USAA Auto Insurance Review for 2025 (Rates, Discounts, & Options Here!)

USAA auto insurance review explains why USAA is the best provider, providing superior value, service, and protection for military families. At just $32 per month for premiums, with high customer satisfaction and a smooth USAA car quote process, USAA is the best in affordability and reliability.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Insurance Agent

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Apr 14, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

This USAA car insurance review explains why United Services Automobile Association is still a top choice among military families. With rates as low as $32 per month, USAA leads the pack in service quality and provides 17 car insurance discounts you won’t want to miss, making it a great value for qualified drivers.

USAA Auto Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 4.8 |

| Business Reviews | 4.5 |

| Claims Processing | 5.0 |

| Company Reputation | 5.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.7 |

| Customer Satisfaction | 2.4 |

| Digital Experience | 5.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.6 |

| Plan Personalization | 5.0 |

| Policy Options | 4.7 |

| Savings Potential | 4.8 |

USAA car insurance rating indicates an exceptional overall rate of 4.8 based on flawless records in claims settlement, coverage provided, and online experience.

- USAA auto insurance review gives a 4.8 rating, excelling in claims.

- Car insurance review USAA offers 17 exclusive discounts for savings.

- Automotive insurance review USAA starts at $32/month for military families.

While satisfaction is remarkably low at 2.4, USAA is still notable for dependability and affordability. It’s the perfect choice for military personnel wanting cheap rates, sound support, and reliable insurance.

Compare insurance policies from more than one carrier to get a great bargain. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

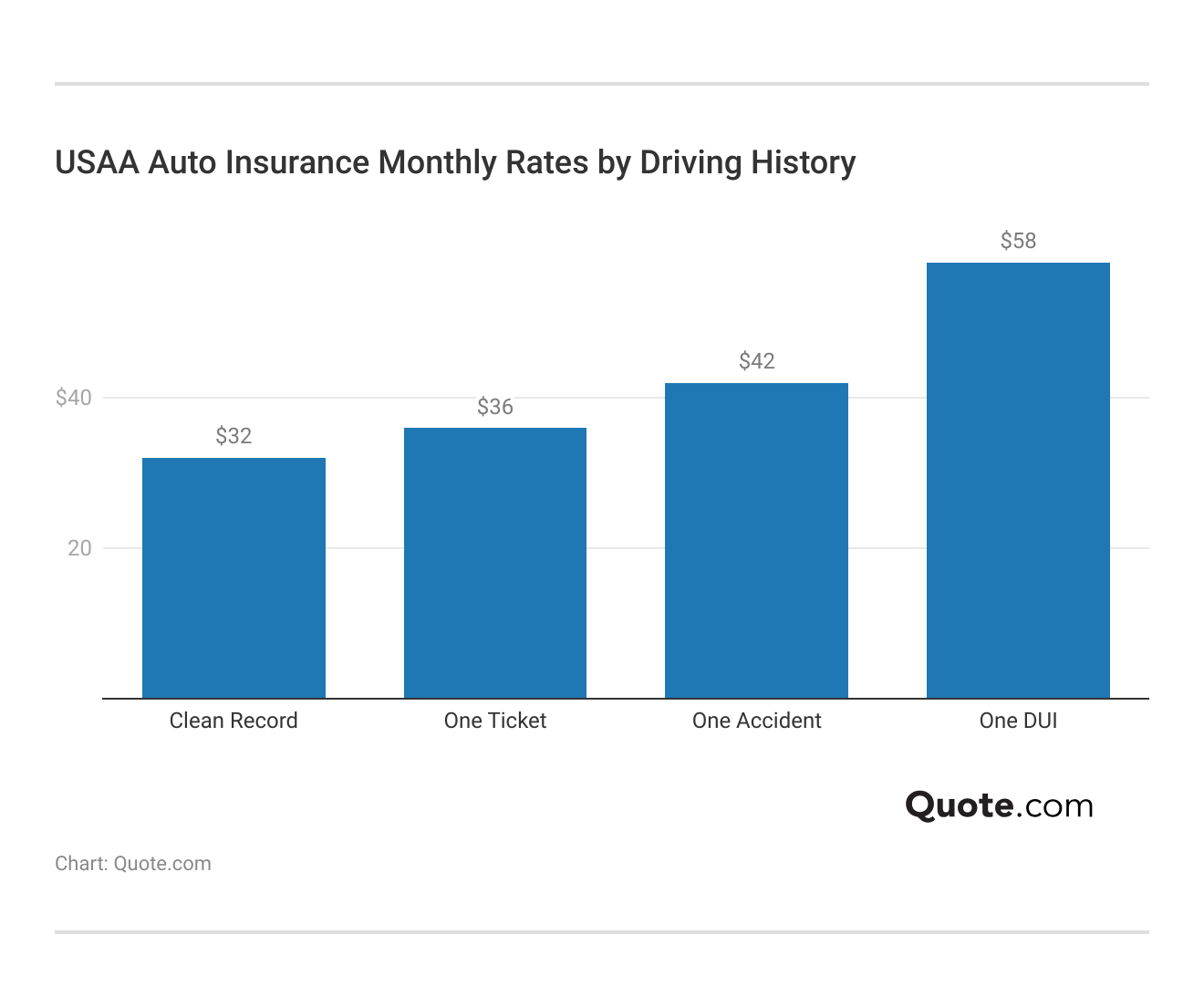

USAA Auto Insurance Monthly Rates by Driving History

USAA is frequently considered the best car insurance in USAA for military families, with low rates, excellent service, and good coverage. Clean drivers pay about $32 for minimum coverage and $84 for full. Discounts contribute to USAA’s excellent value.

USAA provides liability, collision, and comprehensive coverage. When you finance a car, full coverage is usually necessary. Accident forgiveness and traffic collision reconstruction support provide drivers additional peace of mind.

With a 4.6 out of 5 rating based on more than 5,000 reviews, USAA receives high ratings. Drivers adore its tools, claims service, and savings. The best car insurance in usaa also offers guides and tips to assist members in making smart coverage choices.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

USAA Auto Insurance Ratings & Reviews

USAA possesses an A++ rating from A.M. Best, demonstrating first-class financial strength. Its A+ ratings by BBB and Consumer Reports indicate exemplary business practices and customer service, positioning it as a reliable insurer. This makes USAA a dependable auto insurance option, especially for military families.

USAA Auto Insurance Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: A++ Superior Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: A+ Excellent Business Practices |

|

| Score: 726 / 1,000 Above Avg. Satisfaction |

|

| Score: 1.74 More Complaints Than Avg. |

USAA scored 726/1,000 with J.D. Power, which means higher-than-average satisfaction. Its surveys report excellent marks in handling claims, loyalty to customers, and renewals. Most members appreciate its streamlined service and military-centric benefits.

Does anyone have any nice to say about USAA?

byu/IntelligentClam inUSAA

Despite strong ratings, USAA’s NAIC score is 1.74, meaning it receives more complaints than average. Common issues involve claims delays, but overall, USAA remains a top choice for those seeking reliability and competitive pricing.

State Farm Auto Insurance Monthly Rates by Coverage Level

The table illustrates the way USAA insurance premiums vary by age, gender, and coverage. Teenagers pay the highest, particularly for full coverage. The premium decreases with age, indicating that experience counts when it comes to car insurance premiums.

USAA Auto Insurance Monthly Rates by Age, Gender, & Coverage Level| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $137 | $349 |

| Age: 16 Male | $146 | $356 |

| Age: 18 Female | $111 | $257 |

| Age: 18 Male | $125 | $289 |

| Age: 25 Female | $43 | $114 |

| Age: 25 Male | $46 | $122 |

| Age: 30 Female | $40 | $106 |

| Age: 30 Male | $43 | $113 |

| Age: 45 Female | $32 | $84 |

| Age: 45 Male | $32 | $84 |

| Age: 60 Female | $29 | $75 |

| Age: 60 Male | $29 | $75 |

| Age: 65 Female | $31 | $82 |

| Age: 65 Male | $31 | $82 |

There’s a distinct difference between minimum and full coverage prices. Comparing USAA car insurance quotes allows you to understand how your information impacts prices. You might pay more as a younger driver, but full coverage provides more security.

A visual guide to auto insurance makes sense of why full coverage is more expensive—it covers liability, collision, and comprehensive. While it’s more expensive, full coverage with USAA insurance provides good security for your car.

USAA Insurance: History and Origin (Services, Eligibility, Membership, and Community)

USAA which stands for the United Services Automobile Association, was established by army officers to provide insurance coverage on each other’s automobiles. Over time, it developed into an insurer that supplied customized automobile insurance in USAA designed specifically for armed forces families.

USAA insurance review emphasizes the strict membership requirements of the company. Only active and former military personnel, as well as their families, are eligible. This also includes officer candidates, adult children of members, and surviving spouses, which provides a concentrated emphasis on military service.

Based on our USAA auto insurance review, USAA offers exceptional value with a monthly rate as low as $32, making it a top choice for military families seeking reliable coverage.

Ty Stewart Licensed Life Insurance Agent

USAA provides a strong online community with forums and resources, allowing members to connect and share experiences. The insurance reviews USAA section provides information on coverage options, while members can find advice on deployments, financial planning, and military life adjustments.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How to File a USAA Auto Insurance Claim

It is easy to file a claim with USAA, even in the absence of local agents. Whether it is an accident or damage to property, USAA provides convenient means to file a claim at any time.

Here’s a step-by-step guide to ease the process for you.

Select Your Claim Process: You have the option to submit your claim through the USAA mobile app, on the USAA website, or by phone at 1-800-531-8722. All three options enable you to begin the process whenever it suits you best.

Start Your Claim: On the mobile app, click on Insurance and then choose Claims to either submit a new claim or look up the status. The site has a comparable process when you are signed in to your account.

Enter Claim Details: Input important details like the location, date, and time of the accident, and the damage type. Attach any photos you have to speed up the process.

Speak with a USAA Representative: A claims specialist will contact you to get more details and walk you through the process next. They’ll inform you of what lies ahead, whether it be getting your vehicle fixed or requesting reimbursement.

Track Your Claim Progress: You can follow the progress of your claim through the USAA app, your internet account, or by phoning 1-800-531-8722 for information. If you would rather chat, live assistance is also accessible on the web.

USAA makes claims simple with 24/7 support. If you need insurance quotes in USAA or want a quote for auto ins in USAA, their team is ready to help you explore options and guide you every step of the way. Plus, if you want to learn more, you can always meet our experts for additional insights and advice tailored to your needs.

Pros and Cons of USAA Auto Insurance

Pros

- Low Premiums for Young Drivers: USAA auto insurance provides excellent premiums—30-year-old women only pay $40/mo for minimum and $106/mo for full coverage, which is really cheap.

- Equal Pricing Across Both Genders: Car insurance in USAA maintains equal pricing—45-year-old men and women both pay $32/mo for minimum and $84/mo for full coverage, demonstrating excellent consistency.

- Military Family Discounts: USAA insurance provides military families with special benefits, such as safe driver and bundle discounts, along with an easy process for how to buy auto insurance.

Cons

- Limited Eligibility: USAA car insurance is available only to military members, veterans, and their families—others are not eligible, which restricts access to its excellent rates and benefits.

- High Teen Driver Rates: USAA car insurance can be expensive for teenagers—$146/mo for minimum coverage is what 16-year-old males pay, so take an insurance quote in USAA to ensure it’s affordable.

USAA Insurance Discounts

USAA provides discounts in order to minimize premiums, i.e., 30% to good drivers, 20% to claims-free drivers, and 20% to low mileage. Discounts further comprise 15% for anti-theft equipment, 10% for good students, and 5% for defensive driving.

USAA Auto Insurance Discounts by Savings Potential| Discount | |

|---|---|

| Anti-Theft | 15% |

| Bundling | 10% |

| Claims-Free | 20% |

| Defensive Driving | 5% |

| Good Driver | 30% |

| Good Student | 10% |

| Loyalty | 11% |

| Low Mileage | 20% |

| Multi-Car | 10% |

| Pay-In-Full | 20% |

USAA also provides 10% discount for multi-car policies, combining home and auto, and changing from a parent’s policy. If you’re unsure what to do if you can’t afford your auto insurance, request a quote for insurance in USAA to investigate savings.

One of the great benefits of USAA is their affordable, competitive rates. Another is the potential discounts available to customers:

- Safe driver discounts are available to those that maintain a good driving record for more than five years.

- Defensive driving discounts are available to those that take an approved course.

- Driver training discounts are available to those under 21 that complete a basic driver training course.

- Good student discounts are available to those who meet specific academic criteria.

- New vehicle discounts are available for those with a vehicle less than three years old.

- Annual mileage discounts are available based on the number of miles you travel in a year.

- Multi-vehicle discounts are available to those who extend their coverage to two ore more vehicles.

- Vehicle storage discounts of up to 60% are available to those you insure a vehicle in storage.

In addition, if you start your own policy after being on your parents’ policy you could save as much as 10% on premiums. Combining multiple policies, such as home and auto, can also result in savings.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

USAA Products and Services

Auto Insurance

USAA was originally created to sell auto insurance—it literally stands for “United Services Automobile Association.” Perks include possible discounts on new car purchases through the USAA Auto Circle and payment schedules flexible to accommodate military pay.

Renters Insurance

Families with the military move a lot, so renters insurance is a must. It covers your contents and liability, and most apartment complexes require it in order to sign a lease.

Homeowners Insurance

If damage occurs to your home, homeowners insurance protects against fire, theft, vandalism, liability, most weather-related incidents, and identity theft.

Life Insurance

Life insurance pays for funeral expenses and unpaid bills after the loss of a loved one.

Other Insurance

USAA also has coverage for motorcycles, RVs, boats, small businesses, floods, and valuable personal belongings. An agent can assist you in selecting the appropriate policy.

The most common USAA product/service

USAA is most recognized for auto insurance, providing highly rated coverage and special rates to qualified members.

USAA Homeowner and Renter’s Insurance

USAA provides homeowners and renters insurance, protecting various living arrangements—renting or owning a home.

Homeowners Insurance

USAA home insurance protects against fire, theft, vandalism, weather damage, and liability. It also features replacement cost coverage and military uniform protection.

Estimated Rates

USAA rates are reasonable for military personnel, with discounts offered. Rates are somewhat higher than others but are offset by several savings options.

Renters Insurance

USAA renters insurance provides liability and personal property protection, including flood and earthquake coverages, and offers replacement cost coverage for belongings.

Estimated Rates

Rates for renters insurance are affordable, and you can pay more to add enhanced coverage such as flood, earthquake, and replacement cost coverage.

Policy Coverage

Renters Insurance Covers: Clothing, electronics, silverware, phones, jewelry, military equipment, furniture, cameras, bicycles, and more.

Homeowners Insurance Covers: Fire, theft, vandalism, weather damage, liability, and identity theft protection.

USAA’s umbrella policy

If your home coverage isn’t sufficient, an umbrella policy provides additional protection, for as low as $19 per month, in case of such things as legal claims.

Customer reviews

55% of customers endorse USAA homeowners insurance, while 80% endorse their renters insurance, which shows mixed satisfaction in both services.

USAA Life Insurance

End-of-life costs can be daunting. Life insurance assists in paying for funeral expenses, bills, and financial security for your family in times of bereavement.

Life insurance policies

USAA has four life insurance policies: term life, military term life, whole life, and universal life, each with different benefits depending on your requirements.

Term life is coverage for a specified time, paying for expenses such as a car payment or house mortgage. It’s affordable and best for temporary coverage.

Term life for military is designed for soldiers, covering specific threats with additional perks such as quicker review periods and severe military injury coverage.

Whole life is coverage for a lifetime, usually for funeral costs, with higher premiums. It’s highly sought after for young kids, offering lifetime financial security.

Universal life marries whole life coverage with cash accumulation. It builds over time, with adjustable payments, and could double or triple in value if bought early.

Life insurance rates

USAA life insurance premiums range depending on age, health, and needs of coverage. Term life is from $14.15/month, whole life is $70.74/month, and universal life is $84.57/month.

Life insurance reviews

Customer complaints tended to center around premium hikes and USAA’s more expensive life insurance compared with others, generating irritation among customers.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Other Insurances

Beyond the standard

Apart from general coverage, valuable personal property and flood insurance safeguard costly items and compensate for flood damage usually excluded under homeowners’ policies.

Recreational Vehicle Insurance

USAA provides specialized protection for unconventional vehicles like motorcycles, ATVs, boats, motor homes, collectible automobiles, and aviation, depending on individual needs.

Small Business Insurance

USAA’s small business protection covers property of the business, liability, computers, offices, and workers, providing all-around financial security for diverse needs.

Additional Insurance Solutions

USAA offers additional coverage types like umbrella insurance, mobile phone protection, travel, pet insurance, and personal/commercial bonds for special needs

USAA Insurance Strengths

How USAA sets itself apart

- USAA has high customer satisfaction ratings with minimal complaints, and it is a highly regarded provider with a reputation for consistently positive service experiences.

- It has some of the lowest rates on car insurance available, and it helps military members and their families save a great deal on premiums compared to other providers.

- Deploying military members can get accelerated application reviews so that coverage needs are addressed promptly during time-sensitive situations.

- The USAA website contains strong resources and educational tools to assist members in making smart choices regarding their coverage, claims, and financial planning.

- USAA offers lifetime policy renewals for qualified members, providing long-term peace of mind with ongoing access to quality coverage and consistent service.

USAA Insurance Weaknesses

Despite numerous strengths, USAA does have its struggles

- USAA restricts eligibility to active, retired, or honorably discharged military personnel and their families, limiting access for non-military consumers.

- It does not employ local agents, so all customer service is by phone or internet, which can be a hassle for members who like to have in-person service.

Cancelling USAA insurance

- USAA is a direct insurer, so there are no middlemen or brokers, which makes cancellation easier than with insurers that have third-party underwriters.

- Log in to your USAA account on their website to cancel your policy with ease. This is the quickest and most convenient way to handle your insurance online.

- Alternatively, you can cancel by calling 1-800-531-8722 and talking to a USAA representative, who will guide you through the process and answer any questions.

- A different method is to send a cancellation request in the mail to USAA at 9800 Fredericksburg Rd, San Antonio, TX 78288 if that’s more your style.

- USAA will cancel at any time, and you can get a pro-rated refund for unused coverage based on your situation and what remains of the policy period.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

USAA Auto Insurance Review: A Trustworthy Coverage for Military Families

This USAA auto insurance review discusses why United Services Automobile Association is a best bet for military families in 2025. With a starting premium of $32, insurance policies that USAA offers are a great bargain. Famous for USAA best car insurance, USAA offers military-specific perks and discounts.

In spite of some reported delays, USAA is still a reliable choice for qualified military personnel. Find out how to compare auto insurance companies to get the best coverage for the best price. Start comparing total coverage auto insurance rates by entering your ZIP code here.

Frequently Asked Questions

Why is USAA auto insurance a top pick among military families?

USAA provides low rates and military-specific discounts, specifically for active-duty members, veterans, and their families. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Are USAA’s low premiums open to all drivers?

Low premiums begin at $32 for military families, with prices differing depending on driving record, age, and coverage levels. Read more in our cheapest car insurance.

Does USAA provide coverage for drivers with accident or traffic violation histories?

USAA offers insurance for high-risk drivers, although auto insurance reviews within USAA note that premiums could be higher depending on their driving record

What some of the military-specific benefits are that USAA provides its members?

Flexible payment plans, deployment savings, and coverage designed for military families are available from USAA. Explore our 26 hacks to save more money on car insurance for more insights.

Can I get a USAA automobile insurance quote online, and how long does it take?

You can quickly obtain a USAA auto insurance quote online, and the process usually only takes a few minutes to finish.

What types of auto insurance coverage are included in USAA’s policies?

Auto insurance coverage in USAA provides a variety coverages, such as liability, collision, and comprehensive coverage, and additional benefits such as accident forgiveness and collision reconstruction.

Does USAA offer any auto insurance discounts for good drivers?

Yes, USAA offers discounts for good drivers, claims-free drivers, and low-mileage drivers, among others. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

What is the process for filing a claim with USAA auto insurance?

Claims can be submitted online through their app or website, or by reaching out to their 24/7 customer service. Look at our how to file an auto insurance claim & win it each time for expanded insights.

What distinguishes USAA’s customer service from that of other auto insurance companies?

USAA is renowned for outstanding service, with 24/7 assistance and customized service for military families. Dive into our 10 best car insurance companies to gain a deeper insight.

Is it possible to bundle USAA auto insurance with other insurance?

Yes, you may save by taking an USAA auto insurance bundle since USAA makes it possible to package USAA auto insurance alongside home, renters, and other policies in search of savings.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.