17 Tips to Pay Less for Car Insurance in 2026

Discover the 17 tips to pay less for car insurance without sacrificing coverage. These proven strategies help drivers slash premiums by up to 30%. Implementing these tricks to make car insurance cheaper can reduce your insurance costs. Learn how to get cheap car insurance with the following tips.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her research, writing, and communications talents in the areas of human resources, f...

Karen Condor

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Scott Young

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated December 2025

These proven 17 tips to pay less for car insurance can save drivers up to 30% annually without sacrificing coverage. Follow these cheap car insurance tips and tricks, like VIN etching and installing car alarms to save 10%-30%.

- Different types of car insurance have different ways to lower rates

- Getting married or buying a house can reduce rates by 47%

- Taking defensive driving courses can cut costs by up to 50%

Smart tricks for cheaper car insurance include raising your deductible strategically and getting car insurance discounts you can’t miss.

Take action with tips for cheaper car insurance by completing a defensive driving course or considering usage-based insurance programs. See if you’re getting the best deal on car insurance by entering your ZIP code.

1. Etch Your Vin Onto Your Windows

Every vehicle comes with a unique vehicle identification number, or VIN. It’s usually found on a sticker pasted onto the driver side door of a vehicle. This number can be the bane of a car thief’s existence. Since selling or transferring a car’s title requires running the VIN number through a federal database, it’s an easy way of identifying whether a vehicle has been stolen in the past.

One of the best ways to lower your car insurance premiums is by etching your VIN number into your car windows, making it less attractive to thieves.

Dani Best Licensed Insurance Producer

In our Allstate auto insurance review, we explain how the VIN etching insurance discount works:

“VIN etching is the permanent engraving of a vehicle’s federally registered vehicle identification number (VIN) onto its windshield and windows. VIN etching is often seen as a deterrent to thieves because it not only makes it nearly impossible for thieves to profit from selling windows and windshields, but it also makes it more difficult for thieves to find a way to dispose of the vehicle once it has been stolen.”

Now like most things that involve messing around with glass, VIN etching may initially seem like a potentially risky proposition. However, the Arizona Automobile Theft Authority offers some assurance that VIN etching won’t damage or alter your vehicle’s appearance, and the whole process only takes around ten minutes.

However, make sure you don’t pay too much for VIN etching. Dealerships often offer to etch the VIN onto the windows of newly purchased vehicles, but at ridiculous prices. Here’s Consumer Law Group with an explanation about its tips for cheap insurance:

“…Most dealerships charge well over $100 for the service, and $189 seems to be the going rate in Connecticut; some dealerships charge even more. But, it doesn’t cost a dealership nearly that much to perform this “service”, and consumers can buy a kit [sic] etch the VIN onto their windows themselves for about $20.”

At those prices, even people paying just $400 per year on car insurance could see a $20 VIN etching kit pay for itself within one payment cycle, and then save $20 every year thereafter. This is one of the most effective cheap car insurance tips available to drivers.

Before etching your VIN into your windows, check with your insurance plan and make sure it offers a discount. Also, many newer cars already come with this type of security measure.

If you can’t locate a VIN number on your windows, don’t get ripped off by unscrupulous auto dealers looking to pad their profits. Find a reasonably priced VIN etching kit by shopping online or in an auto parts store, and then just carefully follow its instructions. Afterwards, give your insurer another call and let them know about your car’s brand-spanking-new safety feature.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

2. Install a Car Alarm

Make life a little harder for vehicular bandits and save a little more green by installing a car alarm. Our Amica insurance review shows that this anti-theft measure can cut your bill by up to 30%, and it’s one of the most effective tips for cheap car insurance available today.

If you’re paying $1,400 annually for your car insurance, these little devices could save you up to $420 on your car insurance. That’s money well spent on keeping thieves away and your premiums low.

Seeing as Cost Helper estimates that the cost of buying and installing a car alarm falls between $110 and $800, you could see this piece of added security pay for itself within one or two years at those prices.

However, getting the full savings requires installing a passive car alarm, not an active one. The difference between the two gets broken down over at Our Everyday Life:

Passive alarms turn on automatically once the ignition gets shut off and all the doors get closed. The driver doesn’t have to do anything to turn it on.

The twelve states of Florida, Illinois, Kentucky, Louisiana, Massachusetts, Minnesota, New Mexico, New York, Pennsylvania, Rhode Island, Texas and Washington mandate that insurers must provide discounts for passive alarms, according to the Rocky Mountain Insurance Information Association.

Active alarms only turn on when the driver activates them using a remote or other method. Since drivers might forget to turn on their active alarm, car insurance companies offer a smaller discount for their installation.

3. Buy a New Car

When it comes time to get a new ride, you can also get lower rates – sometimes thousands of dollars lower. This represents one of the most significant tips for saving money on insurance available to drivers.

Insure rounded the cheapest and most expensive cars to take out a policy on in 2016. At the top of the heap sits the Dodge GT Viper, coming in at an average annual premium of $4,048. As for the cheapest, that’s the Honda Odyssey LX at $1,113. Trading in your roadster for a minivan could net you $2,935 in savings.

Read More: Ultimate Guide on the Best Time to Buy a New Car

Most people probably won’t make such a dramatic swap as the one mentioned above. However, knowing what insurers look for when pricing a car’s premiums can help you choose a ride whose policy won’t break your bank. These insurance shopping tips can make a substantial difference.

An important thing you should note is that higher-priced vehicles don’t necessarily mean higher rates. The article brings up the following useful auto insurance advice:

“Insurance companies base rates on multiple factors, such as cost of repair, safety ratings and the number of claims on a vehicle model. And that’s before taking into account your driving record. So you really can’t guess where it’s going to fall based on purchase price. You have to run the numbers.”

So even if you get a deal on a foreign car, it may cost more to insure since the parts needed for its repairs will fall on the pricier end of the spectrum.

Another somewhat counterintuitive point raised in the article is that safer cars don’t always translate into saving money on car insurance:

“Insurers look at past claims histories, such as how much damage results in a typical crash for that model, the extent of injuries and fatalities — not just the occupants in the car, but also other parties.”

So say you get a big tank-like SUV. If you crash into an unoccupied VW Beetle, your car might not get a scratch, but the smaller vehicle will likely get totaled, forcing your insurer to pay out a pricey claim. This provides the best answers for cheap car insurance considerations.

Getting a new car can save you a healthy amount of money on your auto insurance rates, but only if you shop smart. Make sure you compare the cost of insurance for every vehicle you’re seriously considering buying. It could save you a whole lot of money in the long run.

Life Events Let You Cut Your Rates Without Lifting a Finger

Sometimes, just reaching certain milestones in your life can reduce your car insurance premiums. Buying a house, changing jobs, or getting married can all help you keep money in your pocket, as in up to 47% more cash, in some cases.

That discount would rack you up $795 in savings on a $1,500 annual car insurance bill, money that could be spent on clothes, fragrances, massages, or any other way you care to treat yourself or someone you know. These significant life changes represent some of the most effective tips to get cheap car insurance without requiring any extra effort.

4. Buying a House

That 47% savings on car insurance statistic comes from the Consumer Federation of America, that found home ownership means some major savings:

Major auto insurance companies charge good drivers as much as 47% more for basic liability auto insurance if they don’t own their home, according to a new analysis of premiums by the nonprofit Consumer Federation of America (CFA). ”

Naturally, you shouldn’t take out a mortgage for the sake of lower car insurance payments or home insurance endorsement benefits. If you plan on settling down sometime soon, you can plan on some savings coming your way. This is just one of many tips on car insurance worth considering.

This is one of the important tips for shopping for car insurance that many new homeowners miss. Your car insurance provider will want to verify that you actually own your home, so make sure you have a copy of your property deed, mortgage documents, or tax statement handy to send them.

These car insurance tips and tricks can lead to significant savings over time. For those interested in cheaper car insurance tips, homeownership is definitely something to consider when making your long-term financial plans as well as knowing how to estimate home insurance costs based on where you live.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

5. Turn 25

Surviving until you’re a quarter of a century old means saving money on your car insurance. Males who hit this age usually see a discount of up to 20%, and women around 12% to 15%, according to Cars Direct.

That means a guy shelling out $800 annually on insurance will see rates fall down to $640, while a woman paying the same amount would see premiums decrease down to around $670.

Car insurance rates fall after turning 25 due to younger drivers taking more risks. The CDC reports that teens and younger drivers speed, crash, and use their seatbelts less than older drivers. That makes them much more risky to insure, so car insurance companies hike their rates for youngsters.

Read More: Buckling Up Behaviors: Exploring Americans’ Seatbelt Habits

The good news is that these rate discounts should kick in automatically once your policy renews after your 25th birthday. However, not all car insurance companies offer age-based discounts. Contact your insurer to find out whether it factors age into its rates. If not, it may be time to search for a lower price with a different company.

6. Get Married

Tying the knot can mean saying “I do” to both the love of your life and lower insurance rates. You could see decreased premiums between 8% and 22% on average, as reported by the Consumer Federation of America.

On a $1,250 annual bill, that could mean taking between $100 and $275 off your premiums and saving it for a honeymoon. Those are some great rates for you to have and hold when your bill comes due. Learning how to pay less car insurance can start with something as simple as updating your marital status.

Our Nationwide insurance review lets you know about the ins and outs of how and why marriage affects your insurance rates. It turns out that married folks get in fewer accidents than single people, as well as sustain fewer injuries when they are in a wreck.

That makes a person who put a ring on it a safer bet for car insurance companies, which gets reflected in the reduced rates for their policies.

After that, the question comes down to whether you should combine auto insurance policies with your spouse. While this multi-policy or multi-vehicle discount can save you money, it can sometimes backfire and lead to higher savings. Finding tips on getting cheap car insurance like these can help you make informed decisions about your coverage.

“The driving records of both you and your spouse will be factored into your new premium, so if your spouse has had a number of tickets or accidents, you could actually see your rates rise. Additionally, it may be better to keep separate policies if your spouse:

- Drives a car model that is pricier to insure.

- Drives a valuable classic car.

- Travels many more miles per day/month than you.”

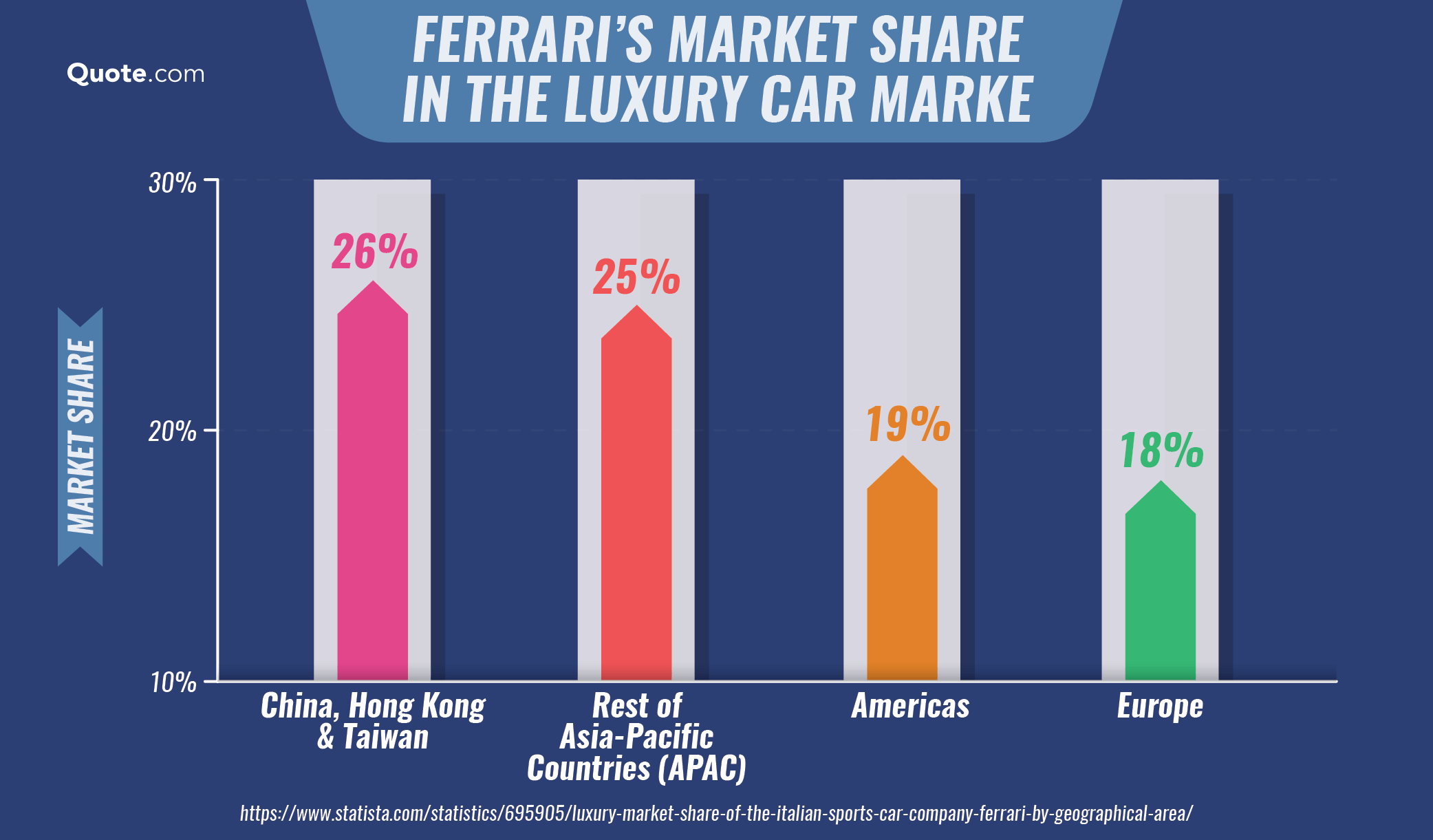

If your dearly beloved uses their Ferrari for commuting 50 miles every day into work while you roll around in a clunker, you should probably keep your policies separate for the lowest rates. On the bright side, congrats on marrying someone with such a sweet car.

To get this rate reduction, call your insurance company after the wedding bells fade and let them know about your newly minted marriage. Be prepared to send them a copy of your marriage certificate if necessary.

7. Join the Military

Being all you can be also lets you save all you can save on car insurance. Military members can receive substantial discounts on car insurance, but choosing the best option for reducing car insurance prices depends on your specific situation.

For instance, say a service member gets deployed somewhere and can’t take their car with them. As Veterans United tells it, they should consider suspending or reducing coverage for a vehicle they won’t be driving:

“The best option for most people is a suspension or reduction of services in the interest of saving money during deployment. While you may typically pay full coverage on multiple drivers, taking off liability, collision, and payments, and personal injury protection can shave hundreds off of your insurance payments.

Many insurance companies offer a complimentary suspension service to service members faced with deployment to save money without higher fees. Just be sure to stay within the minimum legal requirements and start saving today.”

If you pay $100 for the state minimum amount of liability insurance, $250 for comprehensive, and $300 for collision, cutting down to just liability could save you $550 on insurance bills while you’re away from your vehicle. To get that discount, just call your insurance agent and let them know you’re interested in decreasing your amount of coverage.

Entering the service also gets you access to special discounts from almost every insurance company.

However, it also means you can take advantage of plans specifically designed for military members, like USAA. These tips for getting car insurance at better rates can make a significant difference for service members.

According to our USAA auto insurance review, members save an average of $376 per year on car insurance, receive a 15 percent discount when garaging their car on base, and can get a 60 percent discount if their vehicle gets put into storage for more than 30 consecutive days.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

8. Switch Jobs

Changing careers can cut your premiums in some cases, sometimes up to 18 percent as told in an article published by CarInsurance.com. If someone makes a jump from a career insurers hate to one they love, that could mean going from a $2,000 annual bill to $1,640.

Once again, the difference in rates comes down to risk. Allen Harmon Insurance explains why certain jobs pay more for car insurance than others:

“Your occupation, therefore, affects your car insurance rates for a variety of reasons that include statistics, behavior, travel patterns, and location. Certain occupations are more likely to be involved in accidents, while certain personalities and behaviors are more common to specific occupations.”

Think about it like this: If you’re a NASCAR driver, your insurer worries your speed demon antics could extend off the track and increase your likelihood of a crash. That means you’ll end up paying more. Since most people aren’t race car drivers, Allen Harmon Insurance compiled a list of the professions that pay the highest and lowest rates for car insurance:

Pay high amounts for car insurance:

- Doctors

- Lawyers

- Social Workers

- Architects

- Executives

- Business Owners

- Builders

- Salesmen

Professions that pay less for insurance:

- Scientists

- Pilots

- School Teachers

- Police Officers

- Nurses

- Actors

- Artists

Even if you switch into a career that pays more for car insurance, you can still compensate for this with special savings. Going back to that CarInsurance.com article, many insurance plans offer discounts for certain professions.

Farmers Insurance in California offers a 15 percent discount for licensed physicians, so a doctor paying $2,500 for insurance every year could cut their rate down to $2,125.

These discounts vary by state and company, so if you recently switched jobs, call your insurer and find out whether you could receive a lower rate.

9. Move to a Different State

Moving across the country can be stressful, but the chance of getting cheaper car insurance might ease some of your pain.

Every state uses its own specific rules, regulations, and laws for governing how insurers can set their rates. That means insurance rates vary wildly from place to place. For instance, the National Association of Insurance Commissioners found that New Jersey clocks in with the highest average rates in America of $1,334.54 per year.

Read More: The Worst States for Filing an Auto Insurance Claim

In contrast, Idaho reigns as the king of auto insurance savings with average annual premiums of $639.19. So what happens if someone with an average rate moves from Jersey City to the land of amazing potatoes? They save a whopping $695.35 on their premiums.

Of course, you shouldn’t plan your move around where you’ll get the best auto insurance rates. If you find yourself moving to Boise or somewhere else with cheap car insurance anytime soon, letting your insurer know about it will save you a pretty penny.

10. Graduate From College

Education can open doors in life, not least of all for better car insurance rates. The Consumer Federation of America found that even if two people were equal in all aspects other than education, prices for car insurance could be up to 45 percent lower for someone with a college degree. On a $1,600 annual premium, that would come out to $720 in savings.

Our Mercury auto insurance review explains why such a difference in prices exists:

“The majority of auto insurance companies take into account a driver’s education level because there is some research indicating that those with higher education are less likely to engage in risky behavior and have fewer accidents.

Plus, those with higher degrees often have higher incomes, which allow them to pay higher car insurance deductibles at the time of an incident, which also lowers their premiums as well.”

If you don’t have a college degree, you can still save money by looking for an insurer that doesn’t use educational attainment as a factor in setting rates. Freeway Insurance offers some tips for hunting around for the right car insurance company:

“The best way to avoid paying higher rates based on educational degree or achievement is to check with local or online auto insurance companies and see if you must provide your education level in order to receive an auto insurance quote.”

If you recently graduated from college, call your insurer and show off your fancy new diploma to see if you qualify for lower rates. Folks without a degree can find reduced premiums by shopping around for a car insurance company that doesn’t base their prices off of schooling for reduced rates.

Lower Your Rates by Taking Matters Into Your Own Hands

While purchasing discounted items or hitting life’s milestones can reduce your car insurance rates, some of the best ways to save money are free. Sometimes, simply taking a little bit of action can help you keep your money where it belongs – in your bank account.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

11. Comparison shop

When it comes to auto insurance, shopping around can save you some serious green. J.D. Power found that switching insurers saved people an average of $388in 2015. That’s a pretty great incentive for doing a bit of looking around.

For advice on shopping around, Quote.com polled 39 different experts in the insurance field. Here’s their advice for finding the best rate available:

Don't be fooled by coverage cuts – if one quote seems too good to be true, make sure you check that your requests for adequate coverage are being met.

Scott Young Managing Editor

That means don’t just focus on the price. See whether that specific company offers the level of comprehensive, collision, liability, or other form of insurance you need to make sure you’re adequately covered.

“Don’t choose your insurer because you like a company’s ads. Compare at least three quotes for your insurance, and make sure that you’re comparing the same coverage levels. You can save hundreds of dollars a year by shopping around.” – Janet Ruiz, California Representative, Insurance Information Institute

In case you’re curious, a separate article on Quote.com contains the three companies offering cheap auto insurance tips on the market. Make sure you start your search with these companies, but don’t end with them. You can find bargains on great insurance in unexpected places.

Now, if only there were a website that let you know how to compare auto insurance companies. If only.

12. Get Good Grades

Budding scholars can get rewarded for making the grade with good student auto insurance discounts. These savings can be substantial, which helps keep the high rates for young drivers affordable. For instance, State Farm will cut premiums up to 25 percent for students with a high GPA – that’s $400 off a $2,000 plan.

As explained by DMV.org, statistics show that these high-performing students get in wrecks less than their peers. That makes insurers see them as less risky to insure, and are more likely to offer them a better rate on car insurance.

The article goes on to explain that getting a good student discount requires:

- Being younger than 25 years old

- Full-time enrollment in high school, college, or a university

- Maintaining a 3.0 GPA, the honor roll, or the Dean’s List

- Showing other proof of good performance if homeschooled

If your insurer offers this discount, getting it just takes calling them up and sending over a report card or letter signed by a school administrator. Do this every time your policy renews to maintain your low rates.

13. Drive Less

Low-mileage discounts let you put more money in your bank account in exchange for putting fewer miles on your car. An article in the Huffington Post found that someone who drives 5,000 miles per year can pay 8.4 percent less than someone driving 15,000 annually. That could take your rates from $1,300 per year to $1,190.

As for the reason behind the discrepancy, it comes down to (get ready for a shocker)—risk. The article quotes Loretta Worters, vice president of the Insurance Information Institute, on the subject:

It’s all about risk, she says. The more miles driven, the greater the chances of being involved in an accident.

If 5,000 miles sounds way lower than the typical mileage you put on your car every year, there’s still hope for a low mileage discount. Some specialty plans, like Esurance Pay Per Mile, offer reduced rates for drivers who put fewer than 10,000 miles on their odometers annually.

To find out whether you should look into these plans, first calculate how many miles you drive per year. Insurance provider Direct Line offers a great tool for calculating how many miles you drive in a typical day and converting it into a yearly figure.

For example, say you drive 20 miles on an average day. According to Direct Line, that would come out to approximately 8,000 miles per year. Factor in a few hundred miles of wiggle room for unexpected trips or other occurrences, and you can tell you would probably save some money with the Esurance Pay Per Mile program.

Read More: Everything You Need to Know About Esurance

After doing this basic research, you should be ready to call your insurer and find out if you qualify for its low-mileage discounts. If not, you can look around for a different company that offers reduced rates for reduced driving.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

14. Take a Defensive Driving Course

Proving you know the rules of the road (here it comes again) makes you seem less at risk of filing a claim with insurers. You can show them your knowledge by taking a defensive driving course, and knock around 5 to 10 percent off your premiums, as told by The Law Dictionary.

That’s discounts of between $90 and $ 180 on a $1,800 annual premium – not bad considering most online courses cost around $30. You can learn more about the best auto insurance for good drivers.

As these legal specialists explain, defensive driving courses go over topics ranging from proper yielding procedures to what you should do after getting in a wreck. These courses can either be taken online or in person.

To get this discount, search online for a defensive driving course approved in your state. Typically, the website for your local DMV will list several options. Just sign up, and complete the course.

After completing your defensive driving training, you’ll receive a certificate proving that you passed the class. Ship a copy of this off to your insurer, and they’ll apply the discount whenever your policy renews. However, you can only get this type of rate reduction once every few years, depending on where you live.

15. Let Your Insurer Track How You Drive

It may sound creepy, but letting your insurance company install a tracking device in your car can save you around 10 percent on your premiums on average – that’s $190 if you’re paying $1,900 a year.

However, some insurers offer absolutely ridiculous discounts for this specialized form of insurance, typically known as usage-based insurance (UBI for short). State Farm’s Drive Safe and Save program offers up to 50 percent off your premiums, while Nationwide’s SmartRide program boasts up to a 40 percent reduction.

While this section summarizes UBI, for an in-depth look at how these plans can save you some serious cash. Usage-based insurance tracks how you drive using a device that plugs into your car, your mobile phone, or your car’s existing systems like OnStar. It uses this information to supplement what it already knows about you – your age, the type of car you drive, marital status, and other factors – to better estimate your risk and set your rates.

Basically, if you drive safer, you pay less. UBI plans determine whether or not you’ll save by monitoring certain driving behaviors.

Here’s what most UBI plans typically track:

- When you drive: More accidents occur at night or in rush hour, so daytime driving when there’s not much traffic means reduced rates.

- Where you drive: If you don’t regularly add triple digits onto your odometer, you may pay less. After all, cars in garages don’t get in crashes.

- How you drive: Hard braking and acceleration increase the likelihood of a wreck. Be gentle with your gas and brake pedals, and your premiums will be gentle with you.

If you’re an infrequent, safe driver who avoids rolling around after dark, UBI would probably save you some money. Check with your insurer whether they offer UBI, or use the handy checklist included in our UBI article to determine if this type of insurance is right for you.

16. Raise Your Deductible

Comprehensive, collision auto insurance, and a few other types of insurance include a deductible, which is how much of the cost you’ll be on the hook for in an accident before your plan starts paying out. The financial gurus over at Five Cent Nickel offer a great explanation of how this premium reduction works:

“For example, let’s say that you reduced your six-month car insurance premium from $600 to $500 by increasing your deductible from $250 to $500. So in this example, you’d save $200 per year in premiums, but you risk paying an additional $250 out of pocket if you file a claim.”

In this case, you’re basically betting that you’ll avoid accidents for two years. At that point, you would have saved $400 on your rates, enough to cover your losses by $150 in case you get in an accident, and pay out $250 so you can meet your deductible.

However, sometimes cutting just a little from your premium can hurt you in the long run. The article’s author offers this personal example:

“When I called my insurance company asking about raising my deductible from $500 to $1,000, I was told that the savings I would earn on my premiums would only be $27 every six months. At that rate, I would have to be claim-free for about ten years in order to recoup the increase in risk I took by raising my deductible.”

Before raising your insurance deductible, perform a cost-benefit analysis over how long you’d have to go without an accident before seeing any substantial savings. Find this out by asking an insurer how raising your deductible would affect your rates. If you can save enough money within a few years to make up for any losses in case you do get in a car accident, this could save you some cash.

Raising your deductible means your insurance plan is less likely to have to pay out when you file a claim, and it will cut your rates in exchange.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

17. Bundle Insurance Plans

Most insurance companies want to be your only insurer, covering all your vehicles as well as everything from health insurance to life insurance.

These companies offer some steep discounts for the privilege of your business as well. State Farm will cut you up to a 20 percent discount for adding two or more cars onto an existing policy, which would work out to a $300 discount on a $1,500 annual premium.

Meanwhile, Allstate offers up to 25 percent off auto insurance rates and 35 percent off home insurance premiums — see how much you can save by bundling.

DMV.org offers a breakdown of all the different things you need to qualify for a multi-vehicle policy or one provider insurance bundle. If you’re looking to just insure all your cars on one plan, here’s what you should know:

- All the cars insured under a multi-vehicle policy must be under your name. That means if your spouse has a separate policy for their car, they have to switch it over to you.

- These cars must only be driven by the policyholder or people in their household.

- All cars must currently be in use, not in storage.

If you can check all the boxes listed above, you can save on your car insurance by calling up your provider. The savings should kick in whenever the policy renews.

For those interested in combining multiple types of insurance with a single company, the process is also simple. Call up your insurer, and if they offer multiple lines of insurance, see how much you can save by bundling. If the company’s offer seems unsatisfactory, it’s time to shop around.

Where to Start With the Different Types of Car Insurance

Before jumping into the tips to get cheaper car insurance, you should know what basic types of car insurance are out there. These different kinds of auto insurance each require their own unique methods to cash in on a lower rate. Here are the basics based on what we learned by analyzing 815 insurance companies:

- Liability Insurance: Almost every state requires liability insurance. This covers a set amount of damages to property and people injured in accidents where you’re at fault. If these damages go over this set amount, you could be sued for the remaining balance. Also, liability insurance won’t pay for your medical bills or repairs for your car – you need comprehensive and collision insurance for that.

For a very simple exaggeration of how liability insurance works, imagine you had $50,000 worth of liability insurance and got in a wreck that caused $100,000 worth of damage. In all likelihood, you could be sued for the remaining $50,000 your insurance didn’t cover. Shelling out for the right amount of insurance here can save you cash in the long run.

How to save money on liability insurance: While there are car insurance tips that help, the biggest way to cut costs here is to have a safe driving record. It lowers your monthly or annual rate for liability insurance.

- Collision Insurance: If you want your car to be covered in case of a wreck, collision insurance is the way to go. Unlike liability insurance, collision plans have a deductible, which says how much money you pay upfront for repairs before your insurance kicks in and covers the rest.

Say you drive a $20,000 car, and collision insurance costs $200 a year. You drive it for two years before totaling it in an accident. Your car probably depreciated in value a few thousand dollars, but in this case, paying that extra $200 could have saved you over ten thousand dollars – and that payment could have been even cheaper by following the tips in this guide.

10 States With Highest Motor Vehicle Death Rates| State | Percentage Rate |

|---|---|

| Rhode Island | 87% |

| Kansas | 29% |

| New Mexico | 27% |

| Louisiana | 23% |

| Vermont | 19% |

| Alaska | 18% |

| Colorado | 16% |

| Washington, D.C. | 15% |

| New Jersey | 15% |

| Hawaii | 14% |

How to save money on collision insurance: Saving money on collision insurance requires choosing a safe car and not driving like a maniac. We share more tips on how to get cheaper car insurance quotes below.

- Comprehensive Insurance: Cars that get stolen, wrecked by natural disasters, or vandalized all get covered by comprehensive insurance. Basically, anything that damages your car other than a wreck falls under this type of coverage. Like collision insurance, comprehensive insurance has a deductible.

Once again, say you drive a $20,000 car, with your comprehensive insurance making you shell out $150 per year. After five years, you drop coverage after spending $1,750. That’s when a hailstorm hits, doing $2,000 of damage to your car.

Continuing with your comprehensive would have saved you $250 on repairs, or thousands of dollars if your car was stolen instead of damaged by the weather. Following these auto insurance tips provides you with customized strategies on how to pay less for car insurance based on your coverage needs.

Spend a Little Money and Get a Big Discount on Car Insurance

Purchases big and small can result in lower rates on car insurance. Buying anything that makes your car safer or harder to steal usually results in your insurer cutting your rates. In some cases, spending only $20 can result in a 5% to 15% discount on comprehensive car insurance. That means you could go from shelling out $1,200 a year for car insurance to $1,020.

Paying Less for Car Insurance

These 17 tips to pay less for car insurance can help you reduce your rates and save hundreds of dollars. Whether by purchasing rate-reducing devices, etching in your VIN (therefore, giving having the option of someone running the VIN number), checking off premium-slashing life milestones, or putting in some elbow grease to keep your auto insurance costs down, you can have more money to spend on a swanky vacation or paying down debts.

Interested in how to save more on car insurance? Take a look at these reviews of these car insurance providers and the definitive guide to cheap car insurance.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Frequently Asked Questions

Does VIN etching lower insurance?

VIN etching typically provides 10-15% savings on comprehensive coverage. This simple VIN etching technique only costs about $20 and makes your vehicle less attractive to thieves.

Which life events can reduce my car insurance rates?

Marriage can lower rates by 8-22%, while homeownership saves up to 47%. This natural car insurance advice can get you cheap car insurance without requiring any extra effort. Find the cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

How much can I save by bundling multiple policies?

Bundling can save up to 25% on auto insurance. Companies like State Farm offer substantial pay-low insurance opportunities when you combine multiple vehicles or different insurance types.

Read More: State Farm Auto Insurance Review

Are defensive driving courses worth the investment?

Taking a $30 defensive driving course can reduce premiums by 5-10%. This practical car insurance tip typically saves $90-180 annually on a $1,800 premium.

How to cheapen car insurance?

You can cheapen car insurance by bundling policies, raising deductibles, installing anti-theft devices, maintaining a good driving record, taking defensive driving courses, and comparing quotes from multiple providers before choosing coverage.

Can you avoid paying for car insurance?

Legally, you cannot completely avoid paying car insurance in most states where it’s mandatory. However, you can reduce costs by qualifying for discounts, choosing minimum coverage, or exploring pay-per-mile plans for infrequent drivers.

Read More: What to Do If You Can’t Afford Your Auto Insurance

What is the average quote for car insurance for a 17-year-old?

The average quote for car insurance for 17-year-old drivers ranges from $4,000 to $8,000 annually. Teens can reduce these high rates through good student discounts, driver education courses, and joining family policies.

How to get a lower insurance quote?

To get a lower insurance quote, compare multiple providers, maintain a clean driving record, bundle policies, increase deductibles, ask about available discounts, consider usage-based insurance, and improve your credit score where applicable. Knowing how to buy auto insurance is essential to get lower insurance quotes.

Why do you think that most automobile insurers offer discounts based on good grades?

Most automobile insurers offer discounts based on good grades because statistics show students with higher GPAs are typically more responsible and get into fewer accidents, making them less risky to insure than their peers.

How can military members maximize car insurance savings?

Military discounts average $376 annually, with additional savings for on-base garaging. These include up to 60% off for vehicles in storage during deployment. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.