Allstate Auto Insurance Review for 2025 (See Ratings & Cost Here!)

Allstate auto insurance starts at $87 a month and includes liability, collision, and comprehensive coverage. In this Allstate auto insurance review, we break down rates by driver profile, available discounts like Drivewise and multi-policy savings, and how coverage compares to other big-name insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Monthly Rate

A.M. Best

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsOur Allstate auto insurance review starts with rates at $87 per month and includes liability, collision, and comprehensive coverage. Drivewise and Milewise give drivers a chance to save based on their habits.

| Rating Criteria | |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 4.0 |

| Claim Processing | 3.0 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 2.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.4 |

| Plan Personalization | 4.5 |

| Policy Options | 3.4 |

| Savings Potential | 3.9 |

You’ll also see where Allstate offers real discounts, like for bundling or safe driving. However, customer reviews raise concerns about slow claims handling and rate increases after accidents.

- Allstate auto insurance review covers policy options, discounts, and claims

- Milewise pay-per-mile coverage helps low-mileage drivers save on insurance

- Monthly rates start at $87, with discounts for safe driving and bundling

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Allstate Auto Insurance Rates Breakdown

The Allstate auto insurance reviews show that rates are high for younger drivers but become more reasonable with age or a clean driving record. A 16-year-old male pays $371 per month for minimum coverage and $910 for full coverage, much higher than competitors like Geico at $41 and USAA at $31 for minimum coverage.

Allstate Auto Insurance Monthly Rates by Coverage Level| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $338 | $868 |

| 16-Year-Old Male | $371 | $910 |

| 18-Year-Old Female | $275 | $640 |

| 18-Year-Old Male | $318 | $740 |

| 25-Year-Old Female | $98 | $258 |

| 25-Year-Old Male | $102 | $271 |

| 30-Year-Old Female | $91 | $240 |

| 30-Year-Old Male | $95 | $252 |

| 45-Year-Old Female | $87 | $231 |

| 45-Year-Old Male | $88 | $228 |

| 60-Year-Old Female | $84 | $214 |

| 60-Year-Old Male | $86 | $220 |

| 65-Year-Old Female | $87 | $226 |

| 65-Year-Old Male | $86 | $223 |

Rates decrease dramatically by age 25, when a female driver pays $98 for minimum and $258 for full coverage. Allstate is more competitive at age 45, with its minimum coverage costing about $88 and full coverage costing $228.

Allstate Auto Insurance Monthly Rates vs. Top Providers| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $60 | $247 | |

| $56 | $178 | |

| $93 | $317 | |

| $41 | $166 | |

| $65 | $210 |

| $74 | $225 |

| $55 | $186 | |

| $45 | $191 | |

| $45 | $147 | |

| $31 | $121 |

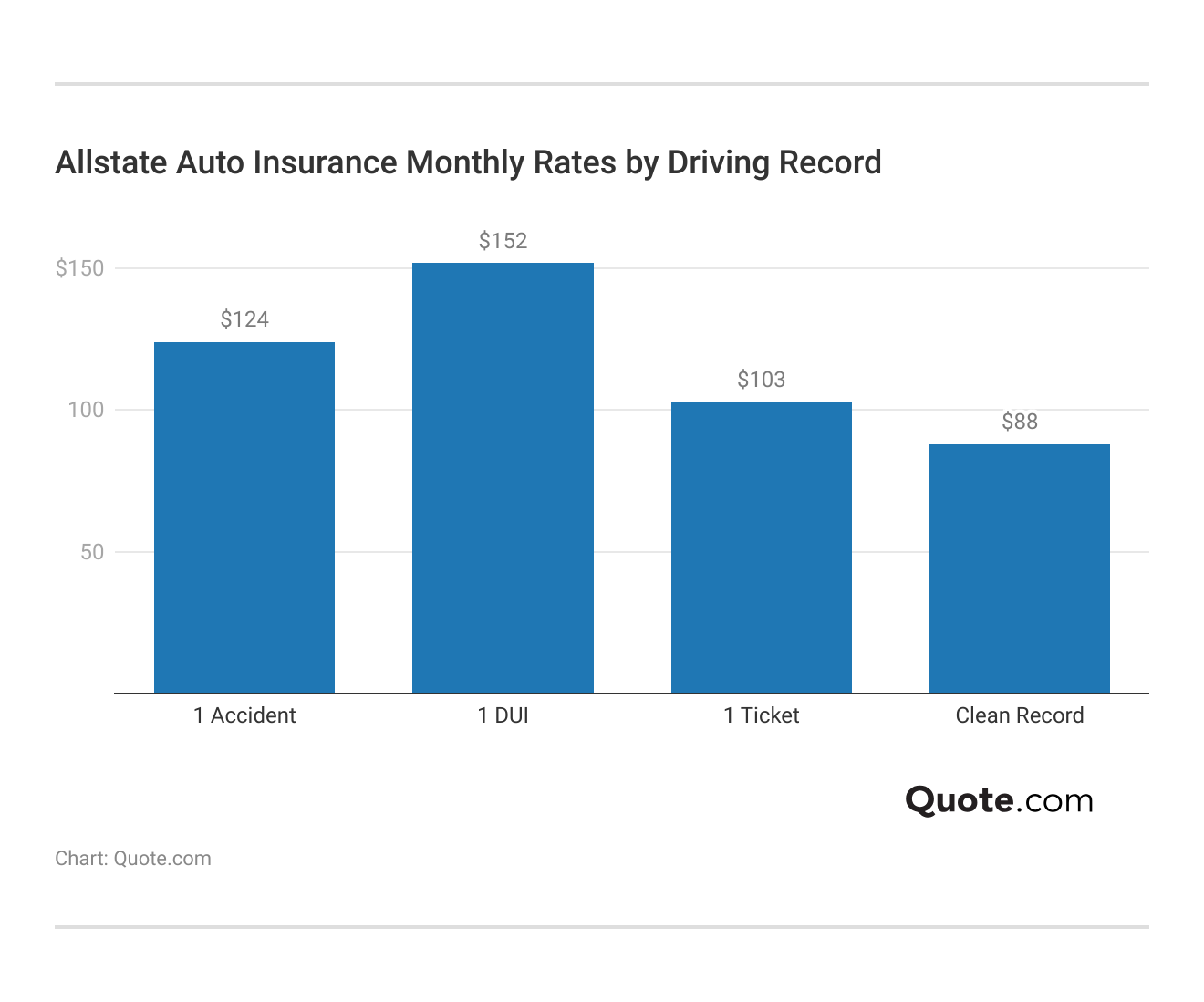

Compared to other top insurers, Allstate’s average rate is $60 per month for minimum coverage and $247 for full coverage, less than Farmers but higher than American Family, Geico, and USAA Insurance. Driving history also impacts pricing; a clean record gets you $88 for minimum and $228 for full coverage, but rates rise to $124 and $321 after an accident and up to $152 and $385 after a DUI.

Allstate rewards safe drivers through Drivewise and Milewise, but younger and high-risk drivers will likely find cheaper options elsewhere.

Allstate Car Insurance Rates by Credit Score

Allstate car insurance rates are highly competitive and offer low rates by credit score, making it one of the most competitive options we’ve seen. Allstate’s monthly cost for a driver with good credit, $120, is moderately priced compared to Geico’s $95 and Farmers’ $125.

Allstate Auto Insurance Monthly Rates vs. Top Competitors by Credit Score| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $120 | $180 | $240 | |

| $110 | $170 | $230 | |

| $125 | $185 | $245 | |

| $95 | $145 | $195 | |

| $115 | $175 | $235 |

| $105 | $165 | $225 |

| $105 | $160 | $215 | |

| $100 | $150 | $200 | |

| $98 | $148 | $198 | |

| $85 | $125 | $175 |

The difference becomes more pronounced for those with fair credit, where Allstate charges $180, still below Farmers at $185 but above Geico at $145.

Pick coverage that fits your driving, and use Allstate’s 24/7 tools for fast claims.

Jeff Root Licensed Insurance Agent

Allstate doesn’t offer the cheapest car insurance, but its rates are competitive for drivers with good credit. A driver with a strong credit score pays around $120 per month with Allstate—more than Geico at $95 but less than Farmers at $125. It’s a middle-ground option for those who want broader coverage with some discount opportunities.

Allstate’s Monthly Rates Can Drop With the Right Discounts

Allstate auto insurance offers a wide mix of discounts that can make its higher-than-average monthly rates easier to manage, especially if you qualify for several savings. While a clean driving record brings the rate down to about $88 per month for minimum coverage and $228 for full coverage, stacking discounts can drop it even more.

Allstate Auto Insurance Discounts by Savings Potential| Discount | |

|---|---|

| Accident-Free | 25% |

| Anti-Theft | 10% |

| Bundling | 25% |

| Good Student | 22% |

| Low Mileage | 30% |

| Multi-Vehicle | 25% |

| Paperless | 3% |

| Pay-in-Full | 10% |

| Safe Driver | 18% |

| Usage-Based | 30% |

For example, you could save 25% by staying accident-free, 30% by driving fewer miles, and another 25% by bundling policies. Students can get 22% off with good grades, and usage-based options like Drivewise may shave off up to 30% if you’re a safe, low-mileage driver. These numbers make a difference and help drivers save more money on car insurance, especially if they don’t qualify for the lowest base rates with Allstate.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Allstate Full Coverage Rates by Driving Record Compared to Competitors

Allstate’s full coverage auto insurance rates for drivers with a clean record are notably higher than some competitors, such as USAA, Travelers, and Geico, but they are more affordable than Farmers. Specifically, Allstate charges $247 per month for drivers without any incidents, which is significantly lower than Farmers at $317 but higher than USAA’s $121 and Travelers’ $147.

Allstate Auto Insurance Monthly Rates vs. Competitors by Driving Record| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $247 | $290 | $330 | $270 | |

| $178 | $210 | $270 | $200 | |

| $317 | $370 | $420 | $340 | |

| $166 | $210 | $390 | $190 | |

| $210 | $260 | $350 | $250 |

| $225 | $270 | $320 | $260 |

| $186 | $230 | $400 | $215 | |

| $191 | $240 | $290 | $220 | |

| $147 | $180 | $250 | $170 | |

| $121 | $145 | $200 | $140 |

The price difference becomes more pronounced following an accident, with Allstate charging $290 compared to Farmers’ $370 and considerably lower than Progressive’s $400 after a DUI.

This pricing pattern shows Allstate as a mid-range option in the market, balancing cost with the comprehensiveness of coverage and the benefits provided by their policies, like accident forgiveness and safe driving incentives.

Analyzing Allstate’s Insurance Ratings and Customer Reviews

Allstate auto insurance reviews BBB highlight the company’s solid financial strength, backed by an A+ rating from A.M. Best. While the Better Business Bureau reflects positive business practices, customer satisfaction is average. Allstate scored 691 out of 1,000 in J.D. Power’s study, and Consumer Reports gave it a 74 out of 100.

Allstate Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: 691 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction |

|

| Score: 1.45 Avg. Complaints |

|

| Score: A+ Superior Financial Strength |

The NAIC score of 1.45 suggests it receives more complaints than the industry average. Despite this, some customers, like Douglas G. from Alabama, report highly positive experiences. In his Yelp review, he praises the efficiency of Allstate’s claims process after an accident, saying the adjusters and litigation teams secured the work to get his car fixed and the insurance company to refund his deductible with little effort on his part.

Allstate stood out to him for its professionalism and reliable service, especially compared to other insurers. While Allstate auto insurance reviews Consumer Reports show mixed results, his experience was positive, mainly because of how helpful and responsive his local agent was.

Allstate Auto Insurance Coverage Options

Choosing the right auto insurance coverage ensures you’re financially protected on the road. Allstate offers a variety of options tailored to different driving needs. Here’s a breakdown of key coverage types:

- Liability Coverage: Pays for injuries and property damage if you cause an accident. Most states require it.

- Collision & Comprehensive Coverage: Collision coverage covers repairs after a crash. Comprehensive coverage covers theft, vandalism, fire, and weather damage.

- Uninsured/Underinsured Motorist Coverage: Covers your costs if a driver with little or no insurance hits you.

- Personal Injury Protection (PIP) & MedPay: PIP covers medical bills and lost wages. MedPay covers medical expenses but not lost wages.

- Additional Coverage: Rental reimbursement pays for a rental if your car is in the shop. Roadside assistance covers towing and emergency help. Gap insurance pays the difference if your car is totaled and you owe more than its value.

Understanding these coverage options can help you choose the best policy for your needs, incorporating tips to pay less for car insurance to maximize your savings.

Allstate offers coverage for basic liability, full protection, and extras like rental reimbursement and gap insurance, making it easier to tailor a policy to how and what you drive.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Allstate Insurance: Coverage & Discounts

Allstate offers various insurance and investment products, including auto, home, renters, business, life, and supplemental health insurance. Investment options include college savings plans, annuities, IRAs, and mutual funds. Auto policies cover liability, comprehensive, collision, medical payments, and uninsured motorist coverage.

Specialized coverage is available for classic, modified, and customized vehicles. Auto policyholders can access premium features like rental reimbursement, towing, and repair coverage. Rates vary by location, driving history, and age, with younger drivers often paying more. The Drivewise Program rewards safe driving with rebates. Discounts include savings for anti-lock brakes, airbags, anti-theft devices, and owning a new or economy car.

Bundling policies can lead to extra savings, such as the Auto/Life Discount and Multiple Policy Discount for combining auto with renters or home coverage. Additional savings are available for responsible financial habits, including the Good Payer Discount, Early Signing Discount, EZ Pay Plan Discount, FullPay Discount, and eSmart Discount.

Student and senior discounts include good student discounts (20% off for full-time students with good grades), resident student discounts (up to 35% for students living 100+ miles away), and senior discounts (10% off for retirees 55+). Safe driving discounts, part of car insurance discounts you can’t miss, include Premier, Premier Plus, Defensive Driver, Safe Drivers, and TeenSMART, offering savings of up to 45%.

Special Car Insurance Options From Allstate

Allstate provides specialized car insurance options based on everyday driving situations so that drivers receive insurance coverage tailored to their individual needs. Whether you’re a safe driver seeking discounts, a collector protecting a valuable classic car, or a rideshare driver requiring additional coverage, Allstate has flexible solutions.

- Drivewise: Rewards safe driving habits by tracking speed, braking, and phone use through the Allstate app, offering policy discounts for low-risk drivers.

- Classic and Collector Car Insurance: Partners with Hagerty Insurance to provide agreed value coverage for vintage and collectible vehicles, ensuring their full worth is covered while restricting daily use.

- Ride for Hire: Bridges the gap between personal and rideshare insurance, covering deductible gaps and ride-request periods often excluded from standard policies.

- Electric Vehicle (EV) Insurance: Includes the same coverage as traditional cars, with added benefits like EV-specific discounts, roadside battery charging, and home charger protection.

These special insurance options, as detailed in many Allstate car insurance reviews, help drivers save money. These specialized insurance options protect vehicles and provide coverage in situations that standard auto insurance might not cover, specifically including auto insurance for luxury and exotic vehicles.

Allstate Specialty Vehicle Coverage

Allstate offers motorcycle insurance with comprehensive coverage, including bodily injury liability, medical payments, property damage liability, collision, personal injury protection, towing, uninsured/underinsured motorist coverage, and rental reimbursement. Discounts include New Motorcycle Replacement, First Accident Waiver, and Genuine Parts Guarantee Repair Program.

Motorhome insurance covers both the vehicle and living space, offering bodily injury liability, collision, comprehensive medical payments, personal injury protection, uninsured/underinsured motorist coverage, towing, rental reimbursement, property damage liability, contents, and sound system coverage. Eligible policyholders may qualify for senior, multi-policy, and transfer discounts.

Snowmobile and recreational vehicle insurance provides coverage for property damage liability, bodily injury liability, comprehensive, and collision, starting at $13 per month for snowmobiles and $12 per month for recreational vehicles. Discounts include a safety course, easy pay plan, full-pay, and multi-policy to help lower costs.

Allstate's Drivewise lowered my premiums and personalized my rate. It rewards safe driving with real savings.

Meghan Steinberg

Boat insurance starts at $20 per month, covering liability, medical payments, property, and emergency services. It also includes uninsured watercraft coverage, repair costs, and agreed-value options. For further details, see a visual guide to auto insurance. Discounts are available for multiple policies, such as the Easy Pay plan, homeownership, full payment, and boat education.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How to File an Allstate Insurance Claim

Allstate makes claim filing simple, with 24/7 filing available by phone, online, or via its mobile app. Although the system is quick and intuitive, Allstate auto claims reviews show that response times and satisfaction can vary depending on the situation.

- Gather Evidence: Collect photos, witness details, license plate numbers, insurance information, and medical reports to support your claim.

- File Your Claim: Report the claim through an agent online, by phone (800-255-7828), or through the Allstate Mobile App to receive a claim number.

- Damage Investigation: A mechanic assesses the vehicle, determines repair needs, and provides an estimate for repairs or replacement.

- Estimate Review: A claims adjuster contacts you to review the repair estimate and discuss your settlement and reimbursement options.

- Settle the Claim: Choose to either repair the vehicle (paid directly to the shop) or receive reimbursement via check or direct deposit.

Allstate aims to streamline the claims process, as highlighted in many Allstate Insurance reviews. If you have any questions about how to file an auto insurance claim, reaching out to an Allstate agent or their hotline can provide clarity on your options and help ensure a smooth resolution.

Exploring the Real Value of Allstate Auto Insurance Coverage

The Allstate auto insurance review highlights the importance of considering several factors beyond the cost of premiums when choosing car insurance companies. The importance of considering the insurer’s stability, customer satisfaction ratings, and the breadth of coverage options. With its longstanding history and financial ratings, it offers a diverse range of products that allow for significant customization to fit individual needs.

However, the content does mention some customer complaints regarding claim resolution practices that could be a red flag. Prospective members should look for these before making a decision. Allstate Insurance quotes and thoroughly examines user reviews and company ratings to make a well-rounded choice that considers cost, coverage, and service quality.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool.

Frequently Asked Questions

Is Allstate good at paying claims?

Allstate pays claims, but the experience depends on the situation. The company has an A+ rating from AM Best, so it’s financially stable and able to cover losses. Some customers say the claims process is smooth and handled quickly. Others report slow responses, low payouts, or trouble getting updates, especially after major accidents. If you’re considering Allstate, know that results vary by agent and region.

What is Allstate deductible?

Allstate’s deductible is the amount you pay before insurance covers the rest of a claim. You can pick between $250 and $1,000 for collision or comprehensive coverage. A higher deductible lowers your monthly rate but increases your cost if you file a claim. With Deductible Rewards, Allstate takes $100 off when you sign up and knocks off another $100 each accident-free year, up to $500.

What are customers saying in Allstate home insurance reviews?

Many customers appreciate the bundling discounts and digital tools, while others mention increasing premiums and denying claims. The policies provide coverage for property damage, liability, and personal belongings, with options for identity theft protection and water backup coverage. This range of services makes Allstate a consideration for those seeking cheap homeowners insurance.

Does Allstate offer a student discount on car insurance?

Yes, Allstate offers a student discount for full-time drivers under 25 who maintain at least a 3.0 GPA. Students can save up to 20% with the Good Student Discount. There’s also a Resident Student Discount of up to 35% for those attending school over 100 miles from home without regular access to a vehicle.

How much does Allstate gap insurance cost?

Allstate gap insurance typically costs between $20 and $50 per year, depending on the car’s value, loan terms, and your location. This add-on covers the difference between what your car is worth and what you still owe on your loan if it’s totaled or stolen. It’s most useful for new cars with loans that exceed the vehicle’s current value.

How do Allstate’s life insurance reviews compare to competitors?

Allstate life insurance reviews note both term and permanent policies. Term life offers affordable, fixed premiums for 10 to 30 years, while permanent policies like whole life and universal life build cash value. Although some customers find Allstate’s prices higher than those of competitors like State Farm or Nationwide, the flexibility of these policies could be the reason that convinced you to get life insurance.

Does Allstate cover windshield replacement?

Yes, Allstate covers windshield replacement under its comprehensive coverage. If you add Full Glass coverage, Allstate waives your deductible for windshield repairs or replacement. Without it, you’ll pay your standard comprehensive deductible—typically between $250 and $1,000—before coverage applies.

What do Allstate renters insurance reviews say about their coverage?

Allstate renters insurance reviews highlight low monthly costs—often around $15 to $25—making it affordable for most renters. Many customers like the bundling discounts when paired with auto insurance and the coverage for personal property, liability, and loss of use. However, some reviews point to delays in claims processing and limited communication during settlement.

What do Allstate pet insurance reviews say about coverage?

Allstate pet insurance covers accidents, illnesses, and routine care through Wellness Rewards. It includes emergency visits, surgeries, and cancer treatments. While bundling discounts is a plus, some report slow claim processing. Keep this in mind when reviewing questions to ask when considering pet insurance.

Does Allstate offer RV and motorhome insurance?

Yes, Allstate offers RV and motorhome insurance that covers collision, comprehensive, liability, and roadside assistance. Policies also include options like vacation liability, full-timer coverage, and protection for personal belongings inside the vehicle. Rates typically start around $125 per month, but final pricing depends on the RV type, usage, and your location.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

What is Allstate famous for?

Allstate is best known for its auto insurance and its long-standing slogan, “You’re in Good Hands with Allstate.” It’s one of the largest personal lines insurers in the U.S., offering car, home, renters, and life insurance. The company is also recognized for its Drivewise and Milewise programs, which reward safe and low-mileage drivers.

How can I cancel Allstate car insurance?

To cancel Allstate car insurance, contact an agent or customer service by phone. You might need to show proof of new insurance if switching providers. Be aware of possible cancellation fees, which vary by policy and state laws. Consider if it’s bad to cancel car insurance before making changes.

How do Allstate Insurance reviews compare for customer service?

Allstate’s NAIC complaint index is 1.45, meaning it receives more complaints than the industry average of 1.00. While some customers report helpful local agents and a functional mobile app, others note delays in claims and rate increases after accidents. The reviews show inconsistency, depending on the region and agent.

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.