Mercury Insurance Review

Founded in 1961 in Los Angeles, CA, Mercury offers a variety of insurance products, including homeowner's, car, renters and business insurance. However, it's best known for its homeowners and auto policies. Our Mercury Insurance review will help you find out everything you need to know.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Feb 26, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Feb 26, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

If you’ve ever considered going with Mercury Insurance for homeowners, auto, renters or business insurance, but would like to know more about the company and its offerings, this is the guide for you.

We’ve compiled all of the latest information as well as answers to common questions about Mercury Insurance—and you may be surprised to learn what we found out.

Before you make your choice, read our Mercury Insurance review below and make a more informed and confident decision about your insurance.

What is Mercury Insurance?

Founded in 1961 and headquartered in Los Angeles, California offers multiple lines of insurance, including homeowner’s insurance, car insurance, renters and business insurance, with their major focus being home and auto insurance. The company does not offer motorcycle insurance so you won’t be able to find Mercury motorcycle insurance quotes online.

Mercury’s founder, former insurance industry worker, George Joseph, created the company with the intent of offering a lower-cost alternative to larger insurance companies.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

What products and services are offered by Mercury?

Mercury offers a variety of insurance products and services, including:

Car Insurance

Car insurance is designed to protect you in a variety of situations—even when you’re not at fault.

Car insurance offered by Mercury includes:

- Liability Insurance – Liability insurance branches into two types of coverage – bodily injury and personal property. Most states require you to carry a certain amount of liability insurance. If you’re liable for damages either to someone else or their property, liability insurance helps to cover them.

- Collision coverage – Collision insurance, as its name implies, covers damages to your car caused by hitting another vehicle, a guard rail, lamppost or telephone pole

- Comprehensive coverage – Comprehensive coverage is also called “other than collision” insurance. It covers losses to your car from things other than an accident, such as vandalism and riot damage, floods, hail, fire, animal collision, and theft.

- Medical coverage – If you or your passenger(s) are injured in an accident, medical coverage helps pay for the expenses incurred in the treatment of injuries

- Personal injury protection – Similar to medical coverage but covers beyond what medically insurers such as rehabilitation expenses, funeral costs, loss of work and so on. Most states require driver to carry a certain level of personal injury protection (PIP).

- Uninsured/Underinsured motorist – According to a 2014 study by the Insurance Research Council, about 1 in 8 drivers are completely uninsured, and about 30% are underinsured. Uninsured/underinsured motorist provides liability (bodily injury/property damage) coverage for you if you are injured and an uninsured/underinsured motorist is at fault.

Home Insurance

Homeowners insurance is available with a wide range of coverage options, including:

- Dwelling protection – covers damage to the home due to fire, smoke, storm damage or lightning

- Personal property coverage – covers household items in the event of fire, theft or similar covered loss

- Extended replacement cost – additional coverage up to 150% of your home’s policy limits to help rebuild your home in the event of a covered loss

- Additional living expenses – If your home becomes uninhabitable due to a covered loss, this insurance option provides coverage for reasonable living expenses

- Personal liability protection – Covers medical expenses for property damage or bodily injury caused to others as a result of a covered incident

- Guest medical protection – Extends coverage to guests who are accidentally injured on your property

- Identity theft protection – Pays for expenses incurred as a result of criminal identity theft

Additional coverage is available for valuable as well, such as fine art, jewelry or antiques.

Umbrella Insurance

Sometimes, unforeseen events can happen that even regular homeowner’s insurance doesn’t cover.

If an overgrown tree fell and crashed through your neighbor’s roof, or your dog accidentally bit your neighbor’s child, what would you do?

For these scenarios and much more, there’s umbrella insurance—and Mercury’s umbrella insurance provides added protection that goes beyond the traditional limits of home or auto insurance.

Other Products

Mercury also offers a variety of other products including renter’s insurance and condo insurance, and provides business auto insurance as well as coverage options for businesses including owner’s policies, commercial property insurance, and commercial liability protection.

What are its best products/services?

Mercury is best known for its homeowners and auto insurance policies.

They also offer discounts when you bundle car and home, as well as discounts depending on many other factors as outlined below.

Mercury Auto Insurance

Mercury auto insurance is another of the company’s most popular products, and just as with its homeowner’s policies, Mercury offers a variety of car insurance plans that can be customized to fit your needs.

Liability, Collision, Comprehensive Coverage

As you might expect, Mercury offers many of the most popular types of car insurance, including liability, collision and comprehensive coverage. A local agent can tailor a plan that includes additional benefits as well.

In nearly every state, drivers are required by law to purchase liability insurance to cover bodily injury or property damage caused by an accident that they are at fault for. It’s important to note that with liability insurance, you’ll need to think about how much protection you need for the following:

Bodily Injury – If you are legally at fault for an accident, liability insurance / bodily injury covers the medical expenses to others.

When buying liability insurance, you’ll see coverage limits for bodily injuries, such as $25,000/$50,000/$15,000.

What these numbers represent, respectively, is:

- The maximum coverage for a single injury

- The maximum coverage per accident for all injuries

- The maximum per incident that the policy will pay for property damages.

Your state likely has minimum mandatory coverage requirements, but if you’re unsure, the Insurance Information Institute suggests that drivers carry liability insurance of no less than $100,000/$300,000.

Property Damage – Property damage pays for damage to someone else’s property that is caused by your vehicle. It can be to their vehicle but can also extend to things like buildings, utility poles, trees, fences, garage doors and so on.

Mercury Insurance New Car Replacement

Many insurance companies offer a relatively new benefit known as “new car replacement coverage.” When a car is declared a total loss (when estimated costs to repair it exceed its value).

While Mercury doesn’t advertise this particular benefit specifically, oftentimes what will happen is that so long as you have collision and comprehensive coverage policies, and your car gets totaled, your car insurance company will pay the market value of your car, minus your deductible.

Of course, depending on the make and model of your car, you’ll need to weigh the pros and cons carefully. The extra coverage comes at a price and is focused on newer cars, so that early 2000s model you’re driving won’t qualify. Remember, too, that your car starts losing value immediately after you drive it off the lot.

According to Black Book & Fitch Ratings 2015 Vehicle Depreciation Report, the depreciation value for used cars is currently around 14.5% per year. Also keep in mind that Mercury’s policies and extra options vary from state to state, and a new car replacement may not even be an option where you live.To find out, consult your local agent.

Mercury Insurance Accident Forgiveness

Accident forgiveness is another common benefit advertised by insurance companies. Of course, everyone is concerned about what happens when they file a claim, whether it was their fault or not.

“Will my rates go up?” they ask.

The fact is, establishing car insurance premiums is actually a very complex and involved process. Each time a claim is submitted, the insurer carefully evaluates and analyzes all of the details, including who was at fault, their accident history, any moving violations or prior claims, as well as the age of the car, type of the car and so on.

It may very well be that if the accident is not your fault and this is the first accident you’ve been involved in, and if you have no prior claims or moving violations, you may have no premium increase at all.

But what if it is your fault?

If there’s property damage, you may lose the discount you’ve accrued by being a good driver and you may have an increase in premium. If there’s bodily injury, you can expect a 20-25% increase in premium along with the removal of your good driver discount. Repeated offenses could mean that your policy cannot be renewed and will be canceled.

It’s very important that in the event of an accident, your fault or not, you still go through the claims process.You may feel like it’s nothing serious or just a fender bender and doesn’t warrant a claim, however, this mistake could set you back thousands of dollars.

What was originally a fender bender could become an injury claim. By reporting the accident, you are insuring yourself against future claims since both insurance companies will now have a record of the claim. Also, don’t try to be your own claims adjuster.

Often, in the heat of the moment, people get caught up emotionally and this can exacerbate the issue. Insurance adjusters are trained to resolve these kinds of problems quickly and diffuse situations when emotions run high.

Online Claim

Unlike many insurers, Mercury does not have an online claim service. You can, however, pay your premium online by registering for an account (free).

To file a claim with Mercury Insurance, simply call the toll-free claims hotline at 1-800-503-3724. You can file a claim 24 hours a day, seven days a week.

In the case of a homeowner’s insurance claim loss due to burglary or theft, it’s vital that you notify the police right away. In the event of a fire, smoke, storm or other damage, do not dispose of items that are damaged since they may be needed in order to complete your claim. Also, be sure to keep all receipts.

You will need the following information when filing a homeowner’s insurance claim:

- Policy number

- Police report number (if a police report is taken)

- Police department name

- Description of damage

- Date, time and location of the incident

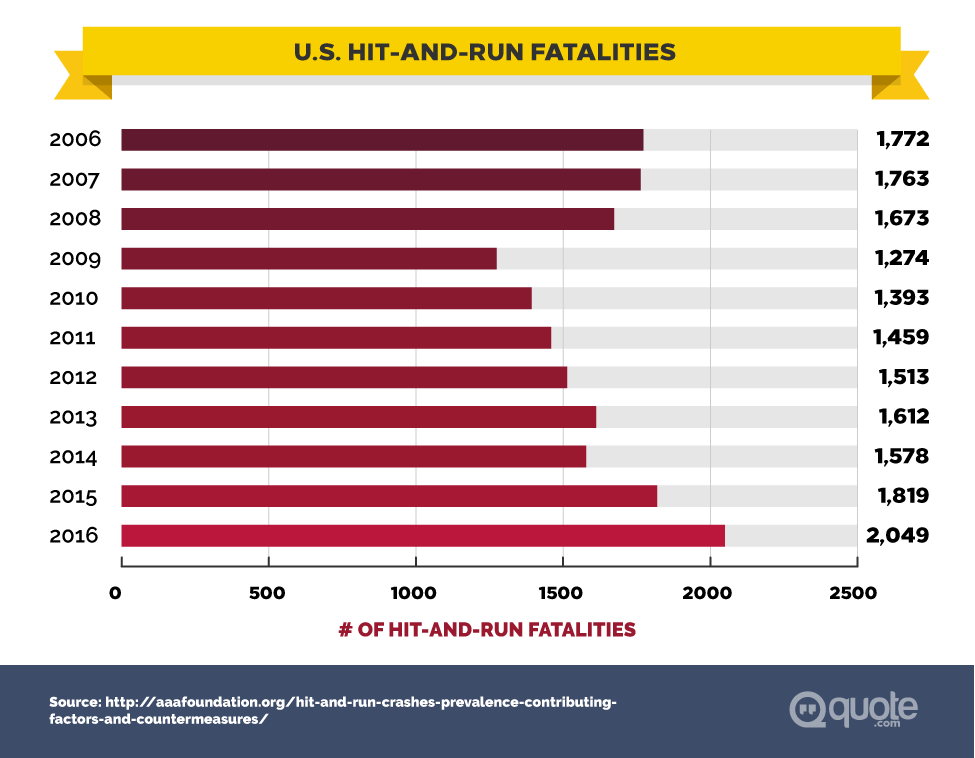

For auto insurance claims, move your vehicle to a safe location if possible and check for injuries. If the driver of the other car tries to flee the scene without providing information, or there’s the possibility that the fault will be disputed, you should contact the police.

Also, call 911 if there are any injuries or if the accident was a hit and run.

If you have a camera, be sure to take photos of any damage to the vehicle(s), the scene of the accident, and the party or parties involved.

You’ll need to collect the following from everyone involved in the accident:

- Name

- Phone number

- Address

- Drivers License Number

- Auto Insurance Carrier

- Auto Insurance Policy Number

You should also obtain the year, make and model of the car as well as the state and license plate number, and gather any information from any witnesses at the scene.

Do not, under any circumstances, admit fault, even if you feel you are responsible. Be sure to cooperate with law enforcement and obtain relevant information from them, such as a police report. It’s also a good idea to collect relevant details.

It’s understandable that emotions will be running high, but it is also easy to forget small things that can make a difference in how your claim is handled, including:

- What direction(s) the vehicle(s) were traveling

- How fast the vehicles were traveling

- Whether or not anyone used their brakes, horn, or tried to avoid the accident

- What the weather and road conditions were like

- If the road was wet, if it was raining or foggy

- If traffic was heavy or light.

Mercury Discounts

Mercury Insurance offers a number of valuable car insurance discounts, many of which can help lower your auto or home insurance premium.

Depending on things like where you live and the age/type of vehicle you drive, you may qualify for discounts based on:

- Your driving record (also known as a Good Driver Discount)

- Any accidents or thefts reported

- Whether or not you bundle your home and auto insurance with Mercury

- Whether or not you have a multi-car policy with Mercury

- The estimated annual mileage you put on your vehicle.

- How easy it is to repair or replace the damaged vehicle

- If you are a teenage student and maintain a specific grade point average

- If you have anti-theft features on your vehicle (cut off switches, chip-keyed ignitions, etc.)

- If you are a member of certain professions or associations

What are the estimated rates of Mercury auto insurance?

Because no two auto insurance policies are the same, it’s a good idea to get a free, no obligation quote for Mercury auto insurance. This not only allows you to see which options are available in your state but also learn how much a policy would cost after you customize it with the features you need most. It costs you nothing to find out more, so you’re encouraged to get a quote and compare rates.

What are the reviews for this service?

Generally, users of Mercury auto insurance have favourable reviews in terms of the ease with which their policy was created, the affordability of premiums, the availability of discounts, the claims process, and overall customer service. Of course, with any insurance review, Mercury will have some reviews from frustrated and unhappy customers.

As with homeowners insurance from Mercury, many of the customers report varying degrees of satisfaction depending on their local agent and the flexibility with which claims are processed and resolved. Overall, users who are customers of Mercury’s auto insurance policies appreciate the discounts they get and the affordability of policies, even for those on a tight budget.

Mercury Home Insurance

Mercury’s home insurance is one of their most popular products. In addition to helping cover your home due to lightning, storm, smoke or fire damage, the policy can also cover personal items, with an extended replacement cost to rebuild your home in the event of a covered loss.

Additional living expenses and personal liability protection are also available, as is extended coverage to protect valuables that are irreplaceable, such as antiques or fine art.

Homeowner’s Insurance

Unlike car insurance, you are not required to have a certain amount of homeowner’s insurance for your home. However, if you’re still paying off your mortgage, the lender may require you to have homeowner’s insurance to protect the property and home from unexpected damage.

Consider homeowner’s insurance an investment in protecting your investment in your home. It’s important to note that most homeowner’s insurance policies don’t cover damage caused by earthquakes or floods, but there are separate insurances specifically for those types of natural disasters.

What does Mercury home insurance cover?

One of the best reasons to consider Mercury home insurance is that an agent can customize a plan that fits your specific needs and budget. Typically, homeowner’s insurance covers your home and the items in it in the event of specific types of damage such as fire, storm damage, and theft.

In the event that your home is uninhabitable because of the damage, homeowner’s insurance can provide additional living expenses as well as an extended replacement cost to cover up to 150% of your homeowner’s insurance policy limits in the event that you need to rebuild your home because of the damage.

Home insurance also covers injuries on your property depending on the incident. For example, you have the option, if guests are injured accidentally on your property, of buying guest medical protection in addition to traditional homeowner’s insurance, to help pay for their medical expenses. Of course, you’ll want to speak with a local agent to tailor a plan specifically to address your concerns.

What are the estimated rates of Mercury Home Insurance?

Because Mercury home insurance plans and options differ from state to state, there’s no “one size fits all” approach to rates.

If you’re interested in learning how much it costs to get Mercury home insurance, you’re encouraged to get a free, no-obligation quote so that you can better customize a plan that fits your needs and budget.

What are the reviews for this service?

Reviews for Mercury’s homeowner’s insurance are very much a mixed bag.Some tell disturbing stories of homeowners who have found themselves “high and dry”—sometimes literally!—due to issues in their home that should have been covered, but were not.

They tell of adjusters doing everything they can to wriggle out of paying, and of customer service agents that are rude and belittling to customers. On the opposite end of the spectrum, many users report saving a great deal of money and dealing with claims adjusters that are prompt and courteous.

Much of what ultimately boils down to user reviews of Mercury’s homeowner’s insurance ends up with the local agent. If you can easily reach your local agent and find them attentive and helpful, you’re likely to have a better experience with Mercury than someone who finds it difficult to reach their agent, or has to go to a third party in order to get their claim resolved.

Mercury Umbrella Insurance

Umbrella insurance helps to cover the things that traditional homeowner’s policies do not—including things like dog bites, injuries on your property by people who are not considered guests (such as your mail carrier) damage from a tree from your yard crashing into your neighbor’s home, and so on.

These are “what if” scenarios that no one likes to think about, but that can very quickly add up in terms of litigation and medical bills. Umbrella insurance provides peace of mind for these kinds of scenarios.

What are the policies offered?

Although umbrella insurance spans many types of situations, there is no “one size fits all” policy that works for everyone.

In order to learn more about umbrella insurance policies and what’s covered, it’s best to get a quote for Mercury umbrella insurance first.

What are the rates of Mercury umbrella insurance?

Since you’ll want coverage that specifically applies to your situation, there is no “blanket rate” that applies to everyone.

It’s best in this case if you get a no-obligation quote and discuss the details of your umbrella insurance needs with an agent who can help you find the perfect price point to cover you in the event of such an emergency or situation.

What are the reviews of this product?

Since no two umbrella insurance policies are alike, it’s hard to pinpoint precisely what customers have to say about Mercury’s umbrella insurance.

Your best bet is to get a quote to determine if umbrella insurance would suit your specific needs and budget.

Other Products

Mercury also offers other types of insurance, such as insurance for condo owners, renters, and businesses, as well as business vehicles.

What are the reviews for these services?

As you might expect, the market for these services is much smaller than for their traditional home and auto products. What’s more, since customers can customize their particular plans, there are no truly accurate reviews that reflect options for everyone.

If you’re interested in these types of products for yourself, your property or your business, it’s a good idea to get a quote online and see what your rates would be, as well as what’s covered under these types of policies.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Mercury Strengths

Mercury Insurance offers a number of strengths that make them worth considering as your insurance provider, namely:

Covers Most Bases for Policies

Rather than getting a piecemeal policy that doesn’t cover all the bases, you’ll be glad to know that Mercury Insurance offers comprehensive policies that cover most people, most of the time.

This helps give you peace of mind in the event of an emergency or accident.

Many Discounts on Products

As you can see from the list above, Mercury offers many valuable discounts to help reduce the cost of your homeowner’s, renters or automobile insurance.

In many instances, customers can combine these discounts to save even more. Of course, that being said, not all reviews of Mercury Insurance are glowing. Every insurance company has their pros and cons, and Mercury is no exception.

Mercury Weaknesses

There are a few notable weaknesses you’ll want to keep in mind if you are considering choosing Mercury Insurance.

Not Available Nationwide

Mercury only offers coverage in the following states:

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Georgia

- Michigan

- New Jersey

- Virginia

- Arizona

- Oklahoma

- Nevada

If you move from one of these states to another one not in the list, you will need to change insurance companies.

Keep in mind as well that not all insurance options are available in all states.

Customer Service is Lukewarm

Customer service is an area where Mercury could show some improvement. Although its financial strength ratings demonstrate that it can meet its obligations and pay claims promptly, many customers report that resolution is anything but prompt or courteous.

They often find that when filing a claim, the adjuster is not responsive or difficult to reach, or that the company drags their feet on paying claims while finding any reason to wriggle out of payment. Obviously, the experience varies from customer to customer but based on existing J.D. Power & Associates customer service surveys, results are very lukewarm

Mercury Insurance Umbrella’s Policy

As noted above, Mercury’s Umbrella policy is a policy that extends the limits of traditional homeowner’s insurance to cover things not ordinarily part of the policy.

You may want to consider an umbrella policy if you often entertain guests, or if you want to extend the value placed on certain items within your home. In these cases, it never hurts to be prepared, and umbrella insurance can help you do just that.

How to File a Mercury Insurance Claim Online

Unlike many insurers who offer the ability to file and follow claims online, Mercury does not have this capability. To file a claim, you’ll need to call 1-800-503-3724.

Mercury’s Claims page details how to file a claim (including what information you will need to collect) for auto claims, home claims or mechanical breakdown claims. You can also call the number above if you are unable to drive your vehicle or need roadside assistance. Claims can be filed 24 hours a day, seven days a week.

Report an Accident/Damage to Mercury Insurance

If you have an accident and need to report it or damage to Mercury insurance, call 1-800-503-3724.

If you are involved in an accident and cannot drive your vehicle, you can also call this number to arrange for towing or a rental car.

What are the most common complaints about Mercury?

Complaints about Mercury Insurance can typically be divided into two camps: customers who have auto or homeowners policies with Mercury, and those who must deal with Mercury because they are the victim of an accident.

For the former, complaints generally revolve more around homeowner’s insurance and storm/water damage issues rather than auto insurance.

For the latter, complaints run high and commonly refer to Mercury shuffling its feet when it comes to paying claims, assessing damages correctly or overpaying on claims and demanding a refund.

Canceling Your Mercury Insurance

Canceling Mercury car Insurance is fairly easy and straightforward—as long as you’re near the end of your 6-month policy. Otherwise, there are fees and charges involved.

Most insurers would like at least 30 days to notice that you’ll be canceling. Be sure to have a replacement policy ready to go, as you don’t want to cancel your car insurance policy and then go without car insurance.

Mercury Car Insurance Cancellation Policy

Mercury does have a cancellation fee of 10% of your remaining premium, so, for example, if you still owe $300 or more on your policy, you’ll also pay a $30 penalty fee.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Can you cancel it at any time?

You can cancel your Mercury Insurance policy at any time, however doing so may subject you to the fees noted above depending on how much time is left on your policy.

If you just want to make changes to your policy, you can call your local agent by finding their contact information in your Mercury Customer Portal (online) or by calling the number on the back of your proof of insurance card or on your bill.

FAQ

It’s natural to have many questions before you decide on an insurance company.

Whether you’re considering a homeowner’s policy with Mercury or you want to insure your vehicle (or both), or you’re looking for business, renter’s or condo insurance, we’ve outlined and answered the most common questions we’ve received about Mercury Insurance.

Do products/services offered by Mercury differ from state to state?

Yes.

Mercury currently operates in only 13 states, and not all products and services are available in all states.

If you’re concerned about whether or not the service you want is available, contact your local agent to find out.

What is mechanical breakdown protection?

Much like an extended warranty for your vehicle, Mercury’s Mechanical Breakdown Protection Plan covers the cost to repair your vehicle.

Rather than just one plan, there are a number of plans within the Mechanical Breakdown Protection suite of products available, including a Platinum Plan, which covers nearly all of your vehicle’s mechanical and electronic components (excluding normal wear and tear items like shocks, brakes, etc.).

There are a number of benefits to consider when looking at extended warranty plans.

Mercury’s Mechanical Breakdown Plan includes the following at no extra charge:

- 24-Hour Roadside assistance

- Rental vehicle assistance

- Tire protection

- Trip interruption coverage

- Nationwide protection

- Repairs can be done at any licensed U.S. repair facility (meaning you can choose your mechanic/repair shop)

- No limit on the number of claims made

- Coverage is transferable between vehicles

How much does Mercury insurance go up after an accident and/or speeding ticket?

This will depend on other factors, such as if you’ve faced any previous accidents (at fault or not) or received tickets or moving violations in the past.

Repeat traffic offenders can expect their insurance premiums to go up by 20% or more, but first-time offenders may be given a pass, particularly if they are found to be not at fault.

If you are concerned about rates going up after an accident or ticket, contact your local agent to find out specifically how this affects you and by how much.

What does comprehensive insurance cover with Mercury?

Despite its name, comprehensive car insurance doesn’t cover everything.

At its core, it protects your car against damage that doesn’t result from a collision—including things like theft, vandalism, fire, and even rockslide or tree damage— and it also covers glass damage and damage incurred from hitting an animal.

It doesn’t cover things like towing or roadside assistance, rental cars or if personal property is stolen from your car.

However, there are additional policies and roadside assistance options available from Mercury if you are concerned about these issues.

Does my Mercury insurance cover a rental vehicle?

While many insurance companies do cover the cost of damage to a rental vehicle, it does not appear that Mercury offers this service.

If you rent a car or truck, you may wish to purchase third party insurance from the rental agency directly, which can help protect you and the vehicle in the event of an accident—even if it isn’t your fault.

Does my Mercury car insurance cover me in Canada or anywhere outside the USA?

According to the U.S. Bureau of Consular Affairs, if you are a non-resident tourist crossing the border into Canada, any U.S. based auto insurer will still cover your vehicle while you are in the country.

You should, however, contact Mercury to get a “Motor Vehicle Liability Card / Canada Inter-Province” insurance card, which is available at no additional charge from Mercury.

Mexico is a different story, as U.S. insurance companies are prohibited from offering liability insurance there, so insurance would need to be purchased separately from a Mexican insurance company. You will need to buy a liability policy with at least 50,000 pesos worth of coverage (around $3,800 in U.S. dollars).

This doesn’t cover much beyond a fender-bender, so you may want to purchase additional liability coverage since any death resulting from a car accident where you are at fault (including hitting a pedestrian, bystander or passenger) subjects you to a minimum fine of $25,000.

Consider purchasing a temporary Mexican car insurance policy for your car that includes:

- Legal assistance

- Travel assistance

- Medical expense coverage

- Civil liability coverage

If you are traveling elsewhere outside of the U.S., contact your agent to determine what your requirements may be.

Does Mercury insurance use credit scores?

It’s a myth to say that your credit score doesn’t affect your car insurance premium—but to say that insurers don’t use credit scores at all just isn’t true. Credit scores do count for car insurance because they’re used as a sort of “risk barometer” (unless you live in California, Hawaii or Massachusetts, as these states have all banned this practice).

Your credit score is typically used to determine your creditworthiness. Since you’re not applying for a loan when you get a car or home insurance, the insurers don’t look specifically at your ability to repay, but rather the likelihood that you will submit an insurance claim in the future.

Insurers instead take a multi-faceted approach that involves looking at your credit-based insurance score, your driving history, claims history and so on. Since insurance companies started using credit scores, rates have become more accurate across the board and customers who are safe drivers have reaped many benefits, including discounts and a return of a portion of their premiums.

If you are concerned about your credit score affecting your car insurance rate, you can take steps to help clean up your credit report. The Fair Credit Reporting Act gives you the right to obtain your credit report for free once a year, and you can make the leading credit reporting bureaus aware of any errors, omissions or problems that need to be fixed.

What are Mercury’ financial strengths?

Mercury has been in business for over 50 years and in that time, has built up a reputation for financial stability.

Mercury Insurance Group has a rating of A+ (Superior) from the A.M. Best insurance rating organization, which is purely a reflection of Mercury’s ability to pay claims and financial obligations promptly and is in no way a reflection of their customer service.

How long does it take for Mercury insurance to pay for a claim?

The promptness with which Mercury pays claims will depend on numerous factors. As every situation is different, there is no blanket “response time” for paying for claims.

If you are concerned about getting your claim handled promptly, you can contact Mercury Insurance’s claims department directly by calling 1-800-503-3724.

Is Mercury gap insurance coverage available?

Mercury Insurance does not specifically offer gap coverage—also known as “loan/lease payoff coverage.”

If you have a loan or lease on a car, your car is protected in the event of a loss by gap insurance, which pays the difference between the outstanding balance on your loan or lease, and the actual cash value of the car. So even if your car is covered by a loss including an accident, theft, fire, or vandalism, and you have comprehensive and collision insurance, there is still some financial gap that you will be left owing.

Does Mercury insurance have roadside assistance?

Mercury does indeed offer roadside assistance as part of its Mechanical Breakdown Protection plan—a separate plan that functions much like an extended warranty for your vehicle and is separate from your car insurance.

What does my rental insurance with Mercury cover?

Rental insurance with Mercury covers you whether you rent a house, condo or apartment, including coverage for:

- Personal property – coverage for household items that are damaged or destroyed in the event of a theft, fire or other covered loss

- Additional coverage – for items like fine art, jewelry, and antiques – is also available

- Personal liability protection – Covers you in the event of an incident which causes bodily injury or property damage

- Guest medical protection – Pays for the medical expenses of guests who are accidentally injured on your property

- Workers’ Compensation Coverage – Pays for the medical expenses of personal, part-time employees on your property who are injured on the job. This can include gardeners, nannies or maids.

Keep in mind that not all coverage types are available in all states, and you’ll want to check with your local agent to determine what your renter’s insurance covers.

What are the deductibles on Mercury insurance?

Insurance is generally sold with a deductible, which is the out of pocket cost you agree to pay before the payment from the insurance company comes in.

Usually, the higher the deductible, the lower the coverage premium.

Deductible amounts range from $250 to $1,000 or more.

Will adding a teenager to my policy will increase the cost?

You may pay more on your auto insurance if you add a teenage driver to your policy, however, there are ways to offset this cost.

If your student driver gets good grades, for example, or maintains an exemplary driving record, you may be entitled to discounts on your car insurance.

Will my rate go down if I make my payments on time?

You can pay your Mercury Insurance bill directly online through the Mercury Customer portal, enabling you to “go paperless”.

And although you’ll save time and the cost of a stamp, paying your insurance on time every time won’t affect the rate itself.

However, Mercury does offer numerous discounts on insurance based on things like anti-theft devices or locks, student performance in school, driving record, professional association membership and much more. There are many ways to lower your payment, so be sure to speak with your local agent for more details.

Should I opt for automatic payments and renewal or shop around after my policy is done?

This will depend on how good of a deal you’re getting on your current plan versus what other plans and prices are available in your state. Since not all insurers operate in all states, you may find that you’re getting the best possible coverage for the features you need from Mercury.

If this is the case, it’s worth giving yourself one less thing to think about and enabling automatic payments and renewals. If you feel you may get a better deal or better service with another company, feel free to shop around.

One thing that you don’t want to do, however, is let your insurance lapse while shopping around for an alternative. Be sure you have insurance lined up and ready to go when you cancel your policy or let it expire.

Does Mercury cover third party liability?

Mercury does offer liability insurance. If you’re at fault for an accident or injuryc to another person or property, liability insurance steps in to help cover medical expenses, lost wages, legal fees, and pain and suffering. Property damage liability covers damage to the other person’s vehicle and repairs to that vehicle as well as property damage.

Can I add up my family member’s car to my insurance plan?

You can add a family member and their vehicle to your Mercury Insurance plan, and you may even enjoy a discount for doing so. Mercury offers multi-car discount plans among its auto insurance policies.

Check with your local agent to see if multi-car policies are available in your state.

Can I get my car repaired by my own mechanic or are there specific repair shops I should get my car fixed from?

Mercury’s Mechanical Breakdown Protection Plan allows you to take your vehicle to any licensed U.S. mechanic or repair shop, so you never have to worry about shopping around for a mechanic to fix your car in the event of a breakdown.

What happens when I pay throughout the year without filing any claims?

Insurance carriers appreciate drivers who continue to maintain an exemplary record without filing claims.

In addition to enjoying potentially lower rates, you may also qualify for other discounts, such as a safe driving discount on your car insurance.

Does Mercury offer uninsured motorist coverage?

Mercury does offer uninsured/underinsured motorist coverage, which protects you in the event of an accident with an at-fault driver who doesn’t carry (or carries too little) liability insurance.

In these cases, the at-fault driver’s liability limits are too low to cover damage to the vehicle(s) or medical expenses, so uninsured/underinsured motorist coverage steps in to fill the gap.

The Verdict

If you’re thinking of going with Mercury, it’s worth getting a quote from your local agent.

Mercury has a solid financial history and its customers rate its auto insurance highly.

However, many customers are less than impressed with Mercury’s homeowner’s insurance and have difficulty in getting claims resolved as promptly or as fully as they had hoped—particularly the case when drivers insured with Mercury are at fault.

Be sure that you understand your policy carefully and know what’s covered (and what isn’t) before you sign up. Mercury insurance cancellation fees and penalties may also come into effect if you still owe on your policy.

As with any major decision, buying insurance isn’t something to take lightly, so read your policy carefully and contact customer service (via email or phone) should you have any general inquiries. Overall, Mercury is a solid choice for car insurance that covers all the basics, but if reliable, courteous, and timely service is high on your list of priorities, you may want to look elsewhere.

Do you have experience, positive or negative, with Mercury Insurance?

We’d love to hear from you!

Share your thoughts in the comments below.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.