Infinity® Auto Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Insurance Agent

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

The Verdict

Infinity offers insurance for high-risk drivers across the nation

Infinity is one of the largest nonstandard insurers in the nation.

This in-depth review of its coverage, customer service, and prices will help you know whether its services are right for you.

Covers high-risk drivers. Most auto insurers won’t cover drivers with bad credit, an SR-22, or a poor driving record.

Infinity is different, providing policies for those that can’t get insurance at larger companies like Nationwide or State Farm.

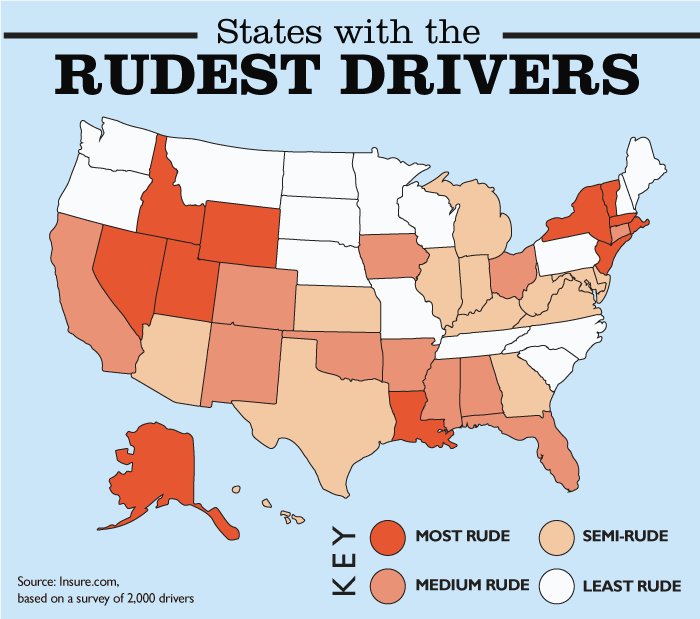

Available throughout the USA. The second-largest nonstandard insurer in America, Infinity is authorized to underwrite insurance throughout the nation.

Caters to Spanish speakers. With more bilingual agents and online resources than its competition, Infinity makes its insurance accessible for Spanish-speaking drivers.

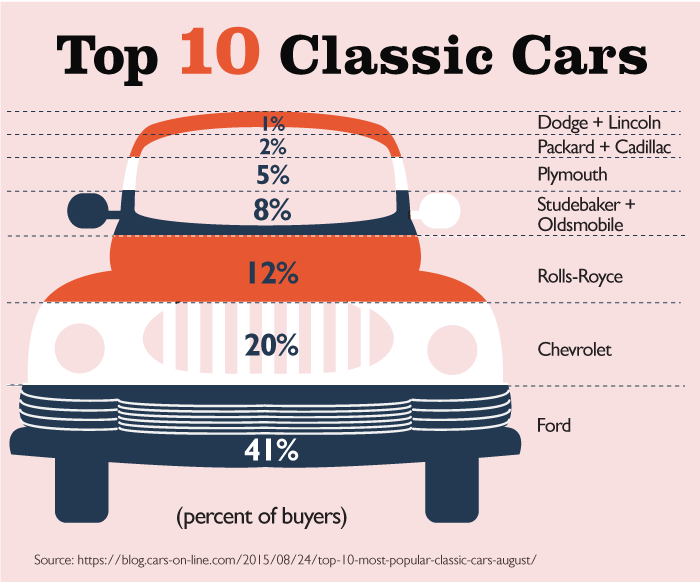

Decent classic car insurance. For drivers only looking for pretty good insurance on their antique or classic car, Infinity presents some alright options.

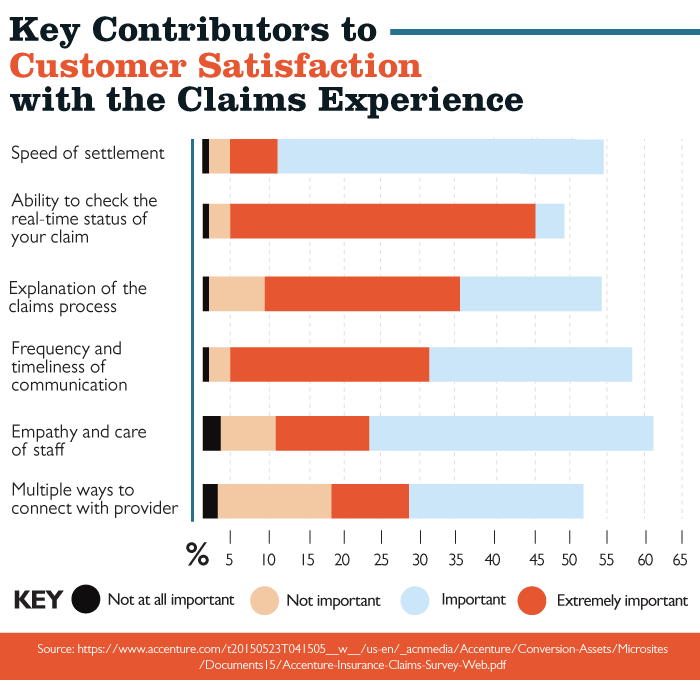

Poor customer service and claims. All these benefits come with one big drawback, namely that the company has a low ranking when it comes to customer service and claims handling.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

The Competition

Infinity competes with Direct Auto

Both Direct Auto and Infinity focus on non-standard insurance.

However, the two companies differ in a few important ways.

Direct Auto offers more discounts. The 12 different discounts for cutting your premiums makes Direct Auto stand out among nonstandard insurers, according to Finder.com.

Infinity only lists six available discounts on its website, though more may be available through an agent.

Infinity serves more states. Direct Auto can only write insurance in eleven states, while Infinity is available nationwide.

Better mobile experience with Infinity. While Direct Auto doesn’t have an app or much of an online presence at all, Infinity offers many digital functions including a pretty good app, as told by Insurantly.

The Question Everyone Is Asking

What is the Infinity DriverClub?

Not exactly free. The Infinity DriverClub sounds like a pretty good deal: Free roadside assistance available 24 hours a day, seven days a week.

However, the service isn’t actually free.

You pay every time you use its services, from towing your car to replacing a dead battery.

Connects roadside assistance companies and consumers. What the DriverClub does is serve as a middleman between you and various roadside assistance companies throughout the nation.

The benefit is that representatives vet these companies in advance so you know they won’t provide low-quality services.

The drawback is that it still costs money.

Open to all. You don’t have to have Infinity car insurance to join the DriverClub.

Membership is open to everyone, regardless of insurer.

The Strengths

Infinity is strong because of its accessibility and availability

Bilingual resources. Infinity’s bilingual website and agents make them a good choice for those looking for a Spanish-speaking insurance company, according to CarInsuranceCompanies.com.

The company is huge. One big advantage Infinity has over other nonstandard car insurers is its availability throughout the nation, as highlighted by AutoInsurance.org.

While most of its brick-and-mortar locations are found in larger cities, people throughout the country can get insurance over the phone or on Infinity’s website no matter where they call home.

Accepts all kinds of drivers. Like other nonstandard insurers, Infinity insures drivers whose poor driving history or credit may prevent them from getting car insurance elsewhere.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

The Weaknesses

Infinity is weak because of its poor customer service

Lots of negative feedback. Infinity has a lot more customer complaints than other insurers its size, according to Smart Shop Your Car Insurance.

Many people report the company isn’t that great at handling claims and offers a poor customer service experience in general.

Fees and fees. Customers can get hit with all kinds of fees if they’re not careful, as told by AutoInsuranceEZ.

These can include charges of $9-$25 for something as simple as paying premiums in installments instead of upfront.

Why You Need Their Services

You should use Infinity if you’re a high-risk driver

You can find out whether you should choose Infinity for auto insurance by answering a few simple questions:

- Are you a high-risk driver with an SR-22, poor credit, or multiple accidents or tickets on your record?

- Do you prefer a company with lots of resources in Spanish or Spanish-speaking agents?

- Can you pay for your policy completely upfront to avoid installment fees?

- Are you a standard driver looking for standalone classic car coverage?

If you answered yes to these questions, then Infinity is worth your consideration.

The Company’s History

Infinity helps build bilingual literacy

One big insurer. Starting in 1955, Infinity has grown into the second largest nonstandard auto insurer in the nation.

In fact, the company holds the rank of 21st on the list of largest car insurance companies in the nation.

Focused on education. The Read Conmigo program sponsored by Infinity helps build bilingual literacy among children.

Since it began in 2010, Read Conmigo has given away over one million free books to kids, schools, and libraries.

Infinity works best if you live in a large city

Though Infinity sells its policies everywhere over the phone and online, its physical locations are mainly in urban areas.

That means city dwellers have the perk of talking with an agent face to face and should make sure to give the company a look.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

What The Company Does

This is what and how Infinity works for you

Like almost all other insurers, Infinity offers liability, collision, and comprehensive auto insurance.

It also provides a few other products worth examining.

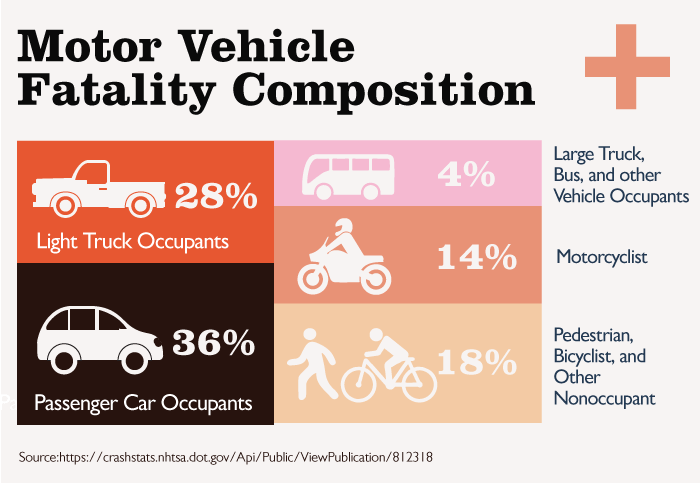

Liability insurance

Pays for others, not for you. Liability insurance covers bodily injury and property damages for other parties involved in a collision where you’re at fault.

It doesn’t pay for your car or any of your medical expenses, though.

Get more than the minimum. If you can afford it, make sure you get more than the state-mandated liability insurance.

You’re on the hook for any damages that exceed what your policy pays out, which can lead to a nasty lawsuit if you’re in a wreck.

For instance, let’s say you carry $50,000 worth of coverage.

If you’re in an at-fault wreck that causes $75,000 medical and property damages, you can get sued for the remaining $25,000.

Collision insurance

Pays for your car. If you’re in an accident, collision insurance will cover the current cost of your vehicle.

Don’t jeopardize your discount. Infinity offers up to a 25% safe driver discount, which you can potentially lose for filing an at-fault collision claim.

That’s not to say that if you’re in an accident with another driver you should avoid contacting your insurer.

However, if you’re in a minor accident without another driver involved, consider paying out of pocket instead of filing a claim and seeing your discount vanish.

Comprehensive insurance

Covers non-collision damages. Comprehensive insurance pays for your car if it gets vandalized, stolen, or otherwise damaged outside of a car wreck.

Set a high deductible. Comprehensive and collision insurance both carry a deductible, which is what you pay out of pocket before your insurance covers any damages.

Policies with higher deductibles charge lower premiums, so setting it as high as you can reasonably afford helps keeps your car insurance rates less expensive.

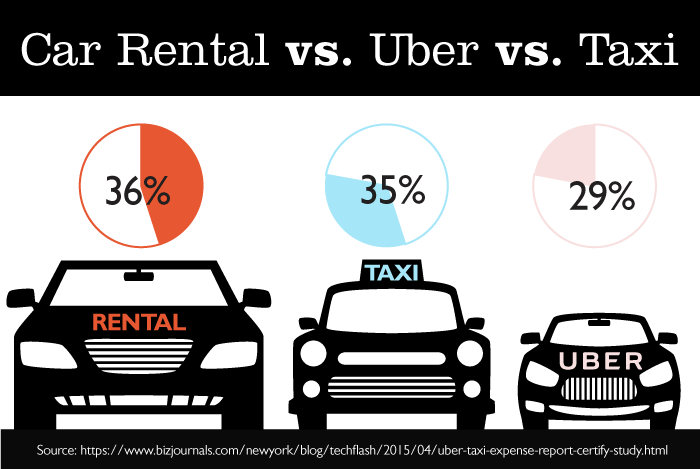

Rental insurance

Pays for a temporary car. If your car is in the shop for repairs, rental insurance will help defray the cost of a rental car so you’re not stuck without transportation.

Check your warranty first. Some extended warranties actually already cover the cost of a rental car.

If you purchased a car with extensive warranty protections recently, look it over to see if this is covered before signing up for rental insurance.

Uninsured motorist bodily liability

Protects you from uninsured drivers. In cases where you’re in a collision with an uninsured driver, this type of insurance will help cover your medical expenses.

Say you carry uninsured driver insurance worth $20,000.

If a driver without insurance hit your car and caused you to rack up $10,000 in medical bills, your policy would cover the entire cost.

Uninsured, not underinsured. One technical thing to note – this isn’t underinsured driver insurance.

That means if the other driver is only carrying the state minimum insurance but causes more damages than their policy can cover, your uninsured driver insurance wouldn’t pay out a cent.

What People Love About It

People love this company because of its coverage options

Covers all kinds of vehicles. Infinity doesn’t just offer car insurance.

It can also cover your RV, ATV, boat, or motorcycle, something the experts over at HighYa found noteworthy.

Good classic car insurance. Vintage cars are pricey investments, and Infinity offers policies designed to protect your classic automobiles, according to Car Insurance List.

Their policies are reasonably priced, making them worth it even if you only occasionally take your classic vehicle out on the road.

Biggest Complaints

The biggest consumer complaints focus on poor customer service

Infinity isn’t accredited by the Better Business Bureau, which gives them a B+ rating based on its response to customer reviews.

Those customers had quite a few things to say about Infinity’s service.

Poor communication. Gary P. reported unresponsive agents, saying, “ZERO COMMUNICATION via phone or email on their part. Should have done my research before choosing such an awful company to cover my family.”

High fees. Little fees add up quick according to Blanca N., who writes, “Stop charging clients for every little thing. On top of $5 processing fee for every change made, I get charged $6 every month for installment fees!”

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Key Digital Services

Infinity’s app is actually not that bad

Pretty good app. The Infinity app holds 3.5 out of 5 stars on both Google Play and the iTunes Store. You can use it to make payments, pull up your ID card, access DriverClub, upload claim documents, and receive quote information, functionalities far ahead of what other nonstandard insurers offer.

Hard-to-use website. You can use Infinity’s website to file or track a claim, make payments, and get a quote.

However, the website only shows you the types of coverage offered if you go through the online quote process. This makes it complicated see whether Infinity carries the protection you need, according to Eric Stauffer of Expert Insurance Reviews.

How To Start Services

Pay upfront and save if you want to start using Infinity

Multiple ways to start. You can get a policy online, over the phone at 1-800-463-4647, or by using the agent locator tool to schedule a face-to-face meeting with a nearby Infinity representative.

Get a discount, avoid fees. Make sure to pay the term of your policy all at once instead of in installments if you go with Infinity. That nets you a 15% discount for paying upfront and avoids the installment fees the company charges.

How To Cancel

The easiest way to stop using Infinity is calling customer support

Cancel by calling. To cancel your insurance from Infinity, just call 1-800-463-4647.

Avoid a jump in premiums. Make sure you have a new insurer lined up before canceling with your old company.

Going any amount of time without car insurance can make your rates increase.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

FAQ

Infinity offers car insurance to high-risk drivers everywhere and some decent classic car insurance to boot.

Another plus is that they make their services especially accessible for Spanish speakers.

However, they charge fees for almost every little thing and aren’t that great at customer service.

If these benefits outweigh the potential for poor customer experience, then see whether Infinity’s rates and services match your car insurance needs.

Do you use the Infinity?

How has the company worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.