as they reduce the risk of injury, collision, theft, and more. Shop for affordable auto insurance quotes today by entering your ZIP in our free tool.

Can added safety features reduce my auto insurance rate?

Yes, adding safety features like a backup camera or a GPS tracking system to deter theft can help reduce auto insurance rates (Learn More: Best Anti-Theft Auto Insurance Discounts).

What leads to a higher auto insurance rate?

Some of the factors that lead to higher auto insurance rates are age, driving record, location, and vehicle type.

How much do airbags affect auto insurance rates?

Will removing deployed airbags increase my insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.