Firestone Credit Card Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, bus...

Licensed Insurance Agent & Agency Owner

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

Need a new set of tires or an unexpected engine repair?

Since it’s your own safety and convenience that’s on the line, the repair and maintenance of your car isn’t optional, it’s a must.

Unfortunately, you probably know how pricey it can get.

Depending on the the age, make, and model of your vehicle, even routine maintenance can set you back a few hundred dollars and derail your budget for the month if you’re not prepared.

Now if you’re a loyal Firestone customer, there’s a credit card that may help you easily cope with unplanned car-related expenses.

The company has its own credit card designed specifically for customers who rely on Firestone for their car maintenance needs.

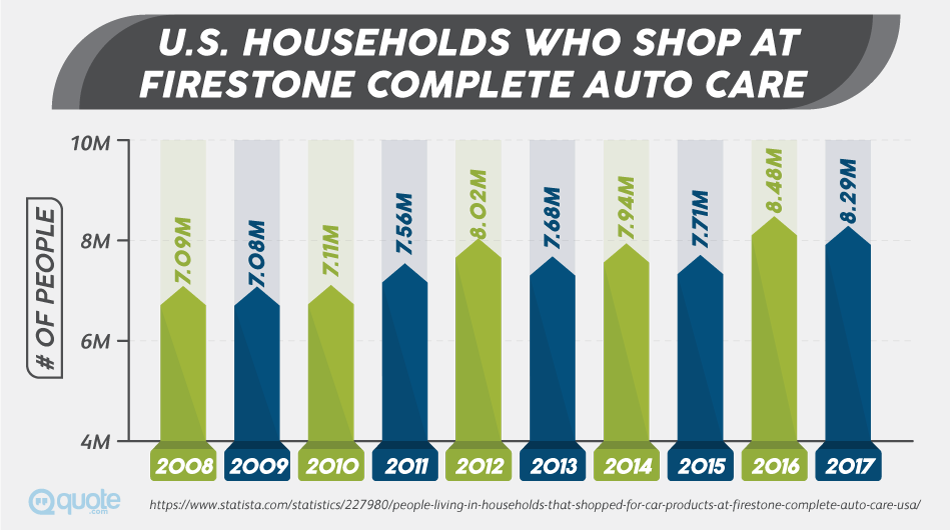

Firestone has been around since 1900 and is one of the largest auto care centers in the US, with over 1,700 locations.

If you already have your car serviced by them, or are considering switching over to Firestone coming from another service center, then you might want to know more about their credit card offering and see if it’s worth your while.

In this review, we’ll go over everything you need to know to decide whether the Firestone credit card deserves a place in your wallet.

Firestone Complete Care Credit Card

A rewarding addition to the wallets of loyal Firestone customers

Credit First National Association (CFNA), a third-party finance company, is the issuer of the Firestone Credit Card.

It’s created specifically for people who frequent Firestone’s and Rubber Company’s over 1,700 US locations.

Although anyone can apply for the card, it’s most beneficial to customers who are looking to finance substantial purchases and transactions such as repairs, tires, or maintenance at the company’s locations.

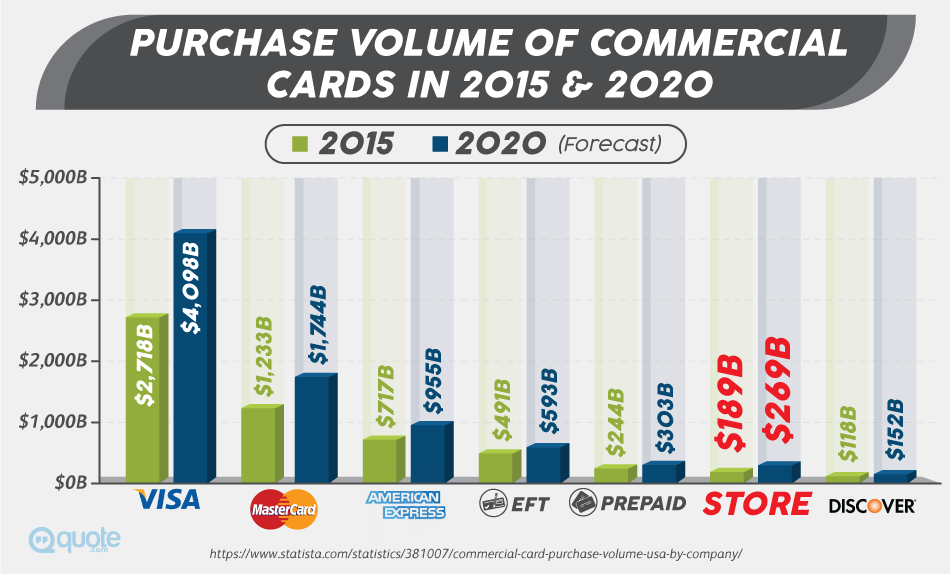

But here’s the catch: This is a retail or store credit card, which is different from your standard Visa or Mastercard.

Store credit cards can only be used at specific stores, in this case, at Firestone and Rubber Company locations.

In other words, if you get this card, you won’t be able to use it to pay for gas or to buy that pair of shoes you’ve had your sights set on.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Rates, Eligibility, and Applying

A promising APR for hefty auto maintenance purchases, no annual fees, and generous credit

The card definitely offers some notable perks.

The lack of annual fees and 0% APR on all purchases $299 and up make the card appealing to use for big unexpected auto-related transactions, like changing busted tires or new brakes.

And because it’s a store card that can be used only domestically at Firestone locations, foreign transaction fees do not apply.

But it does come with one major downside.

If you make a purchase that qualifies for the 0% APR, you have only six months to pay off the entire balance.

After that point, the 22.8% APR kicks in, meaning you might end up paying an arm and a leg in interest.

To avoid paying this APR and to ensure your account remains active, be sure to pay off your whole balance before the due date.

Let’s say your car ended up requiring a significant, unexpected repair that cost $1,000, so you charged it on your Firestone card.

And at the end of six months, let’s say you’ve managed to pay $900 toward that bill.

The interest rate of 22.8% is now going to kick in, unfortunately for you, it’s going to hit for the whole original purchase amount, not just the remaining $100.

Actually, even if you paid $999, as long as you have $1 remaining on your balance, this will still be the case.

So if you regularly carry a balance on your credit cards, this one is definitely not for you.

However, one perk of this card is that unlike most other store cards that offer low credit limits, the Firestone is known to be more generous.

But remember, credit limits are determined on a case-to-case basis.

So the limit you’re approved for will depend on your personal financial situation.

If you were approved for the card and wish to increase your limit right away, you can call CFNA six months after your account was opened to have them re-evaluate you for a higher limit.

They may not immediately offer you an increase, but you can always try again in the future as you continue to build your credit score and credit history.

A request for an increase will be a soft pull on your credit so it should not impact your score.

Low-eligibility requirements make it a win-win for people with less-than-average credit

Before you apply for a Firestone credit card, you have to meet some basic eligibility requirements.

You must be a U.S. citizen, be at least 18 years old, have a valid social security number, and show a valid government-issued photo ID.

A simple and painless application process that saves you time and offers speedy approval

To apply, you can visit any in-store location or fill out an application online.

You’ll know whether you’ve been approved within only a few minutes.

Once you’re approved, you’ll receive your new Firestone credit card in the mail within 5-7 business days.

You can check the status of your credit card application by calling 1-800-321-3950 and have your application reference number handy.

Once you have your card and you’ve created a user log, you can sign in and begin managing your credit card account online.

You’ll be able to take complete control over your card from the web.

Make payments, view statements, review transaction history, report lost or stolen cards, get notices and disclosures, and more.

Payment options that are flexible to your preferences

Remember, you’re required to make at least the minimum monthly payment for this card, but you should really be paying off your balance in full due to the high interest rate.

Your minimum monthly payment is calculated based on your new balance, including payments for purchases made in the past six months, plus other purchases.

Once you know what your payments are, you can choose to pay by check or bank account.

And payments can be remitted online, by mail or over the phone by calling 1-800-321-3950.

The Firestone website is not able to process automatic payments, so make sure you schedule payments through your bank ahead of the due date to leave enough time for normal processing.

If your payment is processed past your due date, you’ll end up with late fees and possibly heavy interest charges.

If you’re late on your payment, you could be charged interest of 22.8% plus up to $15 if your new balance is less than $100, or up to $30 if your new balance is $100 or more.

This is incredibly important to always keep track of scheduled repayments for those big purchases.

If we go back to the example from earlier, let’s say you’ve paid off $900 out of your $1,000 purchase.

You send in a check for that last $100, and due to some unfortunate delay, it doesn’t get processed before your six-month interest-free period is up.

Now suddenly, instead of being in the clear, you are facing an interest charge of 22.8% on the full $1,000 plus an additional $30 penalty—ouch!

Now that could really sting!

Rewards, Pros, and Cons

The information you need to make the right choice

With a wide spectrum of cards available to you, of course you want to know how the Firestone card will reward you.

The good news is that as a cardholder, you periodically get special pricing on tires and other automotive needs.

This ensures you’re getting good deals on car essentials.

The even better news is you can get 0% interest on major purchases of $299 and more, anytime you use your card.

If you’re a loyal Firestone customer with multiple cars serviced exclusively with them, this card is great for you.

You can have them perform crucial repairs on your vehicles and pay off large balances within six months at 0% and benefit from no annual fees.

Great for managing your cash flow without resorting to loans.

However, if you’re not able to pay off the balance in six months for high-dollar purchases, you’ll be hit with an APR that’s worse than the interest on most loans.

Keep in mind that the rate is subject to change at any time.

And if you’re a rewards lover, this card will be a disappointment because it doesn’t offer rewards like a traditional credit card.

The Firestone card does not provide cash back, points, or other types of rewards common to many credit cards.

Also, remember that because this is a store credit card, it can be used only at Firestone locations and nowhere else.

FAQ

If you’re still on the fence and need some more answers, here are the most commonly asked ones that might help fill in some more blanks.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

The Verdict

The Firestone card is not the best option for everyone

Many people turn to customer reviews before they dive into making a financial decision.

The Consumer Affairs website doesn’t hold the Firestone credit card in the highest regard.

In fact, it received a 1 out of 5-star rating.

Customer comments on the card are fairly mixed.

The most common gripes include customers being slapped with late fees because their payments weren’t processed by the deadline even though they sent them in on time.

This is probably in part due to Firestone’s website being unable to process automatic payments.

Another complaint is the lack of customer service at CFNA call center, with customers claiming the staff was unhelpful.

Perhaps more predictably, another pet peeve of clients is that the card has limitations in where it can be used.

On a positive note, while it is mainly a single-purpose card, many customers who have been using the card for some time seem satisfied with it.

They appreciate the deferred interest on large payments, saying it’s helped them pay off balances more conveniently for large, and sometimes unexpected, auto bills.

Others seem to appreciate and applaud CFNA for its friendly customer service and willingness to help. So as you can see, opinions are varied.

So what does this all mean for you?

Should you take the plunge and give the Firestone card a shot?

Are you a loyal Firestone customer who has multiple cars serviced only at Firestone?

Do you have frequent car-related transactions of $299 or more, and can pay off large balances within six months?

If so, then this card might be worth your while.

Due to the low eligibility requirements, it may also be a good option if you’re trying to rebuild your credit, that is if you can commit to paying off your balances every month.

If not, then it’s probably better to skip this one and go after a more rewarding credit card.

Do you have a Firestone credit card?

Tell us about your experience with it in the comments below.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, bus...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.