Farm Bureau Insurance Review for 2025 (Rates, Discounts, & Options)

The Farm Bureau Insurance Company uses local agents, with plans for vehicles, property, agriculture, and health coverage. Our Farm Bureau insurance review compares car insurance rates starting at $72 monthly and home coverage for $303 a month, which is expensive, but you can get cheap quotes when comparing online.

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Insurance Agent

UPDATED: Apr 23, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Apr 23, 2025

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

115 reviews

115 reviews

Farm Bureau Insurance

Average Monthly Rate For Good Drivers

$115A.M. Best Rating:

AComplaint Level:

LowPros

- Rural customers get exclusive discount opportunities

- Bundle auto, home, and farm for better premium rates

- Strong A.M. Best rating ensures financial reliability

Cons

- Coverage options change depending on your location

- Online tools are limited for quotes and updates

Farm Bureau Property & Casualty Insurance Company (FBPCIC), which operates under the Farm Bureau Financial Services brand, provides auto, home, and farm insurance for individuals and small businesses in all 50 states.

Farm Bureau Insurance Rating| Rating Criteria |  |

|---|---|

| Overall Score Rating | 4.5 |

| Business Reviews | 5.0 |

| Claim Processing | 4.8 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.1 |

| Coverage Value | 4.9 |

| Customer Satisfaction | 2.0 |

| Digital Experience | 3.5 |

| Discounts Available | 4.7 |

| Insurance Cost | 4.7 |

| Plan Personalization | 4.0 |

| Policy Options | 5.0 |

| Savings Potential | 4.7 |

This Farm Bureau insurance review highlights its local agent access, unique farm liability coverages, and property protection for rural policyholders.

If you’re looking for cheap auto insurance, Farm Bureau rewards safe drivers with discounts through its Driveology program with telematics.

- Farm Bureau insurance ratings are 4.5/5 for competitive $115 monthly rates

- Farm Bureau requires an annual membership fee to buy coverage

- Farm Bureau insurance coverages and discounts vary by state

Find out how to buy insurance with your local Farm Bureau membership, or enter your ZIP code into our free, easy-to-use quote tool, which is designed to show top regional rates.

Farm Bureau Insurance Coverage Options

Farm Bureau offers important insurance products essentialiduals, families, and farmers, especially those who live in rural areas:

- Auto Insurance: Includes liability, comprehensive, collision, and telematics via Driveology

- Home, Farm, and Ranch Insurance: Protects your home, personal belongings, and liability, and also offers farm property, equipment, and operations protection

- Life Insurance: Covers term life, whole life, and universal life plans

- Business Insurance: Supports small businesses with property and liability coverage

- Health Insurance: Offered in select areas for individuals and families.

These important policy types provide the basic coverage most customers require, with a few additional perks not found with other companies. Take a closer look at Farm Bureau policy options below.

Types of Farm Bureau Home & Auto Insurance

This table outlines Farm Bureau insurance coverage options ranging from vehicle to property protection. Drivers can opt for extras like custom parts coverage or gap insurance.

Farm Bureau Home and Auto Insurance Coverage Options| Coverage Type | Description |

|---|---|

| Liability, Collision, Comprehensive | Standard vehicle protection (accidents, theft, damage) |

| Uninsured/Underinsured Motorist | Covers if at-fault driver lacks coverage |

| Medical Payments / PIP | Pays medical bills regardless of fault |

| Roadside Assistance | Help with towing, fuel delivery, etc. |

| Rental Reimbursement | Covers rental while your car is in repair |

| Gap Insurance | Covers loan difference if car is totaled |

| Custom Parts Coverage | Protects upgrades or custom equipment |

| Dwelling & Property | Covers home structure and belongings |

| Liability & Loss of Use | Covers legal costs & temp housing |

| Scheduled Property / ID Theft | Extra protection for valuables & identity |

| Life Insurance | Term, Whole, Universal, Child coverage |

| Farm Insurance | Covers crops, livestock, equipment, & farm property |

Medical Payments and PIP provide no-fault health coverage, while roadside assistance adds convenience. Homeowners also benefit from dwelling coverage and scheduled property protection, including identity theft defense and temporary housing.

Learn More: Is it bad to cancel car insurance?

Farm & Ranch Insurance With Farm Bureau

This table shows the leading insurance solutions for farmers, including property protection for buildings and tools, and personal liability options in case someone is injured on your land.

Farm Bureau Farm & Ranch Insurance Coverage Options| Coverage Type | Coverage Description |

|---|---|

| Property Insurance | Protection for buildings and equipment |

| Farm or Ranch Liability | Coverage for accidents and injuries |

| Farm Vehicle Insurance | Coverage for agricultural vehicles and equipment |

| Crop Insurance | Protection against crop losses |

| Livestock Revenue Insurance | Coverage for livestock revenue loss |

| Business Succession | Planning for asset transfer to successors |

| Loss Control Services | Services to reduce farm risk |

| Equine Insurance | Coverage for horses against accidents |

Insurance is also available for farm vehicles, crops, and even livestock income. Planning for succession and equine-specific coverage completes the options.

Farm Bureau’s farm and ranch insurance stands out for its deep roots in rural communities and tailored coverage that understands the risks farmers actually face. But on the downside, their rates can be less competitive if you’re not bundling or don’t live in one of their core service areas.

Learn More: Understanding The Eight Types of Home Insurance

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Comparing Farm Bureau Auto Insurance Rates

Farm Bureau Insurance costs vary greatly based on age, whether you are a male or a female, and the kind of coverage you choose. Young drivers pay more money, but costs go down significantly by age 25.

Farm Bureau Auto Insurance Monthly Rates by Age, Gender & Coverage Level| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $300 | $580 |

| 16-Year-Old Male | $320 | $630 |

| 18-Year-Old Female | $230 | $460 |

| 18-Year-Old Male | $260 | $520 |

| 25-Year-Old Female | $140 | $290 |

| 25-Year-Old Male | $160 | $320 |

| 30-Year-Old Female | $125 | $262 |

| 30-Year-Old Male | $135 | $280 |

| 45-Year-Old Female | $115 | $240 |

| 45-Year-Old Male | $121 | $261 |

| 60-Year-Old Female | $114 | $230 |

| 60-Year-Old Male | $112 | $250 |

| 65-Year-Old Female | $110 | $240 |

| 65-Year-Old Male | $120 | $260 |

Farm Bureau car insurance is cheapest at age 45, where monthly premiums become steady at around $115 for minimum coverage and $261 for full coverage.

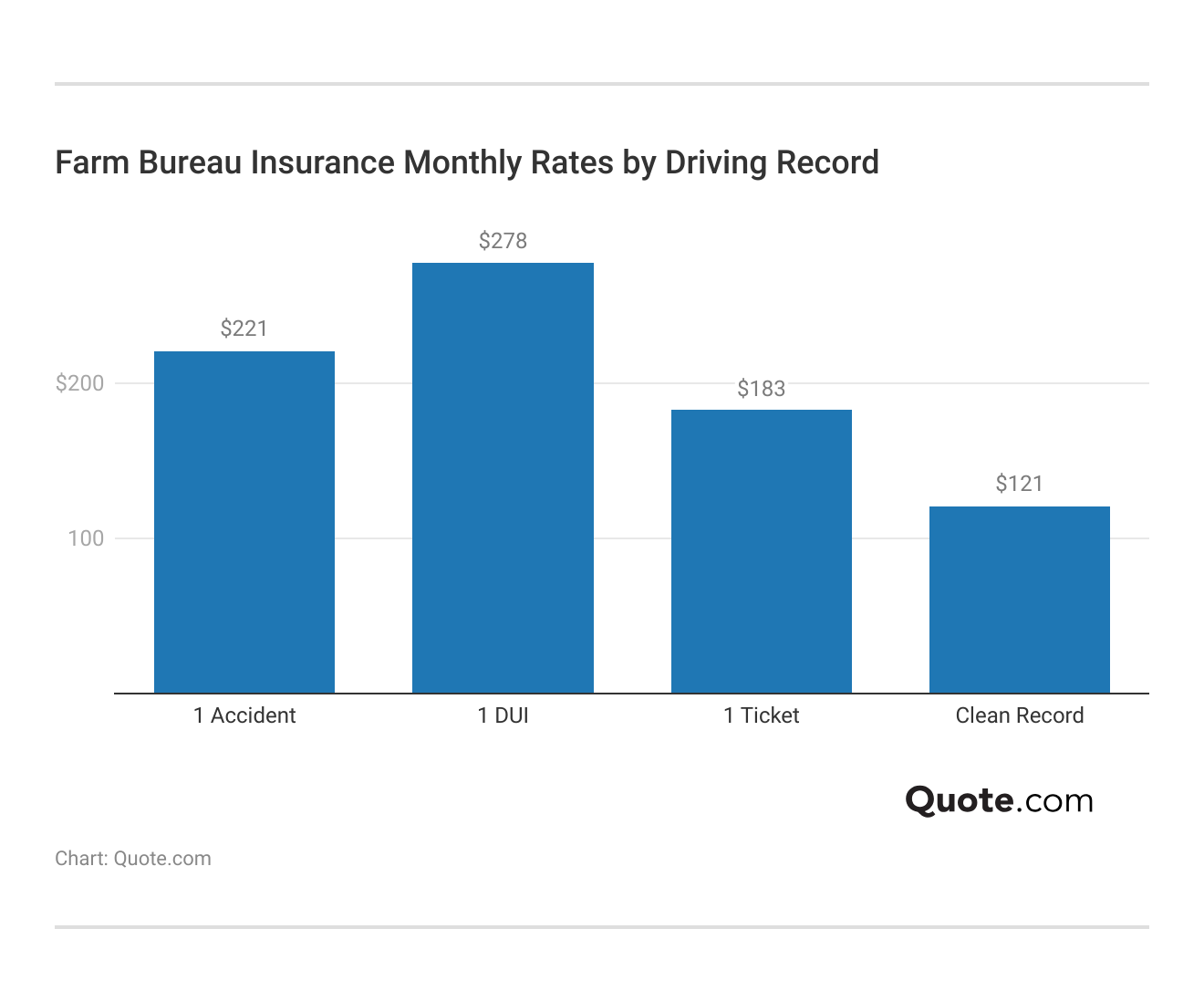

No matter your age, your driving record also impacts Farm Bureau insurance costs. This table shows how full coverage rates change based on driving history with different insurance companies.

These patterns highlight how violations affect affordability differently by company. Scroll down to see how the best car insurance companies rank based on rates and coverage options.

Farm Bureau Auto Insurance vs. The Competition

Farm Bureau is one of the more expensive insurers on this list, with only Liberty Mutual and Allstate being more expensive. USAA boasts the lowest rates at $32 monthly for minimum and $84 per month for full coverage.

Farm Bureau Auto Insurance Monthly Rates by Provider & Coverage Level| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $72 | $187 |

| $43 | $198 | |

| $96 | $114 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

Higher insurance costs are often due to the unique coverage options available and higher policy limits than at other companies.

Most insurance companies raise prices consistently for tickets, accidents, and DUIs. USAA offers the lowest full coverage rates, but costs increase from $84 to $154 per month if you have a DUI. Farm Bureau is still among the most affordable three companies for full coverage car insurance post-DUI.

Farm Bureau Auto Insurance Monthly Rates by Provider & Driving Record| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 | |

| $261 | $202 | $244 | $302 |

| $114 | $151 | $189 | $309 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 | |

| $84 | $96 | $111 | $154 |

If you need high-risk auto insurance from Farm Bureau or any other company, explore tips to help you qualify for the cheapest car insurance possible.

Comparing Farm Bureau Home Insurance Rates

This table shows the monthly cost of Farm Bureau home insurance, broken down by provider and your policy limits. USAA has the cheapest rates for all levels, beginning at $90. Other insurance companies are priced mostly between $100 and $175.

Farm Bureau Home Insurance Monthly Rates by Provider & Policy Limit| Insurance Company | $250K Policy | $350K Policy | $450K Policy |

|---|---|---|---|

| $110 | $140 | $170 | |

| $105 | $135 | $165 | |

| $303 | $425 | $547 |

| $95 | $125 | $155 | |

| $115 | $145 | $175 |

| $100 | $130 | $160 |

| $98 | $128 | $158 | |

| $102 | $132 | $162 | |

| $107 | $137 | $167 | |

| $90 | $120 | $150 |

Geico and Farmers offer good value in the middle range of prices, but Farm Bureau is the most expensive, costing $547 for a policy with $450,000 in coverage. However, Farm Bureau coverage and costs vary drastically by state, so estimate home insurance costs based on where you live to see how much Farm Bureau costs near you.

Farm Bureau Insurance Customer Service & Financial Strength

Farm Bureau Financial Services’ business ratings reflect solid industry performance and customer satisfaction. J.D. Power scores it 849/1,000, marking above-average service.

Farm Bureau Insurance Business Ratings & Consumer Reviews| Agency |  |

|---|---|

| Score: 849 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: 0.58 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Consumer Reports gives a 74/100 with fewer-than-average complaints. A.M. Best rates financial strength as A, indicating reliable claim-paying ability and long-term stability across policy categories.

Read More: How to Compare Auto Insurance Companies

Enter your zip code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How Farm Bureau Adapts to Policyholder Needs

Our Farm Bureau Insurance review found it delivers regionally focused protection for drivers, homeowners, and farmers. From vehicle liability to farm property, the company supports policyholders through local agents who understand rural risk. Customer satisfaction ratings show strong service quality.

With Farm Bureau Insurance, policyholders benefit from region-specific expertise and reliable protection. In particular, small farm owners find strong value here.

Jeff Root Licensed Insurance Agent

Its flexible coverage options are backed by strong financial ratings, but Farm Bureau insurance rates are more expensive than those of other companies for both home and auto insurance. Costs vary based on age, gender, and state, which is why it is essential to get personalized quotes online before you buy.

Follow the best tips to pay less for car insurance and lower your premium with ease, or enter your ZIP code into our free quote comparison tool to get auto insurance quotes from companies near you.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Farm Bureau insurance good insurance?

Yes, Farm Bureau insurance is considered a good option for those who prefer working with local agents and need rural-focused coverage. What can you expect from Farm Bureau Insurance customer service? You’ll receive localized support through dedicated agents who offer help with claims, policy updates, and billing.

Is Farm Bureau Financial Services legit?

Yes, Farm Bureau Financial Services is a legitimate company. What is the rating of Farm Bureau Life Insurance Company? It holds an A rating from A.M. Best, indicating a strong ability to meet financial obligations and pay its claims. It also has strong customer satisfaction scores across several policy types.

Is Farm Bureau homeowners insurance good for your property needs?

Yes, if you value personalized service and rural property protection. Farm Bureau homeowners insurance may be a solid choice, especially for homes needing farm-specific coverage. See how it compares to the best homeowners insurance companies.

What can you expect from Farm Bureau Insurance reviews on BBB?

Customer reviews on BBB highlight strong agent relationships but occasionally note delays in Farm Bureau insurance claims handling or billing concerns.

What do Farm Bureau Insurance reviews in Consumer Reports typically say?

Consumer Reports reviews often mention that Farm Bureau offers reliable local agents and solid claim satisfaction, though coverage may vary by state.

What do Farm Bureau Insurance review complaints reveal?

Many complaints focus on slow claim resolution or policy rate changes, so make sure you ask your agent about renewal pricing and customer support availability.

How does State Farm vs. Farm Bureau insurance compare?

If you want broader national coverage, State Farm may offer more options, but Farm Bureau is often preferred in rural areas for its local expertise and tailored protection. Read our State Farm review to learn more.

What should you know from Farm Bureau Insurance reviews on Reddit?

Reddit reviews often reflect real policyholder experiences and discuss high satisfaction with local agents, though some users report mixed results on pricing and claims speed.

What do Farm Bureau Insurance reviews do Michigan drivers leave online?

Drivers in Michigan often highlight local agent service and fair rural coverage, but some mention higher-than-expected monthly rates for full coverage compared to other providers.

Does Farm Bureau Insurance pay claims?

Yes, Farm Bureau does pay claims, and most policyholders report timely payouts, though response times may vary depending on your location and agent. Learn how to file an auto insurance claim and win it each time.

How do you check your Farm Bureau claim?

You can check your Farm Bureau claim by logging into your online account or contacting your assigned local agent for direct updates on claim progress. Find out the worst states for filing an auto insurance claim.

Can anyone use Farm Bureau insurance?

You must pay a membership fee to join Farm Bureau and buy insurance, but anyone can be a member.

Who owns Farm Bureau Insurance?

Farm Bureau Insurance is owned by individual state-level Farm Bureau organizations, which operate as member-driven mutual or stock companies, depending on the region.

Why is Farm Bureau insurance so high?

Your Farm Bureau insurance may seem high if you’re under 25, have a poor driving record, or require full coverage, which can raise monthly rates above $200. Enter your ZIP code to find more affordable insurance near you.

Is Farm Bureau auto insurance good for your driving needs?

Farm Bureau car insurance is more expensive but does offer many forms of coverage, from the basics like liability and collision auto insurance to impressive add-ons like custom parts coverage and rental reimbursement.

How old is Farm Bureau Insurance?

Farm Bureau Insurance has been serving customers since the 1930s, so you’re choosing a provider with nearly a century of experience in rural and regional insurance.

How are Farm Bureau agents paid?

Farm Bureau agents are usually paid through commissions based on policies you purchase, so they’re motivated to provide you with the right coverage options.

How can you bundle policies with Farm Bureau home and auto insurance?

You can bundle Farm Bureau home and auto insurance to unlock multi-policy discounts, often lowering your monthly premium by up to 20%, depending on your location and coverage level.

Does Farm Bureau loan money?

Yes, Farm Bureau Financial Services offers you personal and farm-related loans, including equipment financing and operating lines of credit (Learn More: What to Do When You’re Denied Insurance Coverage).

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.