Everything You Need to Know About Esurance®

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Mar 18, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Mar 18, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

How do you really provide insurance for the modern world?

Esurance believes you invest in state-of-the-art technology, 24/7 customer support, and personalized insurance plans so people only pay for the coverage they actually need.

Their catchy tagline is more than just a company motto; it’s the foundation they built their entire business on and has become their sole mission.

But does Esurance actually deliver these promises at the affordable rates they advertise?

Today we’re going to investigate what makes Esurance stand out from the rest of the established insurance pack—and why these differences could mean more savings for you.

An insurance company will help cover the costs of repairing or replacing your most prized possessions if they ever get damaged or stolen. You pay the insurance company a premium for this protection and hope you never have to use it.

But how do you decide which insurance company to trust with your hard-earned cash?

Most consumers look for a company that understands what they need, when they need it.

Insurance industry leaders like State Farm, Geico, and Progressive have been around since 1922, 1936, and 1937, respectively. While this may mean they know what they’re doing in the insurance game, if these companies were people, they’d be senior citizens in their 80s and 90s.

Compared to those geezers, Esurance can’t even legally buy a beer yet.

Esurance was born at a completely different time in history.

Just three years after Google was created in 1996, and just five years before Mark Zuckerberg launched Facebook in 2004, Esurance was founded in San Francisco in 1999.

Their mission?

To change the world by bringing insurance quotes online.

See, back in the old days, getting an insurance quote used to mean cold calling random agents or making an appointment with a local insurance agent’s office for a confusing in-person meeting.

Since none of that sounds fun, the brains behind Esurance knew there had to be a better way to connect consumers with the right insurance on the wide open web. They became one of the first insurance companies to sell directly to consumers over the internet.

They started with the most exhausting task: giving visitors a way to receive a simple insurance quote online in a few clicks, not after a few minutes on hold with a representative.

Instead of building offices and hiring a bunch of sales representatives, Esurance focused on developing proprietary algorithms to take their mission to the masses. Convenience, innovation, and digital technology were the cornerstones of the Esurance philosophy and factor into every detail of their insurance process today.

So as you can see, Esurance has a lot more in common with millennials than other insurance companies since it grew up in the middle of the tech revolution just like they did (minus all the selfies).

Esurance chugged away successfully on their own for 12 years until they caught the eye of a bigger fish looking to take them to the next level.

Esurance is a Subsidiary of Allstate

Established insurance vet Allstate typically uses agents to sell their services like the other big insurance guys. Instead of competing with Esurance’s direct approach (which was steadily gaining popularity), they acquired Esurance in 2011 to the benefit of both companies.

Allstate was able to get into the direct insurance business and Esurance became a major player in the insurance arena.

So despite Esurance’s youth, their services are backed by Allstate’s 80 years of experience and their accumulated total assets, which exceed $130 billion (in case you’re wondering).

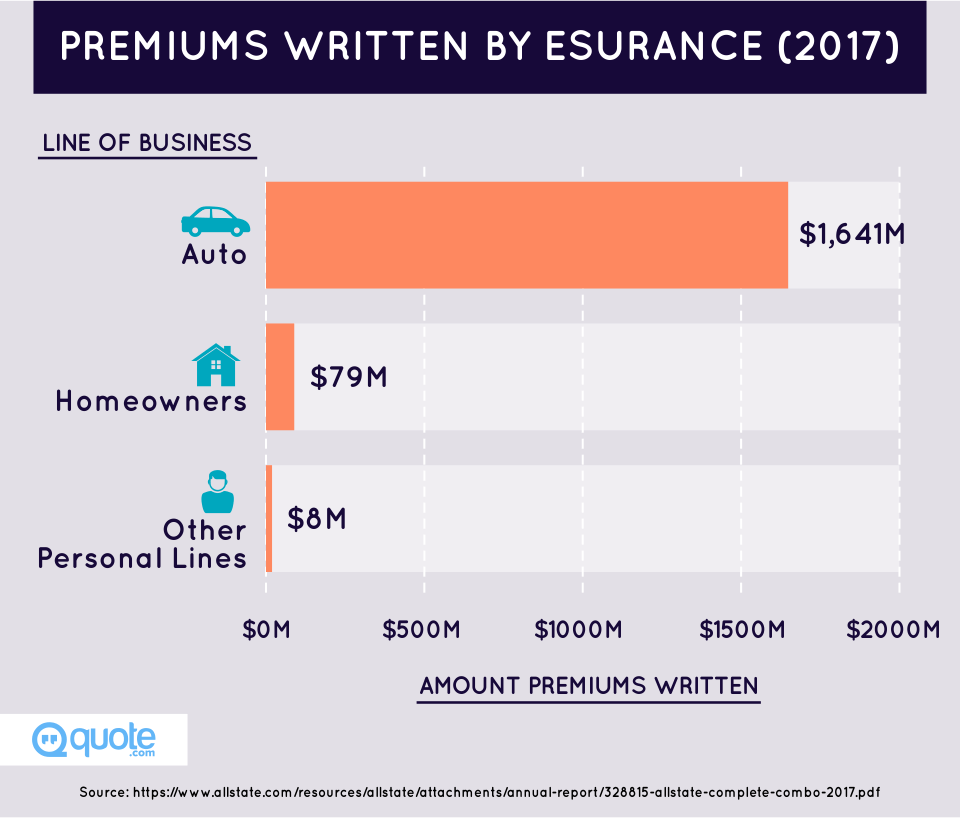

Now Esurance boasts coverage for over 970,000 policies and over $1.5 billion in gross written premiums.

They’re considered one of the leading budget-friendly insurance companies and they’ve even earned an A+ financial rating from A.M. Best (an insurance industry rating leader) for their superior financial strength.

Let’s talk about what coverage from a modern insurance company like Esurance looks like.

What products or services does Esurance offer?

Esurance offers protection for everything that matters to you at every stage of your life.

They have auto insurance to cover your:

Car – Motorcycle – Boat/PWC

RV – Travel trailer – Snowmobile

ATV – Segway – Commercial auto

Scooter – Golf cart – Classic vehicle

They also have property insurance to cover your home, apartment, condo, or mobile home.

And they even offer additional insurance to protect your health, life, pets, cell phone, and even your business.

Here are a few of Esurance’s most popular insurance services:

Vehicle Insurance

Esurance started with vehicle insurance and now they cover more than 5 million vehicles and recreational vehicles on the road.

Esurance segments their auto coverage into 3 categories: medical, vehicle-based, and liability.

But there are tons of coverage choices available within these groups. So with so many options, how the heck are you supposed to know which coverage you should have?

Let CoverageMyWay Help

Esurance thinks shopping around for car insurance shouldn’t take all day or make your head explode.

CoverageMyWay is a smart, intuitive tool to help you figure out the coverage you really need. You’ll have a fast, free auto insurance quote based on a series of questions about your life and your time spent on the road.

These aren’t complicated SAT questions; they’re mainly asking for info like your address, the kind of car you drive, and how many miles you rack up per year.

Your answers will feed Esurance’s complex online algorithms to bring up personalized insurance coverage specifically for you, not those based on what a sales agent thinks you should have (and have to pay for!).

What do the CoverageMyWay suggestions look like in the real world?

- If you finally saved up for your dream car, CoverageMyWay will probably steer you towards collision coverage to protect your baby—err, investment.

- If you’re renting your home-sweet-home, CoverageMyWay may suggest adding renter’s insurance to cover your belongings and your car under one (typically discounted) policy.

CoverageMyWay only suggests what would work well for someone in your similar circumstances. Feel free to add additional coverage or choose as little protection as you can get away with. That’s the beauty of personalized insurance.

CoverageMyWay will help explain Esurance’s common coverage choices, such as:

Medical Coverage

Medical payments cover accident-related medical and funeral expenses for you, other drivers on your policy, and your passengers.

Personal Injury Protection (PIP) is offered or sometimes required in no-fault states to cover the medical expenses for you or your passengers after an accident, regardless of fault.

Vehicle Coverage

Often termed “comp and collision”, these two are not state-mandated though they may be required if you’re leasing or financing your car. Together they provide “full coverage”.

Collision covers the cost to repair or replace damaged parts of your own vehicle in the event of an accident.

Comprehensive covers damage from non-driving accidents, such as those sustained from severe weather, theft, animal run-ins, fire, or vandalism. Comp can also help pay for a replacement if your car is totaled. Unfortunately, it’s not protection against bad luck.

Liability

Legally required by drivers in most states, liability coverage pays for damages, medical care, and lost wages for other drivers and passengers if you’re at fault in an accident.

Each state sets its own requirements for minimum coverage limits, which are typically organized in a 3-tier system.

For example, a 25/50/15 policy means:

- $25,000 – the maximum amount your insurance company will pay for an injury-related expense

- $50,000 – the maximum amount paid for an injury-related expense per incident

- $15,000 – the total amount your insurance company will pay for damages to property per incident

Bodily Injury coverage takes care of the medical treatment associated with the accident and will cover medical expenses and lost wages for drivers and passengers involved.

Property Damage repairs the damages to property (like fences, buildings, etc.) as a result of your at-fault accident.

Uninsured Motorist Coverage helps when you get in an accident with a motorist who’s not fully insured. This coverage takes care of all the costs their insurance won’t cover. Without it you’d be on the hook for the difference.

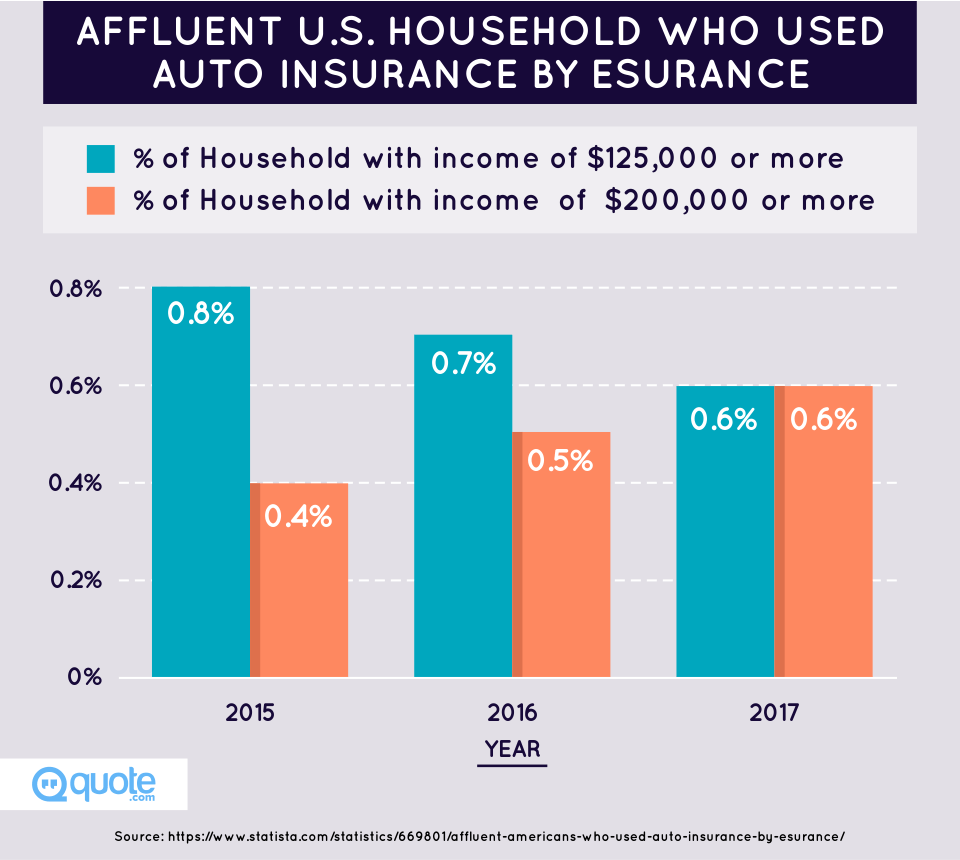

What’s a typical auto insurance rate with Esurance?

According to NerdWallet’s comparison tool, a 30-year-old woman driving a 2015 Toyota Camry up to 10,000 miles a year will see monthly auto insurance rates such as:

- $243 from Progressive

- $232 from Allstate

- $195 from Esurance

A 35-year-old married man driving the same car and traveling the same annual miles will have options like:

- $210 from Allstate

- $201 from Progressive

- $158 from Esurance

Property Insurance

Whether you’ve found your forever home, can’t leave your amazing studio in the city, or want to protect your beach condo or mobile home from the sea, Esurance has coverage for everything that makes your home sweet home.

Homeowners Insurance

Provides coverage for your:

- Home’s physical structure and the other structures on your property (eg., carport, fence, shed, etc.)

- Personal belongings

- Liability if someone gets injured on your property (and you’re responsible)

- Additional living expenses should you need to relocate elsewhere while the damages to your home are repaired

This means you’ll have help paying for damages to your property if they were caused by incidents such as:

- Fires, lighting, or smoke

- Windstorms and hail (including tornadoes and hurricanes)

- Explosions

- Vehicles, aircrafts, falling objects

- Theft, vandalism, or malicious mischief

- The weight of ice and snow

The type of coverage you choose depends entirely on your home and your finances. Generally, you should opt for enough coverage should you need to replace/repair every thing. Remember, whatever you’re not covered for will need to come out of your pocket.

Condo Insurance

Condo owners may feel as if they don’t need to worry about property insurance since they pay an HOA to maintain everything outside their unit’s walls and common areas, but what about everything inside your unit?

Condo insurance works with your HOA insurance to protect you and your belongings from damages, loss, theft, and liability if someone were to get hurt at your place.

It covers everything from your updated kitchen fixtures to that unique rug you picked up on your travels. Plus, it also fills in the gaps your HOA doesn’t cover, like improvements and renovations you make.

Apartment Insurance

Apartment dwellers rely on their landlords to maintain their building and unit’s structure. But

the average renter in a two-bedroom apartment has about $30,000 worth of stuff,

told US News.

Can you replace all of your belongings with your savings if a fire, burglary, or natural disaster strike your pad?

That’s why you need renters insurance to help.

Renters insurance will cover your:

- Personal property

- Personal liability and subsequent medical payments if someone is injured at your apartment

- Additional living expenses if your apartment becomes uninhabitable and you need to find another roof over your head

- Property damage to others, so in case you accidentally break or damage someone else’s property, your renters insurance will kick in as if your own property needed to be repaired/replaced

Other Insurance Options from Esurance

Sure, Esurance takes care of the major adult stuff like home and auto insurance, but they’re also there for you when your dog breaks her leg or you drop your cell phone in the toilet (gasp!).

Esurance provides these extra insurance options to give you peace of mind all the time:

- Life Insurance to protect the financial future of your family if something should ever happen to you. Esurance partners with top-notch companies to customize affordable coverage to help your family pay for their expenses when you’re not around (ie., funeral service, mortgage, bills, etc.).

- Health Insurance to help you pay for personalized medical coverage. Compare their variety of plans—including those subsidized by the Affordable Care Act—and apply for your policy directly online with Esurance’s partners.

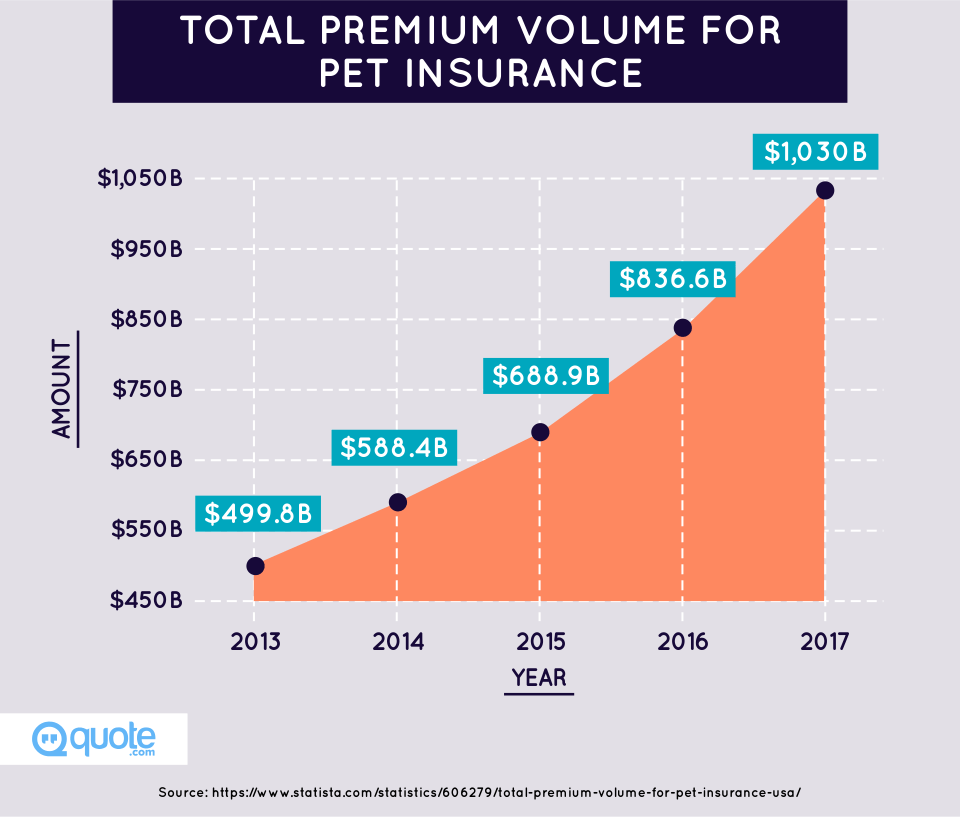

- Pet Insurance to cover unexpected vet bills and treatments when your best friend is sick. Esurance partners with Petplan, a trusted pet insurance provider with high customer service ratings, to offer flexible, affordable payment options for every animal lover.

- Cell Phone Insurance to protect against theft, water damage, and loss of your other brain (aka cell phone). Esurance’s partnership with eSecuritel—which has an A+ rating from the Better Business Bureau—means you’ll have coverage no matter when you purchased your phone. You’ll even get a replacement phone within 2 days of your approved claim. #win

Esurance has the most competitive auto insurance rates in the business. Though they may not be the cheapest rates (depending on certain situations), they will provide premium coverage at a cost much lower than their competitors.

Like they say, Esurance is built to save you money:

But your low rate is just the beginning of your insurance savings with Esurance.

Aside from Esurance’s low rates and flexible payment options, they also offer customers a slew of discounts to slash their premiums even further.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Esurance’s most popular discounts

Fast 5® Discount

The easiest discount on the list to snag, all you have to do is start a rate quote online at esurance.com and you’ll receive 5% off your first-term premium.

Since you’re probably already getting an online quote, this is basically free pizza money.

Multi-Policy Discount

When you have insurance policies with other companies, it’s usually pretty hard to keep track of everything during the chaos of filing a claim. Especially if you continue to add coverage as your life changes.

But if you bundle your auto and homeowners or renters insurance with Esurance, you can access all of your policies in one convenient place.

Besides making your life easier, bundling more than one insurance policy with Esurance qualifies you for the Multi-Policy discount, which discounts both (or all) of your policies. Score!

Paid-in-Full Discount

If you pay your sixth-month premium in full as one lump sum payment—instead of paying it in monthly installments—you’ll receive a 10% discount.

This may not sound like much, but if your sixth-month premium is $200, that’s an extra $20 in your pocket. Not too shabby.

New Home Discount

Sign up for an Esurance homeowners policy within 12 months of buying or completing the construction of your home and you’ll enjoy extra savings thanks to your new abode.

As a homeowner, you may also qualify for the:

- Home Safety Discount

- Storm Shutter Discount

- Smoke-Free Home Discount

Renters Plus® Discount

Add renter’s insurance to your Esurance auto policy and take advantage of the Renters Plus discount, which means 30% of your renters coverage premium gets deducted from your car insurance rate for as long as you have renters coverage.

This win-win situation gives you discounted car insurance and protection for your pad should nefarious activity occur while you’re home or away.

DriveSense™ Discount

There’s a dirty little secret about how insurance companies really determine your premiums, and you’re probably not going to like it.

See, insurance companies can use your driving behavior, insurance history, and factors such as the following to figure out your insurance rate:

- Marital status

- Education

- Occupation

- Credit History

- Location

- Socioeconomic status

The insurance companies use algorithms and statistical information to assess how risky you are to cover based on where you fit in these categories.

For example, DMV.org highlights a study by the National Institutes of Health which shows that, “drivers who have never been married had twice the risk of driver injury than drivers who were married.”

So even though you may have never filed a claim, you may still be forced to pay higher premiums if you’re not the marrying type. Seems kind of unfair, right?

If you’re ready to break out of the pigeonhole you’ve been stuck in, say hello to Esurance’s DriveSenseTM program.

DriveSense is a usage-based insurance program designed to figure out a premium based on your specific driving, not on statistics and demographics.

When you sign up, Esurance will send you a small telematic device that plugs into your car’s onboard diagnostics (OBD) port. This device has access to your car’s computer brain; it can monitor how fast you drive, how hard you brake, and how far you travel every day.

This information is then stored and sent privately and securely to Esurance for review.

You’ll have access to a personalized website to analyze your driving behavior and learn how to troubleshoot specific habits that may be raising your rates (cough cough, speeding).

You can also create notifications based on your data.

Create an alert for when you’ve driven more than your average amount of miles so you stay within your car’s lease terms. Or get notified when one of your teens is driving past curfew.

Drive like an ideal motorist and Esurance will reward you with savings as high as 30%!

Pay Per Mile Program Discount

If you drive less than 10,000 miles a year, the Esurance Pay Per Mile program may save you more than any insurance company.

You’ll install the same telematic device the DriveSense program uses (see previous section) to track how many miles you actually drive every month. Your payment will include your base cost, plus the cost of your monthly mileage.

Your mileage cost will be your per-mile rate (usually a few cents) times the number of miles you drove. You’ll have access to a personal website where you can view your daily mileage and determine your mileage costs and payments.

Pay Per Mile gives you all the same amazing coverage options you’d have with a standard Esurance auto policy, but it will be customized for your needs. Since you’re paying per the number of miles you drive, you’ll pay for exactly the coverage your driving demands. You’ll be totally in control of how much you pay for insurance (aside from the monthly base rate).

PS: If you want to go on a roadtrip, Esurance only charges for the first 150 miles you drive each day so anything more than that is on the house. Bring on the cross country adventure!

Downside: Esurance’s Pay Per Mile is only available in Oregon right now, but they’re hoping to expand their program soon so keep it on your radar.

Since your insurance coverage is usually pre-paid in advance, you could be hit with a $50 cancellation fee if you cancel your Esurance before your next renewal period. Wait until your renewal period and you’ll avoid the penalty.

You can cancel your Esurance Pay Per Mile policy at any time for a $50 cancellation fee. However, if you switch your Pay Per Mile policy to an unlimited mileage policy that fee will magically disappear.

Esurance’s Strengths

Amazing 24/7 Customer Support

No, the technologically-driven Esurance staff isn’t a bunch of robots—there are actually over 3,500 associates buzzing in 17 offices across the country:

- San Francisco, CA

(corporate headquarters)

- Atlanta, GA

- Bridgewater, NJ

- Brooklyn, NY

- Dallas, TX

- Denver, CO

- Ft. Lauderdale, FL

- Greenville, SC

- Los Angeles, CA

- Madison, WI

- Melville, NY

- Ogden, UT

- Phoenix, AZ

- Sacramento, CA

- San Antonio, TX

- Sioux Falls, SD

(24/7 customer service)

- Tampa, FL

Though you may never need to visit an office, you can chat with an Esurance licensed agent online or over the phone anytime—day or night, every day of the year—if you have questions or concerns about your coverage or policy.

Self-Directed Customers

Esurance empowers their customers by providing all of the information they need about their insurance options online. Their online and mobile tools teach customers about their choices on their own time.

Ultimately this leads to smarter customers who make better decisions, which translates to fewer headaches for everyone.

Cheaper Auto Insurance than the Bigger Names

Esurance doesn’t play by the same rules as the other old school insurance companies it competes with. That’s why it’s no surprise they save their customers more money.

For one, they have a crazy low amount of offices when you compare their outposts with those of the bigger industry names:

Fewer offices means less expenses; costs for paper, printer toner, stapler replacements, and electricity are manageable so Esurance doesn’t have to charge their customers for these costs of doing business.

Esurance also employs fewer people, another big budget saver:

They Have the Most Comprehensive Online Tools

If you have questions about your policy or coverage, don’t sweat!

Esurance created the most comprehensive online tool collection so you’re always a click away from answering your own questions (and becoming a more educated consumer in the process).

Check out these four Esurance tools designed to help you understand your insurance:

Coverage Counselor®

As the official car insurance coverage estimator from Esurance, this little tool helps you determine which coverage you need to protect yourself, your car, and everything else you love.

What If Calculator

The Esurance What If Calculator works better than a Magic 8-Ball to predict what will happen to your insurance rate if you make certain changes, such as moving to a new zip code, adding a new vehicle to your policy, or getting a ticket.

Just log into your account, plug in your hypothetical information, and you’ll have a personalized 6-month car insurance quote that takes your potential scenarios into account.

Your premium and policy won’t be affected no matter how many questions or scenarios you play out with the calculator.

Understanding which factors affect your insurance rate the most will inform your future decisions. For example, if you know adding a sports car will raise your premium while a minivan would lower it, you may think twice about that new roadster.

Make Photo and Video Claims

To make the claims process easier, Esurance lets you snap and send photos of the damage to your car when you start the claims process online or via their mobile app.

Esurance provides detailed, step-by-step instructions of exactly what pictures to take so you’re never lost. After your photos are submitted (and your selfies deleted), your dedicated claims rep will contact you within one business day with an estimate for your repairs. No need to take your car to the shop for a quote!

RepairView

As long as you take your car to a recommended E-star Direct Repair facility, you’ll know exactly what’s going on with your ride during every step of the repair process.

With RepairView, you can see and share daily photos of your repairs as they’re happening in real time. Monitor all of your car’s updates online from any computer or via the mobile app on your devices.

Bonus: Your repairs are guaranteed for as long as you own your car through the Esurance E-Star® Direct Repair Program.

They Have Very Few Customer Complaints

The most common complaints about Esurance seem to stem from their three biggest weaknesses (see next section).

However, Esurance has incredibly positive customer satisfaction ratings on the whole and customers would recommend Esurance over their competitors. Check out these customer reviews for yourself:

Esurance’s Weaknesses

Esurance isn’t the right fit for everyone. Common complaints focus on:

Esurance’s non-traditional approach to insurance

Esurance only has 17 offices so the chances of you sitting down with an agent are very slim. People who prefer a more traditional approach to insurance may not be down with Esurance’s all-online approach.

However, those who actually like the ease of filing claims from their mobile devices, or clicking a few buttons for a free quote instead of waiting on hold forever, will dig Esurance’s modern-day convenience.

Their services are not offered nationwide (bummer!)

There’s nothing worse than wanting something you can’t have.

Though Esurance provides car insurance to nearly 90% of the country’s population, it’s only offered in 43 states. Which means customers in these states are totally missing out:

- Alaska

- Delaware

- Hawaii

- Montana

- New Hampshire

- Vermont

- Wyoming

Esurance motorcycle insurance is only available in 11 states:

Homeowners insurance is available in these 31 states:

- Minnesota

- Missouri

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

Renters insurance can be added to your car insurance policy if you live in one of these 21 states:

- Alabama

- Arkansas

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Missouri

- Nebraska

- New Jersey

- Ohio

- Oklahoma

- Oregon

- South Dakota

- Tennessee

- Utah

- Virginia

- West Virginia

- Wisconsin

Don’t get discouraged if Esurance isn’t offered where you live right now—they’re growing and hoping to spread their mission to insurers across the country soon.

Increasing rates over time

Certain Esurance customers have reported an increase in their premium rates over time. While this is definitely not ideal, there are several reasons why your rates may change.

Your premium may increase within the first two months of your new Esurance policy if information that was not disclosed during the quote process, like an undisclosed accident or claim, comes to light.

If your premium increases during renewal time, there are several explanations why, including:

- Having an accident or filing a claim

- Getting a ticket or violation

- A discount no longer being applied (eg., Claim-Free discount will disappear if you filed a claim)

- Moving to a new zip code with higher risk

- Change in your state’s department of insurance rate plan (which affects all drivers in your state)

Esurance promises to contact you at least three times before they increase your rate to maintain transparency and keep you in the loop.

When you have a lot to lose, you can easily surpass the limits on your auto and homeowners policies during the repair or replacement process of a claim.

Umbrella insurance is a secondary liability policy which extends your other insurance policies should they ever get close to their max limits. This means you won’t be forced to pay out of pocket for claims or lawsuits.

Esurance’s Umbrella Policy

Personal umbrella insurance with Esurance gives you:

- Up to $10 million in liability coverage (depending on where you live)

- Extended liability protection and coverage other policies don’t cover

- Liability coverage for non-owned recreational vehicles and watercraft

- Worldwide coverage

Many policies will also provide coverage for:

- An unlimited number of drivers (between 23 and 89 years of age), vehicles, and watercraft

- Up to 15 property locations

- Trusts, estates, personal limited liability corporations (LLCs), or limited partnerships

Esurance doesn’t offer this type of insurance to average Joes. You need to meet their strict requirements, which include:

- A homeowners insurance policy with at least $300,000 of personal liability or tenant coverage

- A personal driving record with no more than one at-fault accident

- An auto insurance policy with limits of $250,000/$500,000 for bodily injury coverage, $100,000 for property damage coverage, and uninsured/underinsured motorist coverage

- Zero major driving violations or DUIs

- No drivers under 23 years old or over 89 years old in your house

Filing a Claim

Esurance makes filing a claim just as simple as requesting a quote.

When you file your claim, you’ll be assigned a dedicated representative who will handle all of the big and small details of your repair. Esurance says they settle most vehicle claims in 10 days or less.

Customers have three easy options to file a claim with Esurance:

File an Esurance claim online: Policyholders will head over to https://www.esurance.com/file-a-claim-online and log in to their account to get the process started. You’ll be able to report damages, submit photographs of the accident, and track your repairs from there.

File an Esurance claim over the phone: Insured drivers can also report a claim to Esurance’s 24/7 line at 1-800-ESURANCE (1-800-378-7262).

File an Esurance claim using the Esurance Mobile app: The Esurance Mobile app is the most convenient way to report a claim. Here’s what you can do directly from the app:

- File a claim

- Schedule a vehicle inspection

- Get roadside assistance

- Reserve a rental car

- Submit photos of your damage for appraisal

- Video chat with an appraiser

- Track your repairs

After you start your claim online, over the phone, or via the Esurance mobile app, you’ll snap a few photos of the damage and submit them to your claims rep for an estimate. You’ll be contacted within one business day with an estimate for repairs, no appointment necessary.

If Esurance thinks an appraiser might speed up the claims process, they’ll ask to schedule a video chat with you so you don’t have to meet one in person.

Simply check in for your call and your appraiser will show you exactly how to video the damage on your car to get a detailed picture of what needs to be done (and how much it will cost).

Your appraiser will give you an estimate—and possibly even payment—the same day so you can start the repair process and get on your with life.

Most Common Customer Complaints

Customers most commonly complain about Esurance raising their rates without warning. However, several different factors go into the algorithm that determines your rate, which are all constantly in motion.

Esurance doesn’t use the same factors in their algorithms as their competitors. That’s why Esurance lets you compare their competitor’s rates to see if you’d get a better deal elsewhere.

In reality, data from the National Association of Insurance Commissioners shows that Esurance had fewer complaints to state regulators during 2015 than other insurance companies.

Esurance isn’t a nationwide provider so customers in certain states won’t have access to any of Esurance’s services or products (boo!) while others will only be offered specific types of coverage in their state.

For example, Esurance offers auto and home insurance in Colorado, but not motorcycle coverage (see section 7).

Additionally, did you know that every state has a department of insurance?

This government body sets the rules for insurance and is the reason why every state’s rules and regulations work differently.

You can check out Esurance’s state-specific guides to car insurance and learn about what your state legally requires of insurance coverage, specific factors that affect your rates, and rules on uninsured drivers and electronic proof of insurance, just to name a few topics.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Esurance FAQ’s

1. Why are Esurance rates cheaper compared to other companies?

Esurance has fewer offices that generate less expenses than their competitors. Because they revolutionized the online insurance experience, their customers enjoy these cost-savings in the form of lower premiums.

2. How much does Esurance insurance go up after an accident and/or speeding ticket?

Your Esurance insurance premium will not automatically go up after an accident.

Esurance uses these 5 specific factors to determine whether your claim will raise your rates:

- The severity of the incident

- Your driving history

- Who’s to blame

- No-fault or not

- Your policy’s details

As long as you’re golden in most of these areas (think: one fender bender and a perfect driving record), you shouldn’t be penalized.

Cruising on to speeding tickets, Esurance also uses a set of criteria to evaluate whether your ticket warrants a higher rate. Factors like your driving record, age, and time between speeding tickets will all be considered.

They’ll also determine if your speeding was minor (5, 10, 15 mph over the speed limit) or reckless (30+ mph over the speed limit). Obviously the riskier they deem your driving, the higher your rates will be.

Short answer: Your Esurance premiums will not automatically skyrocket if you have an accident or get a speeding ticket.

3. What does comprehensive insurance cover with Esurance?

Comprehensive insurance isn’t legally mandated, but if you’re leasing or financing your car you may be required to add this coverage.

Why?

Comprehensive coverage will help you pay for incidents that aren’t connected to collisions, such as unexpected damage from:

- Fire

- Natural disasters

- Falling objects

- Vandalism

- Theft

- Hitting an animal

Comprehensive coverage will help you pay to repair the damages or replace your car if it’s deemed totaled. Glass damage (like a cracked windshield) is usually covered under comprehensive policies.

4. Does my Esurance insurance cover a rental car?

Standard auto policies typically help cover the cost of a rental car should you need one during an approved repair. Esurance will reimburse you for the rental car, or pay them directly if you choose their preferred carrier Enterprise.

The limits and deductibles carry over from your policy to your rental car as long as you’re using it for personal use. If you’re using it for business or commercial use, you’ll need to check your policy.

However, most of them do not cover the cost to replace that rental car should you get into an accident. They also fail to cover the loss of income the rental company misses when the car is out for repairs. Combine these two and you could be facing thousands of dollars out of pocket.

Don’t forget that you can always opt-in for rental car coverage.

5. Does my Esurance car insurance cover me in Canada or anywhere outside the USA?

Your Esurance coverage only extends to drivers visiting Canada, our neighbor to the north, right now. Drive in Mexico or any other country and you won’t have Esurance coverage to back you up.

6. Does Esurance insurance use credit scores to determine their rates?

Though illegal in Hawaii, California, and Massachusetts, many U.S. auto insurance companies use credit-based insurance scores to determine the risk of their current and potential customers.

While these don’t take into account your income, job, or gender, credit-based insurance scores help determine if you’re likely to file a claim, qualify for payment plans, and ensure you’re not overpaying for your coverage.

Studies have shown that higher credit scores correlate with fewer accidents, meaning drivers with high ratings are less risky and cheaper to cover.

When The University of Texas analyzed 175,647 policies, they learned that lower credit scores indicated higher claims payouts and more losses for insurance companies. These losses mean premiums go up for customers to help cover the expense.

If you want to save the most on your car insurance, make sure to pay your bills on time and check your credit score frequently. The Fair Credit Reporting Act (FCRA) gives you the right to obtain one credit report for free every year.

Thinking of switching to Esurance?

Esurance has an A.M. Best Financial Strength Rating of A+ (Superior).

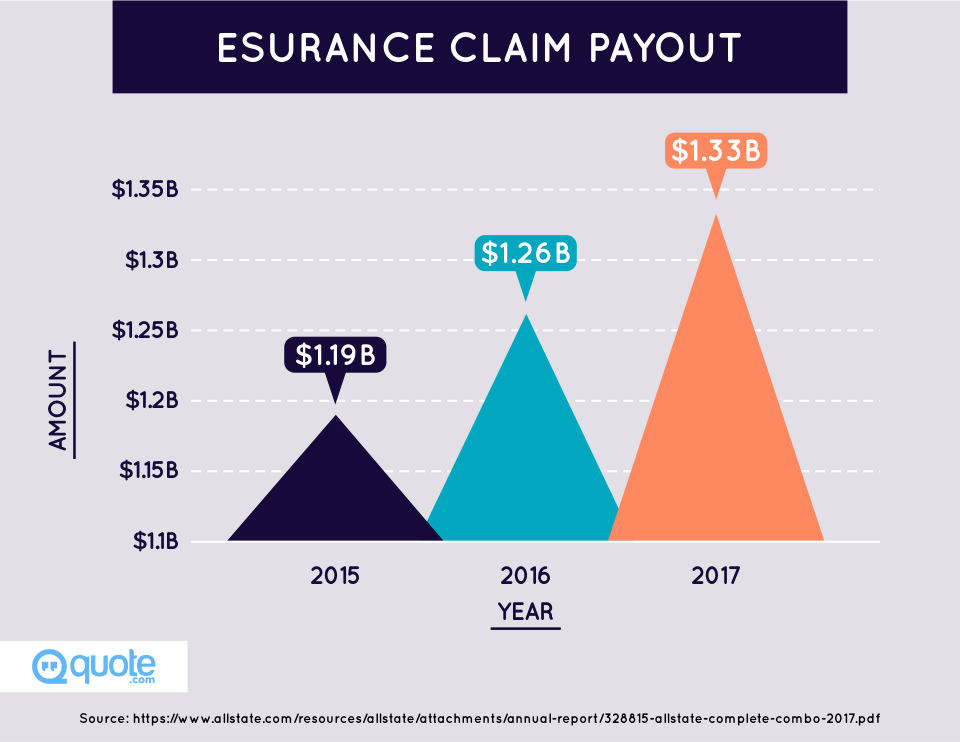

This leading insurance industry score indicates how well an insurer can pay its claims. Esurance is backed by Allstate’s accumulated total assets (which is over $130 billion) so it ranks very highly.

As you know by now, Esurance started their business with online quotes for car insurance and they’ve only been improving the process.

Thanks to their Express Lane® quoting feature, simply enter your name, birthday, and your home address to get an instant quote online for free. That’s it! Esurance will look up all your information so you don’t have to waste any time.

If you’re not cool with the Esurance spiders crawling all over the web looking for your info, you can also add your information manually to retrieve a free quote.

Be warned: You’ll need to have all the following info on hand:

- Vehicle identification number (VIN) for all your cars

- Drivers license numbers for you and other drivers in your household

- Your social security number

- Loan/lease information for the cars or trucks you want to insure

- Info from your current policy (if you have one)

- Car make, model, and year

- Driving history (past violations, accidents, etc.)

- Info on aftermarket accessories installed in or on the vehicle

- Address where the vehicle is garaged

- A credit card or debit card, or checking/savings account info

If you have questions or want to speak with Esurance’s highly rated customer support team, you can also:

- Call Esurance tollfree for help 24/7 at: 1-800-ESURANCE (1-800-378-7262)

- Email Esurance and you should receive a response within 24 hours

- Reach out to Esurance on Facebook or Twitter

So does Esurance really provide insurance for the modern world?

Born in the same time as other tech giants of the digital age, Esurance became a pioneer for online insurance. They’ve continued to beef up their website with educational content and technologically-driven tools so customers learn all about their options without meeting an insurance agent in person.

Although they haven’t been around as long as their stuffy competitors, you can feel confident that the experience and superior financial strength of Allstate, Esurance’s parent company, means they’ll never squelch on their ability to pay out.

Esurance makes buying and managing all of your auto, home, and other types of insurance easy, but you’ll need to see their savings in action for yourself. Get a free rate quote today and see how much Esurance will save you!

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.